The Match Out: ASX higher on signs Chinese stimulus is working, Sims tanks

A soft opening by the ASX this morning before data from China that showed recent stimulus is increasing liquidity across their struggling economy prompted buying and the index rallied +58 points from the 11 a.m. low of 7134, to close on the session highs, which is a bullish sign.

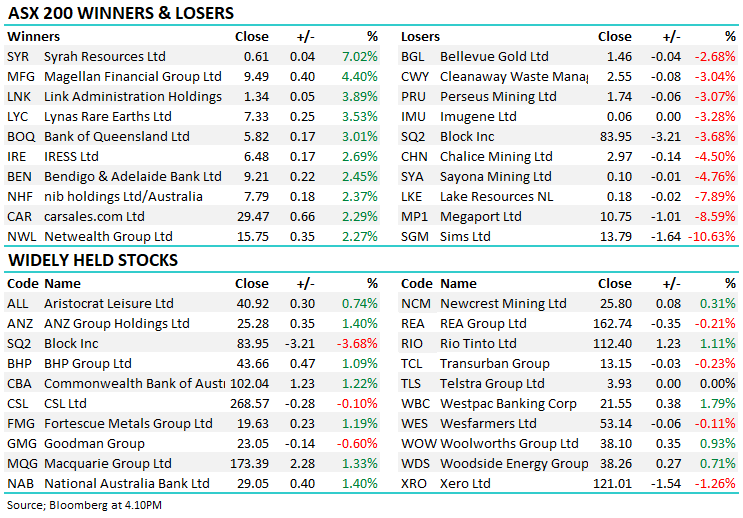

- The ASX 200 put on +35pts/ +0.56% to 7192 – finishing on the day’s highs.

- The Financials sector was best on ground (+1.27%) while Staples (+0.93%) and Materials +0.58% outperformed.

- Healthcare (-0.67%) remained weak while IT (-0.41%) & Property (-0.35%) fell.

- China’s credit expanded more than expected in August after the central bank pushed lenders to boost loans and the government accelerated the sale of bonds.

- Aggregate financing, a good/broad measure of credit, came in higher than thought with financial institutions writing a higher amount of new loans in the month – a sign the wheels are starting to turn.

- Lithium stocks were on the nose with Pilbara (ASX: PLS) -2.22% down after they released an investor presentation that showcased their growth strategy. They talked to their large increase in capex intentions which were announced at their FY23 results on the 25th of August – we cover that here concluding that we see value sub $4.50 in PLS, a stock we’ve been in and out of multiple times.

- Global Lithium (ASX: GL1) -6.45% struggled ahead of a Melbourne Mining Club address. The presentation included further information regarding the potential Direct Shipped Ore (DSO) program at their Manna project which may need more capex than first thought – a common thematic playing through the sector.

- Bendigo and Adelaide Bank (ASX: BEN) +2.45% rallied after announcing the appointment of former Suncorp CEO David Foster as its next chairman. A merger with SUN Bank would be a net positive for BEN and this remains a possibility if ANZ’s appeal fails.

- Domino’s (ASX: DMP) -0.53% fell after a ~16m block cleared at $52.94

- Uranium prices have rallied above $US61/pound (+5% in August) and that’s continued to support the likes of Paladin (ASX: PDN) +2.22% – we continue to like and back the ongoing move in Uranium via PDN and Cameco (NYSE: CCJ) in the International Equities Portfolio.

- Sandfire Resources (ASX: SFR) +1.72% was down early but recovered strongly on the back of the China data – we had talked to switching out of SFR however bullish moves like this have us questioning that approach.

- Magellan (ASX: MFG) +4.4% rallied on a broker upgrade and we remain high conviction on this (still) disliked fund manager after it pulled back to ~$9 after go-ex dividend for the equivalent of 93cps grossed for franking.

- Sims Group (ASX: SGM) -10.63% fell to 8-month lows after the company warned the market of softer earnings early in FY24

- Syrah (ASX: SYR) +7.02% was up after the US International Development Finance Corp approved a $150m conditional loan commitment providing much-needed liquidity/funding. The stock is still in a world of pain!

- Liontown (ASX: LTR) -1.31% is ticking around the Albemarle bid price ($3) with a non-disclosure and exclusivity agreement now in place, with Albemarle’s due diligence expected to take about four weeks.

- Centuria (ASX: CNI) +0.34% announced a new $500m institutional mandate to find and develop industrial assets.

- Gold was up $US8 trading at US$1927 at our close.

- Asian stocks were mixed, Hong Kong down -1.11%, Japan -0.52% while China was up +0.83%

- US Futures are up, the Nasdaq the best of them +0.44%.

- US Inflation data this week (Wednesday) will be important, headline CPI expected to come in at 3.6% YoY up from 3.2% in July driven by energy prices. CPI Ex-food & Energy is expected to be 4.3% down from 4.7%.

ASX 200 Chart - Intraday chart

.png)

ASX 200 - Daily chart

.png)

Sims Limited (ASX: SGM) $13.79

SGM -10.63%: Shares in the scrap metal trading company fell to 8-month lows today after the company warned the market of softer earnings early in FY24. They expect EBIT in the first quarter to be around breakeven while a bounce back is unlikely in the second quarter given weakening volumes in the North American market, an area which remained resilient until now. Prices in scrap metal have been hit by soft demand, which has also been a drag on supply in the market which is hitting both sides of the company’s earnings. Sims remains confident in its ability to generate profits over the longer term, however, there seem to be fundamental issues with the scrap market in the short term which we expect will lead to ~10% downgrades to expectations for FY24.

.png)

Broker Moves

- AWC AU: Alumina Raised to Neutral at JPMorgan; PT A$1

- HHR AU: Hartshead Resources NL Cut to Speculative Buy at Bell Potter

- MFG AU: Magellan Financial Raised to Neutral at JPMorgan; PT A$9

- ORR AU: OreCorp Raised to Speculative Buy at Bell Potter

Major Moves Today

.png)

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

12 stocks mentioned