The collapse of fiat money

It’s possible when looking at the performance of your investments that you are looking in entirely the wrong place. I would wager that you look at the headline. The fund manager says, "we're up 5%". Against what though? What is happening to your measurement basis? It’s melting like an iceberg and making your portfolio look much better than it actually is.

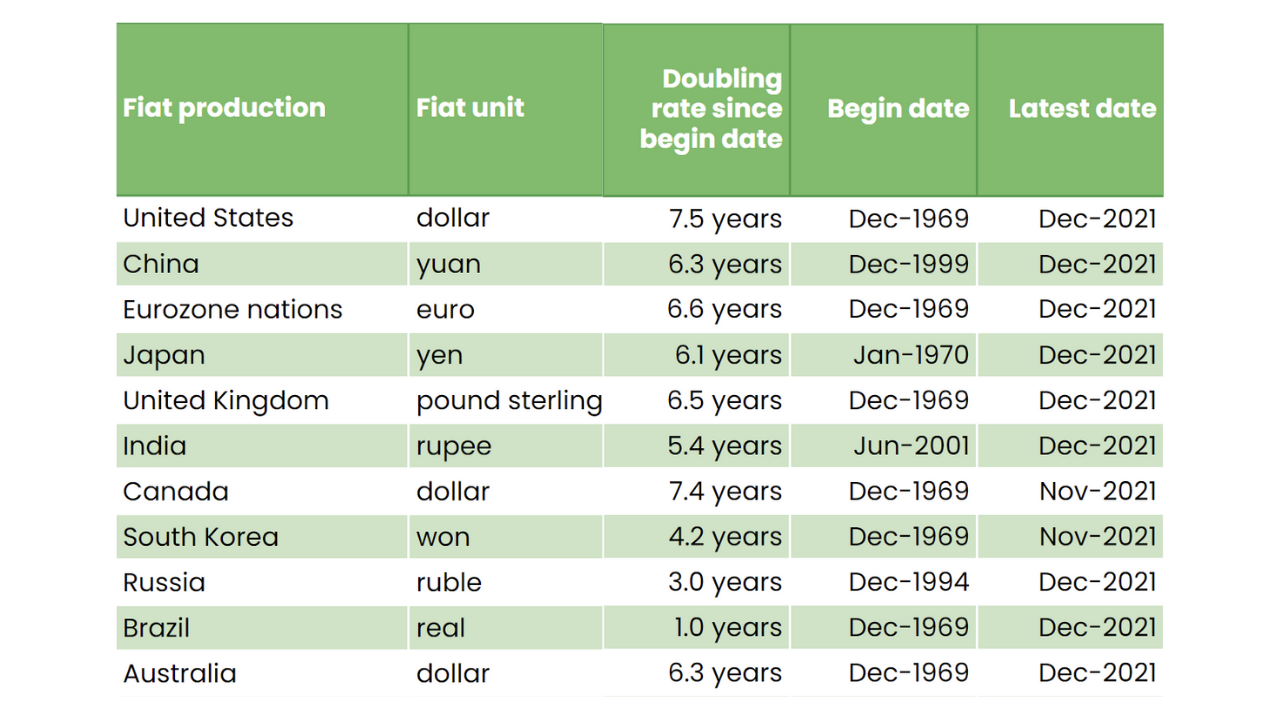

The doubling rate of fiat currency

The table above shows how the money supply in major economies has changed since the 70s. On average, most Western countries have a money supply that doubles every six years. That is not to say that its value halves; unarguably though, it goes down. That rate of increase was perhaps sustainable for a while, but more recently it has accelerated to the point where everyone knows something is wrong. That acceleration is now playing out in inflation, which might go back down, but even if it does the damage to cash holdings (and bonds) has already been done.

The failure of fiat currency

The chart starts in the 1970s for a reason. It marked the closing of the final window to gold conversion by Richard Nixon in 1971. After that, individual countries could no longer convert their dollar claims to gold and the US could do what it wanted with its currency. It did and everyone else followed.

Fiat currency’s role as a measurement basis for performance and wealth simply no longer works, destroyed by the eagerness of the government's money printers in a story as old as time.

When you hear that the US dollar has been around for over 100 years and isn’t going anywhere; that’s provably false. A dollar in 1910 could be exchanged for gold by a private citizen. They received 23 grains of gold (1.5g) per dollar, worth $93 today. In 1971, a nation-state could swap their dollars for $35/oz of gold, making that dollar worth $55 today. The depreciation between those two versions of the dollar was around 50%. A rate that has since accelerated.

