The Goldilocks of dividend income

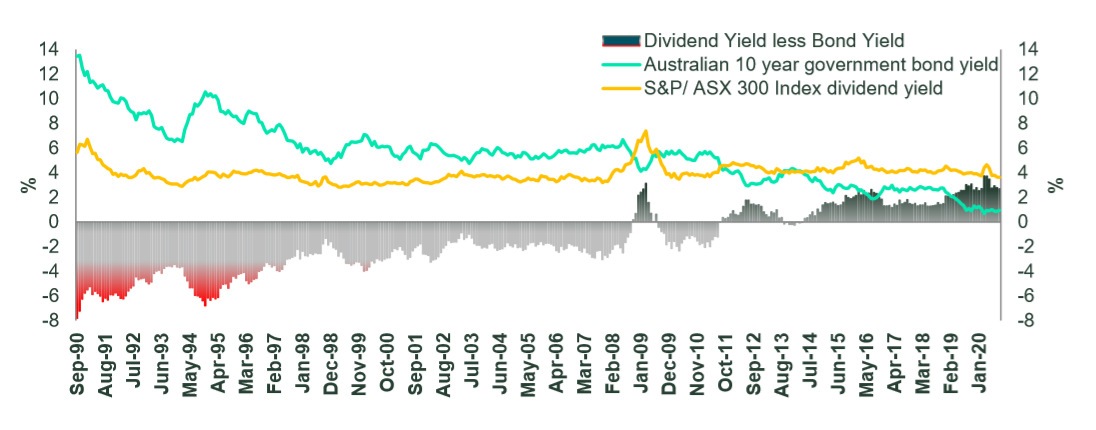

Interest rates have been on a secular decline for 3 decades dropping from midteen interest rates in 1990 to below 1% in a post pandemic world. By contrast equity dividend yields have been much more consistent averaging 3.93% in the last 30 years. The coronavirus pandemic and economic slowdown has impacted equity dividend yields with the current yield dropping to 3.6% on 10 September 2020. Despite this drop they remain significantly above those of the 10 year bond yield of only 0.93%. On a relative basis this makes equity yields more appealing for investors but it does not come without risk.

Figure 1. Low rates maintain the appeal of equity income

Source: Thomson Reuters, State Street Global Advisors as at 31 August 2020. Past performance is not a reliable indicator of past performance.

Despite dividend cuts, equity dividend yields remain attractive

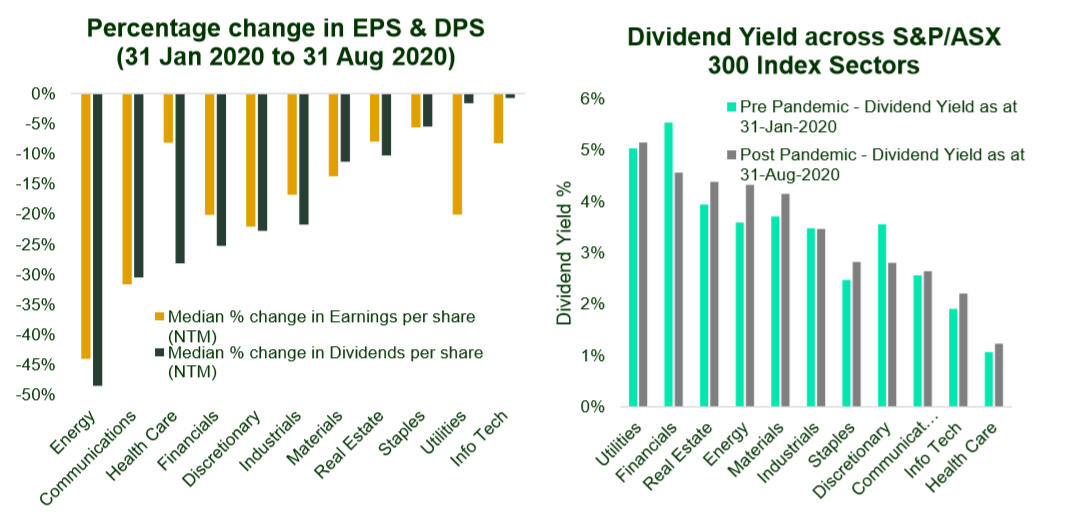

As shown in the left hand chart in Figure 2 below, the pandemic has seen significant lowering of earnings and dividends across the majority of S&P/ASX 300 Index companies. The median decline in expected earnings per share for the next twelve months (NTM) was 15% and the median decline in dividends per share (NTM) was 18%. As at the end of August the S&P/ASX 300 Index price was down 18% from its pre pandemic high.

