The little-known resources stock with a long growth runway

Volatility in this space should come as no surprise to investors and is something we have become accustomed to. Resources companies see greater swings than most, leveraged to fluctuations in the underlying commodity. Calendar year to date, we have seen peak-to-trough declines in base metals such as Nickel (-37%), Iron Ore (-27%) and Copper (-16%). The combination of depressed prices, higher costs of capital, inflationary pressures, economic uncertainty and a slower than expected China recovery is creating headwinds for the sector.

Contrary to the short-term concerns currently underpinning investor sentiment, we see a longer-term opportunity in the Tin market with significant changes in production from the world’s largest players.

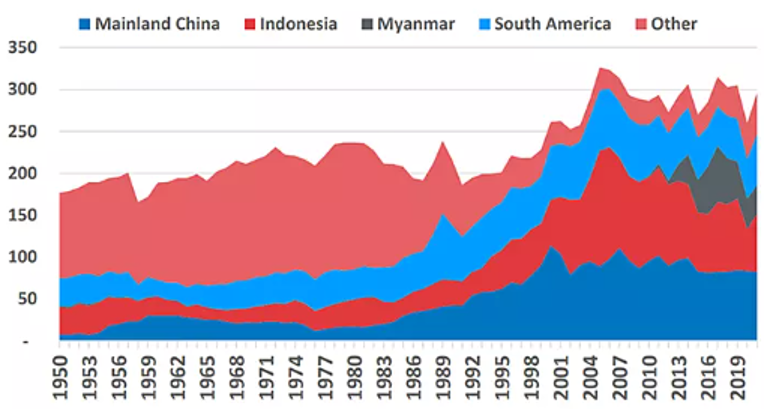

Chart 1: World Tin Mine Production

Source: International Tin Association Dec 2022

Together, Indonesia and Myanmar represent approximately 30% of global Tin production (refer Chart 1). Indonesia, the world’s largest exporter of Tin, absorbs 5% of production domestically, exporting the remainder. The nation plans to ban exports this year to produce end products domestically, capturing more of the value chain. Similarly, Myanmar’s WA State suspended its mining operations on the 1st of August 2023 citing environmental and safety concerns. Combined, we expect these changes to have a positive impact on the Tin price which is up only ~1% year to date despite the above only just starting to unfold.

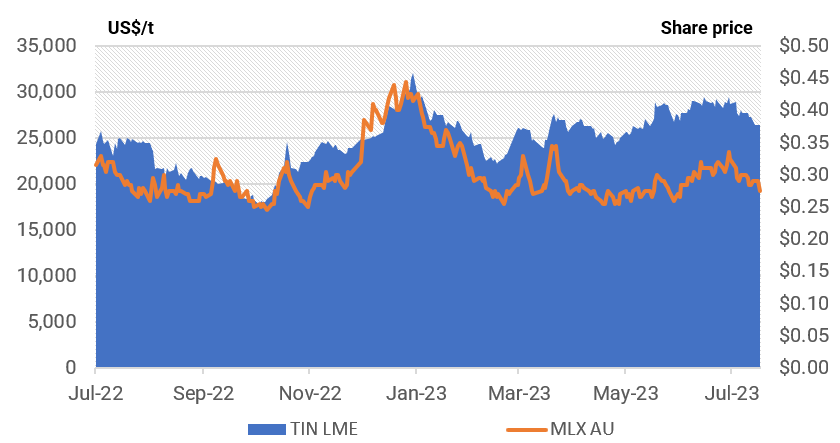

We consider Metals X (ASX: MLX) to be the best pure play Tin producer on the ASX. The correlation between MLX (blue line) and the underlying Tin price (white line) over the prior 12 months (refer Chart 2) highlights a clear dispersion, MLX a laggard in more recent months.

We attribute this change to the market’s pessimistic economic outlook, remaining focussed on the demand side of the equation.

Chart 2: Tin price vs. Metals X

Source: YCM, Bloomberg. Aug 2023

This looming Tin supply crunch and structural underinvestment over recent years is what we are excited about. Metals X has 50% ownership of the Renison Tin Mine located in Tasmania with the remaining 50% owned by Hong Kong listed Greentech in conjunction with project partner Yunnan Tin, the world's largest tin producer. With $124m of cash on the balance sheet, MLX has an enterprise value (EV) of ~$150m putting the business on a ~3x EV/EBITDA multiple over FY23 or annualising the most recent quarterly result, a more enticing ~2x EV/EBITDA multiple.

Given the strength of the balance sheet, improving operating metrics with higher grade ore from Renison High Grade Area 5 and Leatherwood stopes, a reduction in all-in sustaining costs and structural market shifts, we see an attractive risk/reward case for Metals X.

Discover microcap potential

Joel Fleming is the Portfolio Manager for the UBS Microcap Fund , a fund which has been managed by Yarra Capital Management since August 2014. The Fund aims to deliver superior returns and long-term capital growth by investing in undervalued, high quality micro-sized companies in their early stages of rapid growth.

1 stock mentioned