The big signals every investor should watch ahead of 2024

Signal or Noise is a show that is designed to make sense of data and headlines - and 2023 had both of those in spades.

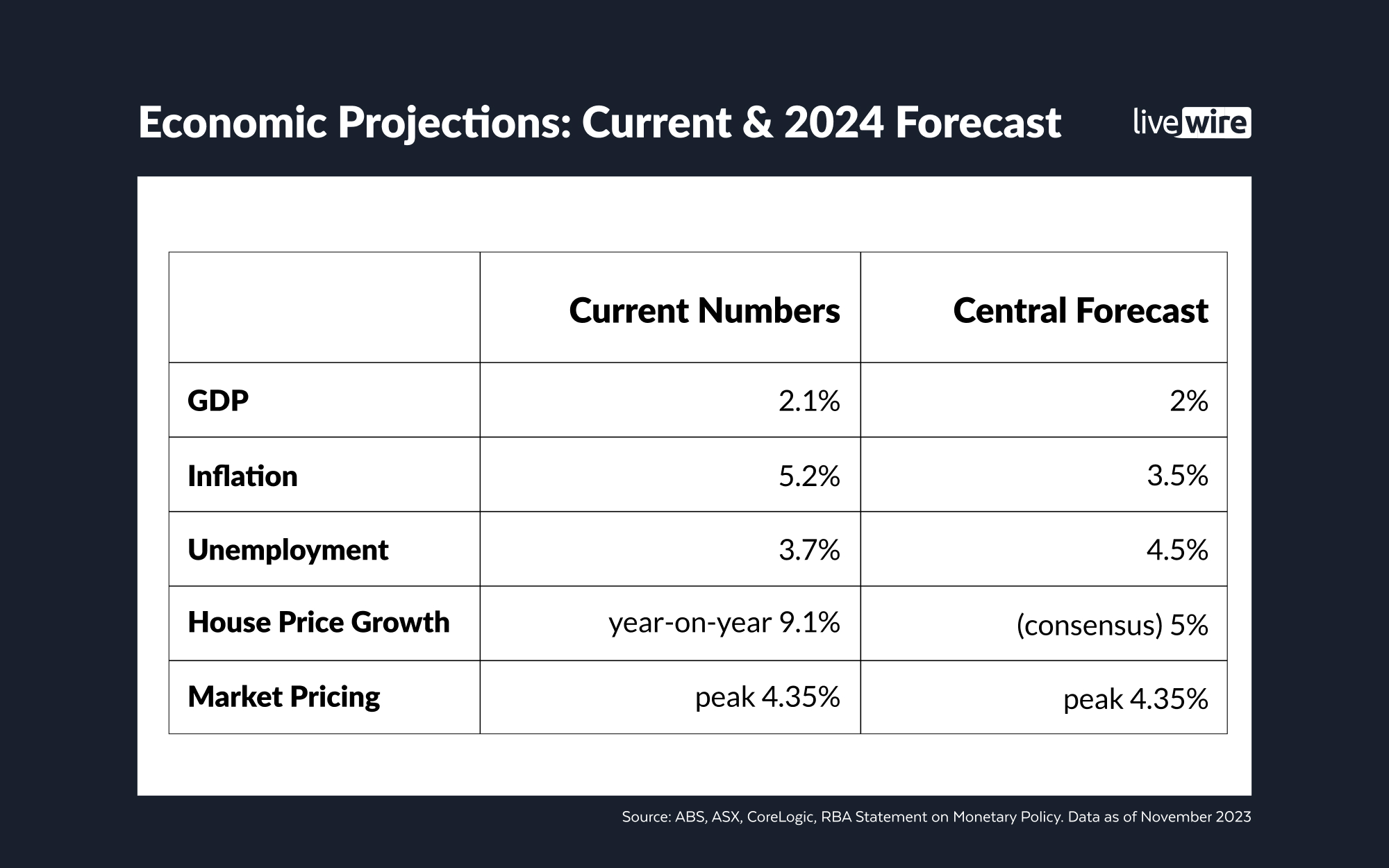

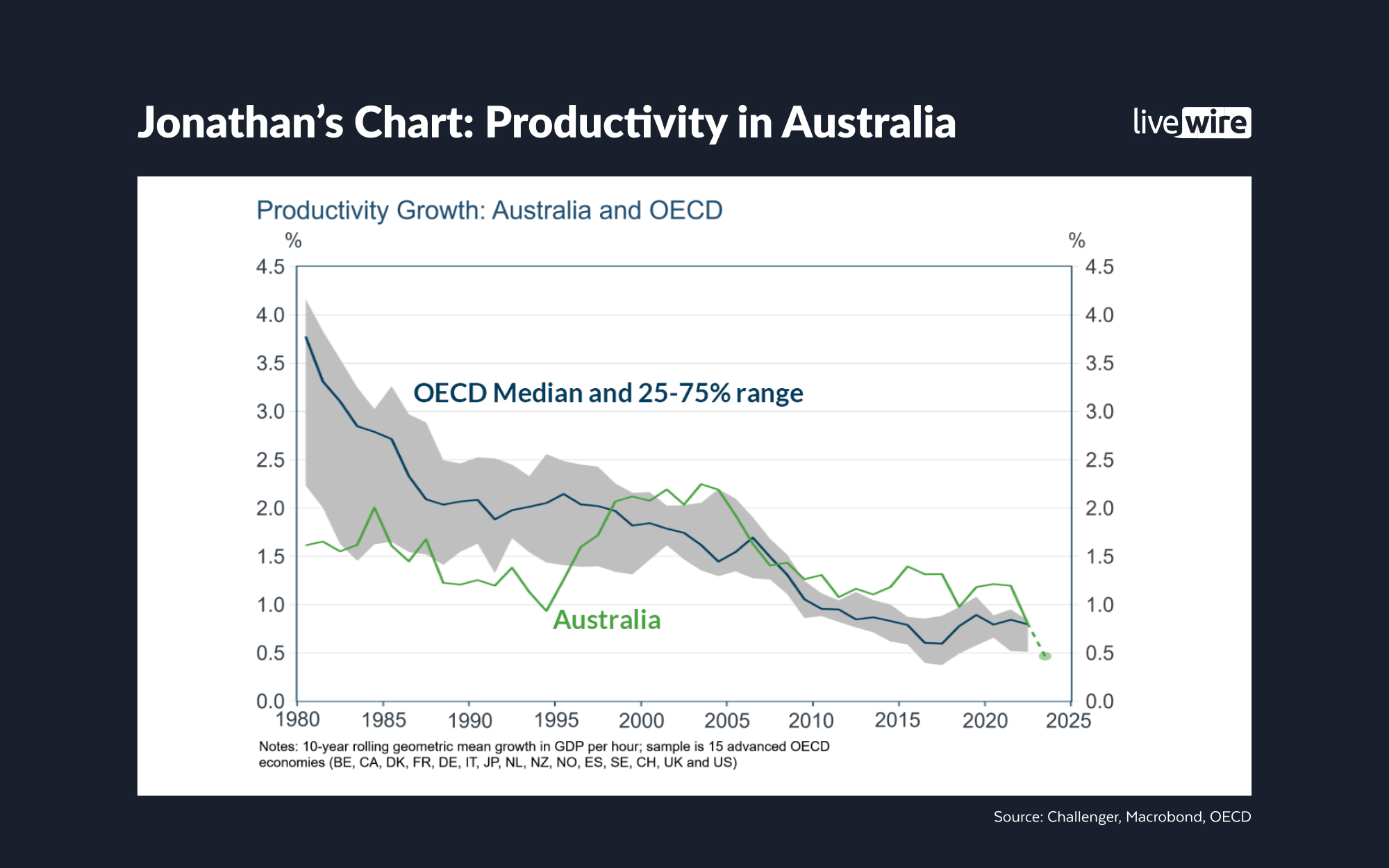

For starters, 2023 revealed just how much 425 basis points in rate hikes from the Reserve Bank of Australia is affecting the economy. Economic growth has slowed markedly and inflation is still more than double the RBA's target. But the labour market remains remarkably resilient, fuelled by migration and a choice of more hiring over increasing existing productivity.

This year was full of market-moving headlines too. The reopening of China stumbled. Credit Suisse and Silicon Valley Bank collapsed. Labour strikes dominated the Northern Hemisphere summer. Wars in Eastern Europe and the Middle East fuelled wild swings in commodity prices. And the influence of AI and Warren Buffett on American and Japanese stocks respectively have all dominated the front pages at one point or another this year.

So what did all this headline-reaction-new headline-new reaction pattern produce in terms of returns?

The ASX 200 will finish the year up around 9%, the equal-weight S&P 500 will likely finish the year up around 10%, and both the Australian Dollar and US 10-year bond yield will likely finish the year where they started.

