The Match Out: ASX drifts, Gentrack (GTK) reports a corker!

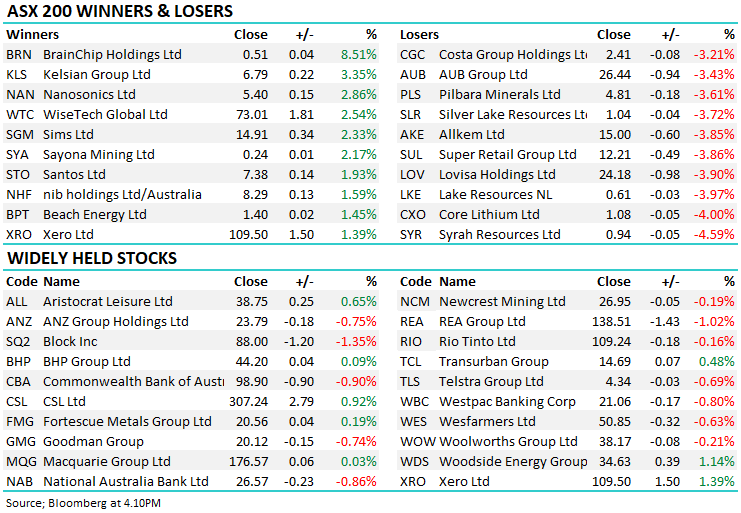

A softer start to the week with banks weighing on the broader index while strength in the IT sector overseas continued to support our local tech stocks, Xero (XRO) a standout again while WiseTech (WTC) continued its march higher.

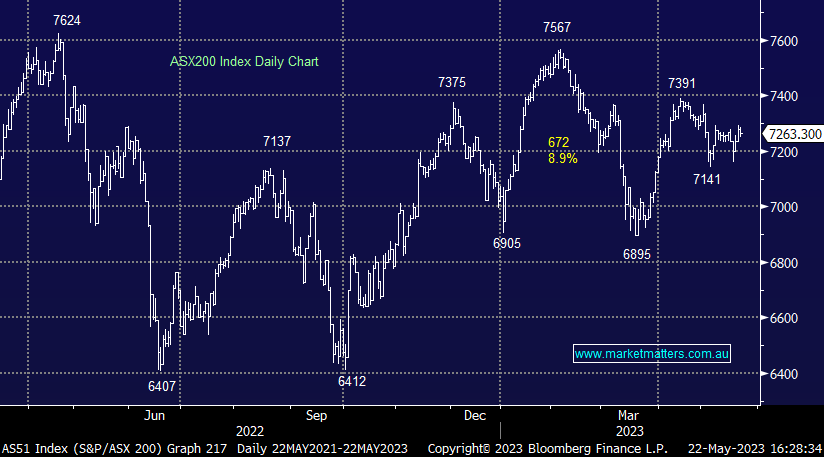

- The ASX 200 finished down -16pts/ -0.22% at 7263

- The IT sector was best on ground (+1.54%) while Energy (+1.00%) & Healthcare (+0.54%) were also strong.

- Property (-0.74%) and Communications (-0.62%) the weakest links.

- Tyro (ASX: TYR) -16.61% fell as Potentia withdraws from change of control talks after a 8 long months of discussions – seems a bit strange.

- New Hope (ASX: NHC) +0.76% produced saleable coal of 2.03M Tons Vs. 1.54M Q/Q .

- St Barbara (ASX: SBM) +3.42% was up Silver Lake (SLR) improved its bid to $722 million on Friday night which is a 16.9% premium to Genesis Minerals’ $631 million cash and scrip bid.

- Gentrack (ASX: GTK) +29% rallied hard on a great 1H23 result plus upgraded guidance – we cover below.

- BNPL stocks fell on Govt regulation.

- Iron Ore was ~2.5% lower in Asia today – down for a 2nd straight session – Coal prices were up.

- Gold was up overnight to ~US$1877 and flat in Asian trade today

- Asian stocks were up Hong Kong added 1.64%, Japan +0.42% while China was up +0.43%

- US Futures are down, not by much

ASX 200 Chart - Intra-Day

ASX 200 Chart - Daily

New Hope Corp (ASX: NHC) $5.15

NHC +0.78%: A decent quarterly out today for NHC with EBITDA of $448.1m for the April qtr, up 14.8% QoQ and +20.6% YoY. Production is solid, pricing has been weaker in recent months and needs to turn for NHC to run on the upside, but they’re producing a lot of coal and a lot of cash, and we remain comfortable collecting the associated dividends in the Income Portfolio.

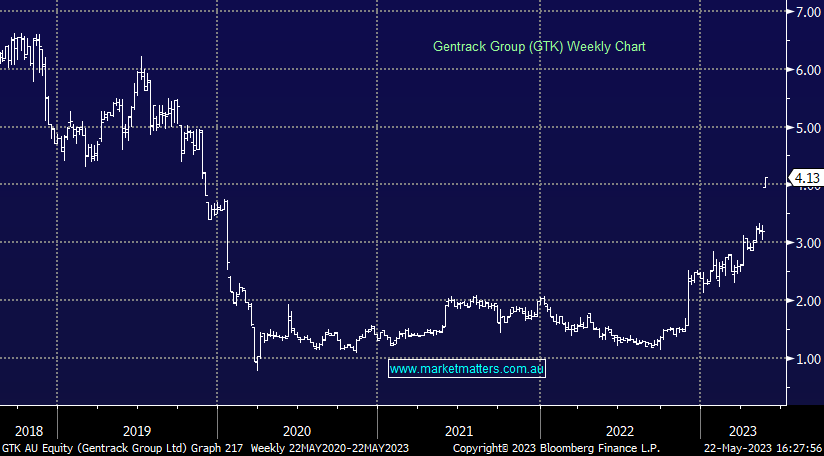

Gentrack (ASX: GTK) $4.13

GTK +29.47%: The one that got away! GTK, the New Zealand-based billing business that powers utilities (water, Gas, Electricity) etc rallied hard on a very strong 1H23 result. Revenue at $84.3m (+48% YoY) was well ahead of forecasts ($73.3m), driven by the Utilities division. Margins were good and expected to be stable while FY24 targets have also been upgraded - GTK now expect revenue of $160m vs ($150m prior). FY24 EBITDA margins are still targeted between 12-17%.

Broker Moves

- Challenger Rated New Neutral at Goldman; PT A$6.45

- Medibank Private Rated New Neutral at Goldman; PT A$3.69

- Nib Rated New Buy at Goldman; PT A$8.80

- Austal Raised to Buy at Citi; PT A$2.31

- Metcash Cut to Neutral at Macquarie; PT A$3.90

- F&P Healthcare Cut to Underweight at JPMorgan; PT NZ$23.20

Major Movers Today

Have a great night

The Market Matters Team

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

4 stocks mentioned