The Eley Griffiths guide to investing in ASX small cap stocks

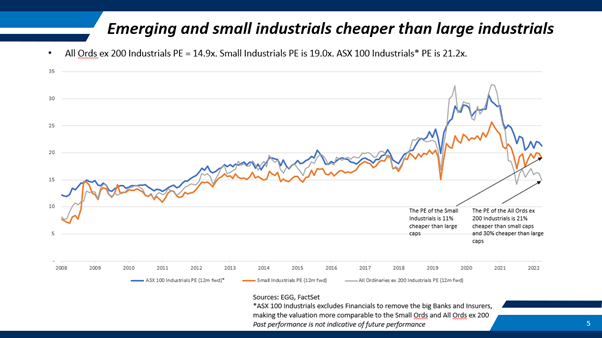

The small-cap sector is known for its combination of heady highs and crushing lows – and we’ve seen the latter in recent times. The ASX Small Ords is down approximately 20% since last January and the Industrials segment of the ASX ex-200 segment has seen a 50% derate and is now below its pre-COVID level, says Nick Guidera, portfolio manager of the Eley Griffiths Emerging Companies Fund.

Speaking with me from a busy airport (something that wouldn’t have happened during the pandemic), he delved into ASX small-cap investing and the process his team follows. Guidera discussed the effect of macro forces and why investors have probably missed the boat on buying defensives. He also touched on some of his favourite themes for the next 12 to 18 months – including one on which Guidera has done a 180-degree turn since last January.

Among some of the hot-button topics he explored are:

- The outlook for small-cap lithium stocks

- What’s happening in consumer discretionary amid inflationary pressures, and

- Whether IPO activity is likely to recover in the short term.

And getting into the nuts and bolts of investing, Guidera explained how his team selects stocks, including the overarching “style-agnostic” approach and the groundwork required to determine which stocks make it into the portfolio. Just as important, he explains how and why they exit positions.

The conversation culminates in Guidera revealing a handful of his preferred plays and two of his highest-conviction picks from disparate sectors.

Edited transcript

What are some of the key elements of your investment process and how do they contribute to your performance?

