The electrification race is on. Can this company project Australia onto the global stage?

When it comes to owning the electrification opportunity, it's not offtake agreements or financing or poor progress that Jevons Global's Kingsley Jones is worried about. The biggest risk facing Australian miners is that we are "not moving fast enough".

"The largest supplier of unfinished/unseparated rare earth concentrate to China is the US. They've come from nothing to 40,000 tonnes a year in total rare earth oxide from the MP Materials Corp (NYSE: MP) mine in the US," he explained.

"We need to be careful in Australia that we don't get blindsided and fail to move quickly enough."

Australia is perfectly placed to serve the needs of both China and the US - while developing our own industry, he added.

"That's the real attraction for investors to get involved with this early - so that we don't fall behind. We don't want others to cut our grass. We need to keep moving forward, which is why we’re very supportive of new projects, like Arafura, coming on," Jones said.

Having reported last week, Arafura Rare Earths (ASX: ARU) has confirmed an investment decision will be made on the Nolan's Rare Earth Project in March 2023, with a contractual close on project financing to follow in mid-2023. In the ramp-up to the final decision on the project, Arafura reported a net loss of $26.9 million in the first half.

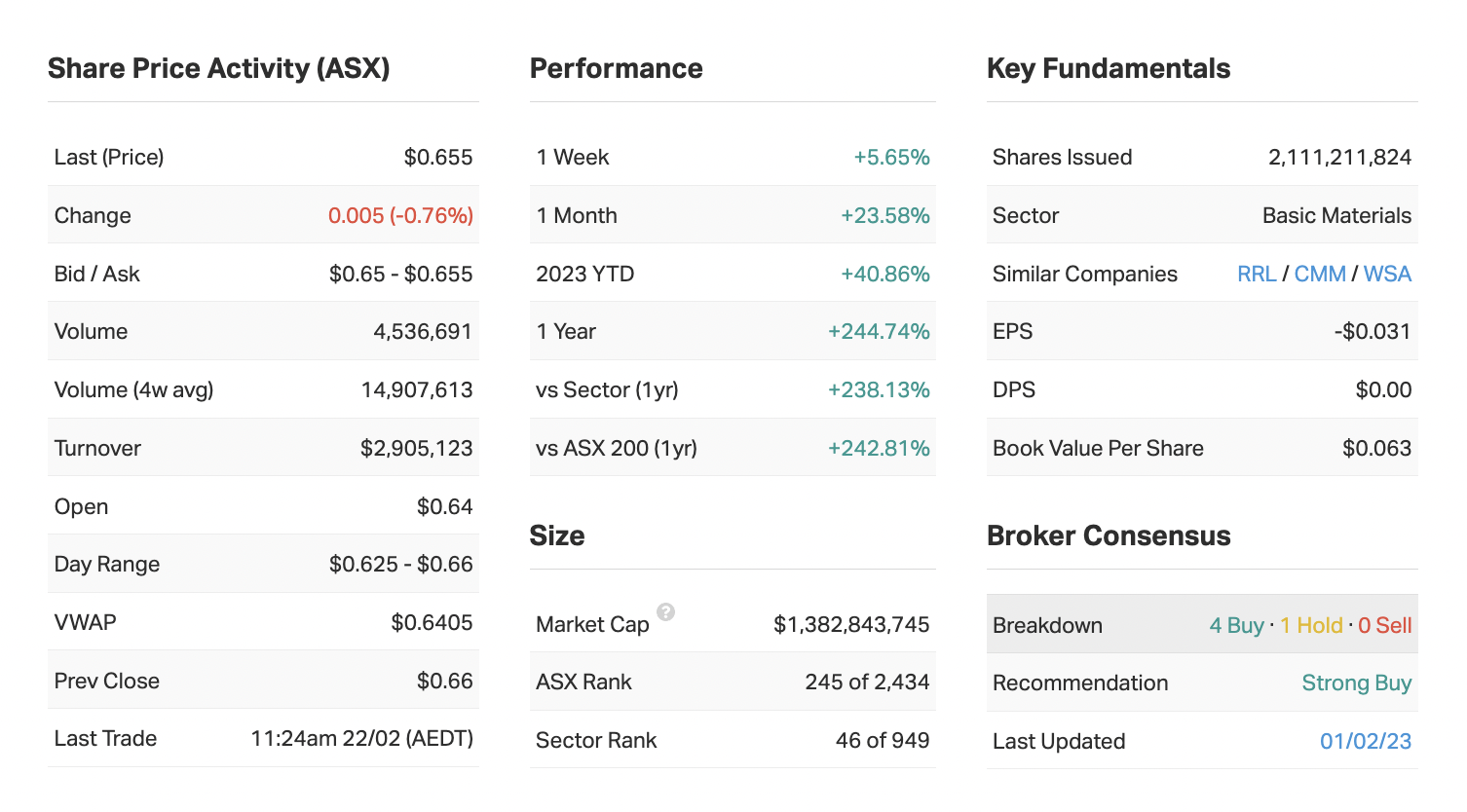

And yet, its share price has lifted a whopping 244% over the past 12 months (see below):

In this wire, Jones takes you through the rare earth exploration company's latest half-yearly results, the main risks on the horizon, and shares why he believes investors should be spreading their bets across the three major players (Lynas Rare Earths, Iluka Resources and Arafura Rare Earths) to best take advantage of the growing demand for rare earths.

