The ASX sector Phil King believes is best placed for the next 5 to 10 years

Australian equities are priced at their most attractive levels in years – in some areas of the market, at least, says Philip King, CIO of Regal Funds.

With ultimate responsibility for individual portfolios, King has been instrumental in driving a total return of more than 90% – an annualised return of 18.8% a year – at the Regal Investment Fund (ASX: RF1) since it first listed in June 2019. King’s track record speaks for itself, which is why his market commentary and portfolio positioning ideas are worth listening to.

During an investor webinar on Friday, King called out a couple of sectors he believes will perform very strongly over the next five to 10 years. The first of these is energy.

Why King is bullish on energy

King has long held strong convictions in Australia’s energy sector, and this remains as strong as ever, largely because of the ongoing underinvestment in the space.

“We’re seeing very limited investment in new supply, despite the increase in commodity prices of recent years. That’s because it’s getting harder to get new mines approved, even in mining-focused countries like Australia and Canada,” King says.

“Even for existing production, we’re seeing huge increases in CAPEX, in labour, energy costs…with huge inflationary pressures in the mining sector.”

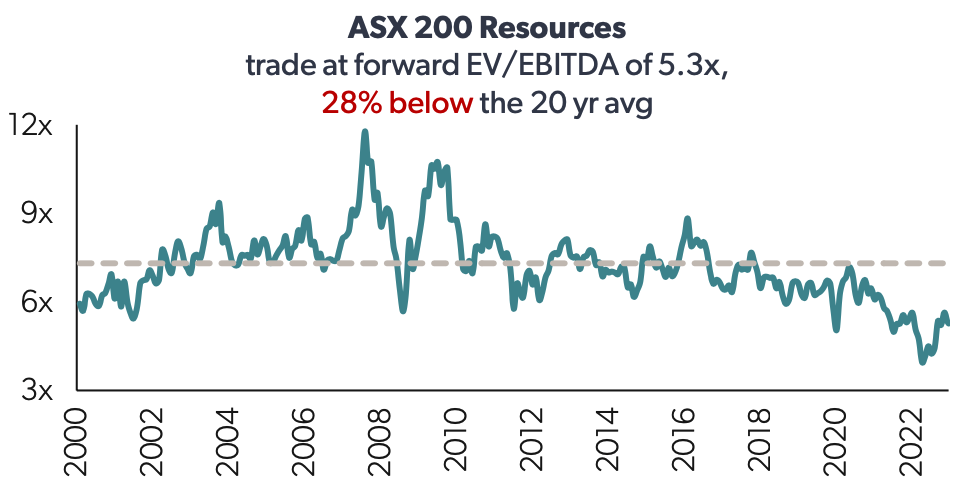

A proof point he emphasises here is the average PE multiple in resources, which sits around 28% below the historical average.

“This would normally suggest resource stocks are pricing in the top of the cycle, but we think the opposite is true,” King said.

“We think the outlook is very positive over the next five to 10 years, which is why we think the resources sector is the best part of the Australian market to be exposed to currently.”

King's favourite commodity

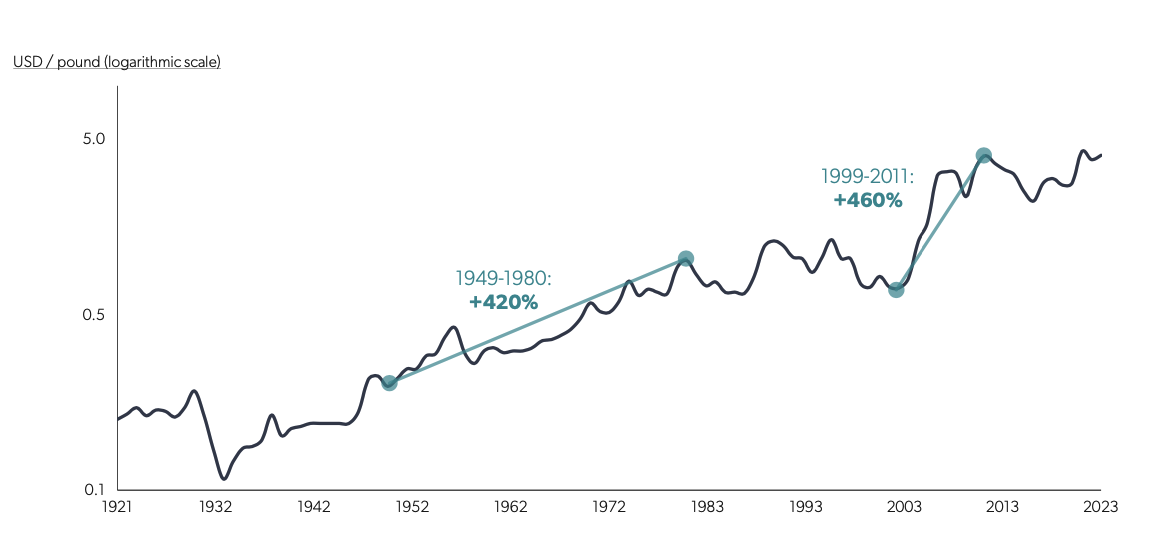

King emphasises the dynamics of the copper price, which “often does nothing for 10 to 15 years,” before then breaking out for a period. This is a pattern he has observed in copper price movements over the last 100 years.