This step of devaluation will happen to fiat currency again. The advent of central bank digital currencies (CBDCs) is almost certain to mean one thing: they will be worth less because CBDCs will be programmable. They could have expiry dates or spending restrictions attached to them. Indeed it will present a very tempting opportunity to monetise debt which I doubt will be passed up.

Another way of thinking about the path of CBDCs is this: It might become a choice between a restricted spending token, or an open one. Given the choice below, it’s a simple answer.

.png)

The reference point for value

One of the purposes of a currency is to provide a reference point for value. If you buy an equity or a bond, how does it perform against the reference point? Most fund managers report in local currency terms. “Smoke and Mirrors Fund had a great year, up 10%”

The fact is, with a measurement base that has doubled every six years you need to perform at 12% per annum to stand still. Fiat currency’s role as a measurement basis for performance and wealth simply no longer works, destroyed by the eagerness of the government's money printers in a story as old as time. It is not that it cannot be fixed, it’s simply that there is no incentive to fix it. For example, the consensus view that the 2% inflation target is good is widely embedded. There is a widespread endorsement for that gentle debasement. Why is it good? Why is it not state-sponsored theft?

Enter digital currency

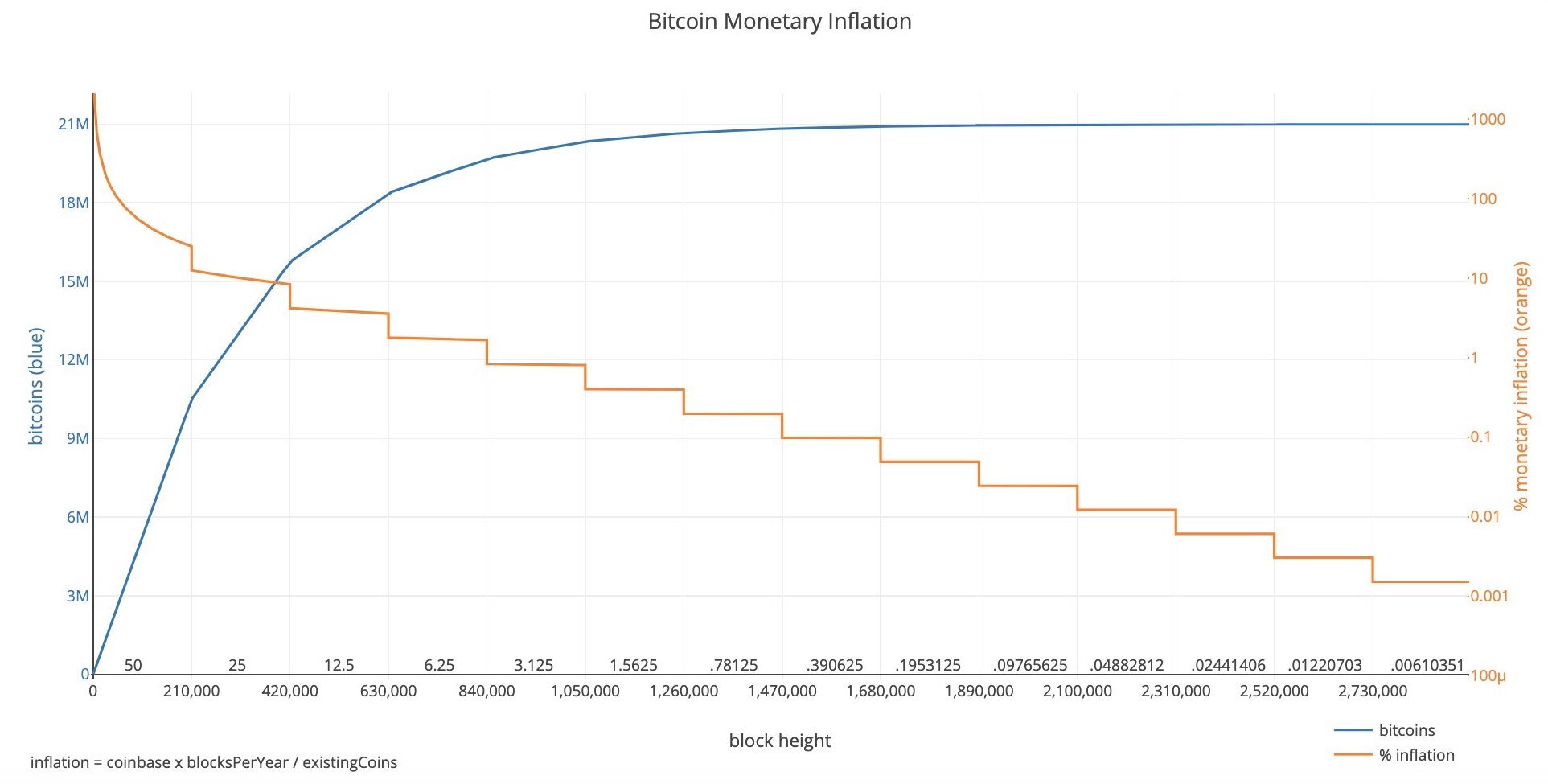

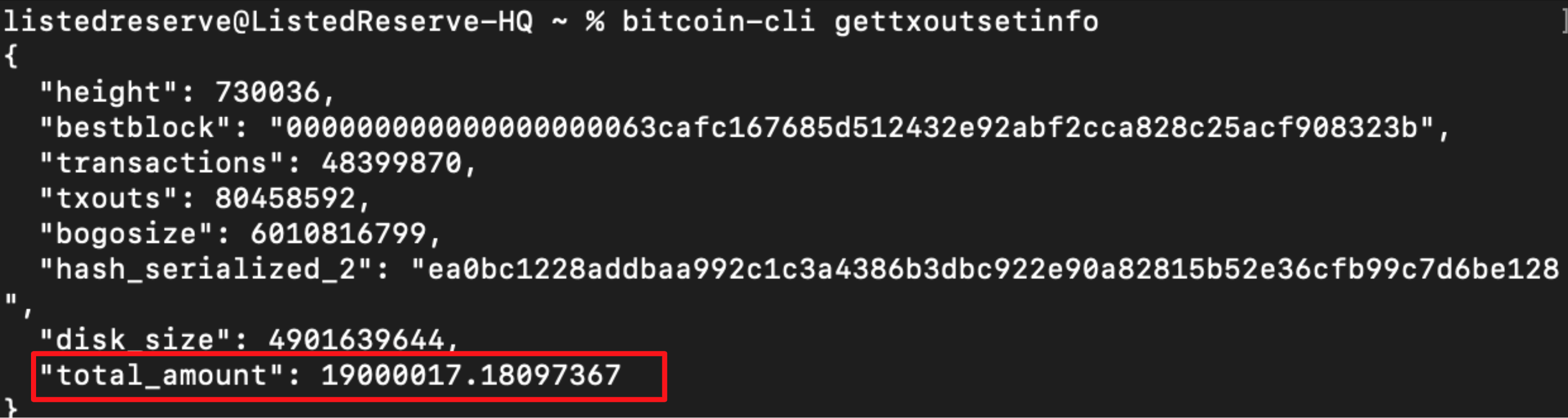

Although there are many iterations of digital currency now, the oldest and largest solved simply one problem. The problem of digital scarcity. In the case of bitcoin, we have a deterministic supply curve forever. Early in April, that supply reached 19 million and it will not reach its final peak of 21 million until 2140. Along the way, everyone, everywhere knows everything about the money supply. Specifically, the number of coins that will be on issue at any point.

Now we have a measurement basis which we know is fixed. Too much complexity has been introduced into the explanations around this. It’s really as simple as: we now have a reference point for all the value in the world that everyone can agree on and personally check whenever they wish.