Note: This interview was recorded on 22 February 2023. Arafura's half-yearly report was released on 16 February 2023.

Arafura Rare Earths H1 Key Results

- Net loss after tax for the first half of $26.9 million up 120% from H122.

- Total current assets of $126.4 million, up 397% over the past six months. Cash and cash equivalents of $125.2 million

- Total liabilities of $7.4 million, down 32% over the past six months.

- Net assets of $238.1 million, up 80% over the past six months.

- Total expenses of $27.4 million, up 124%

Key company data for ARU

In one sentence, what was the key takeaway from this result?

It's consistent with them coming to a final investment decision on the March timeframe, so that is very positive. And the result itself just highlighted extra expenditures that they are taking on right now to do that preliminary engineering work

What was the market’s reaction to this result? In your view, was it an overreaction, an under-reaction or appropriate?

I think it's appropriate in the sense that it's probably driven more by market movements at this point in time than the results themselves. I think what investors are looking for with ARU is progress towards that final investment decision.

I would also point to the capital raisings it had in both August and December. They raised around $40 million in August and another $120 million in December. Both of these were well supported and we think that that's very positive. Most of ARU's reports right now will be their progress against their goals to progress to the final investment decision.

Were there any major surprises in this result that you think investors should be aware of?

Not really, for us. Looking forward, everyone knows the scale of the hill Arafura has to climb from here. So let's be clear about what the big risks would be. And what sorts of news flow might affect your judgment about whether it goes forward.

So in no particular order, those are things like whether it can sell the product and that's what they call offtake agreements. That's progressing with their partner, Hyundai, committing to a binding offtake agreement, and they've also got this MOU underway with General Electric.

A positive would be if it could bring in more offtake or larger scale offtake, or indeed if any of those offtakes translated through to a strategic investment as we have seen with Hancock. I think that will happen, but right now, we're not seeing any sign of that in the news flow. And I think that's because the real trigger in the market for that is when Arafura starts talking about raising a lot more money to complete the construction.

Would you buy, hold or sell ARU on the back of these results?

Rating: BUY

I would certainly be buying Arafura because there are no real negative surprises in the half-yearly result in our view. I think the real strategic moment for this stock comes when that final investment decision is due, which will be sometime in March, and I would recommend investors watch the market's reaction around that event.

That said, having the wealthiest woman in the world (Gina Rinehart) - someone who knows about mining - write you a cheque for $60 million through Hancock Prospecting and take 10% of your firm at this stage is just a ringing endorsement.

Just dwelling on that history, Hancock Prospecting and Gina Rinehart have not gotten to where they are today without taking risks. And this is a sizeable capital expenditure project - it's about $1.4 billion for a 40-year mine life and there's a lot of engineering to do and a lot of remote area operations - in terms of trucking the product to Alice Springs and then by rail to the port in Darwin. These are processes investors like Hancock Prospecting understand, and it provides a level of confidence for the rest of us investors.

What’s your outlook on ARU and its sector over the year ahead? Are there any risks to this company and its sector that investors should be aware of?

We feel that the wise thing to do in rare earths is to actually spread your bets. So certainly Lynas Rare Earths (ASX: LYC), as the biggest producer, has some near-term negative sentiment because of the holdup with the Malaysian plant. We think that actually represents a buying opportunity for Lynas. Arafura is a different story, where they still have to build their plant. We think it's wise to be spread across both, and then finally, I'd also mentioned Iluka Resources (ASX: ILU). We've had some news flow around their mineral sands project with the statement that confirmed investment approval of the Eneabba rare earth refinery.

Lynas is already in production, and Iluka soon will be on the completion of the Eneabba refinery, and then further out we have Arafura. So I think they are our three favoured bets here.

In terms of the risks, they are always around offtake - selling the product, commitments from buyers - and that ties very closely with the scale of financing required, which is often well north of a billion dollars. So they are the main risks.

The other risk I would mention is the risk of not moving fast enough. It's probably not well-known to many readers, but the largest supplier of unfinished/unseparated rare earth concentrate to China is the US. They've come from nothing to 40,000 tonnes a year from the MP Materials Corp (NYSE: MP) mine in the US. The reason that is all going to China right now is that the US doesn't have any onshore processing facilities of note, but they can produce the material required for supply.