And King believes the electrification push could see copper demand double over time. “It could easily go up 400% to 500%, maybe even to US$20 a pound over the next 10 years,” he said.

Copper prices over the last 100 years

What’s going on with ASX stock prices?

Valuations across the market more generally, and within some more specific segments, were also addressed during King’s wide-ranging discussion.

“In terms of valuations, we’ve seen the Australian market de-rate. The price-to-earnings ratio has fallen from around 20 times a year or two ago to around 13.5 times currently,” he said.

“But over the last 15 years, it’s all been about discount rates and interest rates that have been driving valuations.”

King noted that, before Value stocks started rallying in the backend of 2021, the market saw a 12-year period where falling interest rates and discount rates drove huge outperformance in Growth stocks.

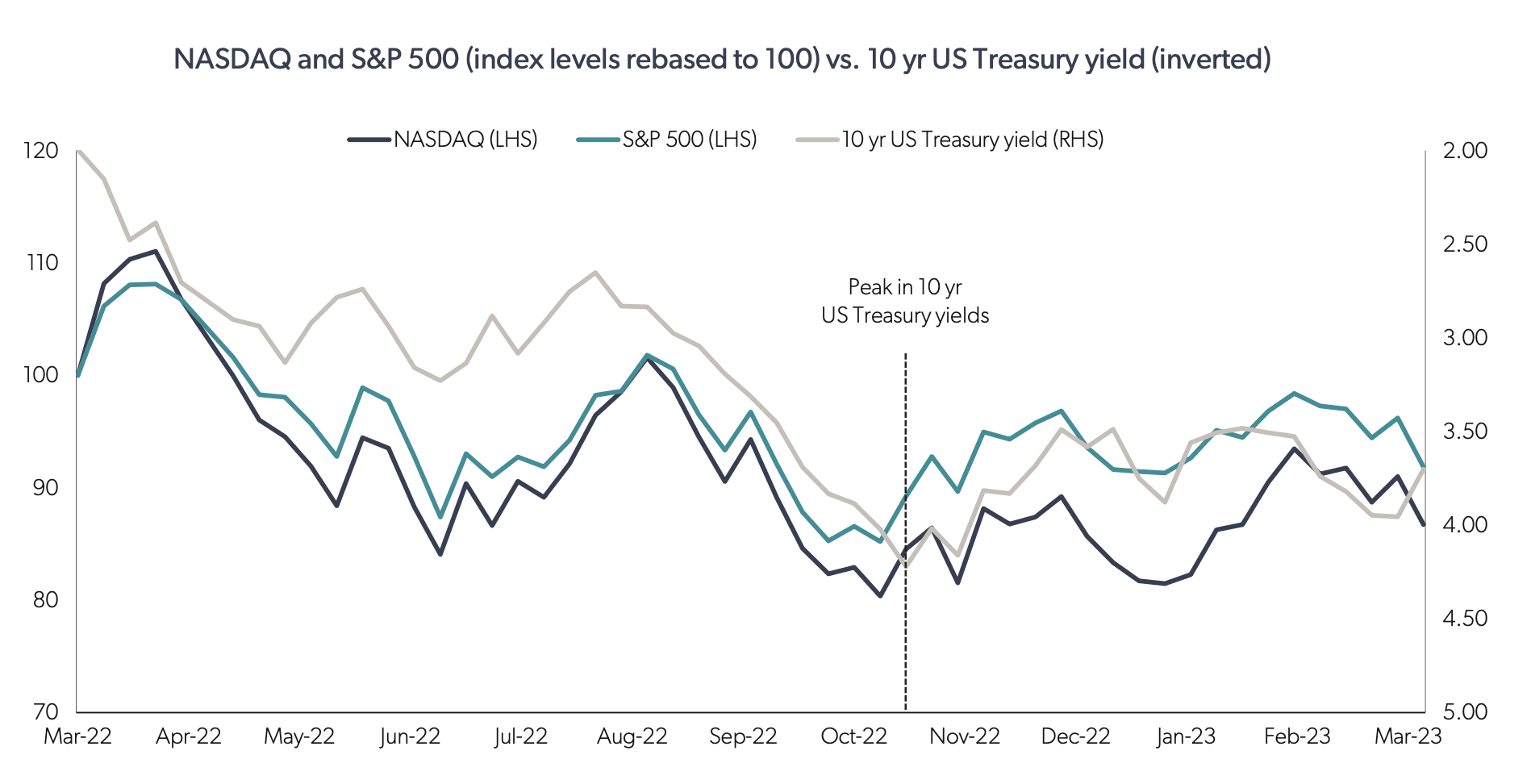

“It was when interest rates bottomed at the end of 2021 that we saw the end of a bull market and the start of a pretty savage selloff in many equities, including tech stocks,” King said.

