The Match Out: ASX drifts as Blackmores (BKL) says Cheers! Newcrest (NCM) production underwhelms

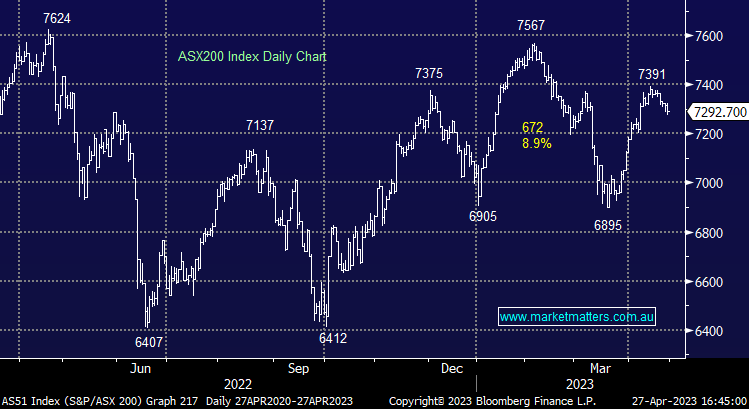

The ASX fell again today, now down five consecutive sessions with Banks & Healthcare stocks contributing most of the pain at the index level. Concern stemming from the US financial system is headlining the media, however, in MM’s view, it has simply been a case of a tired market approaching a seasonally weak period and it made sense to take some cream off the top after a solid run for stocks – that has been our approach and it seems we’re not alone.

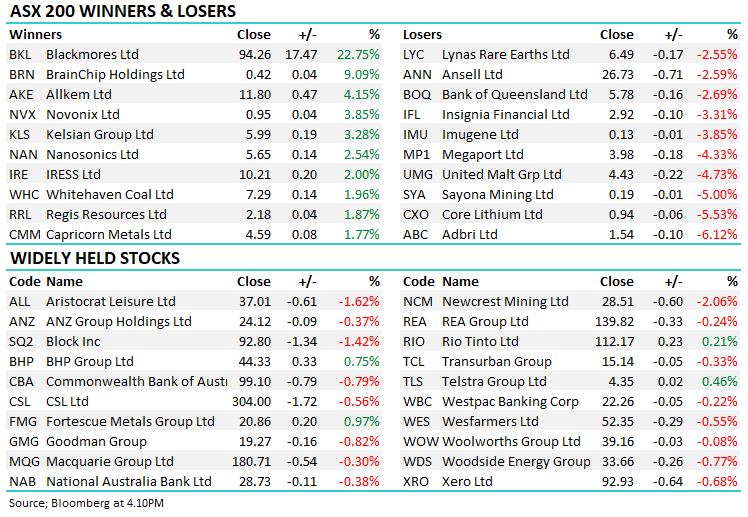

- The ASX 200 finished down -23pts/ -0.32% at 7292

- The Utilities sector was best on ground (+0.24%) while Communications (+0.20%) & Materials (+0.17%) finished higher

- Consumer Discretionary (-0.84%) and Industrials (-0.69%) the weakest links.

- The Future Fund is now heading back to ‘skilled active managers’ for equities saying that the complex environment now lends itself to this approach over and above passive index funds “There’s a richer universe for active management,” the Future Fund’s chief executive said – seems they are singing from the Market Matters hymn sheet!

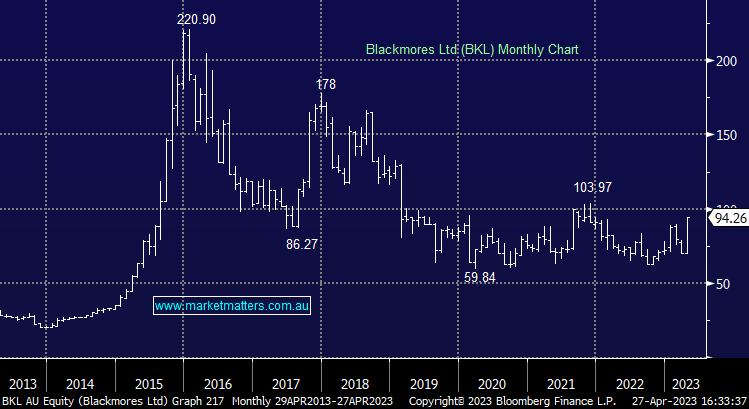

- Blackmores (ASX: BKL) +22.75% received a get-out-of-jail-free card today with a takeover tilt from Japan’s Kirin at a big premium to last.

- Helloworld (ASX: HLO) +9.67% a stock we discussed this morning (here) upgraded guidance and rallied.

- Newcrest Mining (ASX: NCM) -2.06% fell on weaker quarterly production, although they maintained FY guidance

- United Malt (ASX: UMG) -4.73% downgraded 1H expectations after a slower-than-expected ramp-up of their new facility. Strong malt prices have partially offset, and the company maintained FY guidance though this excludes SaaS costs with look to have blown out.

- AdBri (ASX: ABC) -6.12% now expect costs twice as high as initially disclosed for the upgrade to their Kwinana facility on higher construction costs and labour. They are still targeting completion of the upgrade to their cement works project by 2Q24 and fully operational by the following quarter.

- Iron Ore bounced 1%higher in Asia today supporting Fortescue (FMG) +0.97%.

- Gold was up US$12 to ~US$2001 at our close.

- Asian stocks were higher Hong Kong up +0.33, Japan +0.11% while China was up +0.48%

- US Futures are all up

ASX 200

Blackmores (BKL) $94.26

BKL +22.75%: The vitamins company rallied today after Kirin struck a deal worth $95 per share ($1.88bn) to acquire them as the Japanese brewer pushes into health products. The bid is 23.7% premium to Wednesday’s close, is all cash, and the board unanimously recommends it. The deal is expected to close in the third quarter and, unlike many recent bids, has a very high chance of completing.

Newcrest Mining (NCM) $28.51

NCM -2.06%: Bucked the strength in the broader Gold space today following a weaker quarter of production, reporting flat production in the first three months of the year compared to the previous quarter, while copper output fell about 10%. They did maintain FY guidance which was a plus, however, it’s a weaker-than-expected start to the year for NCM, which is under takeover from Denver-based gold giant Newmont (NEM US). Due diligence was about half way through and was expected to finish by May 11 with NCM providing no further update around the deal.

Helloworld Travel (HLO) $2.95

HLO +9.67%: shares in the travel booking company rallied to 18-month highs today on the back of a strong 3Q and an upgrade to guidance. Underlying EBITDA guidance was lifted ~30% to $38-42m for the full year with strong demand for both domestic and international travel supporting earnings. Total Transaction value (TTV) came in 150% above 3Q22, while margins have continued to improve, up to 30.4% in the quarter vs the first half of 21.4%.

Broker Moves

- Insignia Financial Cut to Neutral at Citi; PT A$3.15

- a2 Milk Raised to Neutral at Jarden Securities; PT NZ$6.10

- Bluescope Cut to Reduce at CLSA; PT A$20.50

- Steadfast Cut to Neutral at Macquarie; PT A$6.30

- Camplify Raised to Buy at Ord Minnett; PT A$2.60

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned