The $150 billion opportunity most investors are sleeping on

Note: This video was taped on Thursday 31 October 2024.

Once upon a time, privately owned businesses could secure funding and financing mostly from a bank or by approaching individual investors. But that world has changed dramatically. Now, there are so many more options for businesses needing cash. One of these options, private equity, involves Private Equity firms buying stakes in promising firms, offering them funds and expertise, and then selling them off for (hopefully) a profit.

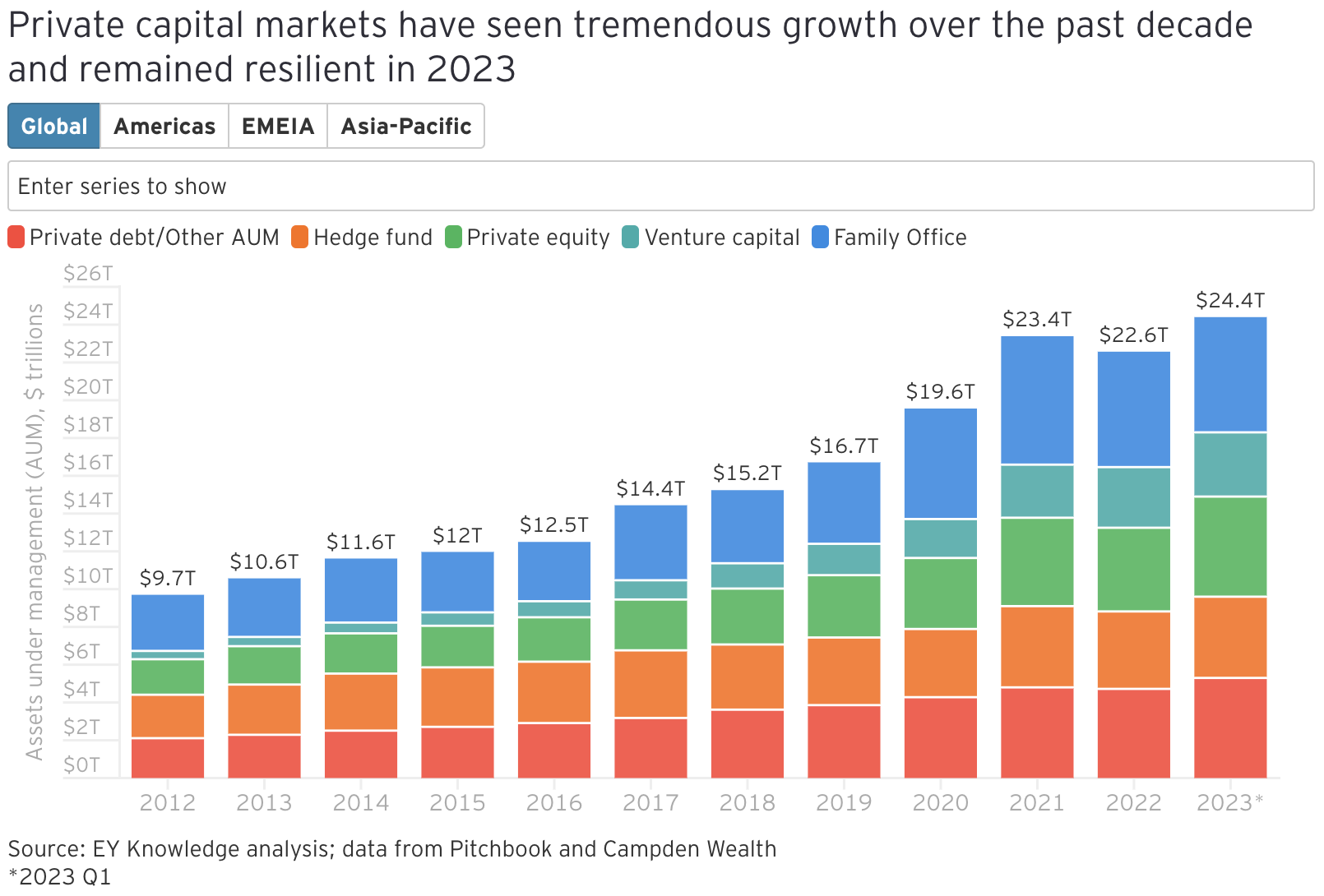

This business model isn't new but what is new is how much it has grown. Between 2012 and the end of 2023, EY data suggests the global private equity market has grown by 179% (in AUM terms). In the Americas, that growth figure is 200%.

And while data from the World Bank suggests there are more publicly listed companies now than there were in 2012, the growth is a) nowhere near the levels of private equity and b) is down significantly from its peak in the mid-1990s.

