The five pillars of portfolio strategy

LGT Crestone

The last couple of months have been extremely volatile to say the least, and this has naturally presented a lot of challenges for investors. Recent years have seen markets rise in an almost uninterrupted fashion with only a few bouts of significant volatility. This has, perhaps, led to some complacency among investors.

Having said that, periods of market stress also present opportunities as dislocations emerge. While markets globally seem to be in a bit of a holding pattern as investors contemplate their next move, we believe now is the time for investors to reassess their strategy and position portfolios for the longer term, so they are protected against further volatility and capture the eventual recovery.

In recent years we have made a conscious effort to position portfolios in a manner that would protect against a stressed market environment. We emphasised building more robust portfolios that were diversified across asset classes and funds, and not overly exposed to any style or theme. In essence, it was not a market environment to take big bets. Rewardingly, our clients’ portfolios have been more insulated from the broad-based sell-off experienced in markets. A number of these philosophies have not changed and remain relevant, particularly given we are yet to gain clarity on how deep or long this downturn may be. In this article, we highlight the five pillars of portfolio strategy—rebalancing, diversification, emphasis on quality, active management and hedging.

1. Rebalancing takes the guess work out of investing

Asset allocation plays a key role in any diversified strategy and we reinforce the importance of rebalancing in an environment like this. Historically, market timing has proved elusive and we have often observed it is darkest just before the dawn. Therefore, rebalancing takes the guess work out of investing and ensures we stay the course with our long-term strategy and objectives. Failure to rebalance can threaten the diversification benefits of a portfolio. It is best practice to set limits or ranges around how far the actual asset allocation can drift from the target asset allocation (i.e. tolerance levels).

There are two layers to this aspect, the first being the strategic asset allocation (SAA) ranges, which are generally hard limits and stipulate a wide range for the asset allocation. For example, an allowable SAA range for equities could be 0-60%. The second layer, which is more applicable in this environment, is around tactical asset allocation (TAA) ranges. Typically, this entails stipulating a maximum and minimum range the actual asset allocation can drift away from the TAA. For example, a +/-3% range for an asset class is a reasonable and practical point to commence the rebalancing process without being too reactive. In risk-off environments, portfolios tend to be overweight cash, bonds and alternatives, while underweight equities and credit. The following section highlights the key focus areas when rebalancing within asset classes.

2. Diversification plays a key role in strengthening portfolios

Given the current volatile environment, it is prudent to maintain a well-diversified portfolio that is not overly dependent upon a particular outcome, which would leave investors exposed to unpredictable risks. While we expect to eventually see a recovery, diversification will continue to play a key role in enhancing the robustness of portfolios. From our perspective, being prudent with asset allocation and having ample exposure to various funds across sub-asset classes and styles are the key components of diversification. Well diversified portfolios should yield better risk-adjusted returns over the long run.

Equities generate long-term growth

As a starting point, we advise that portfolios have adequate exposure to a core equity fund as an anchor strategy. This should then be complemented by high-conviction, growth and value style-biased funds. Portfolios should have dedicated small-cap exposure for additional diversification away from large caps—and emerging markets exposure from a global equities perspective. Small-cap and emerging markets exposure should be appropriately sized and limited to around 15% of the asset class as it can be volatile. The commonality among all these strategies, regardless of style, should be a focus on quality. This generally means exposure to businesses with low debt/gearing, high return on equity and low cyclicality. Should a portfolio not have any of the aforementioned exposures, these should be initiated as part of any rebalancing effort.

Incremental exposures within equities should focus on quality growth funds that can continue to capture growth in an uncertain environment. It is also important to remember that crises create themes and shifts in structural trends. Therefore, these funds should be beneficiaries from the current crisis, and it is key to have funds that can benefit from that. To that end, we feel having dedicated high-quality growth funds in both domestic and global equities is prudent. A growth bias to companies that have balance sheet discipline should help to capture some alpha if the current low-interest rate regime continues.

When trimming exposure, focus should be on pure momentum plays with minimal emphasis on quality and lower quality exposures, particularly in the deep value/contrarian funds style.

