The FED doesn’t blink

After nearly two weeks of speculation, with a few pointed sentences Federal Reserve (Fed) Chairman Jerome Powell reaffirmed that the Federal Open Market Committee’s (FOMC) highest priority remains price stability, while also acknowledging that recent banking sector upheaval and its impact on credit availability are developments they cannot dismiss. By shifting the focus back to inflation and a tight labour market despite indications of a slowing economy, Chairman Powell provided the context for the FOMC’s 25 bps rate hike to a range of 4.75% to 5.00%.

Even with the focus squarely on inflation, we believe the impact of the banking turmoil was already evident in Chairman Powell’s statement. In his Congressional testimony only a few weeks ago, he hinted that rates would likely have to rise higher than the market anticipated. Taking him at his word, futures prices responded by implying the terminal rate would climb as high as 5.75% in mid-2023. Fast forward to Wednesday and his message morphed to a less certain “some additional policy firming may be appropriate.”

All eyes on the mandate

Citing “robust” job gains keeping stickier drivers of inflation – e.g., wages – elevated, Chairman Powell emphasized that there is much work to be done in achieving the Fed’s objective of 2.0% inflation. This meeting’s update to the Summary of Economic Projections reflected the Fed’s modestly hawkish thinking. Estimates for 2023 headline and core inflation were revised upward to 3.3% and 3.6%, respectively. The challenge facing the Fed is acutely illustrated in the incongruity of paltry 2023 gross domestic product growth of 0.4% and the year’s unemployment rate being revised down to 4.5%.

Source: Bloomberg, as of 22 March 2023.