“When we saw the recent peak in inflation and long-term bond yields in October 2022, that represented the end of the bear market. And we’ve had a decent bounce (in equities) since then.”

He argued that, even on a daily basis, “it feels like equity markets have been very much dancing to the beat of the 10-year bond yield.”

Yields continue to pressure equity markets

As King sees it, this correlation between equities and the 10-year bond yields shifted in the lead-up to the collapse of several northern hemisphere banks in the US and Europe. But he said this has more recently reverted, so that equity markets are again more influenced by bond yields than anything else.

“The bears in the equity market have been expecting bond yields to collapse and that certainly hasn’t happened,” King said.

As an example, he pointed to the February half-yearly reporting season, where companies reported more earnings upgrades than downgrades. He also noted this earnings season marked the start of listed companies reporting the cost crunch of rising interest rates – with costs on average up around 12% to their highest level in more than a decade.

“But revenue also grew by a similar amount and profits were up in line with this. The expected collapse in earnings that many bears were expecting hasn’t eventuated – not yet, at least,” King said.

Value versus Growth

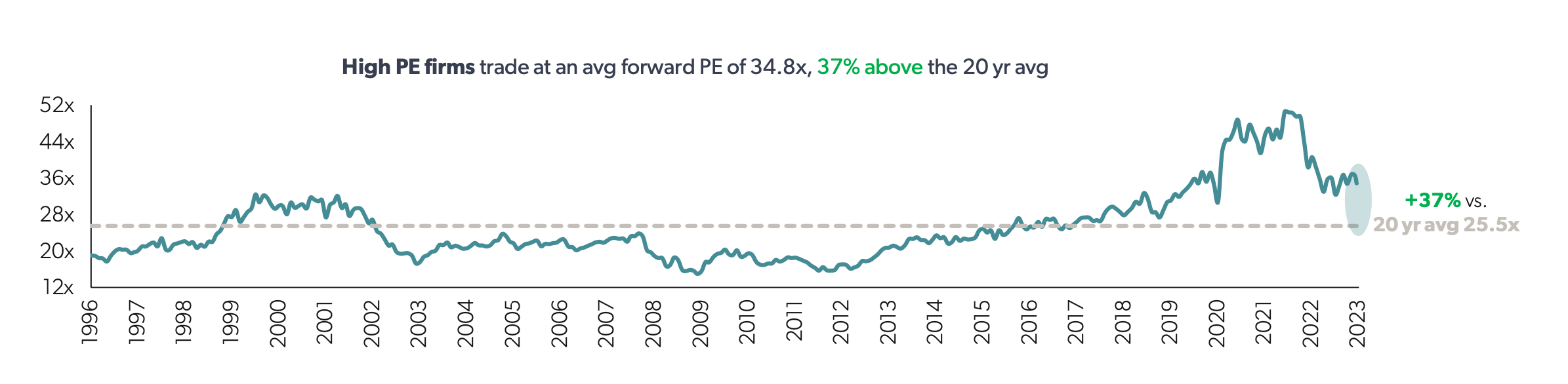

Switching perspective, King also looked at this in terms of the broader Value versus Growth ASX universes. He noted the outperformance of Value stocks versus Growth stocks in the last 12 to 18 months – after a 12-year period where the reverse was true.

“But we think there’s a lot more to play out, that bull markets don’t finish so quickly. We think a lot of the huge run-up in Growth stocks still needs to be unwound,” said King.

As shown in the chart below, the current PE multiple of 34.8 times for high PE firms – which he uses as a proxy for Growth – remains well above the 20-year average.

What will the market look like in five to 10 years?

King discussed how stock markets shift over time, reflecting on his 40 years of investing in the ASX. The ASX financial sector is one prominent example for investors, with the period of regulation in the 1990s – which gave rise to our current “four-pillars” banking system – and paved the way for Australian banks to outperform the market.

“At the peak, banks represented around 50% of the Australian stock market. This has started to unwind, and we think that will continue,” King says. Though he doesn’t expect US-style banking collapses locally, King believes earnings growth in the sector will be much lower than in the preceding 10 years.

On the other hand, he expects the share of the ASX represented by mining and energy stocks will continue to grow.

2 topics

1 stock mentioned

1 contributor mentioned