The Match Out: ASX edges higher on earnings upgrades while BHP production was hit and miss

It was a solid session for the ASX, finishing higher for a fifth straight session and again knocking on the door of new all-time highs. Most love was directed to the Industrial and property sectors while IT stocks led the losses heavily influenced by weakness in BNPL & a 20% decline in Megaport (ASX: MP1).

- The ASX 200 finished up +23pts/ +0.31% at 7592

- The Industrial sector was best on the ground (+2.23%) while REITs (+2.10%) & Utilities (+1.62%) were also strong.

- IT (-2.62%) and Materials (-1.60%) the weakest links.

- BHP -3.06% released Q3 production that had a few swings and roundabouts, FY guidance in Iron Ore and Coal maintained, Nickel and Copper reduced.

- Megaport (MP1) -21.55% tanked on lower than expected reoccurring revenue.

- Challenger Financial (ASX: CGF) +9.81% upgraded earnings guidance.

- So too did Brambles (BXB) +7.98%, now expecting a 11-12% increase in underlying profit.

- Zip Co (ZIP) -4.56% is still grappling with band debts.

- Stockland (SGP) +2.44% said that Q3 was solid and reconfirmed FY guidance – we think this is worth north of $5.

- Iron Ore was flat in Asia today.

- Gold was down US$5 to around US$1952.

- Asian stocks were mixed Hong Kong down -1.74%, Japan +1.25% while China was off -2.56%.

- US Futures are all up, around +0.30%.

ASX 200

BHP (ASX:BHP) $50.70

BHP -3.06%: Q3 update from BHP today confirming that iron ore continues to perform strongly and that they are on track to achieve full-year volume and cost guidance. Meanwhile, their metallurgical coal business delivered strong underlying performance due to strong pricing and decent volumes. Copper production is a tad soft, nickel and petroleum are also lower. They maintained full-year production guidance for iron ore & coal and lowered FY Copper & Nickel guidance. Costs are a slight headwind but they are being managed as best they can – we just struggle to identify what the next catalyst will be for BHP.

BHP

Megaport (ASX:MP1) $10.01

MP1 -21.55%: a very disappointing third-quarter update from the network connections business today which is struggling for growth. Monthly Recurring Revenue (MRR) was up just 3% on the previous quarter to $9.5m. This was hampered though by FX headwinds, but the annualised rate of $114m still leaves them on a very expensive ~15x sales multiple. Shares closed on the day’s low, sending them back to a 2 year low.

MEGAPORT

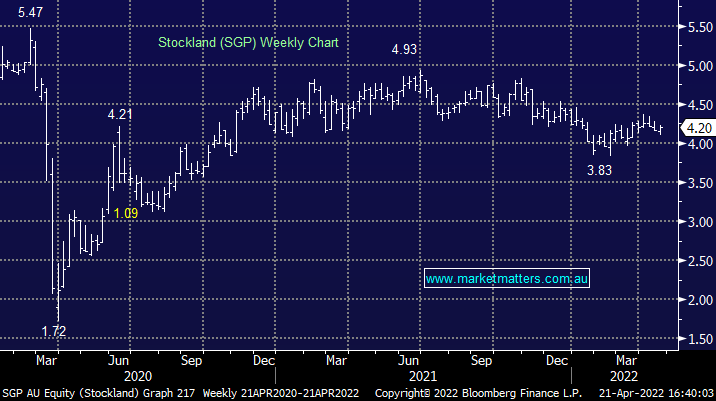

Stockland (ASX: SGP) $4.20

SGP +2.44%: Released a Q3 trading update this morning. Operations are in line with expectations and they reconfirmed full-year guidance for both funds from operations (FFO) of 35.1-35.6c and distribution per share (DPS) of 75-85% of FFO. If we price SGP on a capitalisation rate of 5.5% and a P/E multiple of 11.5x, it should be worth ~$5.10.

