The best performing fixed income funds of FY2022

Fixed income serves as a safety net in portfolios. When equities take a turn for the worse, fixed income helps investors minimise their losses. Hence the logic behind the whole 60/40 portfolio.

But that doesn't mean fixed income performance should be discounted - quite the opposite, in fact. The capacity of fixed income to offset losses in other asset classes is still a function of its own performance.

Livewire has 36 fixed income funds registered on its platform, mostly long duration bond funds with a few credit funds in there too.

As part of a new series we're running on fund performance, we thought it was time to have a look at FY22 performance to see how fund in this asset class fared in what was a challenging year.

.png)

How we compiled the list

The following list was compiled using the information provided here: (view link).

- In the “Fund type” box, select “Managed Funds”

- In “Asset Class”, select “Fixed Income - Australia and Fixed Income - Global”

- We then manually filtered results based on 1 year returns.

Important: It's worth noting that while the above filters are able to narrow down the funds to those in the fixed income space, they don't seperate long duration bond funds and credit funds. As you'll see below, these two types of funds have diverged a bit in performance but also have different risk profiles.

*Please note all data is supplied by Morningstar.

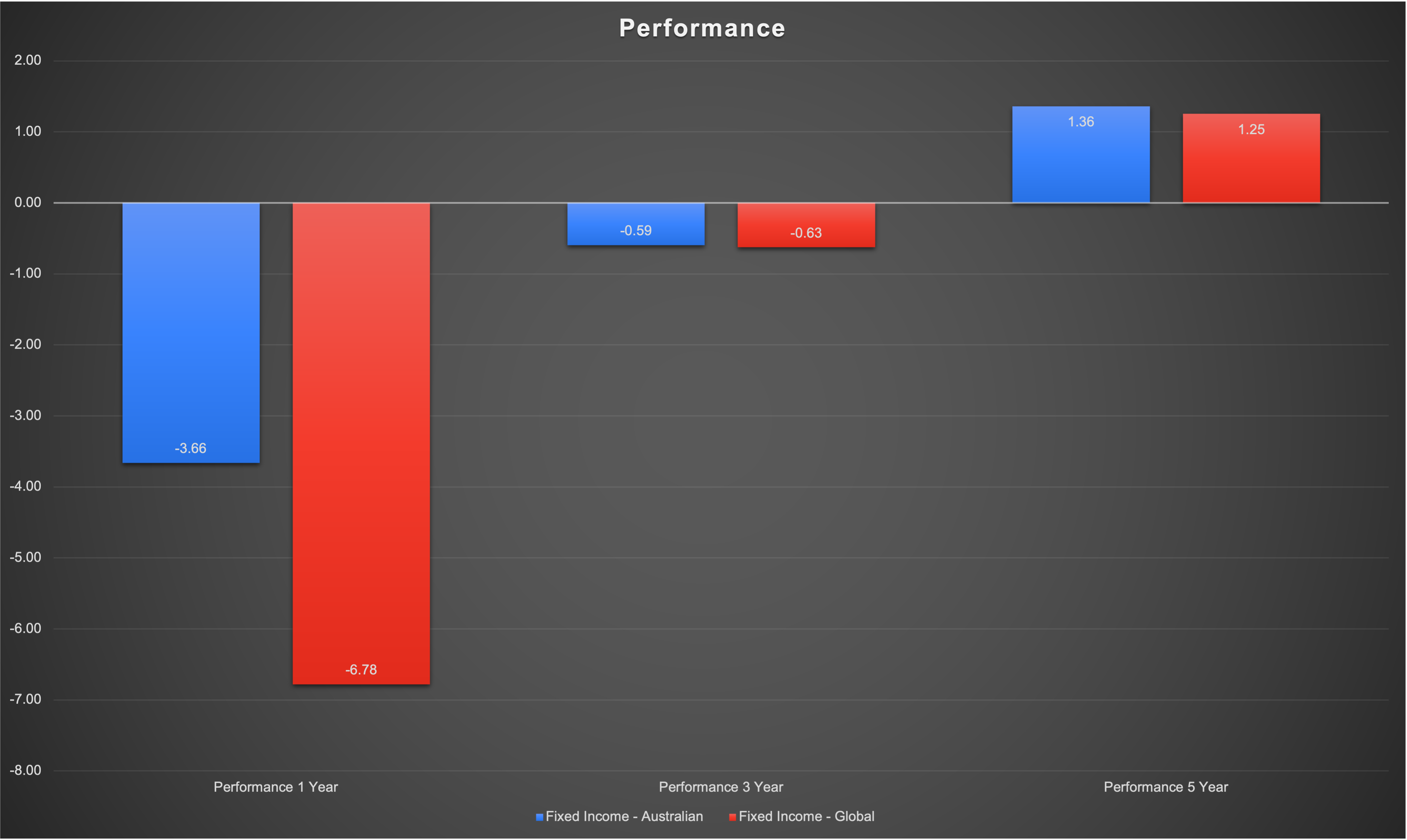

Asset class performance

Before we look at fund performance individually, let's look at the cohort as a whole.

