The Match Out: ASX edges higher, Financials lead the line, Someone get Albo a MM subscription!

The market opened higher this morning however petered out into the afternoon as the resource stocks gave back early gains, particularly in Iron Ore & Lithium. The IT names again dominated the naughty corner as Australian 10-year bond yields topped 3% for the first time since July 2015, however the move was far from aggressive. As discussed in Macro Monday this morning, we think the respective elastic bands are being tested at their extremes, some reversion is now our preferred scenario.

- The ASX 200 finished up +7pts/ +0.10% at 7485.

- The Financial sector was best on ground (+0.78%) while Consumer Staples (+0.62%) & Communications(+0.41%) were also positive.

- IT (-0.85%) and Consumer Discretionary stocks (-0.73%) the weakest links.

- Chinese inflation was a touch hotter than expected in March printing +1.5% YoY v 1.4% expected.

- That, along with growth concerns stemming from lockdowns saw China stocks off ~3% today.

- Australia’s 10-year bond yield topped 3% for the first time since July 2015.

- Albo, if you’re reading this, the cash rate is 0.10% and unemployment sits at 4% - you need to subscribe to Market Matters – Click here for a free trial

- Telco stocks caught my eye today for the right reasons, both TPG Telecom (TPG) & Telstra (TLS) looking solid – two stocks we are bullish on that we discussed last week.

- Independence Group (IGO) +2.34% upped its bid for Western Areas (WSA) +5.84% today responding to an independent expert's report.

- Graincorp (GNC) +6.75% rallied after raising guidance on Friday, demand for Australian product is rising, brokers ticking their numbers higher.

- Lake Resources (LKE) +6.99% signed a non-binding deal with Ford. We had some Lithium experts in last week and I’ll have some insight from this in coming notes.

- Uranium prices have rallied now trading ~US$60/lb, Paladin (PDN) -3.87% today however it did rally approximately 13% on Friday – sitting 87c.

- Whitehaven Coal (WHC) unchanged today, however it did push up to a $4.63 high. Picking tops is always hard (we sold nearer $4) however with the buy-back paused due to blackout, we think WHC may well have peaked for the short term.

- G8 Education (GEM) -3.56% to hold a Q122 trading update tomorrow.

- Iron Ore was ~3.5%% lower in Asia today.

- Gold was down ~US$5 to ~US$1943 – we made some positive comments around Gold this morning.

- Asian stocks were all down, Hong Kong off -2.87%, Japan -0.81% while China was down -2.51% at our close.

- US Futures are all down a touch, nothing too sinister.

ASX200

Western Areas (WSA) $3.80

WSA +5.48%: nearly 4 months on from the initial agreed takeover price, Western Areas has managed to secure a new deal with Independence Group (IGO) 15% higher. The nickel price has rallied around 70% since the deal was struck, and an independent expert report deemed that the market fundamentals had changed forcing Independence Group’s hand to submit a new bid at $3.87/share in cash, more in line with the expert report. WSA’s largest shareholder, Andrew Forrest’s Wyloo, has agreed to vote in favour of the revised terms, and so will the company’s board when the vote comes with the deal expected to be wrapped up in June.

Broker Moves

- Neometals Rated New Buy at Cenkos Securities

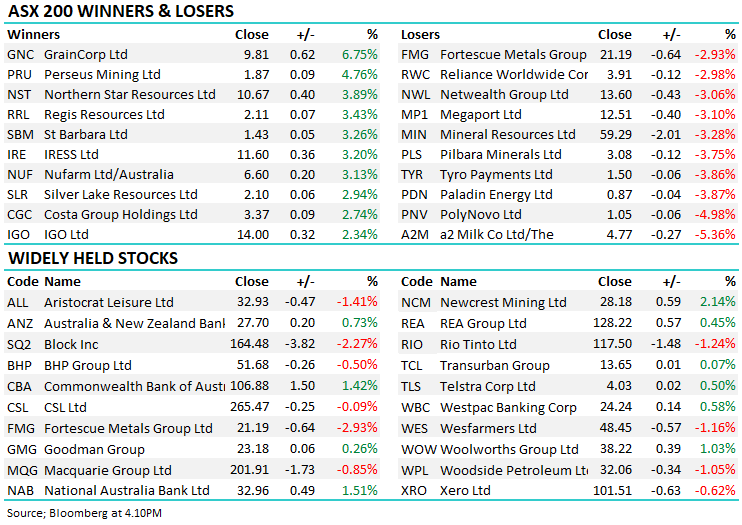

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

10 stocks mentioned