The Match Out: ASX dives into the weekend, commodity markets weigh on performance, expectations of a 50bps hike increase

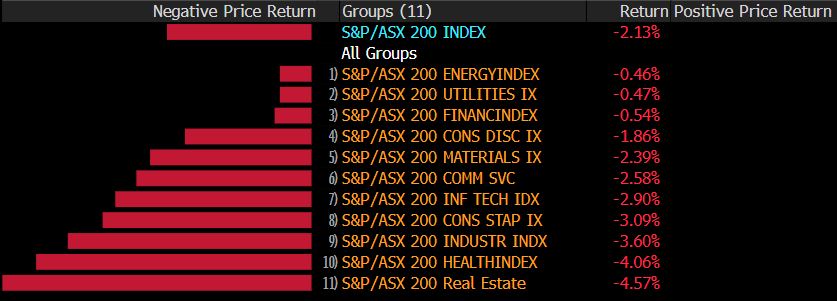

The ASX softened into the weekend with two min drivers weighing on the index. Bond yields were in focus again today with Aussie 2 & 3-year yields rising over 2% to put pressure on risk assets. Weakness across commodities also weighed on the local bourse as the energy and materials sectors felt the most pain. It was surprising to see the tech and consumer discretionary sectors outperform despite the volatility again today. The selloff into the weekend took the week’s losses to -147pts/-2.13%.

- The ASX 200 finished down -95pts/ -1.4% at 6747

- The utilities sector was the best performer, though still falling -0.43%. Tech (-0.6%) & healthcare (-0.61%) were also in the red but fared better than most.

- Energy (-2.96%), Industrials (-2.45%) & Materials (-2.31%) were the three sectors to fall by more than 2%.

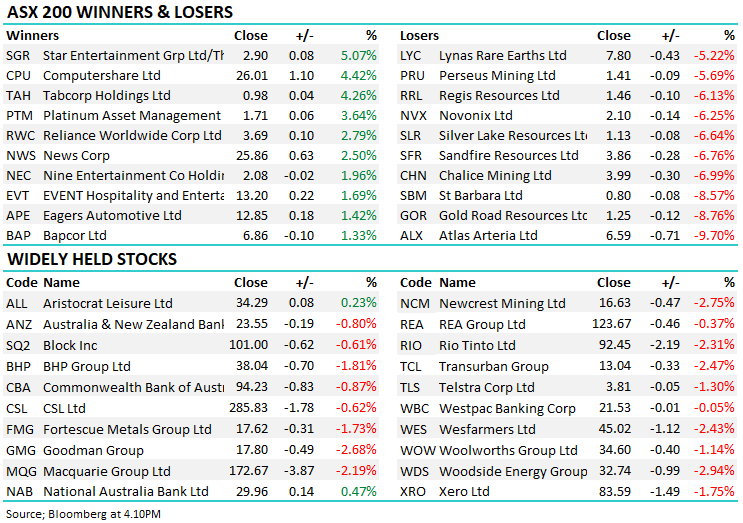

- Atlas Arteria (ASX: ALX) -9.7%, toll road operator was back trading today after a monster $3.1b raise. The money will go towards their purchase of a controlling stake in the Chicago Skyway, the 67% stake costing $US2b.

- Polynovo (ASX: PNV) flat, spent the afternoon in a trading halt as they prepare to announce FDA approval for a new product. We expect shares back online by Tuesday.

- ANZ (ASX: ANZ) & NAB (ASX: NAB) both upgraded expectations for the RBA to hike rates by 50bps at the next meeting which sent bond yields higher.

- Oil was flat in Asian trade, however, it looks set to post a 3rd consecutive week of falls on softness last night. Traders are becoming concerned around a drop off in demand on fears the Fed’s hiking brigade will dampen economic growth.

- Iron Ore was ~1.4% lower in Asia today

- Gold was weak today, down $US2 to US$1662. The level represents a new two-year low for the precious metal, and gold stocks were more than happy to trade lower as a result

- Asian stocks were weaker today, Japan’s Nikkei down more than 1%, Hong Kong down -0.7%

- US Futures are all in the red ahead of tonight’s ‘triple witching’ options expiry. S&P500 -0.75% and the Nasdaq futures -0.98%

ASX 200 Chart

Sectors this week

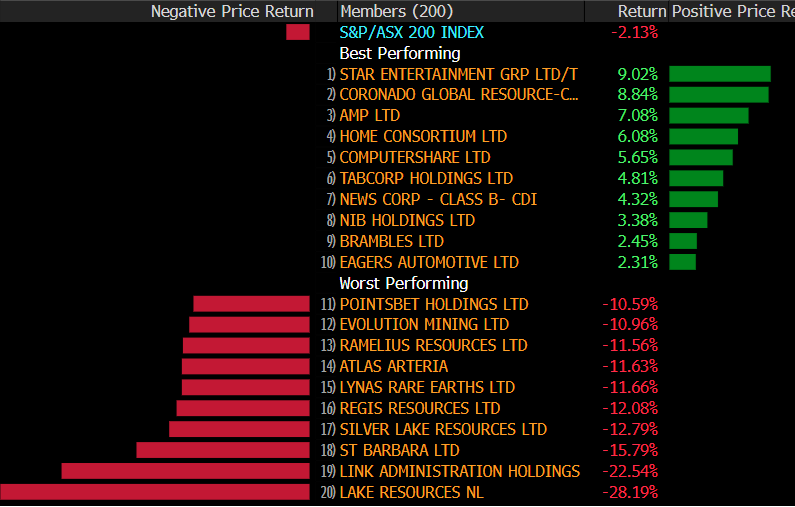

Stocks this week

Broker Moves

- Atlas Arteria Cut to Underperform at Credit Suisse; PT A$6.30

- Pact Group Rated New Buy at Barclay Pearce Capital; PT A$2.56

- MA Financial Rated New Hold at Barclay Pearce Capital; PT A$4.86

- Austal Rated New Underperform at Barclay Pearce Capital

- Charter Hall Group Reinstated Buy at Goldman; PT A$16.50

- Myer Raised to Accumulate at CLSA; PT 70 Australian cents

- MLM AU Rated New Speculative Buy at Morgans Financial Limited

- NAB Raised to Buy at Citi; PT A$32.75

- Bendigo & Adelaide Raised to Buy at Citi; PT A$9.75

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

4 stocks mentioned