The Match Out: ASX rallies 1%, Origin (ORG) bid gets one green light, Performance for September

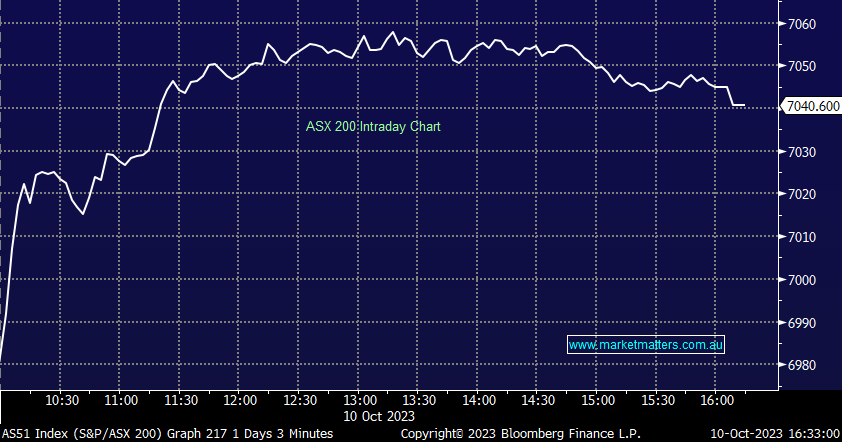

A solid session for stocks today, buoyed by a positive overseas lead along with further local data that suggests price pressures are easing taking the pressure off inflation and thus interest rates. All sectors finished higher on the session with 85% of the main board ending in the green, pushing the ASX 200 back up through 7000, all the more impressive given our two largest sectors lagged the broader advance.

- The ASX 200 finished up +70pts/ +1.01% to 7040

- The Utilities sector was best on ground (+4.17%) while IT (+3.01%) and Communications (+2.24%) also did well.

- Financials (+0.63%), Materials (+0.70%) and Healthcare (+0.72%) underperformed the broader strength.

- Data from NAB (ASX:NAB) today showed that cost and price pressures are easing, with their monthly business survey showing labour cost growth easing to 2% in quarterly equivalent terms, and purchase cost growth declining to 1.8% - both positive signs around inflation.

- Market Matters Invest Monthly Performance Reports out this morning – more on these below with all portfolios outperforming benchmarks. Our Investor Ap will launch shortly backing up an existing comprehensive investor portal. Portfolios are open for investment with a min initial investment of $10,000, making it a highly accessible platform to hold direct equities.

- Citi upgraded a number of Lithium stocks today as they tweaked their long-term Lithium price assumptions, saying that while they expect prices to track sideways for the next 12-18 months, they remain bullish on the long-term outlook as a surplus over the next few years driven by volatile pricing creates a setup for deficits later this decade. Both IGO Ltd (ASX: IGO) +3.53% and Pilbara (ASX: PLS) +6.17% upgraded to buy ratings.

- Xero (ASX: XRO) +4.37% rallied strongly and is the large-cap tech stock we see with a near-term catalyst coming up with their 9th November results. The new CEO has re-calibrated their focus to more profitable growth, with an audit of their US business likely to show further incremental improvements to that end. Interesting also to see a portion of management incentives now linked to some profitability metrics rather than solely skewed toward top-line growth. We won XRO.

- NRW Holdings (ASX: NWH) +4.92% announced $200m of new contract wins, the bulk in their civil division, stock rallied.

- Magellan (ASX: MFG) +4.2% up as Macquarie moved from sell to neutral.

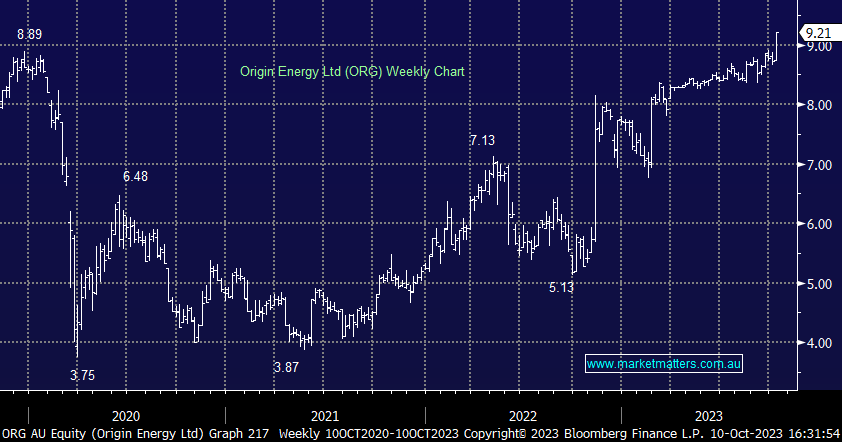

- Origin Energy (ASX: ORG) +5.5% rallied as the ACCC gave the green light on the Brookfield bid, now they just need FIRB approval + probably a better price!