So we need to be careful in Australia that we don't get blindsided and fail to move quickly enough. I would rate that as probably the biggest risk now. Earlier, you could have said the biggest risk was there won't be enough demand. The biggest risk is that you don't move fast enough, and you cede market share to other entrants with very strong government support and with much bigger balance sheets than ours in Australia.

We cannot forget about the commercial contest to own the electrification opportunity. In this new environment of strategic competition between the US and China, Australia is in this place where we can actually serve both of them but we can also keep our own objectives in sight regarding how we develop our industry. That's the real attraction for investors to get involved with this early - so that we don't fall behind. We don't want others to cut our grass. We need to keep moving forward, which is why we’re very supportive of new projects, like Arafura, coming on.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing in the market right now? Are you excited or are you cautious about the market in general?

Rating: 3

I think right now, we're at a three, we're in the middle, but we could easily move to a four because of earnings downgrades.

I think we're seeing weakening conditions across the Australian economy. I'm not in the recession camp, but we all know that these rising mortgage rates will sooner or later start to curtail consumer confidence and spending. And since that's a large portion of our economy, we think areas of the Australian market like consumer stocks and discretionary are going to come under pressure - perhaps less so banking, because we know banks can make money even when the world ends - and we're also already seeing enormous pressure in real estate.

There are these pockets where you can get opportunities due to scarcity of supply, like Qantas (ASX: QAN) for example, with ticket prices at record highs. We know unemployment is low. So we wouldn't be running around saying the market's going to collapse. We don't think that's going to happen. But we think you need to be selective and recognise that you cannot be dependent on a flush consumer.

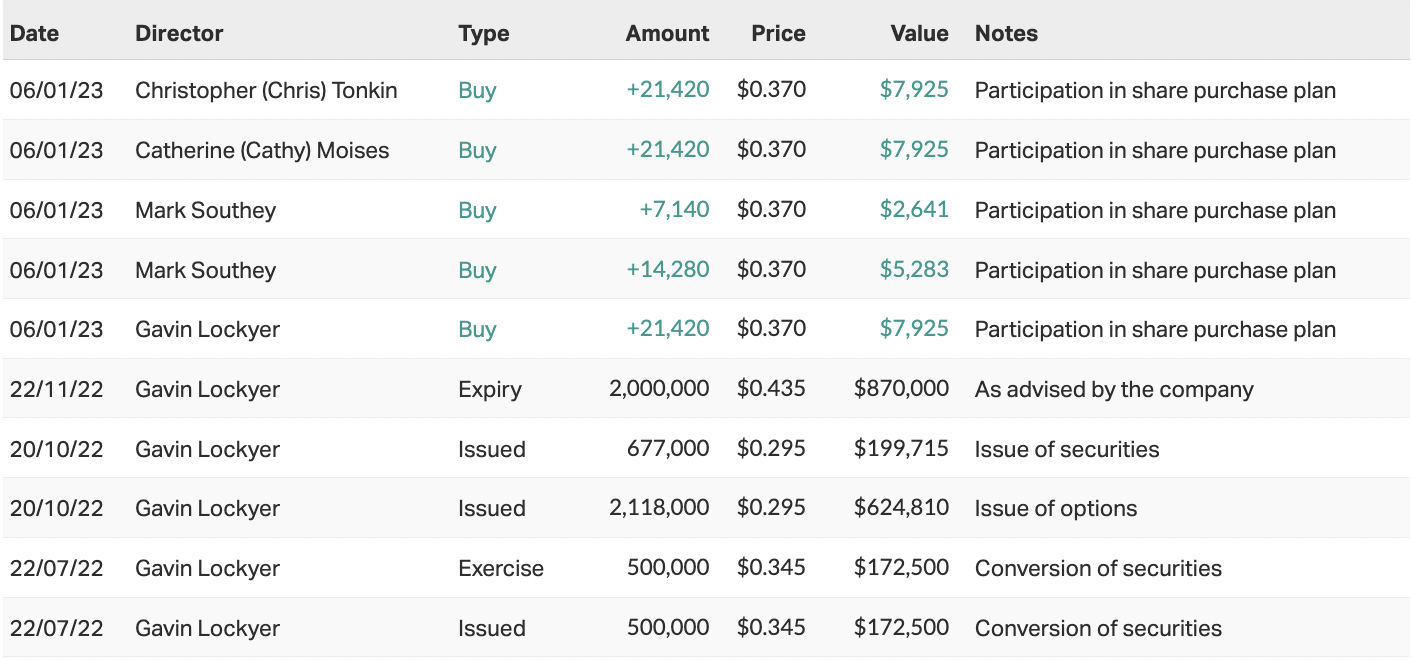

10 most recent director transactions

Catch all of our February 2023 Reporting Season coverage

The Livewire Team is working with our contributors to provide coverage of a selection of stocks this reporting season. You can access all of our reporting season content by clicking here.

4 topics

5 stocks mentioned

1 contributor mentioned