With the growth of the PE market also came the emergence of a secondary market where stakes in those private companies can be transferred between investors. To walk us through this opportunity set, we were lucky to be joined recently by Barry Miller, CEO of the Ares Private Markets Fund. Miller is specifically an experienced professional in private equity secondaries - a US$150 billion sub-section of this broad universe that deals in opportunities that come directly from the primary markets and are said to provide more liquidity and more granular diversification opportunities.

But don't let me tell you all about it! Watch the video above featuring Miller or read our edited transcript to find out more.

Edited Transcript

How do you define private equity secondaries?Secondaries today are defined in three separate categories. We have the LP (Limited Partner) side of the business, the GP (General Partner) side of the business, and the structured side of the business.

If we look at the LP side today, we are, in essence, a replacement limited partner. We are buying down the existing dollars or the net asset value that someone has put into a fund. We generally look to buy that at a discount, and then we take over their unfunded obligation. That's one part of the business.

The second part of the business is the GP-led, which is today the single asset or multi-asset continuation vehicle. It's when a company needs one of two things: more time or more money. We take it out of the existing fund that it's in today. We lift it out, we put it into a new vehicle and we call that a continuation vehicle. That's the second part.

The third part, which sounds like the most complicated, is the structured solutions part. Effectively what we're doing is just creating an instrument that is preferred equity and those are the three parts of the secondary business. The allocation between the three changes over time, but continues to remain focused on one of those three pieces.

Why should investors consider investing in this specific part of the private markets universe?

When you look at secondaries today, and even really back to the beginning of private markets, secondaries give you diversification by sector, by stage, by vintage and by geography. When you are looking at the opportunity to invest in the asset class, you're able to get similar rates of return to the traditional buyout or private equity [space]. You're just getting it with greater diversification.

How big is the secondary market, and therefore, is your opportunity set?

The market is big and continues to grow. If we look at these statistics for the first half of 2024, the market statistics would suggest US$70-75 billion of overall secondary transaction volume. If we take that and suggest that the first half and the second half are equal, we would suggest that US$140-$150 billion.

Putting that into perspective, 2021 was a record year for secondaries. That was the previous record year was US$132 billion, and last year as an industry, we did between US$108-110 billion. So the opportunity set continues to grow.

What is interesting about secondary [investments] is, just by the nature of the word secondary, we are a byproduct of what's raised in the primary market. So that would be new investments in newer funds and 1-3% of that ends up in the secondary [market]. So as that market grows, ours continues to grow as well.

How do you go about your due diligence and investment process to filter it down to the select few transactions you actually want to make?

We continue to be focused on the process. When we look at underwriting opportunities, we spend a lot of time focusing on the general partner or the manager of the individual funds. We have a dedicated quantitative research group that looks at the overall track records, looks at the individual portfolio companies, strips out industry sector, timing, geography, and leverage, looking to see if managers are generating alpha or excess return.

I think it's also important to note that our underwriting process is a bottom-up process. It's not a top-down process. So what does that mean?

What that means is we do individual underwriting for portfolio companies. We then take that individual underwriting for the portfolio companies, similar to a traditional buyout fund. We take that, we roll that into a model for an individual fund. We take that model and roll it into an individual transaction. We then have a portfolio management model that looks at how it affects the overall fund.

Then, we have a corporate finance overlay, which is how do we finance it, how do we structure these? So when you put it all together, there's no one individual piece that drives our underwriting, but collectively as a team, we're able to put all the pieces together and continue to move forward.

What is your downside protection strategy for when things become shaky?

We believe that diversification by sector, stage, vintage and geography will help in a down market and it will give us some level of protection we believe. But as you look forward, there will be assets that may underperform and diversification should help mitigate some of that.

But going forward, having additional resources from a research standpoint, from a credit standpoint, we have our direct lending platform, we have our buyout business, we have our alternative credit business, we have resources that we can use as a larger firm that in tandem with that mitigation, we believe put all together as one opportunity should hopefully protect us going forward.

What are the traits of a great secondary market investment?

A great secondary market investment is buying an asset at a discount not only to the net asset value but also to the intrinsic value. Said differently, if the asset was sold today, what would somebody be willing to pay for it? I think that's the first piece.

I think the second piece here is looking at it to be able to build out a targeted rate of return, which is commensurate with the risk that you're taking. So what does that mean? That means that from a private equity standpoint, we want to get an illiquidity premium or, said differently, paid more than the market. So if we can buy assets at a discount if we can generate returns that are greater than the market, we put that together, that would be an attractive secondary.

Purpose-built solutions to make private markets accessible to investors

Ares is one of the largest and most experienced investors in acquiring secondary private fund ownership stakes in the alternative asset management industry. We seek to generate risk adjusted returns through leading industry analytics and research, robust deal origination, underwriting and portfolio management activities. Find out how to access this opportunity here.

1 topic