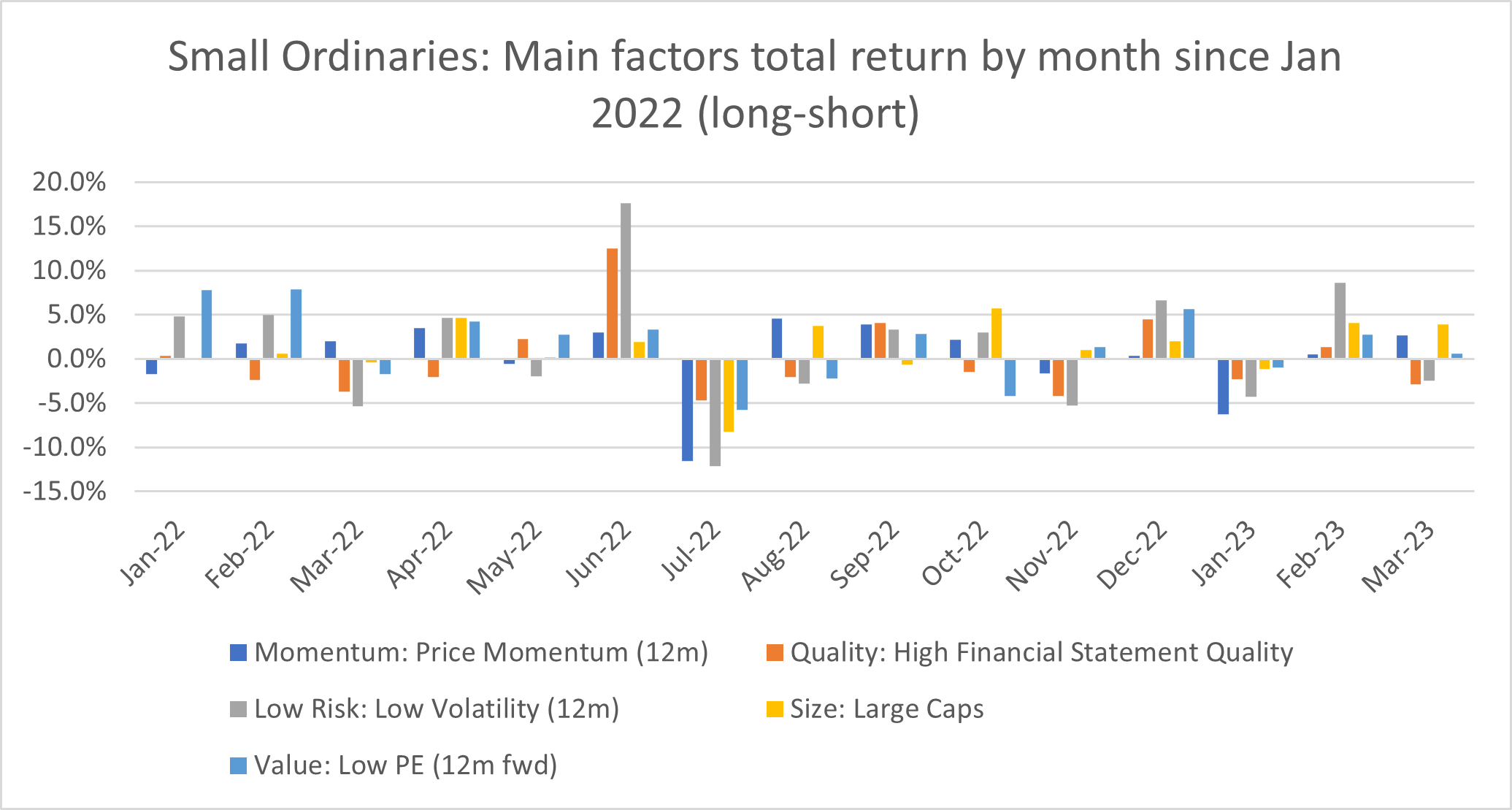

Guidera: We're a style-agnostic fund manager, which means we can own both growth and value stocks at any one time during the cycle. It's been particularly helpful over the last 15 months as the market has corrected with no one style outperforming for more than a couple of months at a time.

We've had a tried-and-tested in-house investment process known as SCOPE, which we've used across our strategies for the past 20 years. Fundamentally, it equally weights qualitative factors such as the track record of management, alignment of interests at the stock ownership level, as well as considering things like the strategic plan of the business and the market opportunity.

We complement those qualitative factors with a quantitative process that looks at the time-weighted EPS growth profile of a stock against its current valuation. This process consistently delivers a group of stocks to consider.

And then, at the small and emerging end of the market, a lot of time is spent on trying to find the next opportunity. This typically means getting on the road and meeting a range of corporates, everything from the next radiology company to the next F1 cooling technology.

Are you more defensive or are you on the hunt for opportunities, and why?

Guidera: During the drawdown, we gravitated to both low-risk stocks and those that are slightly up the market cap spectrum, even at the emerging end.

We think adding to core defensive exposures now, given the drawdown that we've seen, is probably not the right call and you should be relatively selective. Instead, we're spending our time on setting the portfolio up for the next 12 to 24 months.

A recession in the US is now almost consensus, which means that growth will be harder to come by. Therefore, we expect the stocks of the last cycle are unlikely to be the winners of the next. We've been adding new stocks to the portfolio in the last six months as we aim to set the portfolio up for what we think the market will look like in 12 to 24 months’ time.

We believe it may be too late to add defensive exposures now, if you don’t already have the defensives (in your portfolio). This is because many of those defensive stocks have done a lot of the heavy lifting over the last 12 to 15 months, and are probably relatively expensive to other parts of the market.

This

is why our focus is on spending time and dollars on the next lot of stocks that

have the potential to drive the market over the next 12 to 18 months

What are the sectors/themes you are most interested in now?

The lithium space is incredibly topical right now. We've just had a bid for Liontown Resources (ASX: LTR) from Albemarle. The company's revealed it had multiple approaches, suggesting that we may well see consolidation within the sector.

With China reopening and EV sales set to rebound, it'll be interesting to see whether the floor starts to emerge in the lithium carbonate price and the lithium stocks. I look at it and go, "The sector used to be a big part of the benchmark, and despite the falls, it still is, but will people come back to that sector for growth in the next cycle?"

The other sector I think is really interesting, and probably the most important call to get right in this market over the next 12 to 18 months, is consumer discretionary. The RBA has recently paused rates and cited a slowdown in household spending. So, it'll be interesting to see which parts of the consumer discretionary sector it impacts most.

Some retailers have already called out that the softening has emerged, but there's plenty of others like Eagers Automotive (ASX: APE) that aren't seeing the deterioration in new car orders that people had expected. So, I think right now, you want to be open to changing your view as the data comes to hand.

If the markets taught us anything over the last 15 months, it’s that there’s no consistent theme that's lasted longer than a couple of months, so you have to be open to what's happening next.

