The best performing Australian share funds of FY2022

There's a lot of red ink on the page, as we look back over the last financial year. But there was also plenty of green on the bourses of world markets during the period.

The following wire is the first part of our series on fund performance during FY2022. With input from some of the top performers, we reflect on what they got right; and some of the things that went wrong.

Key points

- An overview of the Livewire fund database

- A list of the 5 best-performing Australian share funds in FY22

- FY22 was a year where large-cap Value delivered over growth and small caps

- Energy, Materials Infrastructure and defensive shares drive performance

Disclaimer: The following information is based solely on the Livewire Managed Funds list, which contains a total of 244 funds, including 78 Australian shares funds. It is by no means an exhaustive list and is not meant to reflect the top performers across the entire marketplace.

How we compiled this list

The following list was prepared using the information provided here: (VIEW LINK)

- In the "Fund Type" box, select "Managed Fund"

- In "Asset Class" select "Australian shares"

- We then manually filtered performance based on 1 year returns

*Note all data is provided by Morningstar

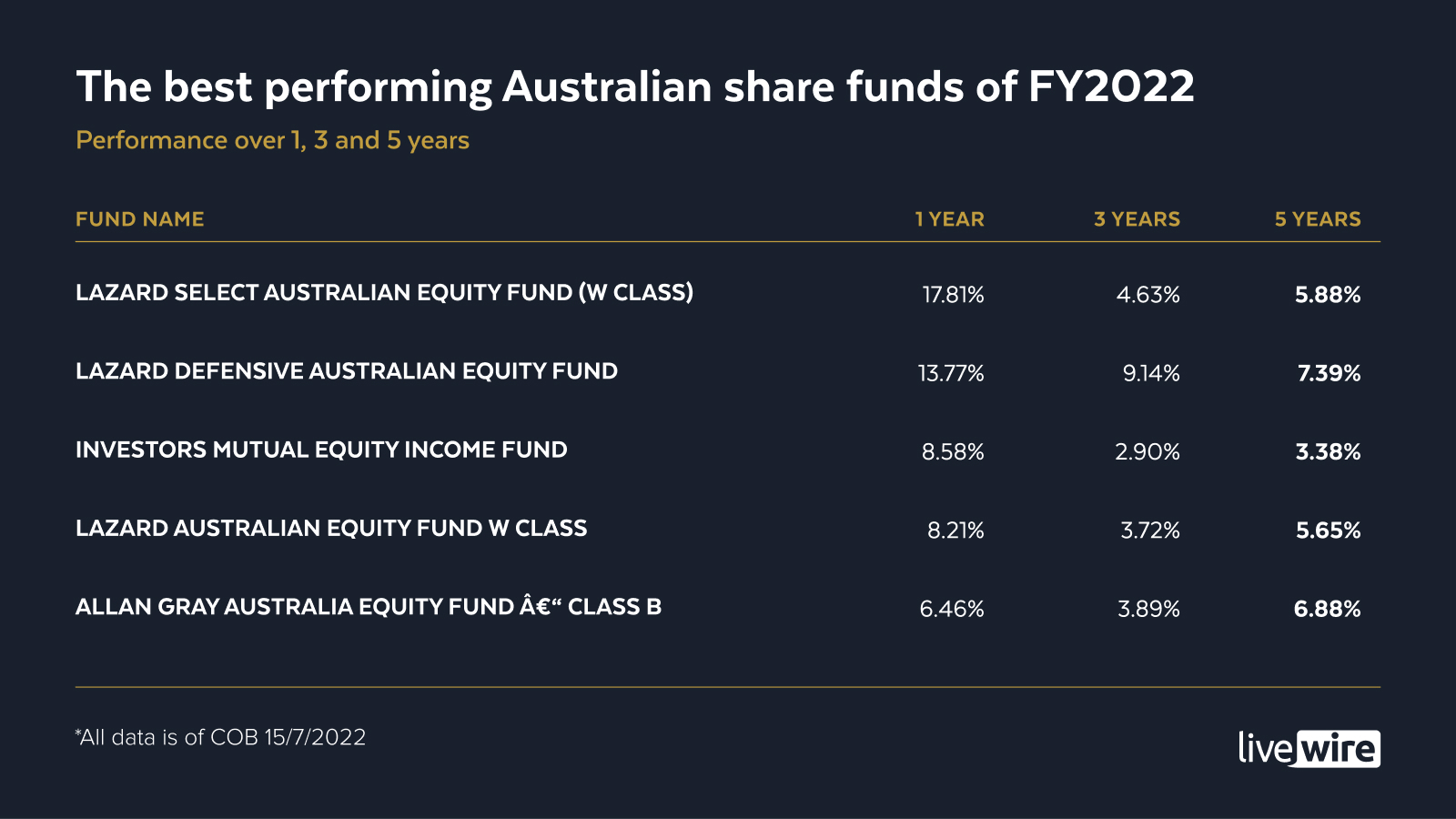

Australian shares best-performing funds for FY22

Below are the 5 best performing Australian share funds in the Livewire database.

