The Match Out: ASX lower despite multiple takeovers in play, Xero (XRO) disappoints

Multiple takeover bids was not enough to get the ASX higher today with weakness across the banking sector following NABs result yesterday & a pullback in the influential resources weighing on the broader market.

- The ASX 200 finished down -35pts/ -0.50% at 6954

- The Utilities sector was best on ground (+13.15%) while Healthcare (+0.91%) & Staples (+0.90%) were also strong.

- Energy (-2.07%) and IT (-1.87%) the weakest links.

- Portfolio Manager Harrison Watt on Ausbiz this morning talking Regal (ASX: RPL), Aussie Broadband (ASX: ABB) & St Barbara (ASX: SBM) – Watch Here

- Origin Energy (ASX: ORG) +34.77% following a takeover bid from a Brookfield led consortium.

- Perpetual (ASX: PPT) +14.82% as Regal Partners (ASX: RPL) +4.15% increases their bid, Pendal (ASX: PDL) -10.93% as a result.

- Xero (ASX: XRO) -10.85% fell on 1H results that missed + the CEO is set to retire.

- Shaver Shop (ASX: SSG) +4.23% gave a positive trading update at their AGM today.

- Computershare (ASX: CPU) +4.12% upgraded guidance, higher interest rates very supportive of this business, but if rates have peaked, so too hard CPU.

- Suncorp (ASX: SUN) +0.67% said the ANZ acquisition of the bank is ontrack to complete in 2H calendar 2023.

- BHP Group (ASX: BHP) -1.51% talked to the ongoing skills shortage at their AGM today.

- NAB -2.08% universally saw multiple downgrades from brokers following yesterday’s result

- Sandfire (ASX: SFR) +5.25% announced a new CEP and rallied.

- Iron Ore was down 1% in Asia today, Fortescue (ASX: FMG) -1.99% - this is a stock we are considering for the Income Portfolio.

- Gold is still trading US$1711 holding recent gains.

- Asian stocks were lower, Hong Kong down -1.92%, Japan -0.76% while China was off -0.64%

- US Futures are all up, around +0.20%

ASX 200 Chart

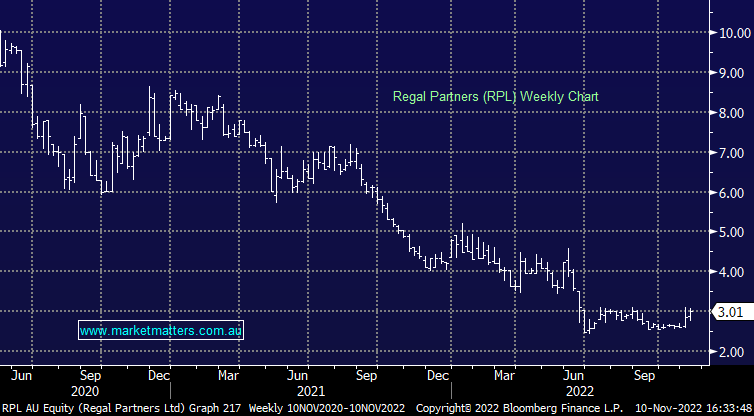

Perpetual (PPT) $33.40 / Pendal (PDL) $3.91 / Regal (RPL) $3.01

PPT +14.82%, PDL –10.93% , RPL +4.15%: This morning the Regal/BPEA consortium increased the indicative offer put to PPT management to $33 up from the original bid at $30. While PPT knocked back the higher bid again, at $33 it represents ~28% premium to 1 day VWAP prior to deal and over the magical M&A level (30%) at 36% on the 30-day VWAP metric, so in other words, it’s getting to be a harder call for PPT to rebuff, indeed we are surprised they have. While Pendal (PDL) / Perpetual (PPT) deal is a binding one, it can be broken with the payment of a break fee ($23m) which in the scheme of the deal, is not insurmountable. As it stands, RPL have moved fast and have with a strong bid on the table, PPT is now on the backfoot and attempting to delay the first court hearing for the scheme of arrangement for the Pendal deal, while PDL have got their backs up and turned slightly hostile it seems.

.png)

Xero (XRO) $64.74

XRO -10.85%: a soft first-half result saw shares in the accounting software company fall to levels not seen since March 2020. While subscription growth in the mature markets of Australia & NZ was strong, international growth weighed with the group coming in ~2% below expectations at 3.5m subs. The average revenue per user (ARPU) climbed as price rises came through, up 13%, however, EBITDA of $NZ109m missed expectations. The company flagged operating expenses would come in at the lower end of the 80-85% of revenue guidance range. Xero also announced it had hired ex-Google and Stubhub executive Sukhinder Singh Cassidy to replace the current CEO as Steve Camos vacates the position early next year. The result is a miss but not a bad one, with some of the decline no doubt related to the

.png)

Origin (ORG) $7.83

ORG +34.77%: shares in the energy retailer surged today after announcing Brookfield had put forward a $9/sh takeover offer. The takeover values Origin at $18.4b in a huge deal that would see the Canadian PE company partner with European energy investor EIG. The bid was a 54.9% premium to yesterday’s close with Origin’s board indicating they would accept the deal, granting the consortium exclusive due diligence. Shares still closed around 15% below the offer price after today’s surge.

