The commodities rally: A new supercycle?

Several commodities have been on an absolute tear in recent months. Iron ore is up around 60% since November. Gold broke above US$1900 an ounce for the first time since April last year. Copper has hit levels not seen since June last year.

One need only look at the chart of the materials sector versus the ASX 200 to understand the importance of commodities to the Australian market. And with one in every five export dollars that this country receives coming from iron ore, the importance of commodities to the Australian economy can’t be overstated.

Without commodities, the ASX 200 is nowhere near all-time highs. Without commodities, Australia does not have the track record of economic growth that is the envy of the developed world.

Whilst increasing commodity prices are great for the Australian economy, there’s one piece of this puzzle that, to me at least, doesn’t quite add up.

If the global economy is about to be tipped into recession, which many pundits are predicting, surely this commodity price surge isn't sustainable. Is it?

The key to commodity prices is supply and demand. If demand dries up and supply levels remain constant, theory tells us the prices can only go down. But there are no signs of that at the moment. It's almost as if markets are ignoring the probability of a recession. So, what gives? Has the market got it wrong? Will the commodity price rally crash and burn, or can it be sustained?

For answers to these questions, insight into how he is viewing the market, and where the opportunities and risks lie, I reached out to Ben Cleary, Portfolio Manager for the Tribeca Natural Resources Fund and Director of ASX-listed Tribeca Global Natural Resources Ltd (ASX: TGF), both of which focus on Energy, Mining and Soft Commodities.

.png)

Ben Cleary, Tribeca Global Natural Resources Fund

Can the rally continue?

First and foremost, Cleary believes that the commodity price rally can continue, even if we see a global recession in the back half of 2023 or early 2024.

“We see higher commodity prices for the next 3-5 years”.

Cleary adds that he feels global demand fears are priced into commodities and commodity producer equities, given the discount to historical multiples the sector is trading on.

As for how the Tribeca Global Natural Resources Fund is positioned, it has been quite bullish in recent years and is still to this day.

“We are a long/short fund but have been positioned quite long for the last two years and remain that way”, notes Cleary.

“On a risk adjusted basis, we see far more exciting ways to generate returns on the long side than the short side given the strong sector fundamentals. This will change in the future, but for now, we see a 3-5 year runway that you want to be heavily exposed to”.

What would change your view?

Whilst Cleary is a bull, he’s not an ostrich. He and the Tribeca team haven’t stuck their head in the sand, and they’re not pursuing the rally with blind faith. Rather, they have a clear understanding of what would cause their view to change.

And it comes back to the supply/demand dynamics discussed earlier.

“To reduce confidence in our portfolio positioning, we would need to see a change in the current supply issues across all commodities”.

Cleary adds that right now, there simply isn’t enough copper, oil, nickel, carbon, silver, and high-purity alumina being produced in the world to meet demand, which is why commodity prices will likely stay elevated for some time.

“This is the product of a very long-term underinvestment cycle across most commodities. This doesn’t happen overnight and could last for decades given the added issues of cost inflation and mine permitting that we are seeing globally”.

Another major risk that Cleary acknowledges is the potential for a major change in Chinese policy and growth rates, as China is a major driver of commodity demand. Whilst these factors could have a significant impact, Cleary assigns a low probability to them; “we see very little chance of China moving away from its re-open policy and the lending growth that has accompanied that”.

How are you positioned?

With the acceleration of global energy transition, there has been a significant shift in the demand profile for numerous commodities. As such, the Tribeca portfolio has also changed.

“We have increased our exposure to metals that are key to energy transition and electrification thematic. Our portfolio is almost totally leveraged to these thematics versus the major ETFs, indices and large-cap stocks."

Cleary goes on to note that one of the key benefits of being a fund manager, as compared to the CEO of a large, mining company, is that “we can pivot our portfolio much more quickly”.