Exhausted and confused? You're not alone.

To walk us through the year it has been and to preview what may happen in 2024, Signal or Noise presents its season finale. Joining series regular Diana Mousina of AMP are these two panellists:

- Raaz Bhuyan, Principal and Portfolio Manager at WaveStone Capital

- Jonathan Kearns, Chief Economist at Challenger Group

Note: This episode was taped on Wednesday 13 December 2023. You can watch the show, listen to our podcast, or read the edited summary below.

Podcast

Edited Summary

What has been the defining market narrative of 2023 and do you expect that narrative to continue influencing markets in 2024?

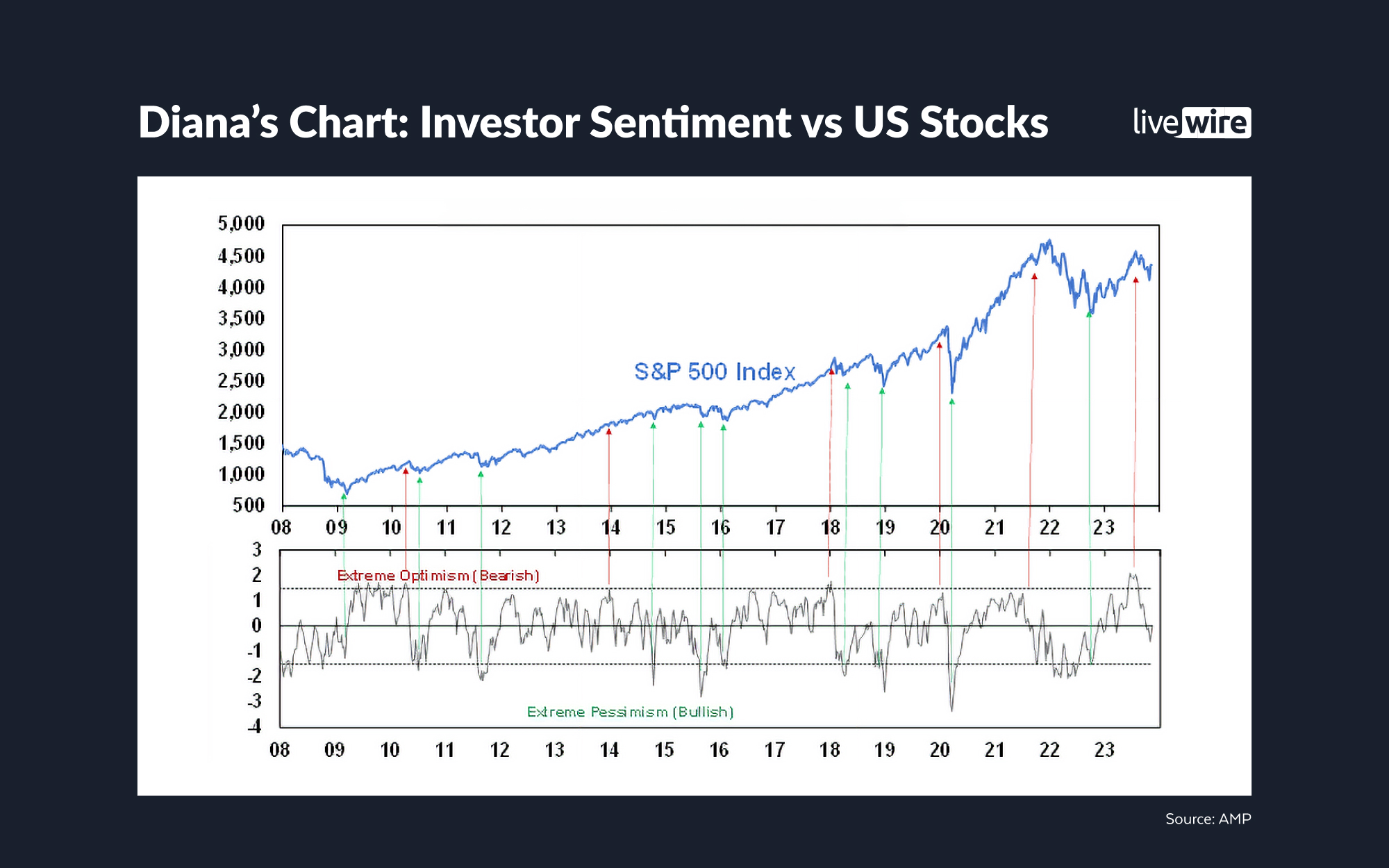

Diana offered the resilience of developed market economies like the US and Australia. And for the most part, that resilience has fed through to share markets. But Diana also cautions that this outperformance may not continue next year.

