The Match Out: ASX lower on RBA minutes, HUB remains a ‘class’ act

While stocks opened marginally lower, it was the RBA minutes from the last board meeting + Deputy Governor Bullock delivering a speech, both of which signalled sharply higher rates that prompted sellers to kick it up a notch, the IT stocks felt the brunt as did healthcare, two sectors heavily influenced by interests rates while Energy, on the other hand, keyed off a 4.6% rally in Crude prices overnight

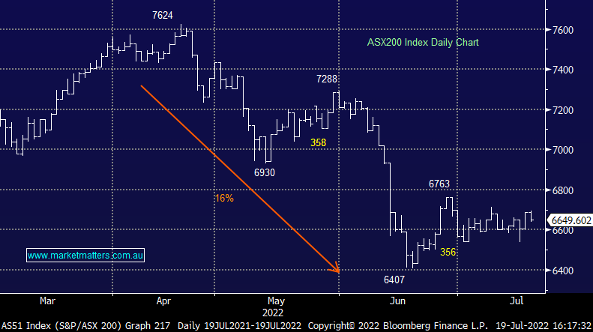

- The ASX 200 finished down -37pts/ -0.56% at 6650.

- The Energy sector was best on ground (+2.45%) while Utilities (+1.01%) were also strong.

- IT (-2.85%) and Healthcare (-2.27%) the weakest links.

- Minutes from the RBA’s most recent meeting + a speech from deputy governor Bullock on how households will cope with interest rate rises both implied substantially higher interest rates – Bond yields ticked up as a result and equities sold off.

- ANZ Bank (ASX: ANZ) was the most bullish on rates seeing 3.35% by the year-end while Commonwealth Bank (ASX: CBA) now expects a 50bp hike in August and September and 25bps in November for the cash rate to be 2.60% before the big guy drops down the chimney.

- Pendal (ASX: PDL) +7.79% went into a trading halt at lunchtime pending an announcement which came out right on the close, seems Perpetual (ASX: PPT) is back at the table with some help from private equity. PDL is our most recent buy in the Income Portfolio, although we had transitioned from Magellan (ASX: MFG) which hurt. Let’s hope Perpetual steps in with a big premium, although both companies still saying it is early stages.

- Whitehaven Coal (ASX: WHC) +5.20% upgraded across the board – Peter O’Connor at Shaw putting a PT of $7.50/share (from $6.25). Citi did something similar with $7.85, Morgan Stanley remains the most bullish at $8.50.

- Not all coal companies are printing cash though with junior Allegiance Coal (ASX: AHQ) down a massive 66% after weak production left them short cash.

- BHP -0.92% released a solid production scorecard as you would expect, guidance a touch light on by generally okay.

- Mineral sands junior Strandline (STA) +12.7% rallied today and is starting to look good as they quickly approach production in the next 4-5months

- Lake Resources (ASX: LKE) +13.6% is now back above the price it was when J Cap released its ‘scathing’ short report – these are no longer having the impact they once did.

- HUB24 (ASX: HUB) -4.97% down after Q422 flows, although tech was down across the board.

- Suncorp (ASX: SUN) -5.01% fell as the smaller lenders started the PR campaign against ANZ’s acquisition of Suncorp bank, sighting a reduction in competition.

- Paladin (ASX: PDN) -2.36% confirmed the restart of Langer Heinrich, we had the CEO Ian Purdy in today and Harry will discuss this in tomorrow’s Portfolio Report.

- Iron Ore was down 1.3% although the miners were mostly higher.

- Not much was happening in the Gold market, trading at around US$1709.

- Asian stocks were mixed Hong Kong, down -0.78%, Japan +0.79% while China was flat.

