The end of Funny Money in Silicon Valley and why it matters

In 35 days Alphabet will expense stock-based compensation in their non-GAAP results. A number of tech titans, including Facebook, have also broken rank from the industry. This shift could change the perception of value in many high-flying stocks in 2017 - a sharp reminder to always focus on real earnings.

2017 could be the year that stock based compensation starts being treated as a real expense, not just ‘funny money’.

Aside from Alphabet and Facebook, video game leaders Entertainment Arts and Activision Blizzard, and online travel agent Priceline have also started reporting non-GAAP earnings expensing stock-based compensation or dropping non-GAAP altogether. Some companies will resist, but we expect that this reporting trend will continue - and it should move stock prices.

What is stock-based compensation and why is it ‘funny money’?

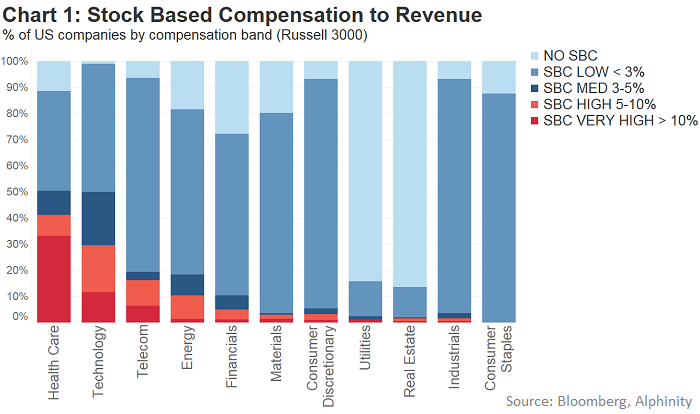

Stock is often used to entice employees to join a company at lower than market salaries. The employees are betting that if the company is successful the stock or options will be worth far more than a higher cash salary. This style of remuneration is most common in the global technology and health care industries. 30% of technology companies and 41% of health care companies in the Russell 3000 have stock compensation above 5% of revenue (the red and orange bars in Chart 1).

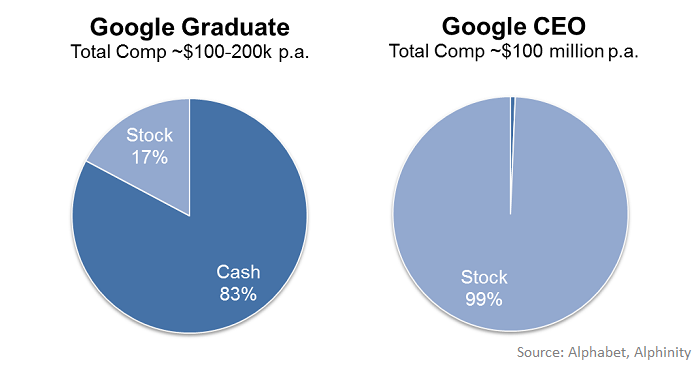

At Alphabet, Computer Science graduates can expect to be paid between $90,000 to $165,000 in cash with an additional $8,000 to $45,000 in stock options. Sundar Pichai, the CEO of the Google division within Alphabet, was paid $652,500 in cash in 2015. But that was less than 1% of his compensation for 2015, with $100 million granted to him in equity in January 2015. In January 2016 he was granted a further $209 million biennial equity award – roughly another $100 million per annum in 2016 and 2017.

Many don’t believe stock based compensation should be included as an expense, arguing that it is difficult to value options and that many stock options have no tangible value at the time of issue because the strike price is at or above the market price. But, as Warren Buffett muses about stock compensation in his 2015 Shareholder Letter, "The very name says it all: 'compensation.' If compensation isn't an expense, what is it?"

The history and how this issue evolved

Until 2006 stock compensation such as this was reported in the notes section of the financial statements, but not in the financial statements themselves. In 2006 the Generally Accepted Accounting Principles (GAAP) code was changed to require companies to show options as an expense in the income statement. There was an uproar at the time from Corporate America and Congress was lobbied to reverse the decision, but in the end the changes stood.

Corporate America lost the battle but won the war. Companies are allowed to report earnings to investors on a non-GAAP or pro forma basis which permits them to adjust their results for a variety of reasons, mostly non-recurring events. Many companies have elected to exclude stock based compensation from their calculation of non-GAAP earnings, the numbers most regularly referenced by sell-side analysts and investors.

Alphabet investors quote earnings as if we pay Sundar Pichai a 'modest' $652,500, not the $100 million we actually pay.