Jonathan pointed to the 'short-termism' that now dominates markets. From geopolitical events to bank failures and corporate earnings misses Jonathan noted that investors have become used to brushing off major events in a matter of weeks rather than months.

Raaz said the defining narrative has been the surge in the risk-free rate. If you can get a Commonwealth Bank term deposit at 5%, why would you want to take more risk?

The RBA's Policy Quandary

Would you vote for another rate hike at the February meeting?

Jonathan: SIGNAL - While the RBA deals with far more information than the table can show, he feels the Bank is "at the edge of where it can be", adding that any uptick in inflation will cause them to hike rates again.

Raaz: NOISE - The recent GDP print and commentary from leading CEOs appear to suggest that rate hikes are taking more effect than many have thought previously.

Diana: NOISE - Following Raaz's answer, Diana argued the GDP print demonstrated how weak the consumer has become. Household income growth is now very poor and the percentage of salaries being paid towards mortgages continues to increase. She also thinks the December inflation indicator may have as little as a 3-handle in front of it by the end of January.

Is there enough in these numbers to signal a rate cut anytime next year?

Jonathan: NOISE - Jonathan does not see the RBA cutting interest rates until the very end of 2024 or 2025 to get inflation out of the system.

Raaz: SIGNAL - Raaz takes the pre-December market pricing view, arguing that any cut (while probable) may not occur until the back half of the year.

Diana: SIGNAL - Diana argues there will be several cuts next year (see The Big Signal)

The panel also shared their views on where they are putting cash to work next year.

