The Big Bank "priced for a soft landing": Morgan Stanley

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 3,946 (+0.34%)

- NASDAQ - 12,134 (+0.84%)

- CBOE VIX - 26.16

- USD INDEX - 109.66

- US 10YR - 3.412%

- FTSE 100 - 7,277 (-1.47%)

- STOXX 600 - 417.52 (-0.86%)

- UK 10YR - 3.1615%

- GOLD - US$1697/oz

- WTI CRUDE - US$89.02/bbl

- DALIAN IRON ORE - US$101.43/T

THE CALENDAR

UK inflation for the month of August dropped late yesterday afternoon. The good news is that it's back under 10% year-on-year at the headline level. The bad news is that it's still 9.9% year-on-year at the headline level. Much more work to be done on Threadneedle Street and at the Bank of England, that's for sure.

Meanwhile, US PPI fell 0.1%, in line with economists' expectations. More interesting was the year-on-year increase of 8.7% ... the lowest since August 2021. If that's not a symbol of the world we now live in, I don't know what is.

Now to today's activities...

Oh, you thought the massive week for macro was over? I've got news for you. It gets even more chaotic today. Before the market open, we'll see NZ GDP for Q2. Then, Australian jobs data takes centre stage. Economists are betting on a partial recovery of last month's job losses while the unemployment rate stays steady. But I will be looking at the rise in average weekly earnings. Anything less than 6.8% still erodes your gains, but how much is the question?

Speaking of jobs, here's a stat that will blow your mind:

If you're not getting a pay rise, you may have to take on more than you thought you could chew.

Finally, we'll get US retail sales and weekly jobless claims tonight. Will retail sales remain near zero? And if so, does that signal the end of the US consumer's strength period? We'll all find out.

THE CHART

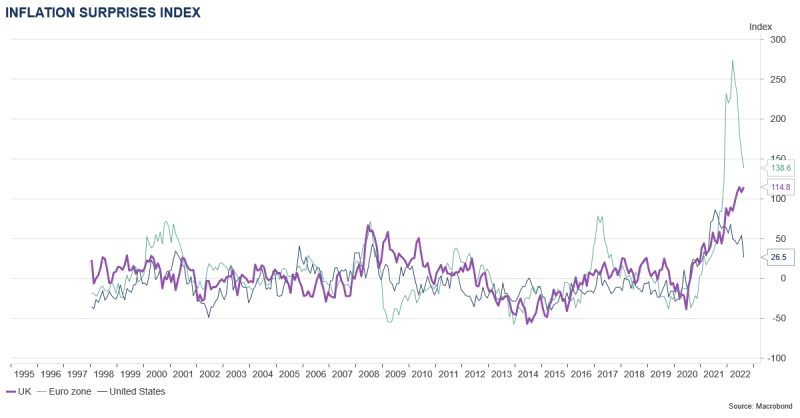

Speaking of inflation, the US read from Tuesday evening was a shocker for all the wrong reasons. This leads me to today's chart - the inflation surprises index across the major northern hemisphere economies (bar China and Japan). Look at the surprises seen in the Eurozone! Although that 26-handle in the US may change before long.

THE TWEET

STOCKS TO WATCH

And now for something completely different - the Big Banks but not evaluated entirely on valuation. It's no secret that the banks have struggled in this era when higher interest rates are supposed to help their margins. But is there reason to believe that things will alleviate? Analysts led by Richard Wiles had this to say:

Significant margin expansion should drive upgrades to consensus estimates and support share prices in the near term before several headwinds come together in the second half of 2023.

So what does that all mean? In a world where NIMs will likely to remain very volatile after a brief respite period of, the big banks are (in general) still likely to perform in line with the broader equity market. But breaking it down, the winner is ANZ (ASX: ANZ) who gets an upgrade to overweight from equal-weight. It joins Westpac (ASX: WBC) in that distinct club.

But - and here's the catch - Commonwealth Bank (ASX: CBA) is the one name that can probably most benefit from a soft landing! And that means there could be some upside to come if you don't want to lose the rose-coloured glasses.

And speaking of soft landings, you can read this piece which is on the website now:

.png)

TODAY'S TOP READ

Ferrari succumbs to SUV trend with a $700,000 offering (AFR): When history writes the book about when consumer spending rolled over, they should think of including this new car in the outlier chapter. I wonder if anyone will buy it - and how quickly it will be shipped out given the supply chain challenges.

Hans Lee wrote today's report.

GET THE WRAP

If you've enjoyed this edition, hit follow on this profile to know when we post new content, and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

3 stocks mentioned

1 contributor mentioned