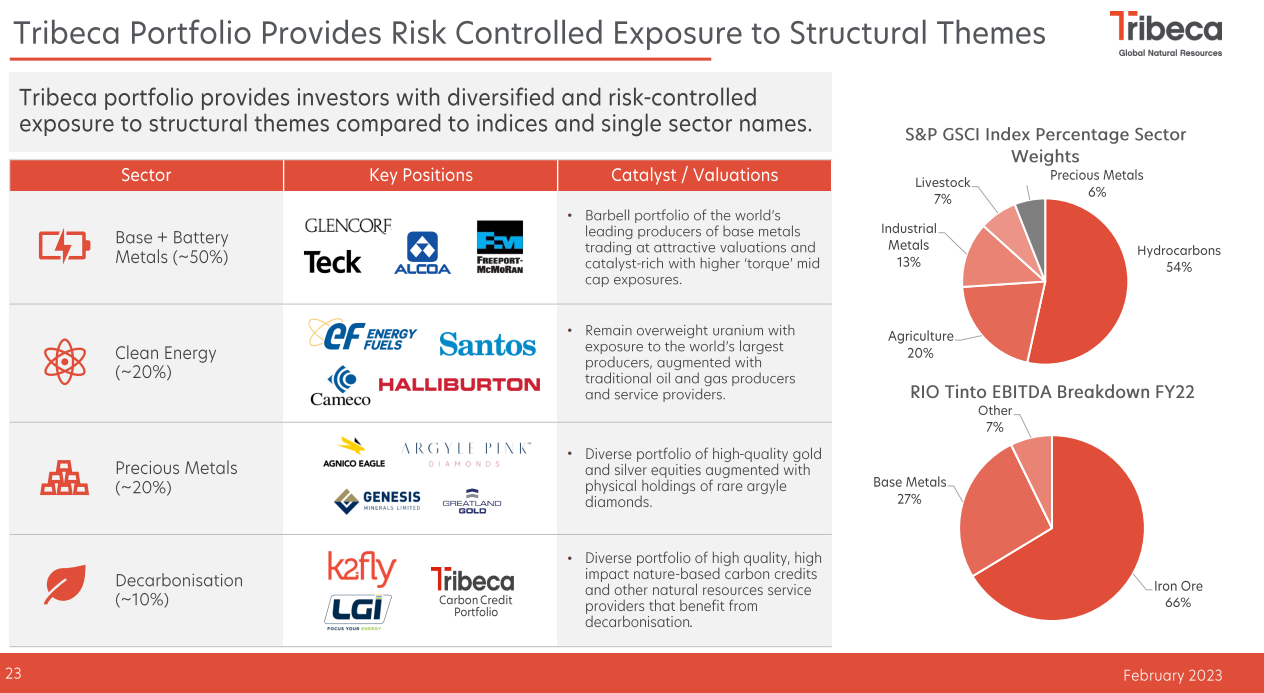

In terms of the breakdown of the portfolio, the Tribeca Global Natural Resources Fund is 50% base and battery metals, 20% energy, 20% precious metals and 10% decarbonisation beneficiaries.

.png)

What hasn’t worked?

If prior supercycles have taught us anything, it’s that price moves are not linear and having 30% pullbacks like we did in 2Q2022, followed by new highs, are very normal in a historical context.

In asking Cleary what didn’t work so well in 2022, he points to carbon credits and precious metal producers.

“The main portfolio detractor in 2022 was our exposure to carbon credits, which was one of our best contributors in 2020/21, and which has generated significant absolute returns over the life of the position”.

Whilst the carbon credit position didn’t fare so well last year, Cleary is sticking with it.

“The carbon credit position is a tick under 10% of the portfolio, and we see this being one of the most attractive and asymmetric positions in the portfolio. We can’t see much downside, and multiples of 3-5x upside over coming years”.

Cleary adds that precious metal producers were also a drag on the portfolio in 2022 but again, he is happy to hold those positions and sees upside for that sector and no reason to cut. That said, he acknowledges that “[the theme] is going to take some time to play out”.

What happens next?

After peppering Cleary with questions about the here and now, I thought it prudent to ask him for a slightly longer-term perspective and the particular commodities and stocks he likes.

Having already offered a bullish view over a 3-5 year timeframe, Cleary identifies (in order), “copper, aluminium, nickel, silver and zinc" as the mainstream commodities Tribeca likes most. And of the more niche but fast-growing electrification commodities, "high purity alumina, manganese, and rare-earths”.

As well as highlighting the commodities of preference, Cleary points out an important factor that anyone considering investing in this space should be mindful of, and that’s the considerable likelihood of M&A activity.

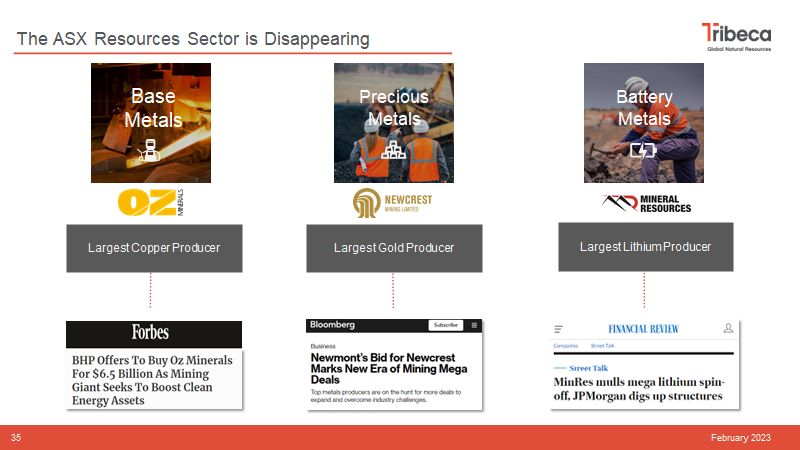

“There is likely to be significant M&A in these commodities given the fact it’s cheaper to buy than build, and this has never been more front of mind for the major mining companies. This is leading to a vacuum and disappearance of the ASX resources sector with bellwether companies such as Newcrest (ASX: NCM), Oz Minerals (ASX: OZL) and MinRes (ASX: MIN) all likely to disappear”.

This means investors will inevitably have to look more globally to gain exposure to these themes.

The final word

Cleary has a firmly bullish thesis for commodities for the foreseeable future, predicated on prior underinvestment, growing demand due to the energy transition, and structural deficits for several key commodities. He also has a clear idea of what would change his and Tribeca’s stance.

When playing in this space, all investors must remember that commodities and commodity-related stocks, are cyclical in nature and that a longer-term view can be helpful.

As Cleary puts it:

“You need to think long term with any investment, and whilst cyclical sectors like resources do present some opportunities to take advantage of short-term market dislocations, you don’t want to try and time your entry and exits within an inch of their lives, or you might miss the bigger moves”.

“At the moment there is lots of talk about 5-10% pullbacks but I will not be missing the 300% move higher which I see coming for stocks in the resources sector. Very similar to the 2000s or 1970s, these moves for equities can happen without commodity prices moving materially higher”.

Learn more about where the team are finding opportunities

Tribeca’s Global Natural Resources investment team invest across metals & mining, energy, soft commodities and carbon markets, leveraging Tribeca’s unique position as a preferred capital partner to companies in the resources sector. For more information, please visit their website.

4 topics

4 stocks mentioned

1 contributor mentioned