.png)

Shaver Shop (SSG) $1.11

SSG +4.23%: the retailer hosted its AGM today, providing a positive trading update that took shares higher. Total sales growth to 6 November was up 13% on FY22, running around $8.5m ahead of last year. Sales growth was running at +19% in the first 7 weeks, with the drop coming as they start to cycle the end of COVID lockdowns last year. The company said it was pleased with inventory levels across the business as they enter the important holiday sales period though they didn’t provide any further guidance for FY23.

.png)

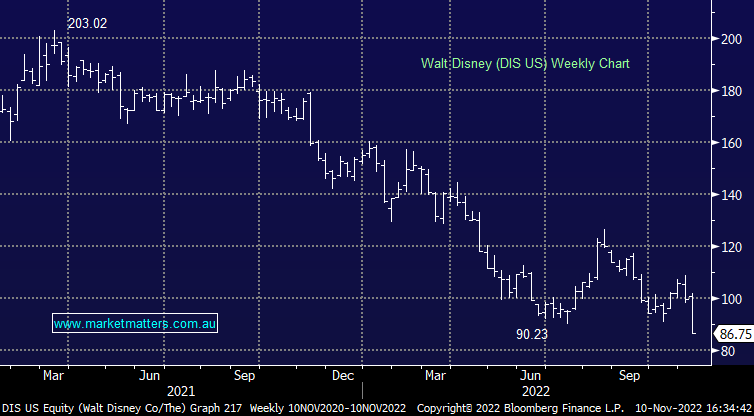

Walt Disney (DIS) $US1375.82

DIS -13.16% Q4 results out after market on Wednesday with the negative reaction overnight warranted. The only positive was subscriber growth in their streaming business ~30% above consensus which implies their target for achieving streaming profitability in fiscal 2024 should become reality. Still, the rest of the result was weaker than hoped with theme park margins softer and their broader direct to consumer (DTC) business which includes global advertising sales, overseas media assets, streaming and syndicated TV missing earnings expectations. Clearly this is a big company that is being impacted by the broader macro environment leading to a ~5% revenue miss and more at the earnings line, however we continue to believe that Disney is best positioned to win in streaming supported by the best depth of content.

.png)

Broker Moves

- NAB Cut to Neutral at Macquarie; PT A$32.25

- NAB Cut to Neutral at Evans & Partners Pty Ltd; PT A$31

- James Hardie GDRs Cut to Neutral at Jarden Securities

- Lottery Corp. Cut to Underweight at Jarden Securities; PT A$4.03

- NAB Cut to Neutral at Citi; PT A$32.75

- NAB Cut to Underperform at Jefferies; PT A$24

- Northern Star Cut to Equal-Weight at Morgan Stanley; PT A$10.80

- Evolution Raised to Overweight at Morgan Stanley; PT A$3.10

- Sayona Mining Rated New Sell at Clarksons Platou

- CSL Raised to Outperform at Credit Suisse; PT A$310

- Whitehaven Raised to Neutral at Citi; PT A$8

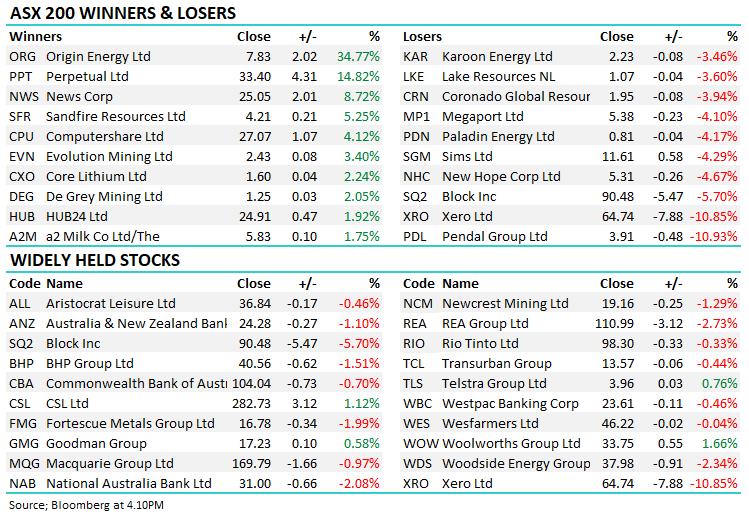

Major Movers Today

.png)

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

16 stocks mentioned