-

Lazard Select Australian Equity Fund (W Class) + 17.8%

- Lazard Defensive Australian Equity Fund + 13.77%

- Investors Mutual Equity Income Fund + 8.6%

- Lazard Australian Equity Fund (W Class) + 8.2%

- Allan Gray Australian Equity Fund (Class B) + 6.4%

Value-focused fund managers locked out the top five slots in terms of performance, which is probably unsurprising given the scale of the Growth selloff since the end of last year.

The Lazard Select Australian Equity Fund (W Class)

The Lazard Select Australian Equity Fund (W Class) is a concentrated portfolio of between 12 and 30 stocks that the team, led by local market veteran Dr Philipp Hofflin, believes are trading at a discount.

Speaking with Livewire’s James Marlay in May, Hofflin explained why he believes the Growth stock selloff still has some way to go.

“The mean reversion has only covered 30-40% of where we'd expect it to go when it returns to normal. Astonishingly enough, the multiples peaked only in late 2021,” he said.

Hofflin doesn’t expect it will be a straight line, but with some periods of gains and losses for both Growth and Value during this period.

“Some of the biggest rises tend to come in bear markets, for all markets. So, I don't think the straight line will continue,” Hofflin said.

Top 5 holdings:

- QBE Insurance (ASX: QBE)

- Woodside (ASX: WSD)

- AMP (ASX: AMP)

- Whitehaven Coal (ASX: WHC)

- Rio Tinto (ASX: RIO)

QBE is the fund’s largest individual position, comprising more than 10% of the fund as of 30 June 2022.

Major contributors to FY22 performance include:

- AusNet (which was delisted from the ASX in February after being taken over by a consortium).

- Spark Infrastructure (also a successful takeover target, the power grid company was delisted in late 2021).

- Incitec Pivot (ASX: IPL) a diversified chemicals and fertiliser company.

Lazard Defensive Australian Equity fund

Another Lazard fund, Defensive Australian Equity, ranked second in FY22. Benchmarked against the ASX 200 Accumulation Index, it’s an income-focused fund that typically holds around 30 stocks.

In line with its defensive mandate, almost 18.5% of the fund is held in financials – which is underweight the almost 28% weighting on the index. Consumer staples are the next highest allocation, with an overweight position of 14% (versus 5% in the index) and consumer discretionary, with 12.6% versus 6.3% on the index.

Top 5 holdings:

- Woodside (ASX: WDS)

- Whitehaven Coal (ASX: WHC)

- Computershare (ASX: CPU)

- Ridley (ASX: RIC)

- Collins Foods (ASX: CKF)

Investors Mutual’s Australian Equity Income Fund

Another wholesale offering, this one ranked third. The fund's co-portfolio managers are Michael O’Neill and Tuan Luu. O'Neill recently wrote about how he and the team generate income in volatile markets.

Top 5 holdings:

- Telstra (ASX: TLS)

- Brambles (ASX: BXB)

- Coles (ASX: COL)

- Aurizon (ASX: AZJ)

- Orica (ASX: ORI).

Lazard Australian Equity Fund

The Lazard Australian Equity fund is a more diversified portfolio than some others in the Lazard stable, it holds between 25 and 45 stocks. It held just over 30% of the portfolio in financials, 18% in materials and 14% in energy as of 30 June 2022.

Top 5 holdings:

- BHP Limited (ASX: BHP)

- Woodside (ASX: WDS)

- Rio Tinto (ASX: RIO)

- QBE Insurance (ASX: QBE)

- Commonwealth Bank (ASX: CBA)

Allan Gray Australia Equity Fund - Class B

The overall fifth-ranked fund from Livewire’s funds' universe, Allan Gray is a contrarian, high-conviction fund manager. This particular fund is benchmarked against the ASX 300.

Top 5 holdings:

- Woodside (ASX: WDS)

- Alumina (ASX: AWC)

- Newcrest Mining (ASX: NCM)

- QBE Insurance Group (ASX: QBE)

- Sims (ASX: SGM)

Materials and Energy are the fund's biggest sector allocations, with Woodside its largest holding (10.8%) as of 30 June. Another energy company, Origin (ASX: ORG) (3%), and energy services provider Worley (ASX: WOR) (3.2%) round out the top 10 positions of the fund.

Allan Gray CIO Simon Mawhinney recently told Livewire why his team holds such high conviction in the sector.

“I think it's likely that oil and gas prices are going to be at levels significantly above where they have been over the most recent five years,” he said.

Why? For Mawhinney, the key reason is “severe underinvestment in new supply...I think supply is likely to fall much faster than demand even in a net-zero, 2050 world,” he said.

Echoing a common theme, the following stocks were some of the biggest performance contributors in FY2022:

- Woodside (ASX: WDS)

- Incitec Pivot (ASX: IPL)

- Origin Energy (ASX: ORG)

Conclusion

The strong showing of Value managers on this list emphasises yet again the Growth to Value rotation we've seen in the last 12 plus months. The large role energy and commodity prices played in the success of the above funds is also notable. This highlights the theme of undersupply we've heard increasingly over the last six months, a situation that's being worsened further as the tragic war in Ukraine continues.

1 topic

13 stocks mentioned

6 funds mentioned

2 contributors mentioned