The anniversary of US stimulus

US consumer companies have entered a nervous sales period as their customers are anniversarying last year’s large stimulus payments. Investor trepidation is warranted but needs to be carefully applied. Only a small group of consumer categories enjoyed outsized benefits last year. Be wary of Best Buy (BBY). Find safety in McDonald’s (MCD). Most importantly, don’t get too bearish on the US consumer.

Key takeaways:

1. Biden’s $1.9tn COVID relief stimulus of Jan-March 2021 created a cash injection of approximately $4,500 per household

2. Stimulus checks were spent on high ticket durable goods, such as appliances, electronics, and jewelry. Stimulus had no material effect on apparel, grocery, or quick-service restaurants

3. Highlight Best Buy (BBY) and McDonald’s (MCD) for their disparate stimulus impacts and the consequences this will have for anniversarying stimulus in the coming months

4. Overall, don’t get too bearish. US household income is still likely to grow in 2022 despite the removal of pandemic stimulus payments. Negative impacts from lapping stimulus will be transitory.

Before we begin, a fair question might be to ask why post on something as narrow as the US Consumer? The answer is because that’s what we do. Great Ocean Road Advisors (GORA) is an Australian-led fund based in New York City that invests only in US Consumer equities. We do this because we find US Consumer an extremely fertile ground for alpha: it features high breadth of companies and categories, high volatility, and most importantly – high idiosyncratic share price returns within the sector. It’s also the only area we’ve ever invested in so we feel a strong affinity for the companies and their management teams. We hope you enjoy and look forward to being a resource sharing our views on the US consumer, through an Australian lens from over here in the States.

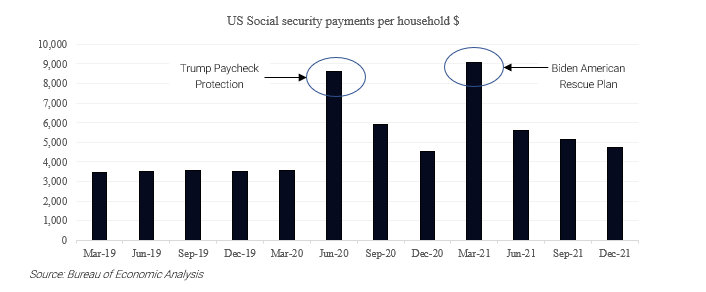

President Biden’s unprecedented 2021 stimulus package

Among President Biden’s first acts upon inauguration was the American Rescue Plan - a historic $1.9tn stimulus program for US households. The package drove a cash infusion of nearly $4,500 per household between January and March 2021. Biden’s stimulus program was even greater in scale than the Trump Paycheck Protection Program, which occurred immediately following the pandemic’s onset when more than 20 million Americans had become unemployed. Trump’s Paycheck Protection was akin to a natural stabilizer, offsetting lost wages created by the spike in unemployment. In contrast, Biden’s stimulus was a powerful boost to US household income almost a year later, when natural recovery was already taking place.

From our chart below, the outsized effect of the two programs is clear. Both are captured by a roughly doubling of social security payments per household. Residual above-normal social security payments in the close of 2021 represent the impact of Child Tax Credits, which have since been eliminated.

Only certain categories benefit

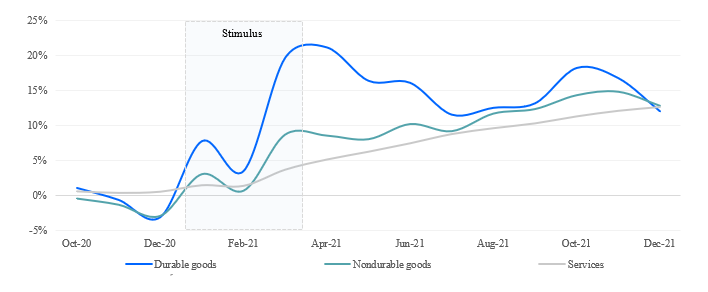

For US households, money quickly received is quickly spent. Most bank accounts carry roughly $5,000. Stimulus payments therefore effectively doubled those balances. However, the nature of large cash infusions to households favors big ticket purchases. Specifically, highly discretionary durable goods, such as appliances, electronics, and jewelry saw an immediate and outsized lift.

Spending on nondurable goods and services is far more driven by underlying economic conditions. From the chart below, these categories of consumer spend saw a muted response to Biden’s stimulus, have since enjoyed accelerating growth from sustainable demand drivers such as income growth, wealth appreciation and inflation.

Turning the corner into 2022, investors are alert to the coming anniversary of stimulus payments but should be careful not to apply this concern to all companies.

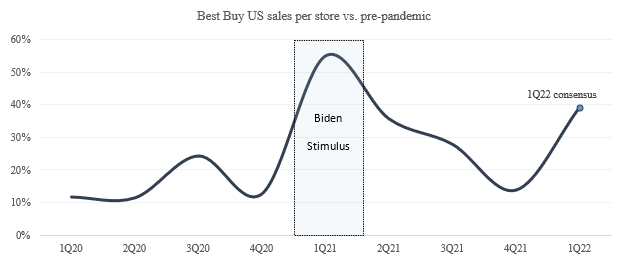

Wary of Best Buy (BBY), safety in McDonald’s (MCD)

BBY and MCD represent large-cap bellwethers for consumer durables and consumer services, respectively. To measure any stimulus effects, we compare sales per location to pre-pandemic levels. BBY’s sales show a strong bounce at the time of Biden’s stimulus payments followed by a gradual fading of sales productivity relative to 2019 as stimulus benefits dissipate. MCD’s sales register barely any impact from stimulus but have sustained their gains as underlying US household income currently enjoys some of its strongest growth in a generation.

Surprisingly, consensus forecasts for BBY do not appear to capture the lapping effect of the stimulus. We are cautious about BBY and select other durable goods retailers as a result. MCD’s consensus forecasts appear within reach.

Don’t get too bearish though, even with gas inflation

The anniversary of stimulus payments and any negative effects on consumer company growth caused will be discrete, transient events. Slowdowns or sales misses will, in the long run, be of immaterial consequence to the intrinsic value of US consumer companies.

Looking further ahead, US household incomes from market-driven forces such as wages and business income are rapidly growing. Market incomes represent a far greater mix of total income than social security payments and therefore growth in these items can offset a material loss in stimulus payments, as well as any impacts from higher energy prices, which represent less than 5% of total household spending.

We expect consumer spending to grow as well. The US consumer is among the most resilient customers any business can have.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.