The Match Out: ASX opens with a bang, ends with a whimper…

The Match Out for Tuesday 28 November with James Gerrish of Market Matters.

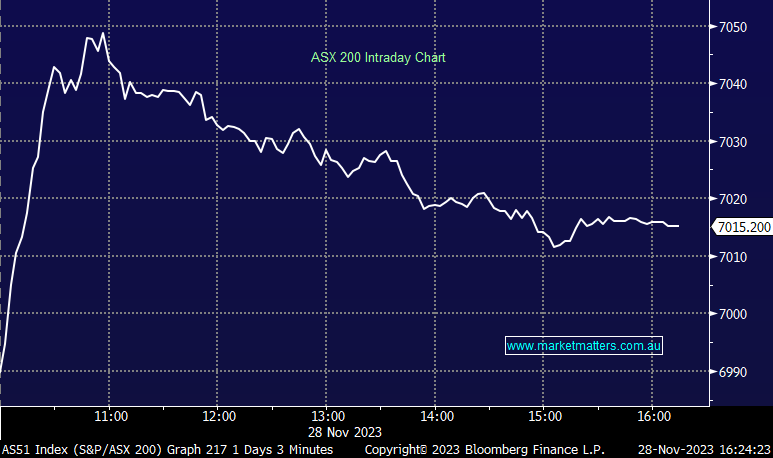

A similar sort of session to yesterday played out today with the best of it seen early, although we started from a higher level with strong buying on open seeing the index +60 points not long after the bell, before sellers emerged cutting those gains in half.

- The ASX 200 finished up +27pts/+0.39% to 7015.

- The Property sector (+1.48%) was the standout, while Consumer Staples (+0.62%) and Consumer Discretionary (+0.60%) finished higher.

- Energy (-1.01%), IT (-0.42%) and Utilities (-0.09%) struggled.

- Retail sales came in softer than tipped in October, down -0.2% from September, missing forecasts of a 0.1% rise

- Clearly higher borrowing costs are starting to bite in retail land as consumers tighten their belt.

- Weaker data reduces the chance of further interest rate hikes, now only around 16bps of tightening priced in by futures.

- PointsBet (ASX: PBH) +5.48% was strong after confirming they were on track to deliver revenue growth of between 10-20% in FY24.

- Imugene (ASX: IMU) +9.89% rallied after being granted Fast Track designation from the US FDA for the clinical evaluation of its metastatic advanced solid tumours program against a new form of cancer.

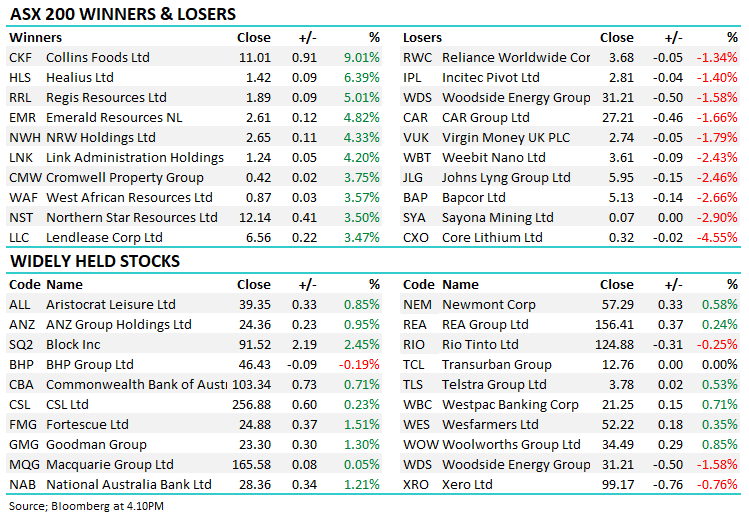

- Collins Foods (ASX: CKF) +9.01% reported strong results and increased dividends, declaring 12.5c for the half.

- AGL Energy (ASX: AGL) -0.61% continued to dip taking their 5-month pullback to ~20% after a ~75% rally from the lows – a volatile ride. We continue to own a small position in our Active Income Portfolio. AGL’s CFO presented at a conference today and talked about future demand for electricity – they expect a doubling of demand for electricity between now and 2050 with electric vehicles underpinning a 30% increase in home electricity consumption.

- Link Administration Holdings (ASX: LNK) +4.2% was up on positive AGM commentary, winning new business and on track for a strong 1H. They upgraded FY24 guidance for revenue growth of more than 6.5% and EBIT growth of 7-9%, up from at least 6%.

- Gentrack (ASX: GTK) +9.85% hit 4-year highs as the billing and customer management software business released strong FY23 results, Revenue +7% above the midpoint of guidance and EBITDA beat by 12% at $24.6m. FY24 guidance was also positive underpinning a very strong move in their shares.

- Plenti (ASX: PLT) +64.71% ripped after signing a deal with NAB for co-branded EV and Renewable Energy loans. We wonder what this means for the alternative financing sector of the market, banks may now be looking for their share of the pie.

- Orora (ASX: ORA) +2.43% upgraded at Morgan Stanley to buy equivalent and $3.50 PT, this is our latest purchase in the Active Income Portfolio, switching out of Wesfarmers (WES).

- Iron ore fell, futures down 2% in Singapore to $US131/mt, although Fortescue (FMG) +1.5% bucked the trend.

- Gold edged higher, now trading US$2015/oz at our close. Evolution (EVN) +2.93% was outshone by Northern Star (NST) +3.5%, two stocks we hold in the Growth Portfolio.

- Asian stocks were mixed, Hong Kong -0.12%, Japan -0.87% while China +0.04% edged higher.

- US Futures are little changed.

ASX 200 Intraday

ASX 200 Daily

Broker Moves

- Clean Seas Seafood Cut to Hold at Bell Potter

- PeopleIN Ltd Cut to Market-Weight at Wilsons; PT A$1.39

- Life360 GDRs Rated New Buy at Ord Minnett; PT A$8.84

- Meteoric Resources NL Rated New Speculative Buy at Canaccord

- Orora Raised to Overweight at Morgan Stanley; PT A$3.50

- Service Stream Reinstated Accumulate at CLSA; PT A$1

- Aeris Resources Cut to Neutral at Macquarie

- Monadelphous Reinstated Reduce at CLSA; PT A$14.40

- NRW Holdings Reinstated Buy at CLSA; PT A$2.90

- Perenti Reinstated Buy at CLSA; PT A$1.50

- Downer EDI Rated New Reduce at CLSA; PT A$4.15

Major Movers Today

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

James is the Lead Portfolio Manager & primary author at Market Matters, a digital advice & investment platform with over 2500 members that offers real market intel & portfolios open for investment. He is also a Senior Portfolio Manager at Shaw and Partners heading up a team that manages direct domestic and international equity & fixed-income portfolios for wholesale investors.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies (“Livewire Contributors”). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

2 topics

8 stocks mentioned

Comments

Comments

Sign In or Join Free to comment