Alternatives provide uncorrelated exposure to fixed income and equities

Alternatives provide an uncorrelated/diversifying exposure to bond and equity markets— a role we feel will continues to be pivotal going forward. Being nimble and opportunistic are key elements that this asset class also provides. Collectively, alternatives can be split into growth and defensive investments—it is crucial to maintain allocations to both, depending on the risk profile and investment objectives of the portfolio.

For those already invested, it is important to stay the course and let these exposures play their role in this environment. The focus should continue to be on allocating to diversified hedge funds, private equity and real assets funds, keeping in mind the liquidity profile of the portfolio. When it comes to real assets, we could see some revaluations lower as the valuation lag catches up to listed markets. While it is unlikely to be severe by any means, when allocating, it is sensible to average in over a couple of quarters targeting actively-managed diversified funds. Any allocations to real assets in this environment should be to quality core assets that don’t exhibit a high level of cyclicality. While private debt can often be overlooked as an alternative, this is an opportune time to allocate. Our core exposure to private debt is highly defensive with a focus on quality issuers and provides a consistent income stream at an attractive yield. Within private equity, real assets and private debt, there are a number of funds with dry powder that are well-positioned to take advantage of a compelling opportunity set.

Fixed income acts as a core defensive allocation

Portfolios should have adequate exposure to a high-grade bond fund as a core defensive allocation, complemented by ample exposure to credit for more attractive risk-adjusted returns. Fixed income remains a conundrum for a number of reasons, including the low bond yields on offer across developed markets and the poor value bonds generally offer. However, from a defensive perspective, bonds continue to have a role to play in a diversified portfolio. They also have the central bank backstop in their favour and, with no prospect for higher rates in the near future, duration risk is fairly low.

Incremental exposure to the asset class should be to funds that focus on higher quality sovereigns and investment-grade corporate credit. Funds that are able to generate reasonable income levels with a capital preservation focus should be a priority. Maintaining meaningful allocations to floating-rate credit is also advantageous, given its lower sensitivity to economic outcomes. We have a strong preference for senior secured debt strategies in this space. Active management is paramount as credit selection, corporate liquidity and business prospects will be differentiators.

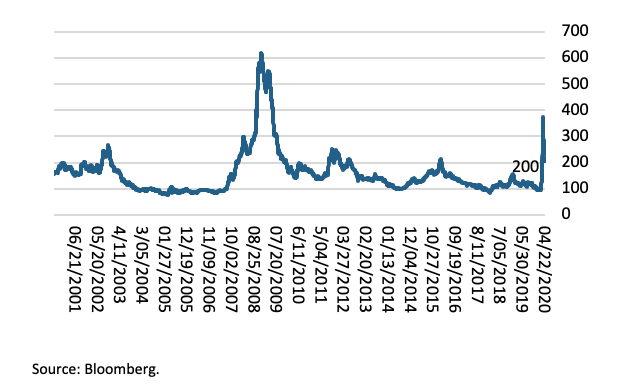

While credit spreads widened in line with the risk-off environment, they have somewhat calmed in response to central bank intervention. The sector experienced broad-based and indiscriminate selling across sectors and issuers as the market priced in draconian scenarios—a move we believe presents significant opportunities for long-term investors. However, given the dire economic and corporate earnings picture, parts of the credit market, particularly high yield, remain high risk and should be trimmed where possible.

Bloomberg Barclays US Credit index – historical OAS

3. Active management can provide downside protection

While recent years have presented some challenges, active management is likely to be best suited to an investment universe where idiosyncratic risk and the cost of information is high. Active management tends to outperform in high dispersion markets where security correlation is low. At Crestone, we have always advocated active management for downside protection and generating returns over benchmarks (alpha) over a cycle. The current stress on businesses, their operating models and balance sheets means there will be a number of pitfalls to avoid. Active management is prudent to help manage these potential pitfalls and should be a key part of an investor’s portfolio strategy going forward.

Now also presents a good opportunity to trim passive exposures to risky parts of the market, such as high yield credit. Having said that, passive strategies can play a role in portfolios, particularly when utilised as a low-cost solution in more predictable parts of an asset class. In practice, this means potentially utilising an exchange-traded fund in equities to gain benchmark-aware exposure to large caps. This would then be complemented by active management in less predictable parts of the market. While this applies to equities, it is less applicable to alternatives and fixed income, where fund manager skill is expected to generate the majority of returns and credit risk has to be managed appropriately.

