The best time to invest in small caps is now

Fears of recession, a market correction and runaway inflation have caused small-cap stocks to materially underperform their large-cap cousins. Those same fears have led many investors asking how wise it is to invest in a small-cap fund now. But investors should remember the stock market is the only market where consumers zip up their wallets when prices are low.

This is why I believe you should be a contrarian investor and invest in a small-cap fund now.

- Widest dispersion prompts Future Fund to Invest in Small Caps

The broad equity selloff last year, and the rally led by just seven large-cap U.S. tech stocks this year, has left valuations for beaten-down global small-cap shares at the cheapest level compared to their larger counterparts in nearly two decades, according to Bank of America.

In Australia, many smaller listed companies have taken a battering as fears of inflation and recession saw investors prefer the security of large caps. The disparity has led Australia’s sovereign wealth Future Fund to explore investing in smaller Australian stocks for the first time. Speaking in April, the Future Fund’s CEO, Dr Ralph Arndt said: “Markets are constantly changing, and we must evolve our strategy in response,” adding, “…changes in domestic markets have made small cap equities attractive to us for the first time and we have commenced a new program to invest in them in recent months.”

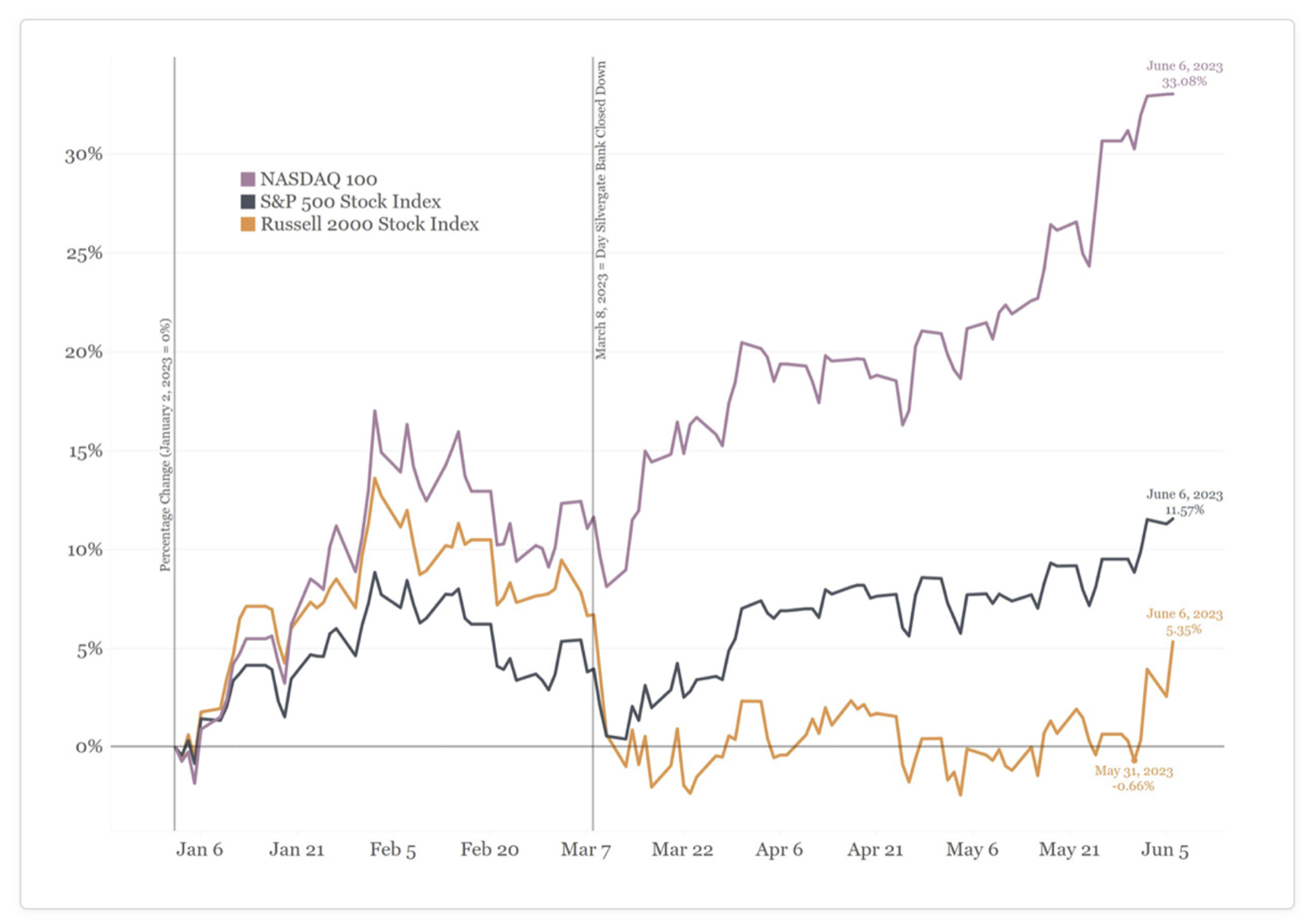

Figure 1. Year to date returns

Source: Bianco Research LLC.

At 13.6 times projected earnings (reading taken on 13 June 2023), the S&P 600 SmallCap Index is materially cheaper than even its historical averages.

- Valuation

Often, the underperformance of a small-cap fund is linked to undervaluation, which can present a great investment opportunity. Small companies experiencing temporary headwinds, either individually or collectively, may see their shares fall out of favour and become undervalued, sometimes relatively and sometimes absolutely. But if the fundamentals of the companies in the fund are solid and the quality high, they may simply be going through a challenging phase. For high-quality companies, large or small, it’s worth remembering the lower the price you pay, the higher your future return.

- Reversion to the mean

Financial markets tend to revert to the mean over time. That means sectors or asset classes that underperform the market for a certain period often have a high potential for bouncing back. So, investing in a high-quality but underperforming fund now could yield significant returns when prices revert.