- US Futures are all up, around +0.20%

ASX 200 chart

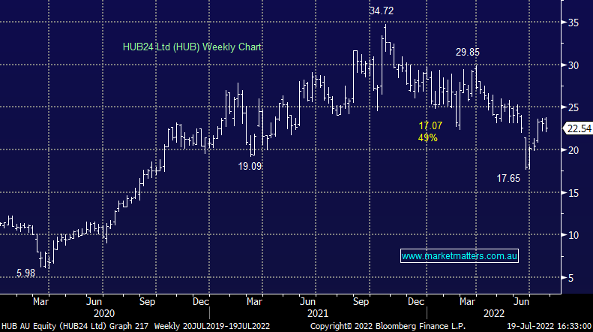

HUB24 (HUB) $22.54

HUB -4.97%: Sold off today after releasing the 4Q22 net flows of $2.5bn and total Funds Under Administration (FUA) of $65.6bn, up +12% YoY. The quarterly numbers were pre-released and represented 21% of annual flows which is below the 31% skew in FY19 and 33% in FY21, and this we suspect is the source of the market’s discontent in the SP today aside from the general sell-off in tech. Total net flows for FY22 totalled $11.7bn which is +56% on FY21 and +137% on FY20 levels while the result compares very favourably to key peer Netwealth (NWL) which saw skinnier net flows of -$360m or -12% vs pcp at their 4Q22 update.

To give some perspective on this business, in FY18 they saw the same net flows in the full year as they did in Q4 alone, and trading on 18x EBITDA, we still think HUB is a ‘class’ act!

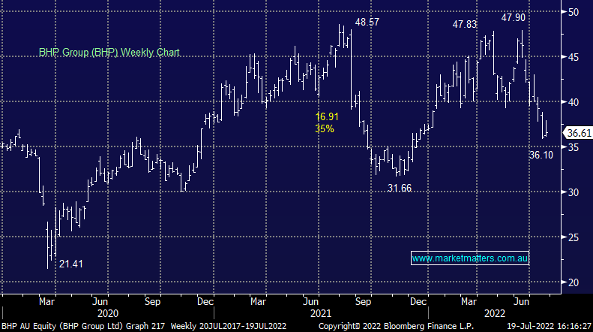

BHP Group (BHP) $36.61

BHP -0.97%: the Big Australian announced their fourth quarter production numbers today with largely little fanfare. A strong finish to the year for copper production saw production up 25% on the previous quarter, Iron ore was 8% higher than Q3 while Energy Coal was more than 50% higher than the previous quarter given better weather and less COVID related labour shortages. The result saw all segments meet their full-year guidance numbers except for nickel which fell short following an unplanned smelter outage. While specifics weren’t provided, the company said costs were also largely within guidance in the period. Shares underperformed peers today, likely after providing guidance that looked a touch light. They are expecting flat production year on year for iron ore & energy coal, ~5% increase for met coal and around 10% more copper and nickel in FY23. They will announce FY22 results on August 16.

Broker moves

- Sims Rated New Neutral at Barrenjoey; PT A$14.40

- Bluescope Rated New Overweight at Barrenjoey; PT A$19.95

- ANZ Bank Cut to Neutral at Evans & Partners Pty Ltd; PT A$23

- Kogan.com Cut to Hold at Canaccord; PT A$4

- Marley Spoon GDRs Cut to Speculative Buy at Canaccord; PT A$1

- Lynas Raised to Outperform at CLSA; PT A$8.95

- Suncorp Cut to Neutral at JPMorgan; PT A$13.25

- Integral Diagnostics Rated New Underweight at JPMorgan

- BHP Raised to Buy at SBG Securities; PT A$41

- WiseTech Cut to Underperform at Macquarie; PT A$42

- Whitehaven Raised to Buy at Citi; PT A$7.85

- Janus Henderson GDRs Cut to Underweight at JPMorgan; PT A$26

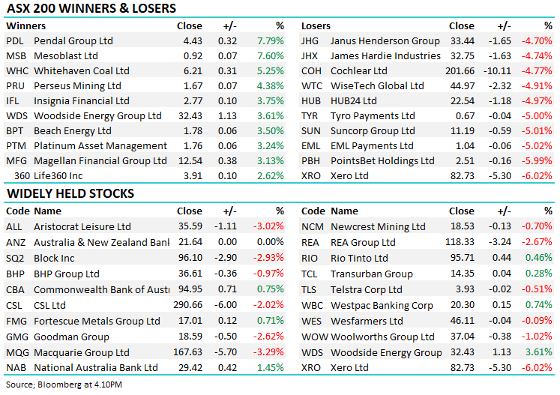

Major movers today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

3 topics

12 stocks mentioned