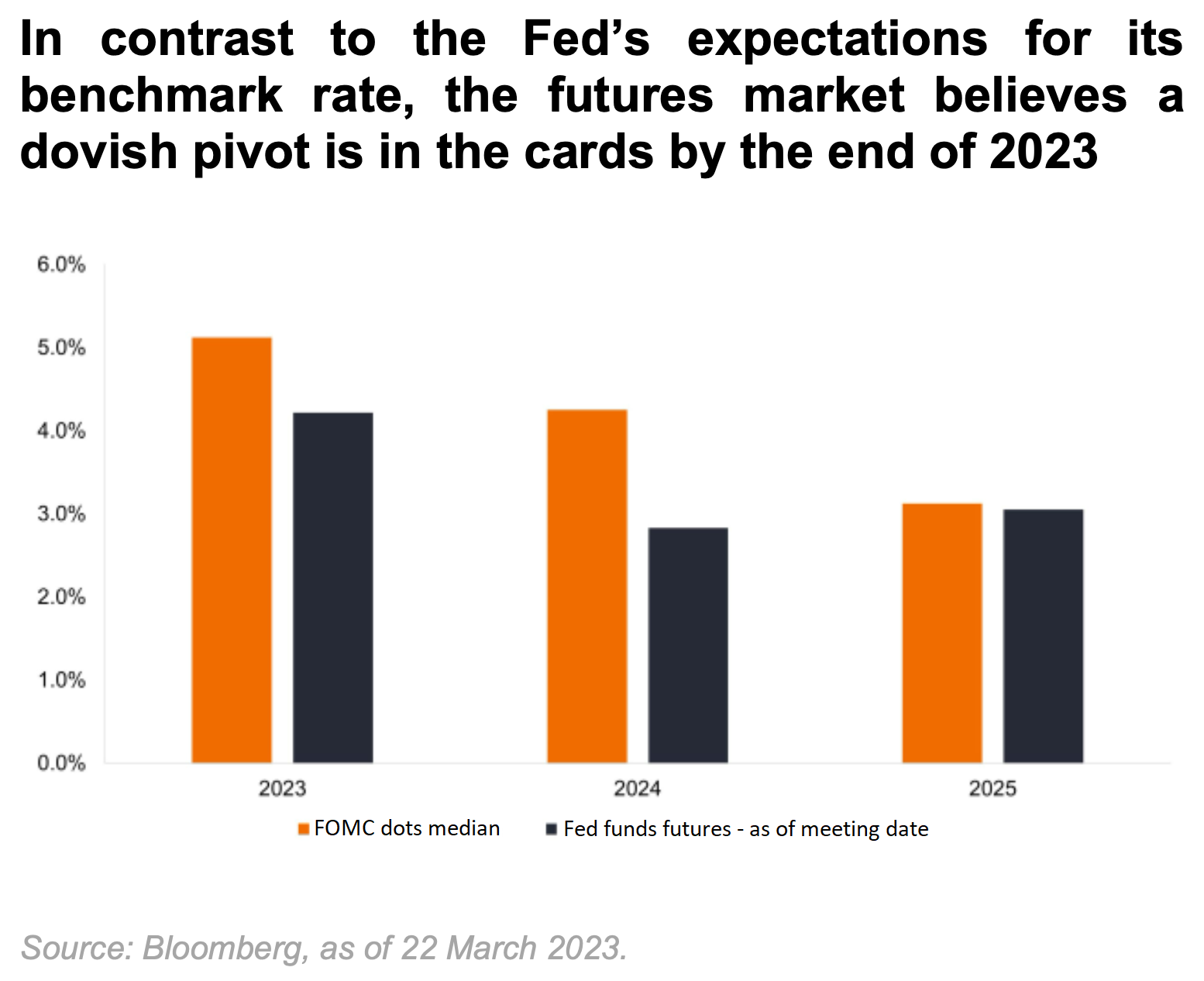

Given the recent developments in the banking sector, we had suspected that the Fed could have considered a 2023 pivot as lenders’ health can materially impact financial conditions. Chairman Powell, however, dismissed that scenario, noting that the FOMC does not see a rate cut occurring this year. In fact, the Fed’s much ballyhooed DOTS survey revealed that respondents see the fed funds rate finishing 2024 at 4.3% – slightly higher than the 4.1% suggested in its December survey. We interpret this as the Fed being willing to leave rates at their cycle high for longer than what the market is currently pricing in. Such a pause would give the central bank time to assess the impact of previous rate hikes and other tightening initiatives.

We believe the Fed was correct in shifting the conversation back toward its battle with inflation.

Even before most people had ever heard of Silicon Valley Bank (SVB), the Fed was faced with striking a delicate balance between reducing inflation and inflicting as little harm as possible on the economy. That battle has not gone away.

Breaking something

Arguably, the genesis of the current banking turmoil was last year’s rise in interest rates, which led to the mismatch between SVB’s assets and liabilities and resulted in the run on the bank. We often state that the purpose of monetary tightening is to break something. Typically, what gets broken first are the weaker business models and pockets of the economy that are dependent upon low rates. While regional banks with narrow customer bases may be the first segment to give way, they may not be the last, and investors must be wary of what else higher rates could expose.

In his statement, Chairman Powell emphasised that the U.S. banking sector was “sound and resilient.”

This is due, in part, to the action taken by the Fed in concert with the U.S. Treasury to shore up banks’ access to funding. Thanks to the alphabet soup of policy prescriptions created during the Global Financial Crisis, the Fed has a full cupboard of facilities well-suited to addressing financial stability. This leaves the fed funds rate available for the task at which it’s effective: addressing inflation.

Bringing this full circle, the stress to regional banks that initially caused a historic rise in rates may, in the end, assist the Fed in tightening financial conditions. Mr. Powell made a point to highlight that households and businesses are likely to face tighter credit conditions. This is in addition to higher rates already negatively impacting the housing market and business investment.

Narrowing rates’ range of outcomes?