Stockland

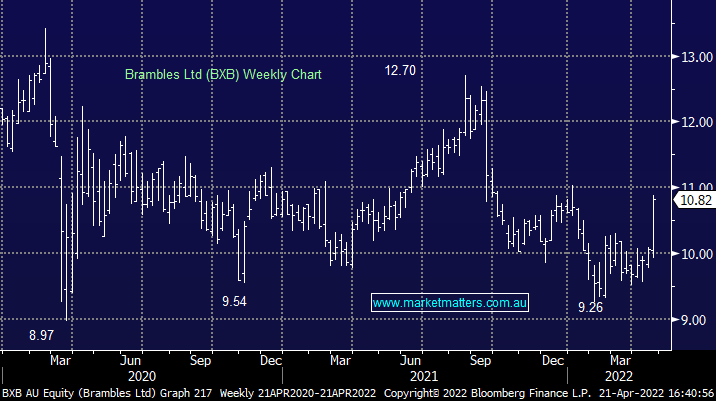

Brambles (ASX: BXB) $10.82

BXB +7.98%: A solid update today from the pallet business; upgrading FY22 sales revenue growth to 8-9% (previous guidance of 6-8%) with underlying profit growth (excluding short term transaction costs) now expected to be between 11-12% (previous guidance 8-10%). The market is focused on whether or not they’ll pursue plastic pallets and clarification here should be the next catalyst.

Brambles

Zip Co (ASX: ZIP) $1.15

ZIP -4.56%: the BNPL company was out with their quarterly report for the three months to March and there was a bit to unpack. They also started trading under their new code, ZIP. Shares initially traded higher but faded through the afternoon to close lower. Transaction volumes grew 26% year on year to $2.1b while revenue grew 38% to $159m as the business saw transaction margins pick up.

Credit losses remain an issue, tracking in line with the 2.6% seen in the first half. It's one of the key reasons the business has been under pressure. It’s hard to see a runway to profit if you’re giving back what you earn (and then some) on each transaction. They’re working on their costs with $30m to come out in FY23 while the changes they’ve made to their risk settings is likely to start coming through in lower credit losses late in the financial year, but more so in FY23.

The Sezzle (SZL) acquisition remains on track and the business is now targeting breakeven in FY24. Overall, it was an average update, but it's no worse than the half-year.

Zip

Broker moves

- Pacific Smiles Raised to Overweight at Wilsons; PT A$2.62

- Ramsay Health Raised to Outperform at Macquarie; PT A$88

- Cooper Energy Cut to Neutral at Jarden Securities

- Ramsay Health Cut to Neutral at Citi; PT A$88

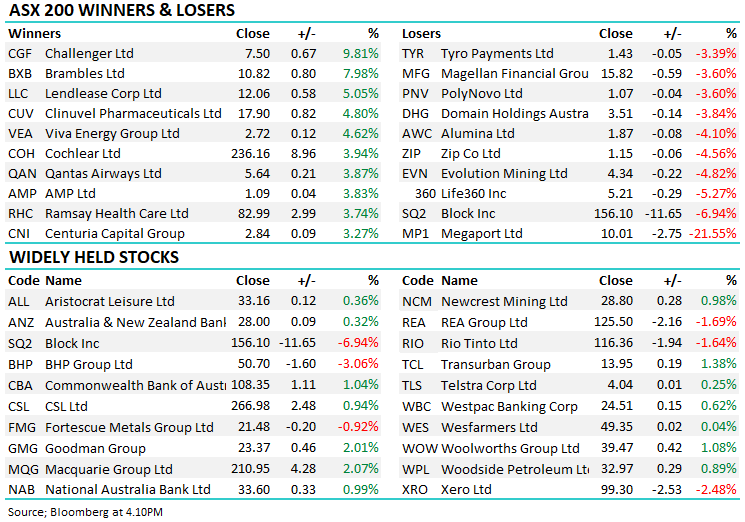

Major movers

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

5 stocks mentioned