The critical signals for investors to survive the profit downturn and 11 stocks to consider

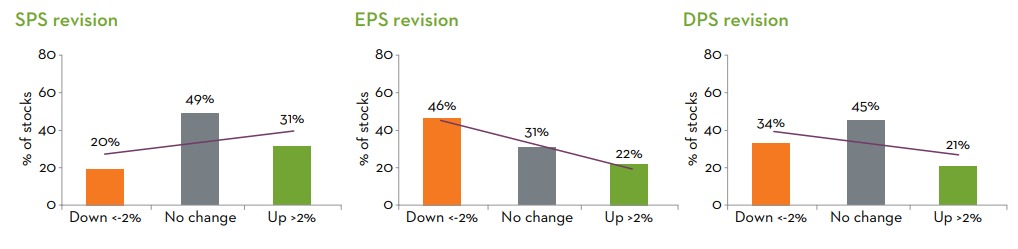

Earnings season surprises for brokers haven't translated into similarly upbeat FY24 assessments, according to Martin Currie in its biannual reporting season analysis.

Not all is fine below the line

Breaking down the profit and loss (P&L) statements, Martin Currie sees the devil in the details below the line in higher interest, tax and depreciation costs: "The inability to pass costs through to higher prices is putting the profit margins of many businesses under pressure."

Does this spell the end of the profit cycle?

Not across all companies. Martin Currie calls out Wesfarmers (ASX: WES) though its cheaper Bunnings and Kmart channels, Telstra Group (ASX: TLS) and TPG (ASX: TPM) who have been able to pass through their higher costs via higher prices in their mobile phone plans. And while REITs have been under some pressure, Scentre Group (ASX: SCG) and Vicinity Centres (ASX: VCX) each implemented CPI+ rent increases to keep revenue tracking ahead of costs.

Dividend winners

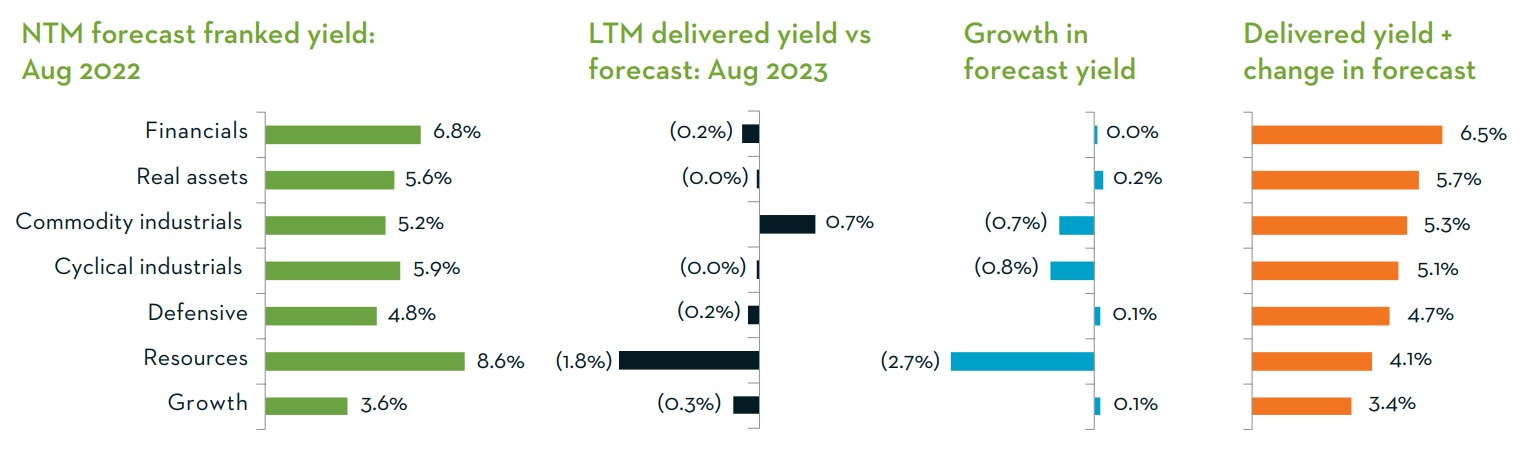

When Martin Currie considers which stocks to hold in its retirement-income-focused portfolios via its income index for the S&P/ASX200, it looks for companies with a minimum 2% dividend yield. Their newly created income scorecard tracks how these companies delivered against market expectations over the last 12 months. They also look at the extent to which the company has been able to protect its dividends against inflation by delivering dividend growth (stripping out the impact of share price change on yield).

The winners were spread across various sectors such as

- financial - Bendigo and Adelaide Bank (ASX: BEN) stood out as a stable player that's benefitted from higher rates and net interest margins

- real assets - Origin Energy (ASX: ORG) and AGL Energy (ASX: AGL), as higher electricity prices expected to deliver higher dividend growth

- commodity industrials, - the petrol retailers Ampol (ASX: ALD) and Viva Energy Group (ASX: VEA) boosted the sector results via improved margins in refining, although lower growth is expected in FY24

- cyclicals - discretionary retailers such as Super Retail Group (ASX: SUL) and JB HI-HI (ASX: JBH).

The critical signals for what's ahead

Martin Currie's favourite forward profit cycle indicator for value stocks is the World Purchasing Managers Index. It's not looking good, as Reece Birtles notes

"The World Purchasing Managers Index (PMI) has been in decline over the last 12 months, and we believe that this is one of the best forward profit cycle indicators. In keeping with this, the Australian (and US markets) have been seeing profit downturns since June 2022."

