The forgotten factor in selecting companies for this big investment theme

When it comes to analysing a company’s impact on the environment, it is important to look below the surface.

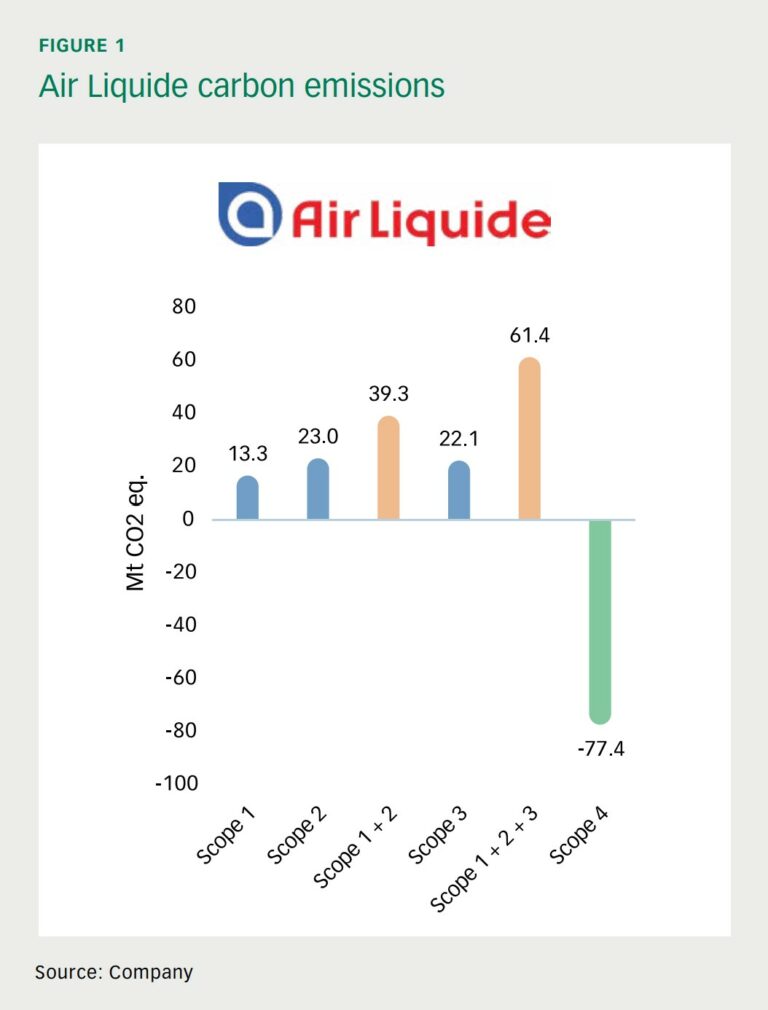

Take Air Liquide, a global leader in industrial gases, as an example. It might seem like they’re a big contributor to greenhouse gas emissions. In fact, their emissions intensity (using Scope 1, 2 and 31 measures of carbon emissions) is among the top 10% of companies in the MSCI World Index. However, appearances can be deceiving.

To really understand Air Liquide’s role in contributing to decarbonisation, we need to consider the contribution the company is making to the globe’s avoided emissions, also known as Scope 4 emissions.

The concept of ‘avoided’ — or Scope 4 — emissions is based on the idea that investors should look beyond a company’s efforts to reduce greenhouse gas emissions in its own operations and supply chains. By looking at Scope 4 emissions, investors are considering the impact a company has through its product and services, outside of its own value chain.

For example, a company that produces electric vehicles could claim Scope 4 emissions for the emissions avoided by replacing conventional vehicles with their products. It gives us a more complete picture of a company’s environmental footprint.

Air Liquide produces hydrogen from natural gas, which is their biggest source of Scope 1 emissions. The company also uses purchased energy to operate Air Separation Units (ASUs) that generate oxygen, nitrogen, argon, and noble gases from air. This is their biggest source of Scope 2 emissions.

When we analyse Air Liquide’s contribution to Scope 4 avoided emissions, hydrogen is produced to remove sulfur from fuels. This lowers black carbon emissions, which contribute to global warming and are harmful to human health.

This is a major part of Air Liquide’s avoided emissions. In fact, their avoided emissions are twice as much as their Scope 1 and 2 emissions (or 1.3 times their Scope 1, 2 and 3 emissions) as shown in the diagram below.

Importantly, Air Liquide has the potential to contribute even more for decarbonisation in the future. The company plans to reduce their Scope 1 emissions by producing green hydrogen. They also aim to reduce their Scope 2 emissions by using renewable electricity.

Air Liquide are also partnering with customers to decarbonise their operations – from more efficient ASUs in industrial applications, to capturing the CO2 in cement production. They are exploring the use of hydrogen in hard-to-abate industries like long-haul transport and aviation.

With 40% of investment opportunities coming from decarbonisation projects, Air Liquide is in a great position to continue fighting climate change. The company has a first-mover advantage across its complete carbon capture offering, having invested in this technology 10-20 years earlier than others. Known as an industry innovator, Air Liquide leads its peers, registering approximately one new patent per day.

The opportunity for companies and investors

Simply screening out companies with high reported emissions risks underestimating the true impact the companies are making toward the decarbonisation ambitions of the world. By considering avoided emissions, we can gain a more complete understanding of a company’s true impact on the environment.

For companies, the provision of new goods and services that avoid greenhouse gas emissions create a huge opportunity to meet the growing demand from stakeholders who want to reduce their climate impact.

For investors, the lack of internationally accepted avoided emissions standards provides a potential edge when analysing a company. The market may underestimate the full contribution to decarbonisation that a company is making given evolving standards and regulations. Understanding avoided emissions can allow investors to make more informed decisions.

Many companies in the Firetrail S3 Global Opportunities Fund have avoided emissions. These include:

- Archer Daniels Midland (NYSE: ADM) and Darling Ingredients (NYSE: DAR) process soft commodities into biofuels to replace regular diesel in transportation.

- Carrier Global (NYSE: CARR) manufactures energy-efficient heating and cooling appliances, replacing less efficient units.

- Ecolab (NYSE: ECL) provides solutions that allow customers to use less water and less energy in their operational processes.

- First Quantum Minerals (TSE: FM) extracts copper to electrify the grid to move away from fossil fuel-derived energy.

- Techtronic Industries (HKG: 0669) is a leader in cordless power tools, replacing petrol with battery-powered alternatives.

- Taiwan Semiconductor Manufacturing (TPE: 2330) produces leading-edge computing chips, lowering the amount of power consumption with each new iteration.

As investors, we look beyond appearances to dig deeper into a company’s operations and impact. By doing so, we make informed decisions about where to invest our clients’ capital to support companies that are making a positive impact on the world and generate excess returns in the process.

Learn more

At Firetrail, we aim to identify the best opportunities and build high-conviction portfolios of our best ideas. Whilst we prefer to focus on stock selection as opposed to macro-economic trends, we are finding compelling bottom-up opportunities across our Australian and Global equities portfolios that will be set to benefit materially from Deglobalisation, Decarbonisation and De-dollarisation in the coming years.

(1) Scope 1 covers the Greenhouse Gas (GHG) emissions that a company makes directly — for example while running its boilers and vehicles. Scope 2 emissions are indirect emissions generated from purchased energy, including electricity, steam, heating, and cooling. Scope 3 are all the emissions that an organisation is indirectly responsible for, up and down its value chain. For example, from buying products from its suppliers, and from its products when customers use them.

1 topic

4 stocks mentioned

1 fund mentioned