The "hope" phase for markets has ended. Here's where we are investing next

The 2023/24 financial year is now complete, concluding what can be broadly labelled as the “hope” phase for financial markets.

A 20% return for global equity markets was only just eclipsed by a 21% return from gold, thanks to some pretty hefty central bank buying. REITs returned a solid 17%, commodities rose a respectable 15%, and although it was a weaker finish to the financial year, the ASX200 returned an above-average 12%. The same return was generated by alternative investments. In contrast, Australian fixed interest returned 3.7% and global bonds a paltry 0.9%.

However, this might be where the good news for some assets ends. In this video, I detail how the combination of geopolitical uncertainty and local economic factors leaves me and our team much more circumspect about the prospects for risk for the remainder of 2024. Indeed, we think now is a good time to take some risk off the table given the geopolitical challenges which exist.

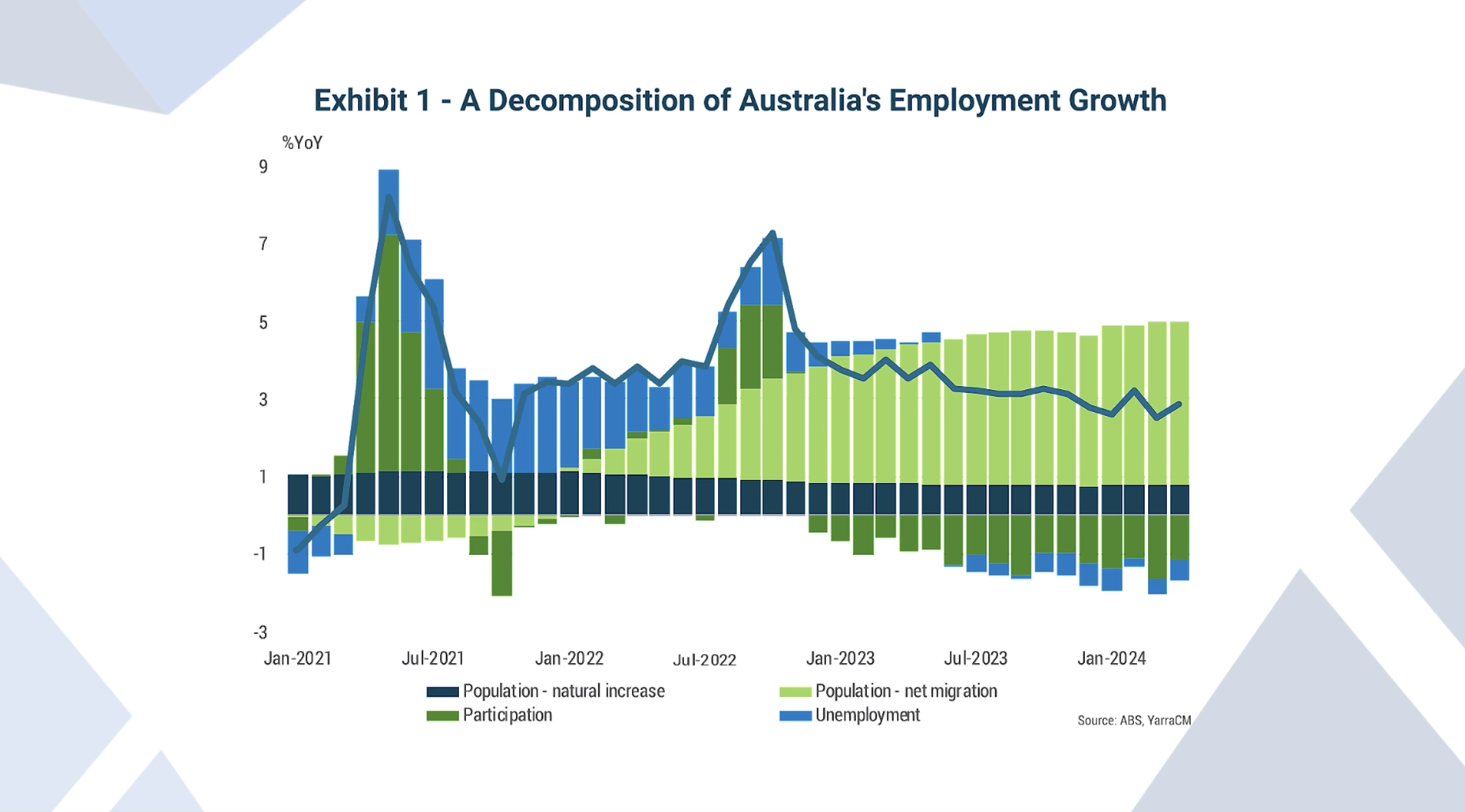

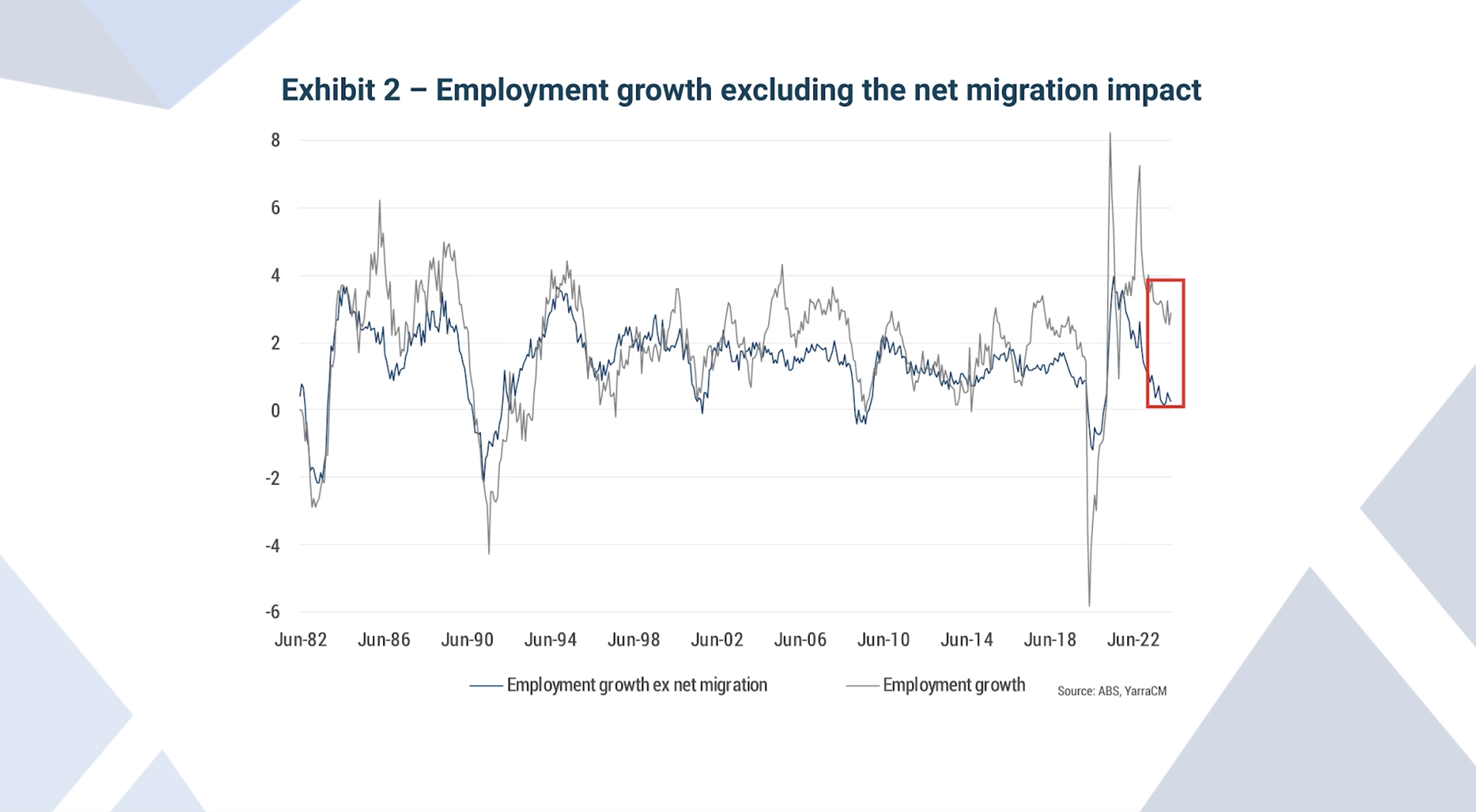

I'll also touch on the importance of a key macro theme - population growth. This could well take centre stage during the 2024/25 financial year, and I'll explain why it threatens to upend forecasts for economic recovery.

Timestamps

- 0:00 - Introduction and a comment about the geopolitical environment

- 2:41 - The era of upside economic growth surprises is now ending

- 3:32 - When the world's largest central banks will cut rates and what it means for portfolio construction

- 4:40 - Local economic developments and its impact on markets

- 5:13 - An update to our most important chart for Australia

- 6:19 - In-depth: Population Growth

- 8:58 - How increased population growth policies will impact the Australian economy

- 11:21 - How we've expressed the population growth conundrum in our economic and market forecasts

- 12:11 - Tim's Big Call: Inflation in Australia will be closer to 3% by December 2024

- 12:41 - When will the RBA cut in 2024 (if it can)?