The announcement that eclipsed this ASX small-cap's strong revenue growth

Calix Limited (ASX: CXL) is no stranger to our readers here at Livewire. It is the only stock to make the reader's picks for small caps for both 2022 and 2023. For those who don't know, the small-cap tech company specialises in industrial technologies, particularly when it comes to reducing CO2 emissions.

Although the share price has stagnated in the last two years, today's 1H FY23 report showed real promise. Revenue growth was over 20% compared to 1H FY22, and a significant positive cash position was maintained despite increased investment in R&D.

However, for Henry Jennings, Senior Market Analyst and Media Commentator at Marcus Today, the major talking point of the report was not the positive surprise on the balance sheet.

"The key takeaway from the result wasn't actually so much about the result because, to be honest, that is a bit of a sideshow."

Instead, he is far more interested in the memorandum of understanding Calix signed with Heirloom for the purpose of partnering on direct carbon removal from the atmosphere. He believes that this, alongside the various strategic relationships CXL holds with other businesses, justifies the 5% surge in share prices at market open.

"I think the reaction was pretty much appropriate. The reaction was predominantly about the future, rather than looking back or looking at the numbers themselves, and the MOU has been very much in focus for investors."

In this wire, Jennings discusses why Heirloom brings so much value to CXL, and in doing so, he illustrates his outlook for the Aussie tech stock, its sector and the Australian share market overall.

Note: This interview took place on Wednesday 22 February 2023

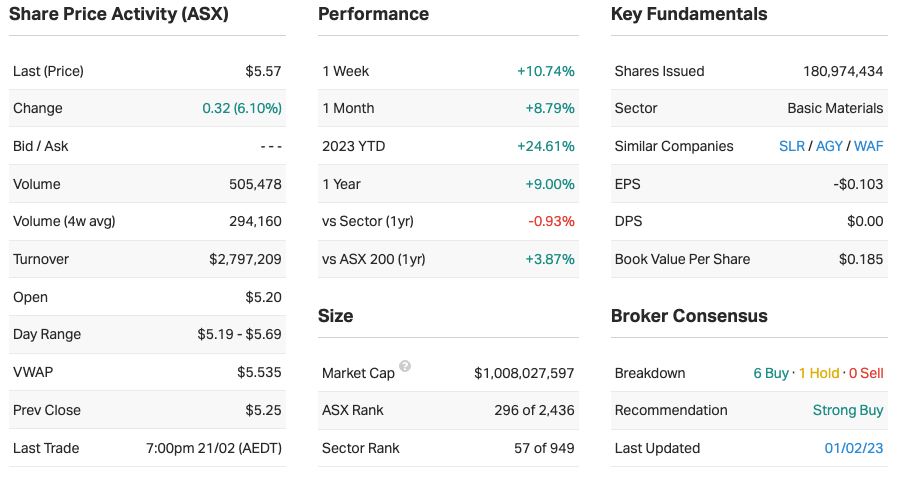

Calix Ltd (ASX: CXL) key results

- $12.7m 1H FY23 revenue (up 20.9% from 1H FY22)

- $88.8m cash on hand

- $5.5m R&D expenses (up from $2.6m 1H FY22)

- Operating loss of $6.5m

Key company data for CXL

What were the key takeaways from this result?

The key takeaway from the result wasn't actually so much about the result because, to be honest, that is a bit of a sideshow. More important was the new memorandum of understanding that they signed with Heirloom for their direct air capture. This is using the 'Leilac' process that they've developed to take carbon dioxide out of the cement-making process.

They are looking to implement this with direct capture to, in layman's terms, suck legacy CO2 out of the air. That refers to carbon dioxide already in the atmosphere, rather than being currently emitted.

So although the results were a little bit better than expected, and the balance sheet looks strong, the market is very much focused on the new MOU with Heirloom, particularly as Bill Gates is one of Heirloom's backers, lending some weight to its credentials.

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction, or appropriate?

The reaction by the market was relatively appropriate. The results came out on a strong day for the market overall, so the stock did rally around 5%. CXL is trading down since the market-open this morning but certainly, the reaction has been positive overall.

The rest of the numbers coming out from Calix re-emphasise the strong balance sheet and cash position of $88.8 million. That's hardly a surprise, however, as CXL raised nearly $82 million in November of 2022. As far as revenue goes, that was also up over 20%.

So overall, I think the reaction was pretty much appropriate. The reaction was predominantly about the future, rather than looking back or looking at the numbers themselves, and the MOU has been very much in focus for investors. We didn't get too much more on an update on Heidelberg or any other projects and they've got it in the pipeline, but certainly, everything seems to be heading in the right direction.

Would you buy, hold or sell CXL on the back of these results?

Rating: HOLD

Well for me, Calix is still a hold, as it is very volatile. It's a stock that we hold in our small-cap portfolio, which I have liked for a long time, ever since it was under $2. But it is very volatile.

The big attraction of course is getting some revenue in the door. This will come from getting pilot plants running, and embedding the technology with the cement makers in Heidelberg, and of course Cemex. So those are the major focuses for CXL going forwards, but at the moment, given the headwinds tech stocks are facing in the market it's still a Hold rather than a Buy. Certainly though, if prices fell back towards $4.50-$4.80 I'd be looking to buy it again.