Martin Currie also advises keeping an eye on interest rates

"We think that it is important to not underestimate the risks to the economy from

rising interest rates, as real rates are now above the pre-GFC period."

They also counsel to keep a beady eye on the inflation jaws

"Data from the ABS suggests that while Australian ‘tradable’ (goods) inflation is slowing rapidly, ‘services’ inflation is holding or even rising, making it difficult for the RBA to get total inflation back with the 2-3% band."

All companies but especially consumer-facing are likely to find their gross profit margins under pressure as they can no longer increase selling prices to offset falling volumes. The cost of doing business is rising faster than in FY23 due to wage rises, accelerating rent rises and a myriad of other things like higher insurance premia, electricity costs and spending on technology.

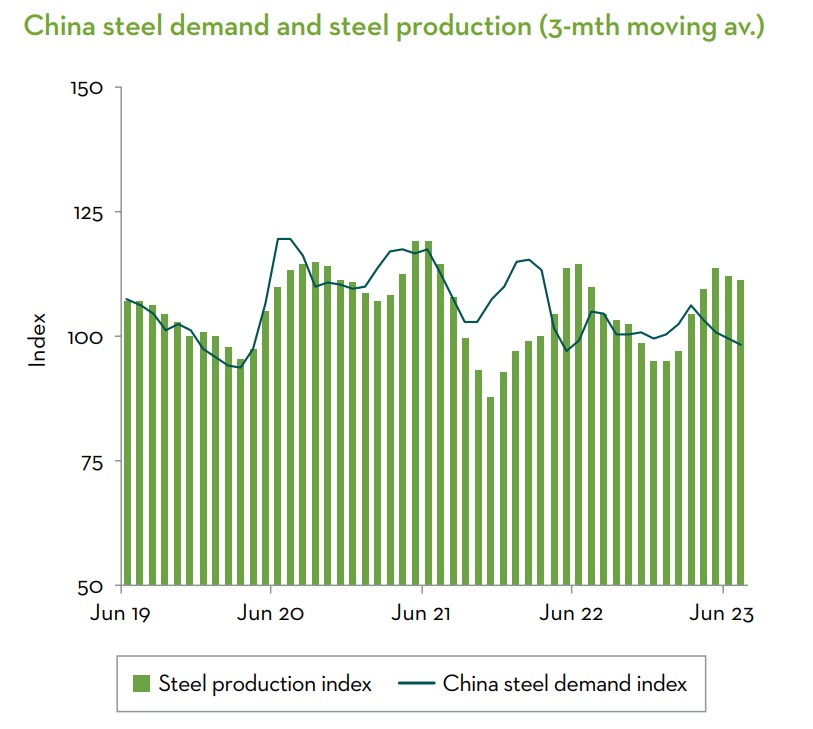

Their demand model for China-based steel based on real-world monthly inputs is set out in the chart below.

"The message to us from this data is that current steel production looks too high and needs to fall ~10% to match demand. This of course has negative implications for Australian Iron Ore prices, which appear to be holding up on the hope of stimulus."

Could AI come in for the save? While Martin Currie notes the hype around AI in stocks like Nvidia (NASDAQ: NVDA) has benefited "many other non- or low-earning companies", it is emblematic of the strong demand for growth stocks compared to traditional value-style stocks since December 2022. Noting that the absolute P/E level of the market is still lower than during the Covid peak and the Growth/Value spread remains elevated, the report comments,

"With Growth stocks (led by tech) currently trading at extreme valuations, we believe that there is an advantage for Value-style stocks within this pricing disparity."

Focus on the ability to grow both earnings and dividends

Preparing for a possible earnings or GDP recession, Martin Currie is lowering the beta of their portfolios to focus on companies still able to grow both earnings and dividends in the high rate environment and not be exposed to valuation risk. According to the report

"The Martin Currie Select Opportunities Fund is more defensive in positioning than in recent times, avoiding those Consumer Discretionary sectors that will be impacted by contraction in household budgets and targeting companies with strong balance sheets and robust cash flows that can withstand any capital funding headwinds which may emerge due to tight monetary conditions."

They are finding much better valuation opportunities in companies like ANZ Group

Holdings (ASX: ANZ), Medibank Private (ASX: MPL), Worley (ASX: WOR), QBE Insurance Group (ASX: QBE), Aurizon Holdings (ASX: AZJ), and AGL Energy (ASX: AGL).

The Martin Currie Equity Income Fund looks out for companies that can support fundamentally higher franked dividends over time. They note that "On a forward-looking basis, the strategy is expected to provide a franked dividend yield of 6.5% over the next 12 months, which compares very attractively to the 5.2% expected franked dividend yield for the S&P/ASX 200."

The highly diversified portfolio includes stocks such as Medibank Private, Telstra Group (ASX: TLS), Aurizon Holdings, Suncorp Group (ASX: SUN), and Woodside Energy (ASX: WDS).

The Martin Currie Sustainable Equity Fund reflects Martin Currie's views on the company’s valuation and its sustainability

attributes. They note the opportunities in stocks such as Brambles (ASX: BXB), Medibank Private, Macquarie Group (ASX: MQG), QBE

Insurance Group and ANZ Group Holdings.

Their final message for investors

"Right now, it is more important than ever for investors to be discerning in their stock picking, focussing on the right companies in this environment, avoiding stocks with valuation risk, or issues with poor pricing power, falling volumes and rising costs."

2 topics

21 stocks mentioned

3 funds mentioned

2 contributors mentioned