The Match Out: ASX down as unemployment ticks up, Goodman (GMG) defies property gloom

The ASX fell again today, although some obvious ‘dip buying’ came to pass as reporting season continued to build, while a higher unemployment rate provided further evidence to support a continued RBA pause.

- The ASX 200 finished down -49pts/ -0.68% at 7146

- The Property sector was best on ground (+1.11%) while Energy (+0.39%) & Utilities (+0.03%) were also up on a down day.

- Industrials (-1.30%) and Healthcare (-1.21%) the weakest links.

- The unemployment rate ticked up to 3.7% this morning, above 3.6% expected – increasing signs rates have peaked.

- Super Retail (ASX: SUL) +2.85% rallied after they reported better-than-expected full-year earnings and strength in its auto business.

- Orora (ASX: ORI) +3.36% on a 'reassuring' earnings report, with earnings growth likely to return in FY24.

- NRW Holdings (ASX: NWH) -1.82% fell sharply early (-12%) before recovering late after flagging an accounting error in their books

- Telstra (ASX: TLS) -2.82% fell on an inline FY23 result + guidance for FY24, some slight weakness in its enterprise business and cost challenges the issue, while they won’t be selling InfraCo any time soon.

- Inghams (ASX: ING) +14.74% flew on better profit but more importantly, a better balance sheet.

- Domain Holdings (ASX: DHG) -7.84% missed FY23 expectations + had run hard into the result.

- Goodman Group (ASX: GMG) +5.72% looked a slight miss on FY24 guidance (earnings growth +9% v +11% consensus), however, the market looked through that, and assumes they’ll upgrade throughout the year (as is the norm) + focus on data centres helped.

- Evolution Mining (ASX: EVN) -4.82% came in ~5% below consensus for FY23 in higher costs and lower copper credits.

- ANZ Bank (ASX: ANZ) -0.93% slipped lower, was largely as expected and in line with NAB’s earlier in the week (although no buy-back)

- Iron Ore rallied 3% up in Asia today, the miners bounced from early weakness.

- Gold fell sub $US1900/oz overnight before edging up $US4 today, settled $US1896 at our close.

- Asian stocks were okay Hong Kong up +0.15%, Japan lost -0.20% while China was up +0.40%

- US Futures are all up, around +0.20%

ASX 200 Intraday

ASX 200 Daily

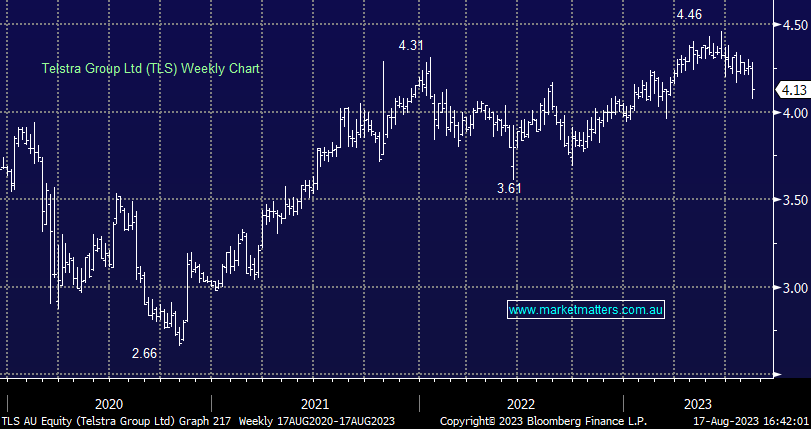

Telstra (TLS) $4.13

TLS -2.82%: FY23 results out today for the 10th largest company on the ASX, booking revenue of $23.24bn inline with consensus, EBITDA of $7.86 billion (inline) and the all-important dividend as expected at 17c/share (FY). They guided FY24 revenue of $22.8-24.8 billion (mkt was $23.9bn) & underlying EBITDA of $8.2-8.4 billion (market was $8.36 billion) – all pretty much inline with existing expectations, so why the drop in the shares?