It shouldn't matter, but it does

In theory whether stock based compensation is in non-GAAP earnings or not, shouldn't matter for investors. The value of a company is the sum of its future cash flows discounted back to today, and non-GAAP adjustments don't change cash flow. However, in practice, Price to Earnings and Enterprise Value multiples are an often used short-hand for valuation models, and as earnings fall these multiples will rise.

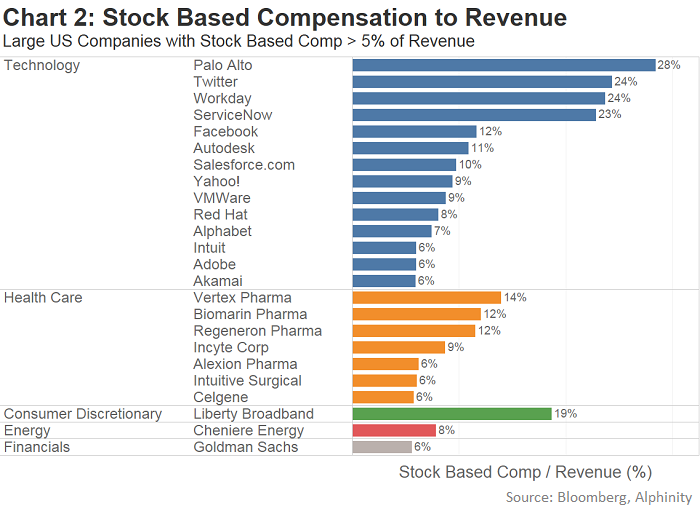

For some companies the difference will be extreme. Twitter, the social networking company that Trump likes so much, spent 24% of its revenue on stock based compensation last year. Non-GAAP EBITDA was $750 million, but it reduces to $35 million if stock based compensation and a restructuring charge is expensed. Twitter's Enterprise Value rises from 14x Non-GAAP EBITDA to 260x. A discounted cash flow model of Twitter doesn't change, but the tone of the discussion about Twitter's value and viability certainly does.

Chart 2 shows large US companies with high levels of stock based compensation, which includes a number of high profile names. But it is smaller, younger and less profitable companies that generally have higher stock based compensation with lower profitability, and will be affected most. Morgan Stanley estimates that the EV to EBITDA multiples of large cap Internet companies will increase by around 15% and small and mid-cap internet companies will increase by 65% (excluding outliers).

Don't bridge the whole (non) GAAP

While it is tempting to rush off and value companies by ignoring all non-GAAP adjustments, it isn't that simple. When assessing the value of a company investors should apply a multiple to earnings that exclude true non-recurring items, and many non-GAAP adjustments are valid. Even Buffett, who is a critic of non-GAAP accounting, suggests that investors ignore about 80% of Berkshire's GAAP amortisation costs when valuing the company.

Adjusting for stock based compensation is not always straight forward either. In February 2014 Facebook stunned the market by buying WhatsApp, a company with $10m in revenue and 55 employees, for a cool $19.6 billion. $4.6 billion of this was paid to Jan Koun and his fellow WhatsApp executives as share based compensation, expensed over 4 years. Excluding the WhatsApp expense, which is non-recurring and rolls off in 2018, Facebook’s stock based compensation drops from 12% to 7%.

Alphinity’s view

It is always important for investors to focus on the real earnings of a company, not the sometimes inflated non-GAAP earnings. Now that Alphabet, Facebook and other tech titans are pushing investors to focus on earnings excluding stock based compensation investors need to be twice as careful in 2017.

For more thought pieces from Alphinity please visit our website: (VIEW LINK)

----

Information contained in this publication is current as at the date of this publication and is provided by Alphinity Investment Management ABN 12 140 833 709 AFSL 356 895 (Alphinity) as investment manager of the Alphinity Australian Share Fund (ARSN 092 999 301), Alphinity Australian Equity Fund (ARSN 107 016 517), Alphinity Concentrated Australian Share Fund (ARSN 089 715 659), Alphinity Socially Responsible Share Fund (ARSN 093 245 124) and Alphinity Global Equity Fund (ARSN 609473127) (Funds). Fidante Partners Limited ABN 94 002 835 592, AFSL 234668 (Fidante Partners) is the responsible entity and issuer of interests in the Funds. The information is intended solely for holders of an Australian Financial Services Licence or other wholesale clients as defined in the Corporations Act 2001 (Cth). It is intended to be general information only and not financial product advice and has been prepared without taking into account any person’s objectives, financial situation or needs. Each person should, therefore, consider its appropriateness having regard to these matters and the information in the product disclosure statement (PDS) and any additional information brochure (AIB) for the Fund before deciding whether to acquire or continue to hold an interest in the Fund. The PDS and any AIB can be obtained from your financial adviser, our Investor Services team on 13 51 53, or on http://www.fidante.com.au