- Telstra (ASX: TLS) +2.11% finally moved, we continue to see value in TLS at current levels, a nice combination of defence, yield and some growth, now at the right price.

- AGL Energy (ASX: AGL) +3.91% was up on the news and looks good here after a period of consolidation – we continue to hold AGL in our Income Portfolio, now more a buy sub $11.

- Copper stocks had a good session, Sandfire (ASX: SFR) +4.17% caught our eye with the stock garnering strong support whenever it ticks below $6, closing today at $6.25

- Gold stocks up a bit but are showing some signs of fatigue after a very strong few days – Evolution (ASX: EVN) +0.28% and Northern Star (ASX: NST) +1.51%, while Newcrest (ASX: NCM) -0.79% lost ground.

- • Iron Ore was down -1.74% in Asia, keeping a lid on Fortescue (ASX: FMG) +0.77% and Rio Tinto (ASX: RIO) -0.88%.

- Gold was flat in our time zone at $US1861.

- Asian stocks were mostly higher, Hong Kong up +1.07% & Japan put on +2.39%, while China fell -0.57%

- US Futures are up mildly.

ASX 200 chart - intraday

.png)

ASX 200 chart - daily

.png)

Market Matters Invest Performance

Monthly Performance Reports and commentary for the suite of Market Matters Invest Portfolios out this morning covering the month of September. To receive these Monthly Updates directly to your inbox, sign up here.

While September was another tough month for equities with the ASX down by -2.84%, our portfolios outperformed across the board:

The Active Growth Portfolio: -1.48% (1 year +22.17%): Download Monthly Report Here

The Active Income Portfolio: +0.09% (1 year +17.33%): Download Monthly Report Here

The Emerging Companies Portfolio: +1.08% (1 year +8.67%): Download Monthly Report Here

The International Equities Portfolio is not yet open for direct investment, however, we are on track for launch before Christmas. The portfolio declined -1.62% in September versus its benchmark of -3.98%, and is up 18.35% for 1 year. The portfolio has been running since 2019 and has returned 16.16% pa.

For Sophisticated Investors, James Gerrish & his team offer bespoke portfolio management via Shaw & Partners – more information is available here. Portfolios are aligned with our Market Matters approach and can include Australian and international Equities, Fixed Interest and alternative assets, with an asset allocation structure designed for targeted objectives. Email: jgerrish@shawandpartners.com.au for more information.

Market Matters Invest Portal

.png)

Origin Energy (ASX: ORG) $9.21

ORG +5.5%: the ACCC showed their softer side today, approving the Brookfield deal to acquire Origin Energy despite some vertical integration concerns. Brookfield already manages gas & electricity distributor AusNet, which raised the ACCC eyebrows given the similarities in Origin’s services. The competition regulator, though, gave this a green light, noting the capital Brookfield plans to put into Origin to transition the company, and the country, away from fossil fuels. The issue is now shares are trading above the bid price despite FIRB not yet giving it the tick of approval. Key shareholders are looking to earn an improved bid price now given the improvements in the business and sector since the original takeover bid.

.png)

Broker moves

- IGO Raised to Buy at Citi; PT A$13

- Core Lithium Raised to Neutral at Citi; PT 38 Australian cents

- Pilbara Minerals Raised to Buy at Citi; PT A$4.50

- ResMed GDRs Raised to Overweight at JPMorgan; PT A$26.50

- 29Metals Raised to Outperform at Macquarie

- Magellan Financial Raised to Neutral at Macquarie; PT A$7

- Beach Energy Cut to Sell at Goldman

- Woodside Energy Raised to Buy at Goldman

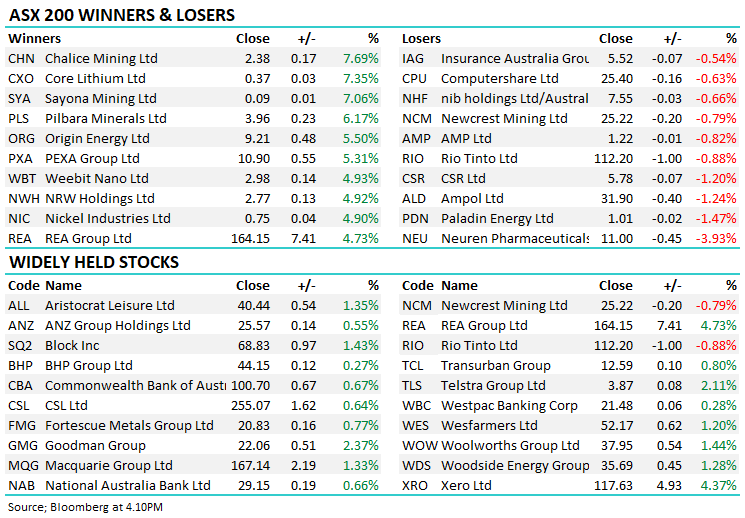

Major movers today

.png)

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live

1 topic

14 stocks mentioned