The past year has not been kind to fixed income funds - especially global fixed income funds.

As you can see in the above chart, global fixed income funds returned -6.78% over the past year. Aussie fixed income funds suffered significantly less, however, returning -3.66% over the past year.

Over three years, when rates were essentially zero, the Aussie and global funds were neck and neck at -0.59% and -0.63% respectively.

As a cohort, you have to turn to 5 year performance to find happier days - with 1.36% for Aussie fixed income funds and 1.25% for global fixed income funds.

Interestingly, Aussie fixed income has outperformed global fixed income across all three time horizons.

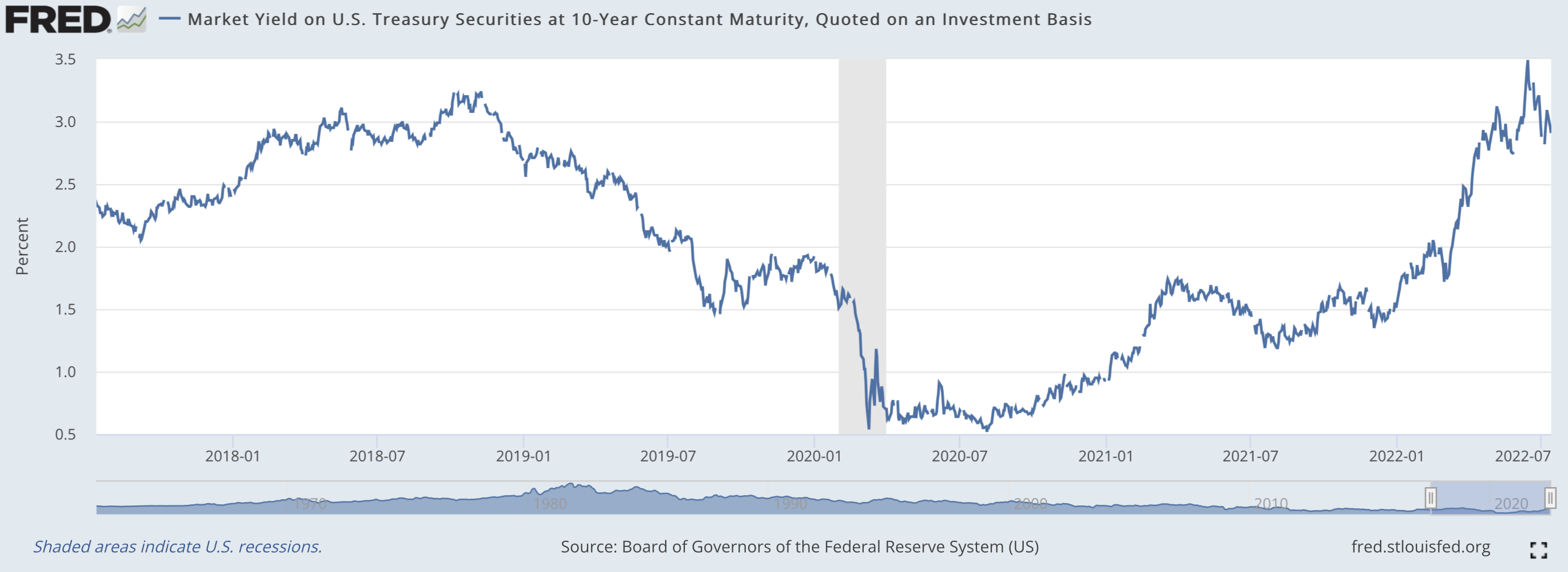

The reason for the poor performance is fairly straightforward. Bonds form the backbone of the overwhelming majority of these funds. Yields paid out for bonds traded on the secondary market broadly dovetail the cash rate (if they didn't, people would just move their money into the bank and collect income that way).

But as yields rise, the value of the bonds falls. Hence the problem for fixed income investments already holding portfolios full of them. This is reflected in short term numbers, however, it is worth noting that holding a high-grade bond to maturity will see your principal returned.

Best fixed income fund performance over 1 year

-

Realm Strategic Income Fund - Enduring Units +5.31%

-

Metrics Direct Income Fund +4.55%

-

Fortlake Real-Higher Income Fund +1.68%

-

CIPAM Credit Income Fund +0.93%

- Realm Short Term Income Fund +0.38%

Realm Strategic Income Fund - Enduring Units

The Realm Strategic Income Fund tops the pops with 12 month return of 5.31%.

As a credit fund, REALM teams up with banks and non-banks to fund wholesale banking facilities, mostly mortgages and loans.