Source: EGG, Factset

In consumer discretionary, investors will need to evaluate how a consumer slowdown will impact traditional retail versus tourism, versus larger consumer purchases. And I put Super Retail Group (ASX: SUL) and Accent Group ASX: AX1) in that traditional retail category.

In tourism, I'd reference companies like Tourism Holdings (ASX: THL) and Flight Centre (ASX: FLT).

And when it comes to serious consumer decisions, companies like Eagers Automotive (ASX: APE) and Peter Warren Automotive (ASX: PWR).

On the lithium side, I mentioned Liontown (ASX: LTR) earlier. And there are many other development and exploration plays that are at different stages of their evolution. Some are close to achieving funding for the project, or others are under construction. I’d call out Leo Lithium (ASX: LLL) as an interesting stock that has a JV with Ganfeng in Mali, where they're constructing a mine at the moment.

You also have resource exploration plays like Red Dirt Metals (ASX: RDT) that are nowhere near a producing mine but have potentially got a resource there that could become one.

How does the IPO space factor into your investment process and what’s your outlook for listings and M&A activity among Australian small caps?

Guidera: We’ve been incredibly selective when it comes to IPOs. Off the top of my head, in the last IPO cycle we played in only about 10% of listings.

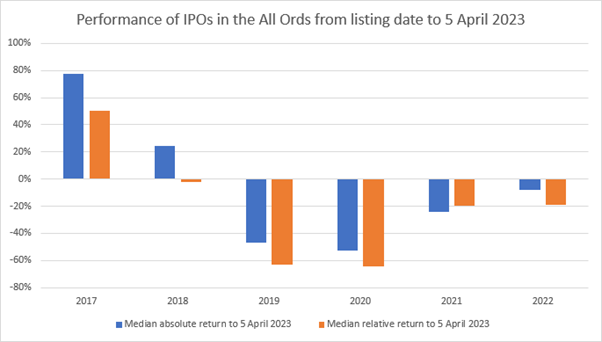

Our reasoning is that we've been fortunate to have a huge pool of companies that are already listed with a history of audited financials and a track record that can be assessed. It also pays to be cautious when it comes to IPOs from the most recent cycle. We've done some work internally, which is headed up by our Head of Quant, Pieter Stolz. Our analysis points out that the median relative return is negative for the last five years of IPOs with only the 2017 cohort seeing both positive absolute and relative returns.

Source: EGG, Factsect

There are some companies contemplating their capital position as we speak, but we'll probably need a greater level of stability in global markets before investors are willing to bet on anything new. That's my take right now.

How do you decide which ASX small caps make it into your portfolio?

Guidera: There're literally hundreds of companies to choose from when it comes to the small end of the market, as well as New Zealand. So, we're regularly running screens on that universe to see which stocks are outperforming, which stocks look cheap relative to history, and which stocks we need to come up to speed on.

It's typically those stocks that form the basis of our new idea generation. And then what we do, is assess each candidate against our process. To do that, it involves building a financial model, meeting management, and undertaking competitor calls. And often one of the more basic things I do is just read the annual report.

The factor that we hold highly, in our process is the track record of management. Have they done what they said they were going to do? Other factors we rank highly include understanding the strategic plan of the business, & the return on equity.

And as I alluded to as part of our earlier discussion, we also consider the appropriate relative valuation for the EPS growth profile of the stock. After following our process, it’s these factors that dictate what stocks can be included in the portfolio.

But portfolios are typically made up of a group of stocks from different sectors. For example, we might find 50 good tech ideas but we can't include them all. Otherwise, we have a very significant active weight towards a particular sector. So we have an eye to the index to ensure we don't extend too far one way or the other.

But fundamentally, we're stock pickers and we try to find good companies. And the art of portfolio construction is to make sure that we have an appropriate balance across all sectors, so that every stock can play its role in the portfolio.

I've got a list of probably 22 stocks sitting in my notepad at the moment, companies that I'm either doing the work on, I'm watching for an appropriate entry price, I want to see a certain quarter or half of numbers print. I think that's the difference between small, emerging and large caps, that there's so much to look at. Our job is to figure out how to rank one stock versus another.

And often, there isn't the research coverage that you see in the ASX 100 listed stocks, so you do have to do a lot of your own work. It just takes a little bit longer to formulate those views and make sure that, if you are going to make an investment, everything lines up.

What's your highest conviction or your largest position in the portfolios at the moment?

