The big issues in real estate debt right now

.png)

Freehold Investment Management

The markets will remain volatile for some time given the unprecedented impact from the Coronavirus on global economies, business supply chains and consumer spending patterns. However, as the landscape is rapidly evolving, it remains to be seen whether the direct impacts will prove to be transient or longer lasting. We are now experiencing unprecedented times, with balance sheets across the world being tested. It will be the survival of the fittest, or strongest balance sheet.

Side effects on the real estate market

We expect this period of uncertainty and volatility to impact liquidity, with debt providers being more selective and conservative in an environment where real estate valuations prove difficult. This is likely to lead to lower transaction activity, with vendors and buyers alike delaying decisions until the depth and duration of this period is clearer.

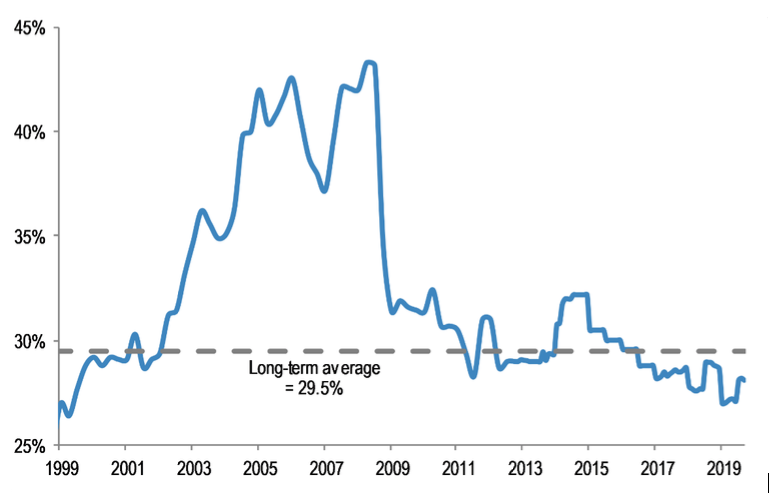

Despite the uncertainty, the real estate market in general terms is well-placed. Average leverage is at a relatively comfortable level, in an historic context, due to the prudential controls on lending that commenced roughly four years ago. That said, some distress may emerge in particularly vulnerable sectors or among particularly vulnerable asset owners, although if the current crisis abates in the timeframes predicted by the government, we wouldn’t expect any significant distress.

Fig 1: A-REIT sector weighted average gearing

Source: J.P. Morgan

Assessing short-term pressures

At Freehold, capital preservation and delivering sustainable returns for investors from tangible assets always drives our thinking. So, our conservative approach to risk and leverage will not change in these times. However, the biggest challenge in an environment where there are fewer willing sellers and buyers, is determining the market value of assets.

Whilst we believe our defensive positioning generally protects the Freehold portfolio, we are conscious that as the impact of the Coronavirus and related health and economic crisis unfolds, it is prudent to assume there may be various issues or liquidity pressures and technical defaults across our portfolio. Any such occurrence may have some impact on short to medium-term returns and cash flows.

Risk and leverage are front of mind

As at 28 February 2020, the weighted average leverage ratio (LVR) was 55% and 95% of the portfolio was secured by first ranking senior mortgages. All facilities within the portfolio remain fully compliant.

In the current environment it is possible that there may be short term defaults. However, the conservative LVRs and the quality of the underlying property should ensure recovery of capital and returns when the market ultimately reverts to normality.

At this stage, we’re not seeing signs of widespread defaults, but we have seen some signs of increased funding costs for borrowers.

Positioning for the weeks ahead

Our current portfolio is diversified across 34 individual projects comprising land finance 69%, construction 27% and two material investments to go into residual stock in March and April 2020. All our projects are sufficiently funded to complete construction and reach point of maximum value.

Looking across the projects, those in construction remain on track. Despite some initial concerns around the potential delay of materials from China, the Chinese economy has started opening again with factories shipping over the last few weeks.

There has also been continued sales and settlement activity across the portfolio - even the last couple of weeks of March. However, we are mindful that it is a rapidly changing environment and, at this point, it is unclear what will happen in the weeks ahead.

This week both NSW and Victoria have further restricted non-essential activities. Additionally, as both Federal and State Governments have indicated, it is likely there will be further restrictions on movement in the near term. These restrictions will have a significant impact on all commercial activity across the economy, not just real estate.

We expect projects that are in the construction phase to continue, but obviously be subject to rapidly changing conditions where work may be stopped. Projects that are currently in design or DA phase have the ability to progress through work from home arrangements.

Transaction activity will drop, and this is already evident. In the near term, developers are likely to pause or delay investment activity, and those with balance sheet capacity may choose to pay down debt.

At Freehold, capital preservation and delivering sustainable returns for investors from tangible assets always drives our thinking. So, our conservative approach to risk and leverage will not change in these times. However, the biggest challenge in an environment where there are fewer willing sellers and buyers, is determining the market value of assets.

Focus on capital preservation and income

Decades of diverse experience come together to provide stable and reliable returns. We are specialist providers and managers of domestic property and infrastructure with highly differentiated client service. Learn more about our strategy here.

Click the 'FOLLOW' button below to be notified when I publish my next wire.

1 topic

.png)

Omar has over 15 years' experience across funds management and real estate. His experience extends across structuring, due diligence, capital raising, as well as managing and growing funds management businesses.

Expertise

.png)

Omar has over 15 years' experience across funds management and real estate. His experience extends across structuring, due diligence, capital raising, as well as managing and growing funds management businesses.

.png)