The Match Out: ASX rallies, Resource stocks lead with Tech a solid No 2

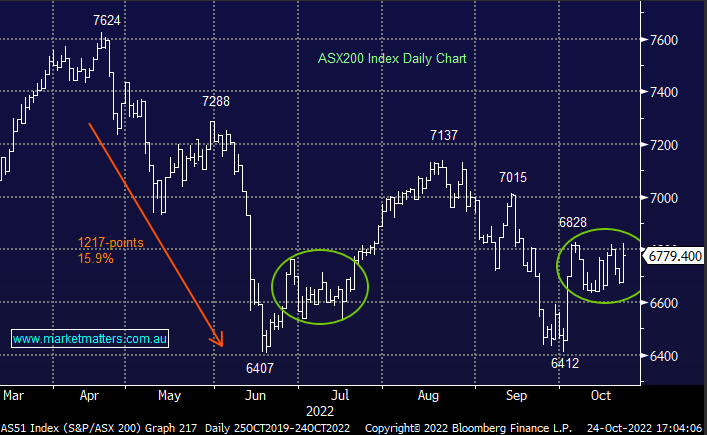

The ASX opened with a bang this morning buoyed by a strong session on Friday night in the US + US Futures also opened +0.75% higher this morning, although as they tapered off, our market followed suit having seen an early high of 6823 we ultimately closed more than ~40pts below it, although still a solid session.

- The S&P/ASX 200 added +102 points / +1.54% to close at 6779

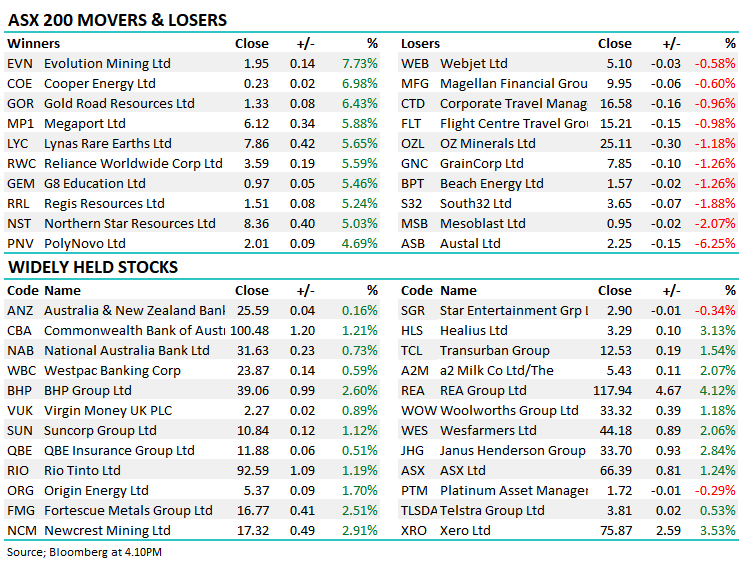

- Materials (+2.51%) & IT (+2.25%) the standouts.

- Energy (+0.74%), Staples (+0.90%), and Financials (+1.02%) underperformed the strong market, but all sectors made gains.

- James Gerrish was on Talking Finance with Alan Kohler this morning discussing markets - Listen Here

- Gold stocks were the star, although all coming off a very low base. If the $US has peaked and tracks lower, Gold could see a very aggressive counter-trend advance. Evolution (ASX: EVN) the standout today up +7.73%.

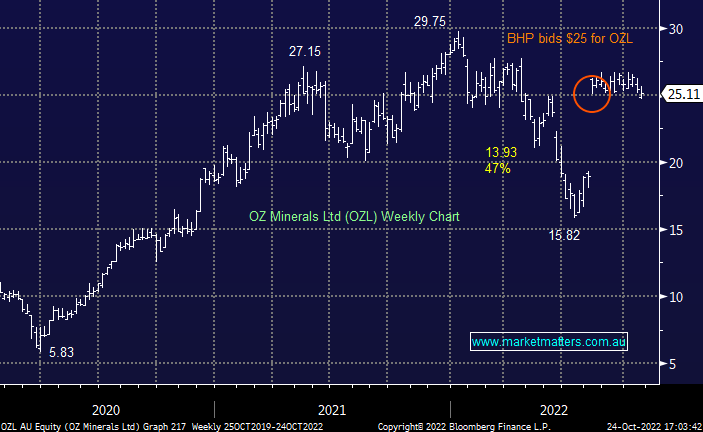

- Oz Minerals (ASX: OZL) -1.18% reported lower quarterly production and higher costs, although they maintained FY guidance. Peter O’Connor’s view of the stock below.

- South32 (ASX: S32) -1.88% another miner to experience cost inflation at a time when production rates have been challenging

- Goldman Sachs talking up the relative value now obvious in Adairs (ADH) +1% saying…. Adairs's core business is resilient and the stock's 40% discount to its discretionary retail peers is unjustified

- The investment platform businesses had a good session led by the smallest of the 3 Praemium (ASX: PPS) which put on +9%. HUB +3.67% & Netwealth (NWL) +3.5% also rallied. We own the first 2.

- Pilbara (ASX: PLS) +6.11% led the lithium stocks higher.

- G8 Education (ASX: GEM) +5.46% rallied today – been a while since this moved by any real magnitude.

- Aussie Broadband (ASX: ABB) +5.38% is another we like coming off a very low base having reconfirmed guidance last week.

- Iron ore was flat in Asia – ditto for Gold trading at $US1655/oz

- A tough day for Hong Kong-listed shares, the Hang Seng down -5.5% around our close after the Chinese leadership reshuffle over the weekend highlighted Xi’s unquestioned grip over the ruling party which is not good for Hong Kong-listed names.

- The Nikkei in Japan was up +0.45%, while China was down 1.8%

- US Futures are flat, they were up ~0.75% early on however they tapered off throughout the day.

ASX 200 Chart

Oz Minerals (OZL) $25.11

OZL -1.18%: Was trading back below the BHP bid price today following a weaker-than-expected production report – another miner struggling with multiple pressures impacting volumes and costs, although they did maintain full-year guidance. Here’s Peter O’Connors comment… CY22 has been a more challenging year in terms of delivery to guidance than any prior year under the current team (since start 2015). Worth noting though that near term blemishes don’t change long term value creation opportunities or indeed valuation. To that end we note that the BHP CEO suggested a the FT Mining Summit (over the weekend) that “OZL was a nice to have, not a must-have.” Interesting and a sentiment we would concur with. But the company has nonetheless lobbed a A$25/share cash bid on OZL which the BHP CEO deemed … “quite attractive.” Note he did not say very attractive or exceptionally attractive or fully priced or last and final. The door has not closed yet, in our opinion, on BHP’s advance(s).

We expect that the next move will see a bump in bid terms to get OZL engaged and give BHP due diligence access. We maintain $30/sh target price.

Broker Moves

- Platinum Asset Raised to Reduce at CLSA; PT A$1.71

- Pendal Group Raised to Accumulate at CLSA; PT A$5.50

- Novonix Raised to Speculative Buy at Morgans Financial Limited

- Insurance Australia Raised to Add at Morgans Financial Limited

- Bendigo & Adelaide Raised to Outperform at Macquarie; PT A$9.25

Major Movers Today

Enjoy your night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

7 stocks mentioned