Guidera: A company that we think fits really nicely in our process is PSC Insurance (ASX: PSI) Management has a good track record of both organic growth coupled with an acquisition strategy that continues to grow its footprint both in Australia and the UK. Management owns a significant amount of stock in the business and is aligned with shareholders. They've got a sound strategic plan to continue to expand in both geographies and distribution.

They recently upgraded their guidance in the first half result. And we think the stock is appropriately valued for the growth expected in FY24.

In this kind of market, it's not necessarily about the highest-growth stock in the world or the most defensive. It’s more about good-quality companies that are arguably a bit boring, that will tend to provide defensive characteristics in market drawdowns. At the same time those same companies are attempting to deliver on their earnings consistently, so that markets will reward that growth when it comes through.

On resources, you've just seen gold prices break out recently and we've regularly played in the gold space. It's a large part of our index, around 8% or 9% at last count. We've been long-term shareholders in Capricorn Metals (ASX: CMM), since effectively the beginning of the development until production.

Tim Serjeant, who I work with – who’s background before Eley Griffiths was a gold analyst on the sell-side understands this space intimately. And we've backed Mark Clark, who's the chairman of Capricorn and his team there in what they've built. It's not the biggest mine in the world, but they consistently produce a significant amount of cash each quarter, and they've got growth optionality. So, I think if you are in this market where gold is breaking out to new highs, perhaps this can be considered alongside an industrial name, which perhaps a lot of your readers would be more familiar with.

What are some of the major risks to your outlook?

Guidera: Maybe cash rates haven't peaked. There's a school of thought that the RBA's pause is only temporary, and also the market still believes that the Fed may well raise rates again in May, pending the inflation outlook. So, that would probably force the market to adjust their expectations around where peak rates are for this cycle.

And on the other side, if they have peaked, perhaps rates remain stubbornly high for some time. In this scenario, you actually start to see the impact of higher interest rates on both the consumer, which we're already starting to see, as well as businesses that are suffering from those higher interest costs. And profitability starts to come under pressure, or worse still, we see those interest costs actually start to bring a whole bunch of sectors unstuck.

The third risk I see is that the volatility we've seen in the last 15 months continues and that the banking crisis hasn't ended. I'm not a fixed-income expert, but it's hard to see so much volatility in the fixed-income market in the last 6 weeks without a similar level of heightened volatility in the equity market. At some point, does that mean there's a level of reckoning for the equity market as well? I'm not so sure, but that's certainly a risk to my outlook.

And I suppose the last risk I'd probably say is the market just continues to meander and we continue to jump from one macro data point to the next. We don't really see that new low, or alternatively, break into a new high. And it becomes just a genuine grind to try to win in this market. This will mean it’s probably more about hitting singles versus home runs until we see clarity around how that macro backdrop looks.

What does it take for you to exit a position?

The really simple answer is that our investment thesis changes. There may be a relatively new management team with a new strategy, that's going to deliver X amount of growth over this particular timeframe and they're going to allocate this amount of capital to be able to do that. They've indicated that it's going to be achievable in this amount of time and this is the outcome they expect.

For some reason, that management team leaves, that management team does an acquisition that's completely off strategy, if that capital is not being allocated accordingly, or even simpler, the macroeconomic backdrop changes and the ability for them to grow that business going forward is different, then you have to ask the question as to why you were invested in the company in the first place. If that reason has changed significantly since you originally bought the stock, then there's terminology out there called “investment thesis creep”.

Often, you try and mould your thesis to suit the story of the day. And I think that's a real risk. You can get caught out trying to justify why you are in a stock if it's not working, when the thing that's actually changed is the very reason you bought it. That is typically a reason we'll exit a stock.

And as my colleague Ben Griffiths has always said, sell your winners slowly. Typically, when we do exit a significant winner, it will be because our investment thesis has played out. And if we do our jobs right at the small and emerging end of the market, all of our portfolio holdings should graduate into the ASX 200 in theory, or the ASX 100 if we're really lucky.

And as a result, our job is to find the next emerging company, the next Ramsay Health Care, the next A2 Milk, whatever it might be. We need to continue to look for the next Saracen in the gold space. We need to continue to find those ideas.

Our winners are sold so that we can rotate that capital into the next lot of emerging companies. In our universe, there is a huge number of stocks that we can potentially invest in. We can't own everything, but there might be a better relative opportunity in a newer emerging company today versus something that's been in the portfolio for the past three years and has delivered a significant amount of outperformance over that time.

Access Australia's most compelling companies

2 topics

11 stocks mentioned

1 fund mentioned

3 contributors mentioned