Incidentally, it takes about three minutes to query bitcoin’s blockchain to find out how many coins are on issue. I ran this on Saturday 2nd April 2021 when the supply hit 19 million.

It can be done on any home computer.

With fiat currency, it is impossible.

Volatility

A reasonable criticism of digital assets is their volatility. Given their wild surges and plunges it’s not really something that one could measure a portfolio against. That is surely true over short time frames and less true over longer ones.

You might look over one year, three years and five years for comparison to see how you performed. The longer you look back, the relatively worse your performance will be. That’s not just because the digital asset class is growing but because your own relative performance was being measured against a melting iceberg. Fiat currency.

Even so, this is a nascent asset class, volatility is to be expected for a long time to come. Right now for example, the sector is 35-40% off its November 2021 highs.

What’s next?

You may not be convinced that this invention is terribly profound. If that’s the case, consider these questions: How many Australian dollars are there? How many will there be next year? In ten years?

You cannot answer those questions, and neither can the government. Not here and not anywhere in the world. So, it is worth at least considering what role digital assets might play in the monetary sense. I believe it can be conveyed very simply:

“Only one asset in the world has a deterministic supply curve.”

It really is that simple and I believe it will be profoundly useful as the years pass.

There is a lot more to digital assets than that and in part two I’ll cover what role they will play in the economy and your portfolio.

~

This article is the first of a three-part series covering an introduction to digital assets. Part two will cover how decentralised software will bring big efficiency improvements to financial markets. Finally in part three, what you might do about it.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

4 topics