The reduction in dividends per share is mostly due to lower expectations for revenue and earnings and surplus cash, but it is also partly due to some corporates being conservative and keeping some powder dry for the uncertainty ahead. Figure 2 shows the Energy sector has seen expectations for dividends decline by more than declines in earnings. In contrast the Utilities sector has seen only small declines in dividend expectations despite larger downgrades to earnings over the next 12 months. Health care has been conservative guiding for lower dividends despite only modest declines in earning expectations. Despite the hits to earnings and dividends, the opportunity for dividend income remains positive.

The dividend yield for the S&P/ASX 300 Index has declined from 3.9%4 to 3.6% but when we look across the S&P/ASX 300 Index sectors, we still observe many reasonable dividend yields available for equity investors. The right hand chart in Figure 2 compares the yields on offer pre and post the economic shock of the pandemic. As at the 31 August 2020 the Utilities sector was offering yields of 5.1%, very similar to that offered pre pandemic. The yield available to financials has come down 18% but still offers yields of 4.6%.

Figure 2. In most cases the declines in earnings have corresponded with similar declines in expected dividends

Source: Refinitiv, SSGA, as at 31 August 2020. This information should not be considered a recommendation to invest in a particular sector or to buy or sell any security shown. It is not known whether the sectors or securities shown will be profitable in the future

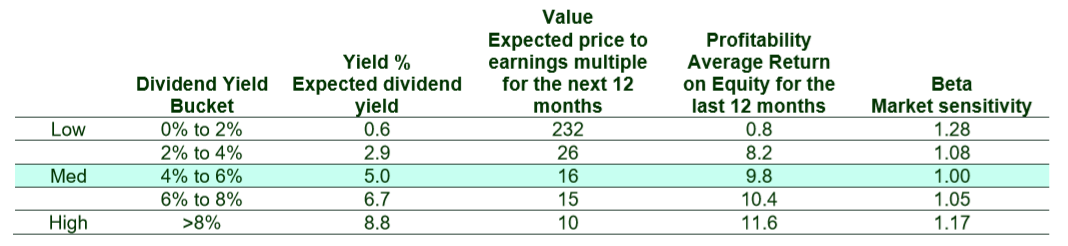

Beware: Higher income often comes with greater risk

Not all income opportunities are equal and looking at yield alone can be quite misleading. We believe that if a company is yielding more than 8% in the current environment, it is likely to be associated with the risk that the security will see earnings declines and or dividend cuts. The highest yielding stocks are sometimes referred to as “value traps”. On the surface they appear cheap but instead continue to become even cheaper. We take a closer look by examining some of the characteristics of higher yielding companies in the S&P/ASX 300 Index as at 31 August 2020.

Figure 3. Fundamental characteristics associated with different levels of dividend yield

Source: Refinitiv, SSGA, as at 31 August 2020

As you would expect, the lowest yielding companies are often considered the most expensive. As the table above highlights, the lowest yielding companies in the S&P/ASX 300 Index trade at an average of 232 times next year’s earnings. By historical standards these multiples are very high and symptomatic of the extreme market environment we are observing. On average this low dividend cohort has delivered the least in terms of operating returns in the last 12 months as represented by the return on equity. It is also the most volatile and as illustrated by the average beta of 1.28. In recent weeks this volatility has been generating front page headlines. At the other extreme, the highest yielding companies are the second most volatile cohort with an average beta of 1.17. So where is the sweet spot for income investors?

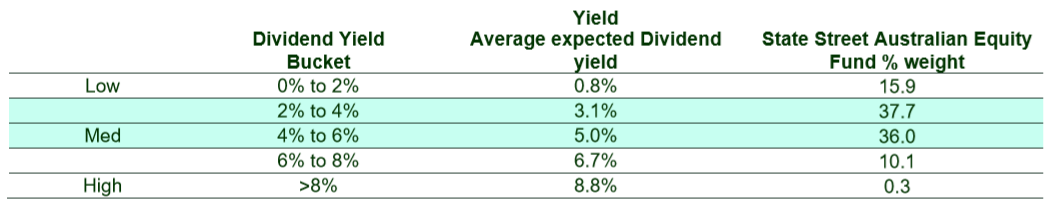

The Goldilocks of Dividend Income: “Not too high and not too low”

We look to invest in companies that are expected to have the highest returns for the lowest expected risk looking forward. These companies are expected to have a stable growth outlook, a higher quality business and reasonably valued. We tend to avoid holding the more risky extremes found in both the highest yielding and lowest yielding securities. Not too “hot” and not too “cold”.

Figure 4. State Street Australian Equity Fund exposure to dividend yield

Source: Refinitiv, SSGA, as at 31 August 2020. Weights are as of the date indicated and subject to change.

Learn more

Stay up to date with our latest thoughts by clicking follow below and you'll be notified every time we post content on Livewire.

2 topics

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.

Bruce is Head of Active Quantitative Equity - Australia, for State Street Global Advisors. He has over 20 years' experience, covering Australian and global equites, long and short equities as well as global macro strategies.