- Opportunity for high growth

Small companies usually have longer runways to grow compared to larger companies that are often mature. Small companies may also have innovative products or services that haven’t been fully recognised by the market, haven’t maximised their geographic potential or haven’t fully penetrated a market. Once these companies hit their stride, the potential upside can be huge.

- Market inefficiencies

Small-cap stocks are not as closely followed as their large-cap counterparts, leading to potential market inefficiencies that knowledgeable investors capitalise on. This means there’s a greater chance a small-cap investment manager finds undervalued stocks which the market has overlooked.

- Portfolio diversification

Adding small-cap equities can help you to diversify your investment portfolio, reducing risk. They often have a low correlation with large-cap stocks, meaning they may perform well when larger companies are struggling and vice versa.

- Economic recovery

Yes, there are fears of a recession, but a recession is not guaranteed. And even if a shallow one occurs, the economy will bounce back from it. Smaller companies can be more sensitive to economic changes. If there are signs that the economy is starting to improve, this could significantly benefit small-cap stocks. Plus, they are often more domestically focused and can be offer good protection against global uncertainties.

There are several compelling reasons why investing in underperforming small caps might be a good strategy. Your individual financial goals, risk tolerance level, and investment horizon should inform your decision, and it’s crucial to perform due diligence before investing in any fund.

Carefully assess the fund’s portfolio, the track record of the fund manager, and the overall health of the sectors in which the fund is invested. Don’t invest solely on the notion of “buying the dip”. Rather, make sure you believe in the small companies’ underlying value and growth potential within the fund.

Finally, a balanced portfolio with a mix of funds with exposure to different asset classes, sectors, and company sizes is usually the best strategy for long-term wealth creation. If your portfolio lacks exposure to the growth and potential of small caps, their relative value and underperformance right now might make them worthy of your attention.