- They poured some cold water over the near-term spinout of infrastructure &

- Some cost pressure was obvious in the result.

- A solid result, the only real surprise was commentary around infrastructure assets being retained near term, which is understandable given the pricing environment has deteriorated.

- Consensus dividend for FY24 is 18c, rising to 19c in FY25.

Super Retail Group (SUL) $13.72

SUL +2.85%: A strong FY23 result for the diverse retailer today with brands such as Super Cheap, Rebel & BCF, however importantly, they also talked more positively than others about the start of FY24; it has slowed but remained resilient. FY23 sales of $3.8 billion were up 7.1% on the year and inline with consensus, while Net Profit After Tax (NPAT) of $273.5 million was up +12% and ahead of the $261 million expected. They announced a dividend per share (dps) of $1.03 which included a 25c/share special dividend.

A great result for SUL, showing that quality retailers can buck the negative consumer headwinds.

Goodman Group (GMG) $20.88

GMG +5.72%: First take of the numbers this morning looked a slight miss on FY24 guidance (earnings growth +9% v +11% consensus), however, the market looked through that, and assumes they’ll upgrade throughout the year (as is the norm), and importantly, be one of the very few property companies that are showing growth in a tough market.

For FY23, they produced operating earnings of $1.78 billion (+17%) inline with consensus, with guidance for +9% growth in FY24 implying they’ll hit $1.96 billion this year. The dividend of 30c/share was as expected, however, the main driver of the shares today came from the evolution of the business, Greg Goodman articulating their relatively new push into data centres as AI drives demand, GMG saying ~30% of their ~$13 billion development book is now exposed to that theme – which is huge.

We recently sold Goodman (GMG) around current levels, however, today’s result has us questioning why!

ANZ Bank (ANZ) $24.59

ANZ -0.93%: 3Q update today was largely as expected and in line with NAB’s earlier in the week, though ANZ didn’t hand investors a large buyback as they wait for the Competition Tribunal to have a look at their planned takeover of Suncorp’s bank.

The Capital Ratio is at 13.51%, though 13.31% when adjusted for the potential acquisition while credit provisions came in below the prior quarter at $77 million likely supporting earnings. Loan growth in Australia was solid, up 2% on the prior quarter, growing above system. They did note a continuation of the uptick in 90-day past due loans as was seen in 2Q, though this was expected.

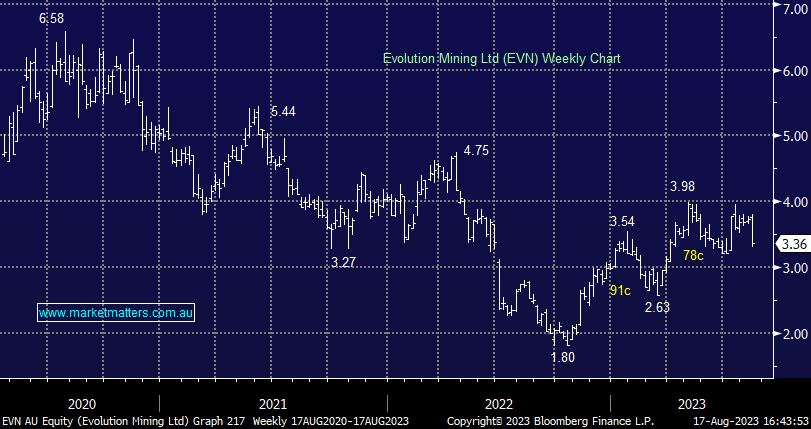

Evolution Mining (EVN) $3.36

EVN -4.82%: FY23 report out for the gold miner today, its shares underperformed peers which were also weaker as gold traded below $US1,900/oz for the first time since March. EBITDA of $844 million was ~5% below expectations with costs and lower copper credits biting.

