The Match Out: ASX bounces back, Commodities underpin advance, AMP tops the 200

The ASX bounced back today with the heavyweight Materials & Financials leading the line after a tough start to the week, IT the only sector to finish lower.

Buying was fairly broad-based, ~75% of the ASX200 finishing higher and as we touched on this morning, some recovery started to play out amongst the beaten up bulk miners even though the underlying commodity prices remained on the nose.

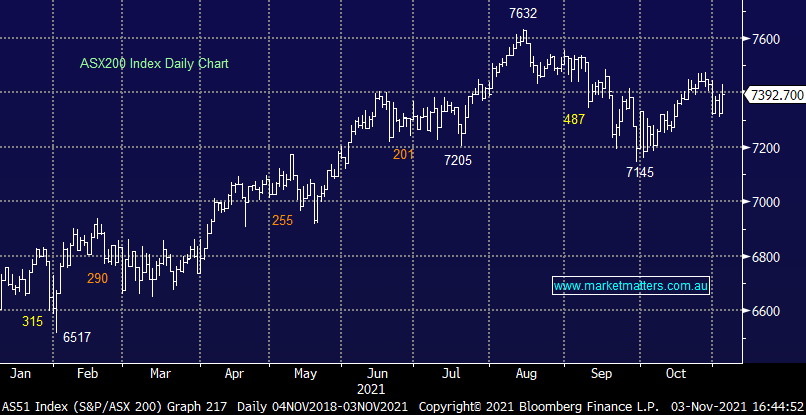

- The ASX 200 added +68pts /+0.93% to 7392 today

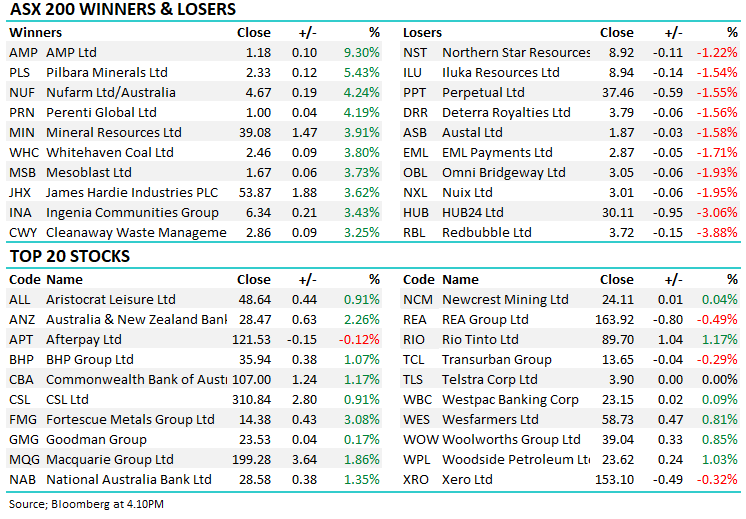

- Materials bounced today led by the bulks, Fortescue (FMG) +3% & Whitehaven Coal (WHC) +3.8%

- The Lithium stocks were also very strong, Orocobre (ORE) +7% & Pilbarra (PLS) +5%

- PCB supplier Altium (ALU) +2.76% saw an upgrade this morning from Bells, they upgraded to BUY with $42.50 PT

- Praemium (PPS) +8.77% rallied as brokers supported the boards view that it’s worth more than Netwealth’s (NWL) initial shot across the bow. Our own Danny Younis saying: Under-nourished foundational initial bid from NWL given offer of 29% premium over last day close pales in comparison to the premia offered on the last two deals in this space: IRE/OVH +67% and HUB/CL1 +72% and, additionally, PPS has been undervalued relative to NWL/HUB over the long term. Danny upgraded PT to $1.80 – we are holding for now.

- The loser here could be HUB24 (HUB) -3.06% which we also own – a bigger, more diverse competitor with greater scale at a time when HUB was making ground up on their larger rival. As we said this morning, we are pondering our position in HUB.

- AMP +9.3% ripped today on the sale of their stake in Resolution Life – we continue to think that the sum of the parts in AMP is more than the SP is reflecting, although we don’t own it

- Tyro Payments (TYR) -15% held it’s AGM this afternoon, the stock tanked on the update, more about that tomorrow.

- The Market Matters weekly video update was due out today, which didn’t happen. Keep an eye out tomorrow, the video will be with our mining Analyst and will focus on Iron Ore & Coal markets. I was on Ausbiz this morning talking about commodities, portfolio positioning post RBA and why we’re still holding Praemium (PPS) – Click Here

- Gold was lower in Asia today, down US$6 to ~$US1781

- Iron Ore Futures were down a touch

- Asian markets were mixed, Japan up +0.06%, Hong Kong off -0.74% while China fell -0..20

- US Futures all marginally lower

ASX 200

AMP $1.75

AMP +9.30%: the embattled financial services company rallied today after selling its interest in Resolution Life Australia. AMP held a ~19% stake in the business after selling AMP Life to Resolution last year. Now 18 months on, they’ve sold the final cut to the same buyer for a handy sum of $524m. After a few one-offs, adjustments and taxes it will help boost AMP’s capital position by $459m, giving them a bit more dry powder to grow (turn around) the business and more flexibility as they look to divest the AMP Capital’s Private Markets business.

AMP (AMP)

Broker Moves

- Transurban Rated New Sector Perform at RBC; PT A$15

- Altium Raised to Buy at Bell Potter; PT A$42.50

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

8 stocks mentioned