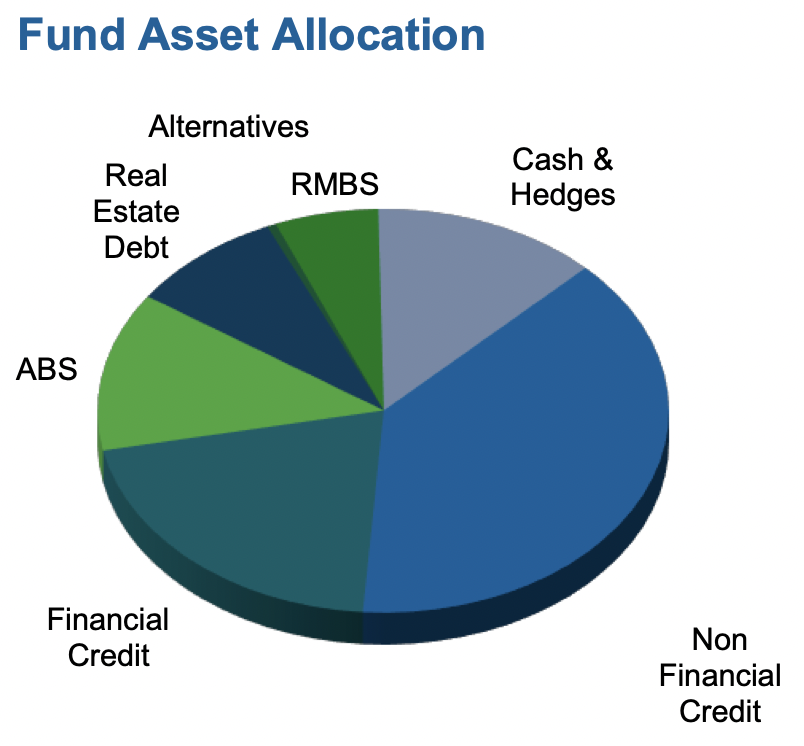

60.69% of the fund is made up of private asset backed securities (ABS) and residential mortgage backed securities (RMBS), 26.11% public ABS/RMBS, and 4.65% structured secured securities backed by loans.

The portfolio has an average credit rating of BBB - which is riskier than a purely government bond but still qualifies as investment grade.

It has an average weighted duration of 1.18 years and a pre fee running yield of 6.53%.

"In one way, corporate credit securities are a bond play, a credit play and also a currency play," says Andrew Papageorgiou, head of bank capital and corporate capital at Realm Investment House.

Metrics Direct Income Fund

With one year return of 4.55%, the Metrics Direct Income Fund gives investors exposure to Australian corporate loans, diversified by borrower, industry and credit quality – an investment space dominated by the banks.

The fund is highly diversified, with 267 investments allocated in the above sectors. More than half of them (52%) are investment grade, and the fund has overall credit duration of 2 years.

It targets a return of 3.25% p.a. above cash, net of fees.

The beauty of income funds can be found in the floating rate nature of their returns. If rates go up, so too do the returns because they're pegged to the bank bill swap rate (BBSW).

"The interest on Australian corporate loans is usually structured as an additional margin over the benchmark Bank Bill Swap Rate (BBSW), which is correlated with the RBA Cash Rate," says Andrew Lockhart, Managing Partner at Metrics Credit Partners.

"In this way, the returns on corporate loans keep pace with inflation, helping investors to maintain their purchasing power even as prices of goods and services rise."

Fortlake Real-Higher Income Fund

Fortlake's REAL-Higher Income Fund, which has returned 1.68% over the year, invests in a mix of bank deposits, high grade and investment grade bonds, and asset backed securities.

The fund target a return of 4% over cash. It hasn't achieved this over the past year, with return of 1.68%, but in a year like we've had I'd say that's still a respectable figure for any kind of fund.

CIPAM Credit Income Fund

Coming in fourth, with 1 year return of 0.93%, is CIPAM's Credit Income Fund, another traditional bond fund.

The fund has a running yield of 3.1% and an average asset rating of BBB-, which is still investment grade.

CIPAM's big thing is mixing public and private debt together into one fund.

"[Public and private debt] have complementary qualities that can be exploited to efficiently manage exposures throughout the cycle, while building a portfolio that provides diversification and yield premium relative to traditional fixed income," says Pete Robinson at CIP Asset Management.

REALM Short Term Income Fund

Realm's second fund in the top five invests in a mix of cash and domestic issued fixed interest securities: 164 in total.

The fund targets return of 1.50–2.00% over cash, net of fees, and currently boasts a running yield of 2.96%.

The credit rating (A) is a bit higher than Strategic Income Fund fund, which might account for the lower one year performance.

Residential mortgage backed securities and asset backed securities make up the largest proportion of the fund (29.56%), followed by corporate bonds (22.99%) and subordinated debt (19.96%).

Key takeaways

- The Realm Strategic Income Fund - Enduring Units topped one year performance with return of 5.31%

- Over one year, Australian funds outperformed global funds by 3.12%

- Credit funds ruled the roost, beating out long duration bond funds to take the top five positions over one year

.jpg)

5 funds mentioned

5 contributors mentioned