They left guidance largely unchanged, expecting cost per ounce to fall on higher production and the benefit of their copper production offsetting higher labour costs which are expected to climb ~6% in FY24. We still see EVN as a great way to get exposure to gold with the added copper kicker also supported by our medium-term view on the commodity.

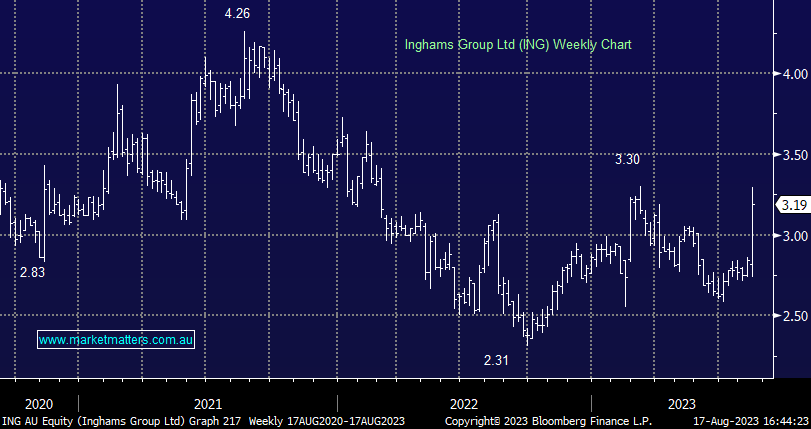

Inghams (ING) $3.19

ING +14.75%: the poultry business hit ~5-month highs today after better expectations for FY23 and significantly de-gearing the balance sheet. Revenue of $3 billion was up 12% and in line with consensus, EBITDA up 14% to $434 million was a small beat while NPAT of $71 million was ~14% ahead of expectations.

The strong second half was largely driven by better prices with Aus volumes slightly lower and NZ volumes a touch higher. Debt to EBTIDA at 1.4x was the big surprise with the market expecting a number closer to 2x today, likely to benefit cashflow given a lower interest expense as a result. The company didn’t provide any commentary for FY24 which is not unusual for Inghams.

Broker Moves

- Seek Cut to Neutral at UBS; PT A$26.50

- Endeavour Group Cut to Neutral at Evans & Partners Pty Ltd

- Vicinity Centres Raised to Reduce at CLSA; PT A$1.94

- Mirvac Group Raised to Outperform at Macquarie; PT A$2.66

- Mirvac Group Cut to Underweight at JPMorgan; PT A$2.30

- Transurban Raised to Neutral at Evans & Partners Pty Ltd

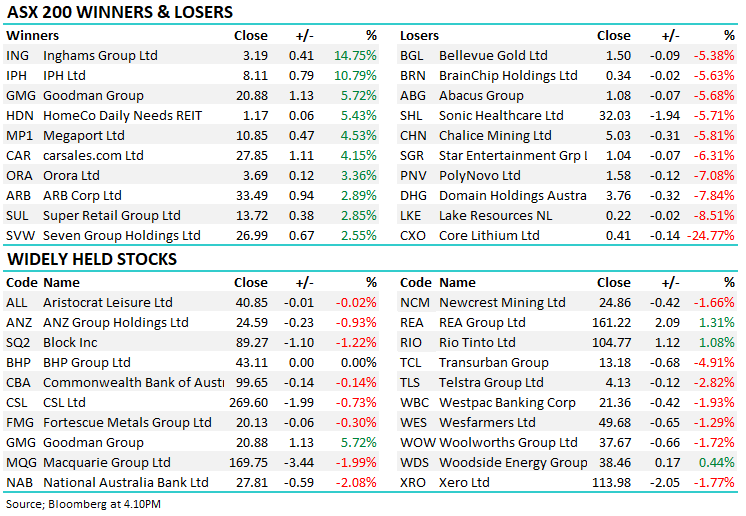

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

9 stocks mentioned