The Match Out: ASX fades post strong Jobs data, Energy under pressure again

Traders faded yesterday’s surge in equities, giving back just shy of half of the gains seen in Wednesday’s session. Energy was under pressure on reports of higher crude inventory levels in the US while strong local Employment data took the shine off Tech and Real Estate.

- The ASX 200 finished down -47pts/ -0.67% to 7058

- The Utilities sector was best on ground (+0.59%) while Staples (+0.38%0 and Telcos (+0.15%) were the only other sectors that finished higher today.

- Energy (-1.00%), Tech (-1.02%) and Healthcare (-1.00%) were the weakest areas of the market

- Employment data came in slightly ahead of expectations. Unemployment was 3.7%, as expected, however, it came with a bigger than forecast increase in the Participation rate to 67% with 55k jobs added in October.

- AMP (ASX: AMP) -15.76% hit hard after trying to hide lower margin expectations with the announcement of a new Digital Bank.

- A2 Milk (ASX: A2M) +0.53% reaffirmed guidance however the commentary on China from the CEO was bearish, saying the market for infant formula is in steep decline

- GrainCorp (ASX: GNC) +1.75% joined other Ag stocks with more positive rhetoric, although they also backed it up with solid financial performance. They’ll pay a special dividend of 16¢ and a final dividend of 14¢, both fully franked + they have a pile of money to invest for future growth. The CEO Rob Spurway called it an ‘outstanding result’! Hard to argue.

- AACo (ASX: AAC) +3.04% was higher despite booking a 1H net loss of $105.5m. The beef grazing giant suffered a statutory EBITDA loss of $124.9 million compared with a year-earlier EBITDA of $92.3 million.

- Steadfast (ASX: SDF) halt, announced a $280m equity raise with JP Morgan & UBS on the ticket as they prepare for an acquisition.

- Sonic Healthcare (ASX: SHL) -4.16% is set to buy Pathology Watch for $US130m out of Utah in the States. Sonic looking to get more exposure to Digital Pathology with the pre-profit acquisition.

- Iron Ore fell -2.4% in China as regulators stepped in calling current prices “unreasonably high.” BHP fell -0.6%.

- Gold was up marginally at $US1,964/oz but it was a mixed day for gold equities, Northern Star (ASX: NST) fell more than 4%,

- Asian stocks were also weaker today, Nikkei faring the best with a -0.25% fall, Hang Seng the worst, down -1.25%.

- US Futures are marginally lower at our close.

ASX 200 Index - intraday

ASX 200 Index - daily

.png)

Market Matters Video Update

Portfolio Managers James Gerrish & Harry Watt covering performance for October, what comes next for markets, and 4 high-conviction stock calls here and now.

Transparency is core at Market Matters, we celebrate the good but it's also important to cover outcomes when they are below where they should be. October was a tough month, no sugar coating it, however, what now and how are we positioned leading into the back end of 2023.

Click here to view the Video Update

Broker Moves

- a2 Milk Raised to Accumulate at CLSA

- Life360 GDRs Cut to Neutral at Evans & Partners Pty Ltd

- Flight Centre Cut to Accumulate at CLSA; PT A$21

- Rio Tinto Raised to Overweight at Barrenjoey; PT A$130

- Fortescue Raised to Neutral at Barrenjoey; PT A$23

- Coronado GDRs Cut to Underweight at Barrenjoey; PT A$1.40

- TPG Telecom Cut to Underweight at Morgan Stanley; PT A$4.40

- Warehouse NZ Cut to Neutral at Macquarie; PT NZ$1.74

- Solvar Ltd Raised to Buy at Bell Potter; PT A$1.09

- Wesfarmers Cut to Underweight at Barrenjoey; PT A$45

- Magellan Financial Reinstated Neutral at Citi; PT A$7

- Platinum Asset Reinstated Sell at Citi; PT A$1

- Flight Centre Raised to Hold at Jefferies; PT A$18

- Bigtincan Cut to Hold at Canaccord; PT 40 Australian cents

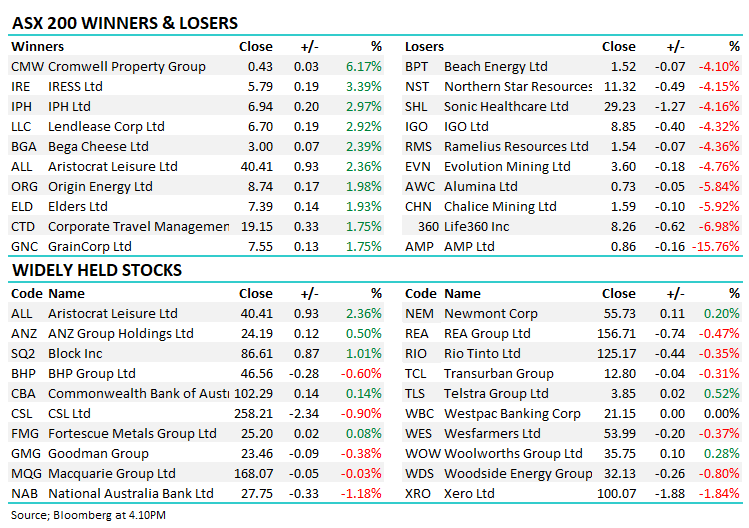

Major Movers Today

.png)

Enjoy the night

The Market Matters Team

1 topic

7 stocks mentioned