4. Quality is the key building block in today’s market

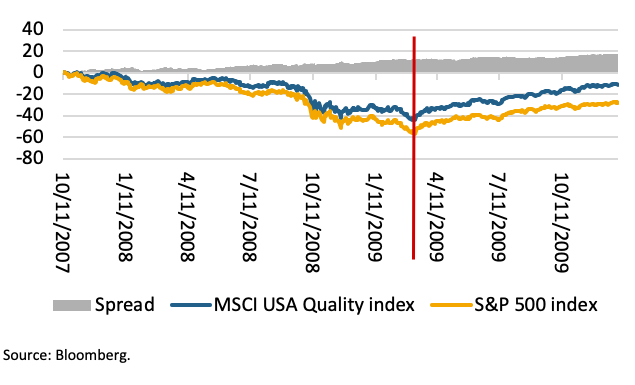

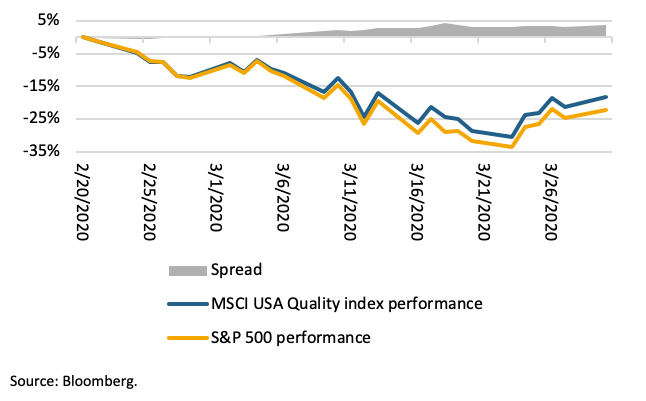

Through the preceding sections, we have emphasised quality as the key building block in today’s market. While quality is always an important part of any investment strategy, it is even more critical now. This aspect of portfolio strategy ties in with rebalancing, diversification and active management. Through stressed market conditions we have historically seen divergence between quality stocks and the broader index increase. This is shown in the following two charts—firstly through the GFC and now since the onset of the COVID-19 sell-off. This phenomenon is also evident in fixed income markets where instruments from debt-laden sovereigns and companies are out of favour. In this environment, it is imperative to differentiate between assets that have solid fundamentals and those that have a real probability of capital loss—higher quality credit is significantly outperforming lower quality credit.

Quality versus S&P 500 index during the GFC

Quality versus S&P 500 index during COVID-19

5. The benefits of hedging are compelling

A falling Australian dollar has been a key part to global equities’ outperformance on an unhedged basis. Holding unhedged global equities exposure also provides a level of diversification from a risk perspective. Having said that, at below 60 US cents, the argument to hedge some of the exposure is extremely compelling. For those investors who desire a level of hedging, determining a strategic hedge ratio is quite encompassing and generally requires a quantitative and qualitative assessment of their objectives. While we have a flexible view of hedging, some research suggests an optimal static hedge is around 20-30% of the Australian domiciled global equities portfolio. There are several high-quality core and growth hedged global equities funds should some level of hedging be required.

In summary

While valuations of most asset classes have improved in recent months, an expected plunge in economic growth over the short to medium term, and the risk that earnings expectations priced into valuations will not be fulfilled, is still real. At present, there is no clear sight on what the earnings picture will look like going forward. The key is to construct portfolios that can still achieve investors’ objectives over the long term and protect against any further volatility or downside in the short term. We believe ample diversification, rebalancing, selectiveness in instrument quality and being opportunistic, along with active management, are the key elements that can deliver on a portfolio’s long-term objectives.

Learn what Crestone can do for your portfolio

With access to an unrivalled network of strategic partners and specialist investment managers, Crestone Wealth Management has one of the most comprehensive global product and service offerings in Australian wealth management. Click 'contact' below to find out more.

3 topics

1 contributor mentioned

With 12 years in financial markets and managed investments research, Stan works closely with Crestone’s investment advisers to understand individual client goals and to deliver suitable portfolios.

Expertise

With 12 years in financial markets and managed investments research, Stan works closely with Crestone’s investment advisers to understand individual client goals and to deliver suitable portfolios.