The Match Out: ASX flat, Banks rally on the week, Energy pulls back after a strong run, Have a great weekend all

The market limped into the weekend with a distinct lack of conviction. Energy and Materials were weak today, the former actually down around 4% on the week after a strong period of outperformance. But as China ratchets up the rhetoric around high prices, some have been shaken out of a trade that MM believes still has legs.

- The ASX 200 finished flat today at 7415 – although that was at a one month high.

- The retailers were strong today rallying 1.35%, as discussed in a timely note we published on the sector this morning – click here

- On the flipside, Materials and Energy were the weakest link, falling 1.18% and 2.08% respectively.

- It was my first day back in the office today and I’ve got to say, I’ve enjoyed four months of change working from home. I think the MM portfolios have benefitted from the reflection time this provided in not focusing so heavily on the cut and thrust – the daily market ebbs and flows – which happen in a dealing room with 150 others. Thinking time is very important in the market and is something I’ve enjoyed.

- Bond yields fell locally today after the RBA intervened, buying $1 billion of bonds to defend its forward guidance of 0.1% for the three years.

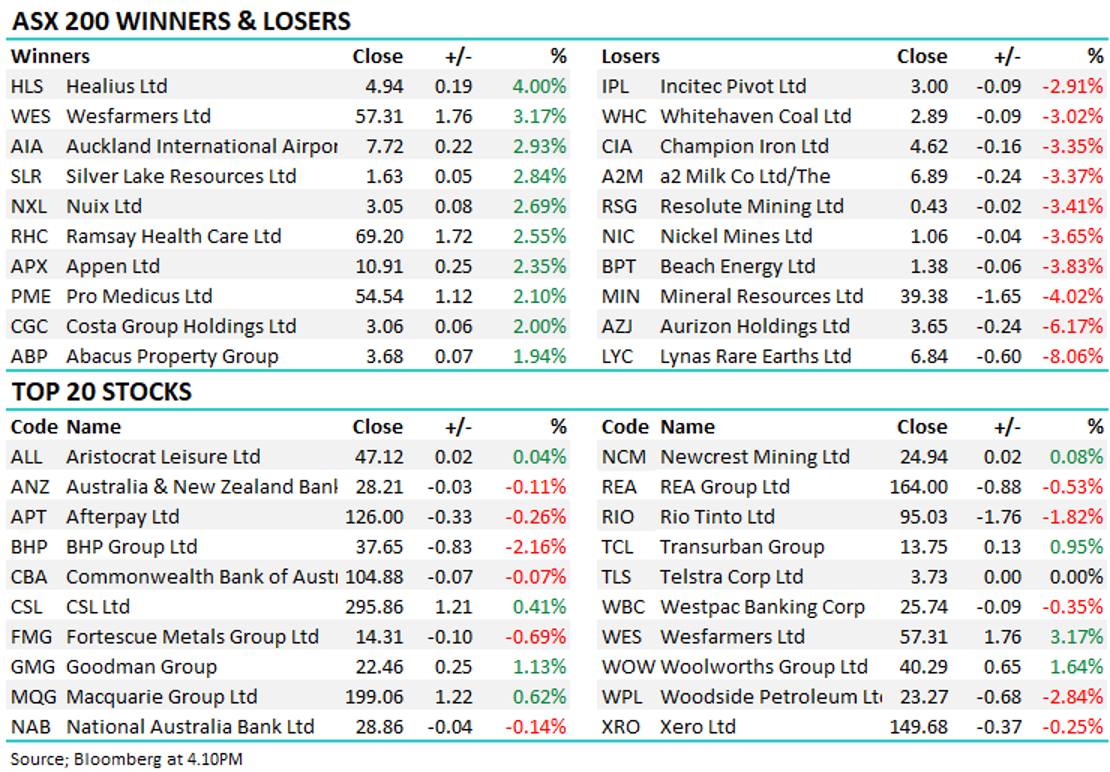

- Banks rallied over the week, Commonwealth Bank (ASX: CBA) climbing 2.5% to $104.88, Westpac (ASX: WBC) advanced 1.4% to $25.74, National Australia Bank (ASX: NAB) added 0.7% to $28.86 and ANZ Bank (ASX: ANZ) rose 1.2% to $28.20.

- Gold was higher during the Asian trade, hitting US$1,787 at our close.

- Iron Ore Futures were flat again.

- Not a lot was happening in Asia today, China down smalls, Hong Kong up smalls.

- US Futures are flat.

ASX 200

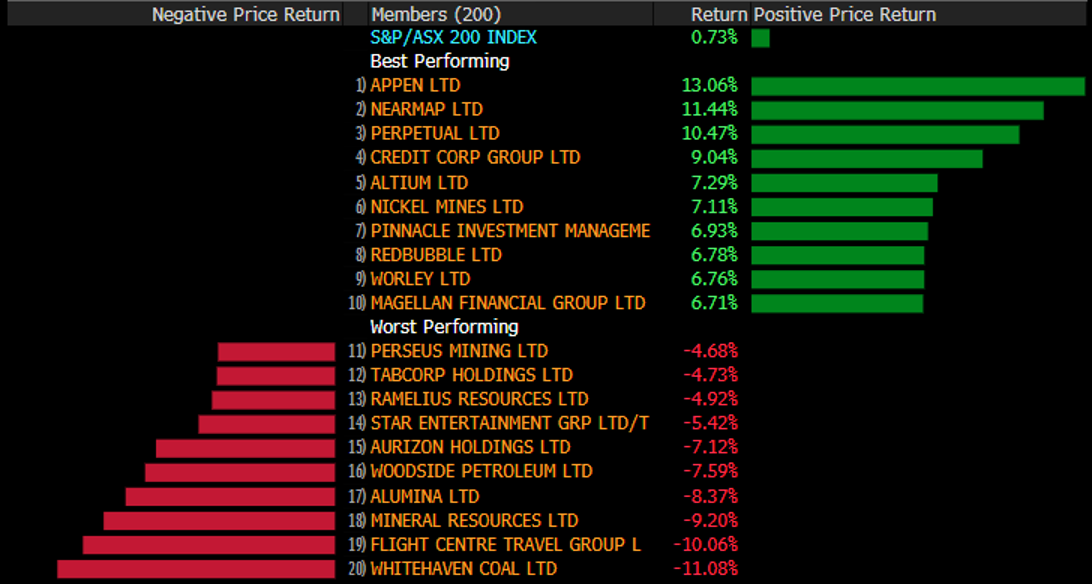

Sectors this week (Source: Bloomberg)

Stocks this week (Source: Bloomberg)

Broker moves

- Mirvac Group Reinstated Hold at Barclay Pearce Capital

- Orora Raised to Outperform at Macquarie; PT A$3.60

- Altium Raised to Positive at Evans & Partners Pty Ltd; PT A$42

- Bluescope Raised to Outperform at Credit Suisse; PT A$28.30

- Camplify Cut to Hold at Morgans Financial Limited; PT A$4.20

- Woodside Raised to Positive at Evans & Partners Pty Ltd

Major movers today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

James is the Lead Portfolio Manager & primary author at Market Matters, a digital advice & investment platform with over 2500 members that offers real market intel & portfolios open for investment. He is also a Senior Portfolio Manager at Shaw and Partners heading up a team that manages direct domestic and international equity & fixed-income portfolios for wholesale investors.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies ("Livewire Contributors"). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

4 topics

15 stocks mentioned

Comments

Comments

Sign In or Join Free to comment