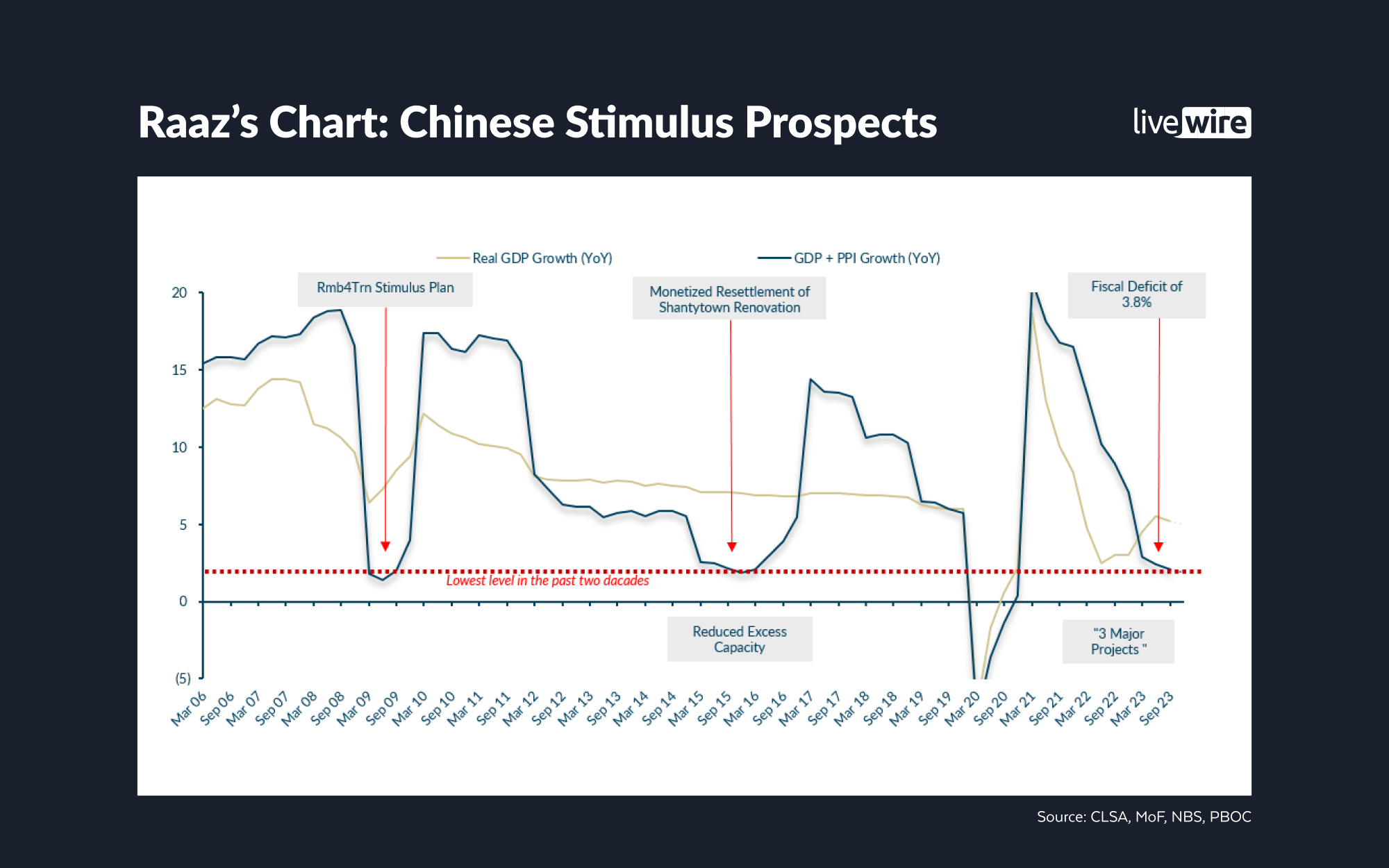

Raaz: The team at WaveStone Capital are going with a barbell approach heading into next year. They continue to hold compounders - or Australian companies with global franchises - as a rule of thumb. These include James Hardie (ASX: JHX), Macquarie (ASX: MQG), and Reliance Worldwide (ASX: RWC). They are also continuing to hold healthcare companies even if it's done badly this year due to duration risk. They are also holding resource companies primarily due to their positive view of China and decarbonisation. But they are underweight consumer discretionary names and in the staples, their primary picks are Wesfarmers (ASX: WES) and Woolworths Group (ASX: WOW).

Diana: The experience of 2023 has demonstrated that share markets can rally even in the face of a historic rate hiking cycle. The team are neutral-rated on equities with a preference for international stocks over local stocks. And if you haven't considered it already, adding fixed income exposure to your portfolio is a good idea - especially Australian fixed income.

Jonathan: If Australia treads further towards a recession, fixed income will be the place to be. And despite all these rate hikes from the RBA, house prices continue to rise and a near-0% negative equity rate in Australia is good for lenders and RMBS assets. Thus, the Challenger team have some exposure to that part of the market.

The Big Signal

Diana: The RBA could cut interest rates three times in the second half of 2024

She thinks the RBA's inflation forecasts will prove too high and that GDP growth will slow markedly through at least the first six months of next year. She also thinks a 4.35% cash rate is unsustainable given the level of household indebtedness.

Jonathan disagreed because a considerable amount of inflation has already been baked into next year. Strong wage growth, weak productivity growth, and rising rents will contribute to stickier inflation. Raaz argues that market pricing (one rate cut, as of mid-December 2023) is more appropriate.

Jonathan: Long bond yields in the US have peaked, making for an attractive entry point for fixed income investments

A more aggressive Federal Reserve has been able to get the disinflation it has so badly wanted. Productivity is also stronger in the US than it is in Australia, which is another reason why disinflation has come through much faster in the US than it has in Australia. While yields may fluctuate, he thinks that 5% is the ceiling for the 10-year bond.

Raaz is not as convinced that rate cuts will come thick and fast in the US but he does think yields have peaked. Absent a recession, he thinks rates will remain higher for longer. Diana agrees that long bond yields have generally peaked but she points to the risk of rising yields in the short term due to concerns over another government shutdown in the US.

Raaz: Aggregate earnings for the ASX 200 will slow, with domestic cyclicals to fare the worst

Raaz's big signals were actually multi-layered but in summary, the WaveStone team believe that next year will see the return of GARP-style investing (Growth at a Reasonable Price), the re-emergence of China after a difficult 2023, and a year where earnings will be dominated by the large businesses that are still able to exercise pricing power.

Diana agrees that next year will be more difficult for Aussie corporates while Jonathan thinks that a rising Australian Dollar will complement the WaveStone view of finding Australian firms with offshore earnings.

The Charts to Watch

Diana's Chart: Investor sentiment vs US stocks

Jonathan's Chart: Productivity in Australia

Raaz's Chart: Is Chinese stimulus all but certain for 2024?

This is the final edition of Signal or Noise for 2023. The show will return in February.

5 topics

5 stocks mentioned

3 contributors mentioned