What’s your outlook on CXL and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

The outlook for CXL over the coming year is pretty positive. There is certainly a lot of room for change, with a lot of announcements to come. The MOU with Heirloom for direct air capture is certainly a positive, and we would like to see more positives along those lines. One key area is the licence agreement with Heidelberg materials, a cement maker, and the revenues that result from the venture.

Certainly though, Calix's slogan "Mars is for quitters", taps into the need for carbon capture and the removal of carbon dioxide out of not only the cement process but also legacy carbon dioxide. So as the year progresses, hopefully, we'll get some more milestones and some licencing agreements actually leading to revenue, so the outlook is pretty positive.

Are there any risks to CXL and its sector that investors should be aware of given the current market environment?

The biggest risk in my view is sentiment risk surrounding technology stocks generally. Obviously, the opportunity to capture CO2, and remove legacy carbon dioxide from the atmosphere is massive. When you consider carbon dioxide from cement production makes up 8% of the emissions globally, there is also a massive opportunity there.

I guess the biggest risk to carbon capture at the moment is the problem in terms of sequestration. It's all very well removing carbon dioxide from the cement process or from the atmosphere, but you've got to put it somewhere. And as yet, carbon sequestration technology is not brilliant.

Countries really have to embrace the means of storing carbon dioxide, whether that's placing it underground, or combining it with another material to make it less of a problem. The biggest risk, however, was that we just don't embrace carbon capture technology quickly enough.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious about the market in general?

Rating: 4

I must admit I'm pretty cautious about the market in general and have been for a little while. We do seem to have been a little overextended in January when there was a little bit too much optimism about what the Fed and other central banks were going to do. The market was quite silly in some ways, in that it put its fingers in its ears and didn't really want to hear what the Fed and other central banks like the RBA have been saying.

Now we're starting to see the market come off as we're listening to central banks, and certainly, results season has highlighted the inflationary issues for some companies, as well as a weaker outlook for consumer-facing companies, not just in Australia but around the world. So on a scale of 1 to 5, I'm about a 4 at the moment and I think we still have more downside to come in our market.

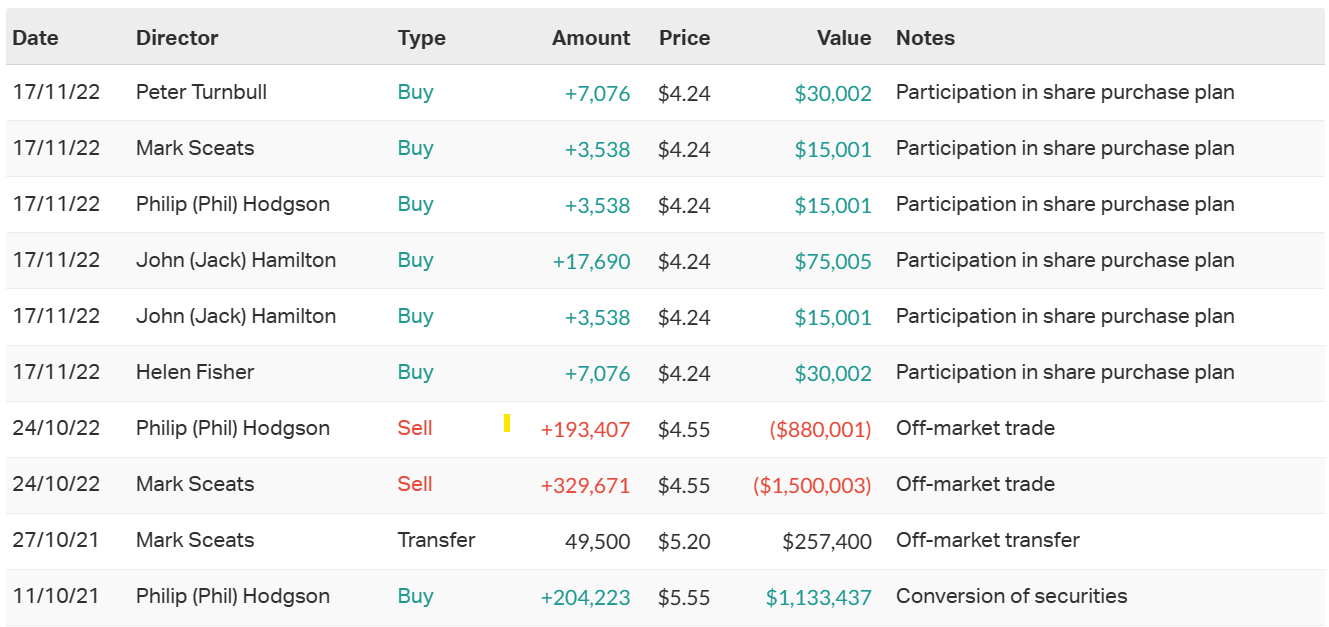

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

5 topics

1 stock mentioned

1 contributor mentioned