The Match Out: ASX falls ahead of key US inflation data

The market was on edge today ahead of the US inflation read tonight which is expected to show headline CPI of 3.6% for August, up from 3.2% in July due to higher energy prices, testing the narrative that inflation has peaked and so too have interest rates. So, some risk off today throughout Asia while US Futures offered little in the way of support.

- The ASX 200 fell -52pts/ -0.73% to 7153 – no recovery today from the lows = not bullish!

- The Utilities sector was best on ground (+0.19%) while Energy (+0.13%) also ended higher.

- IT (-1.56%), Property (-1.24%) & Industrials (-1.23%) fought it out for the wooden spoon.

- Oil prices held 10-month highs on tightening supply while Iron Ore has remained resilient ~US$120/tonne

- Pact Group (ASX: PGH) +7.41% rallied on the prospect of privatisation from its 50% shareholder Raffy Germinder. The stock is down ~60% this year to close today at 72.5c, it was originally IPO’d in 2013 at $3.80!

- Kin Group is offering 68cps to take out the minority holders and come off the boards – the pitch is framed as a way to end the suffering for shareholders.

- Qantas (ASX: QAN) -0.18% down slightly after losing its high court appeal over worker outsourcing, compensation & penalties could now be applied.

- IGO Ltd (ASX: IGO) -7.6% was the biggest drag on the ASX200, although it did trade ex-dividend (but fell more).

- Lithium stocks collectively are still on the nose, Allkem (ASX: AKE) -3.4% and Pilbara (ASX: PLS) -4.35% to $4.40 – we think it’s tickling the BUY zone.

- Viva Energy (ASX: VEA) -2.4% fell after 16% of the stock worth $714m changed hands at $2.87, major shareholder Vitol was the seller. The stock closed at $2.86.

- Centuria Industrial (ASX: CIP) was flat after they offloaded $70m in Melbourne property assets – a strategic review the rationale.

- Telstra (ASX: TLS) -0.26% traded to a low of $3.83 this morning before ticking higher into the close – we covered our views on the stock this morning here

- We also mused about our poor position in ResMed (ASX: RMD) – we hate sitting on the fence but it’s hard to have high conviction one way or another on this post it’s aggressive decline.

- Coal prices are up again, the active contract out of Newcastle trading at $US166/tonne, Whitehaven Coal (ASX: WHC) 0.49% remained muted while Stanmore (ASX: SMR) -2.22% fell as they look to raise debt to fund the purchase of BHP’s Coal assets.

- S32 (ASX: S32) was flat before trading Ex-divi tomorrow for ~5c. The stock has pulled right back and still looks interesting.

- Bapcor (ASX: BAP) +2.92% was strong today, they reported well in August, consolidated the rally and look like popping again.

- Audinate (ASX: AD8) +2.02% raised $50m at $13 (SPP still underway) and has since bounced from the raise level – the stock had a great FY23 result and momentum remains strong.

- Gold was down $US3 trading at US$1910 at our close.

- Asian stocks were down, Hong Kong off -0.22%, Japan -0.52% while China was off -0.70%

- US Futures are lower, only marginally though.

ASX 200 chart - intraday

.png)

ASX 200 chart - daily

.png)

Broker moves

- ACL AU: Australian Clinical Labs Rated New Neutral at Macquarie

- BHP AU: BHP Raised to Add at AlphaValue/Baader

- ERD NZ: Eroad Raised to Buy at Bell Potter; PT NZ$0.98

- IPL AU: Incitec Cut to Sell at Citi; PT A$2.90

- SWP AU: Swoop Holdings Ltd Reinstated Hold at Morgans Financial Limited

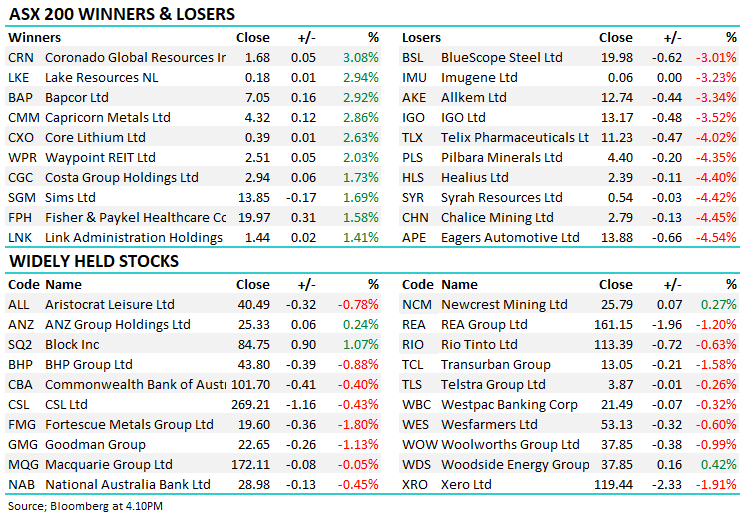

Major movers today

.png)

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

14 stocks mentioned