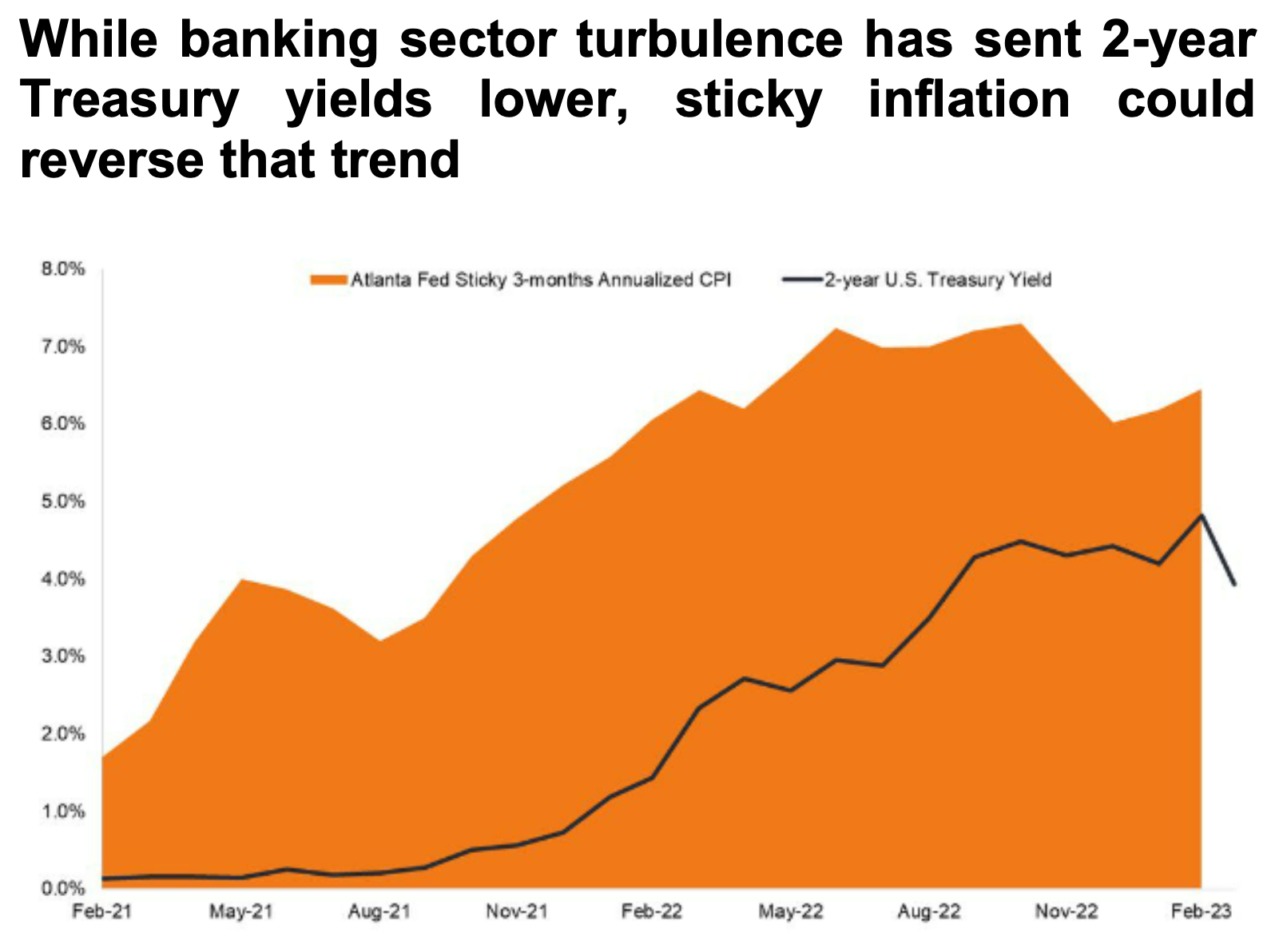

We think recent developments – and the Fed’s decision – leaves much for investors to digest. In one respect, the added headwind of tightening credit conditions means that the near-term ceiling for interest rates may be lower than it was in early March. This could lead to lower volatility in shorter-dated bonds. Still, we see a disconnect between the yield on the 2-year U.S. Treasury of roughly 4.0% and the end- of-2023 DOTS projection of 5.1% for the fed funds rate. This disparity may reflect the Fed’s concern that it’s too soon to declare victory in its battle against inflation.

Recent market and economic developments have no doubt tested the Fed. We appreciate that its focus remains on price stability, as imbedded inflation expectations can lead to long-lasting price distortions across the economy. By recognizing that it has the facilities at its disposal to address financial stability, the Fed can keep another 25 bps rate hike on the table should consumer prices remain uncomfortably hot and the labour market tight.

In choosing a circumspect hike rather than the pause many had called for, the Powell Fed, in our view, has passed the initial test of not blinking at the first sign of something breaking, which – as history has shown – only results in more difficult battles down the road in containing inflation and longer-term rates.

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with content like this by hitting the ‘follow’ button below and you’ll be notified every time we post a wire.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics