The Match Out: A late rally can’t save the ASX, lower again to end a soft week

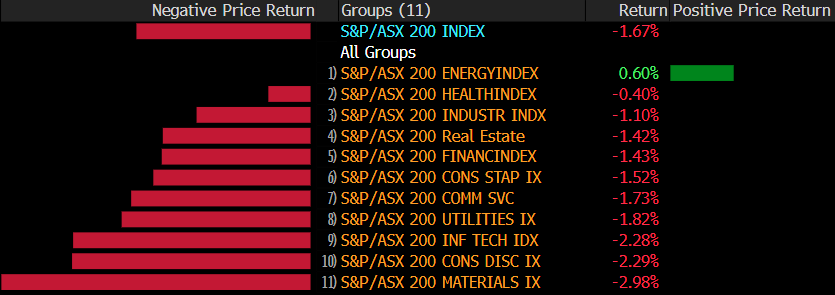

Materials were once again weighing on local equities today, resigning the index to a fourth consecutive decline. An honourable fightback late in the day did see the ASX200 finish 20pts above the day’s low, and winners and losers were almost split evenly from a sector and stock point of view. The ASX200 finished down -122pts/-1.67% for the week with Energy the only sector to finish higher.

- The ASX 200 finished down -14pts/ -0.20% at 7156

- Utilities (+1.05%0 was best on ground today followed by notable gains in Healthcare (+0.62%) and Industrials (+0.40%).

- Materials (-1.00%) was the main pain point, followed by Consumer Discretionary (-0.80%).

- Audinate (ASX: AD8) -9.66% came back online following a $50m capital raise at $13/sh, with the stock closing below that level at $12.91 today.

- Monadelphous (ASX: MND) +0.73% won a $160m contract to build the Talison Lithium Greenbushes chemical plant in WA.

- Telstra (ASX: TLS) -0.25% confirmed it is in discussions to buy cloud consulting company Versent, though talks are at an early stage.

- Platinum Asset Management (ASX: PTM) -4.38% fell to all-time lows after a FUM update was released late yesterday (5.49PM as if they wanted to hide it). They saw $912m of outflows in August, though $650m relates to one institutional redemption. FUM fell to $16.7b.

- GQG Partners (ASX: GQG) -1.04% saw net inflows for the month of $1.3b, taking the total to $7.3b this year. FUM still fell in August to $US107.4b

- Energy stocks were stronger into the close after talks between Chevron and their local LNG workforce broke down, paving the way for a strike that may impact supply.

- Iron Ore was off -2.2% in Asia today with Fortescue (ASX: FMG) feeling the impact the most, down -2.37%.

- Gold continues to tick higher, up +0.3% in Asian trade to $US1,926/oz.

- Japan’s Nikkei was soft today, down -1.6%. The Hong Kong markets were closed with record rainfall keeping workers home.

- US Futures are all higher by around 0.2% each.

ASX 200 - Intraday chart

.png)

ASX 200 - Daily Chart

.png)

Sectors this week

.png)

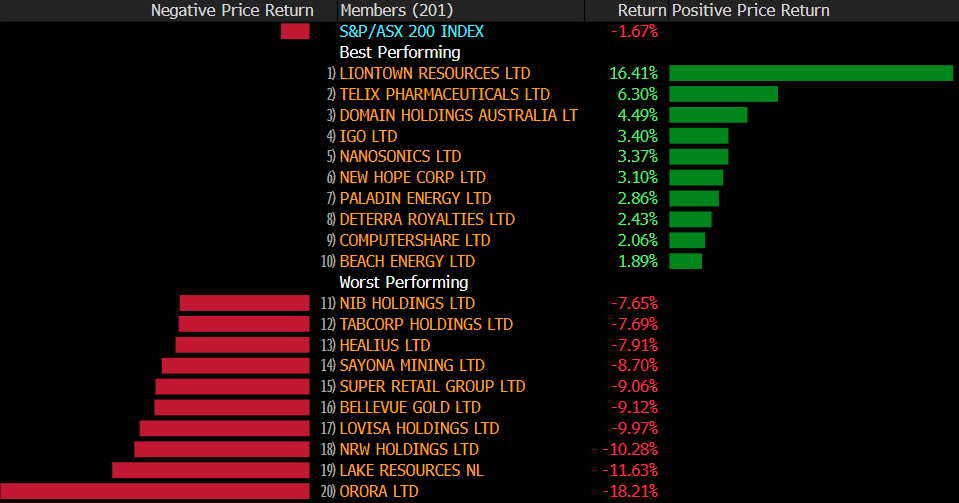

Stocks this week

.png)

Broker moves

- IGO's Nickel Revenue to Rise With Cosmos Mine Despite Delays

- Origin's Power, Gas Earnings May Improve on Margin, Volume Gain

- Fortescue's Green Lean, Ore Prices Could Increase Business Risk

- Origin's LNG Export Profits Might Weaken as Gas Prices Retreat

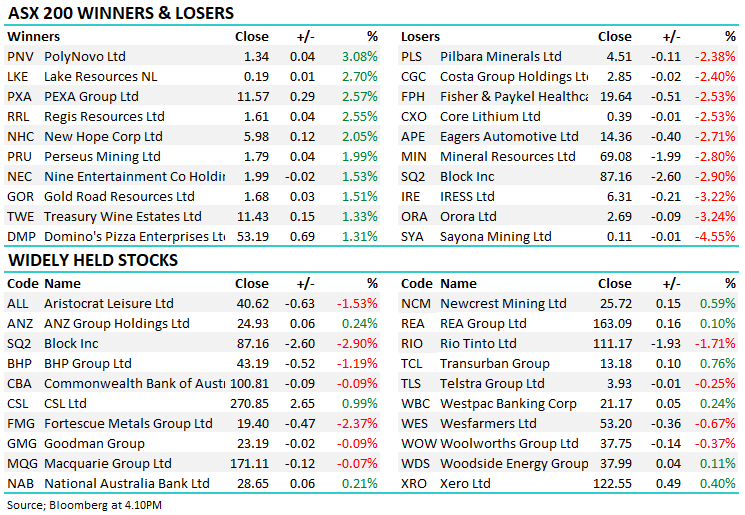

Major movers today

.png)

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

6 stocks mentioned