The Match Out: ASX sees some respite with Financials & Materials higher, New Hope (NHC) announces big dividend

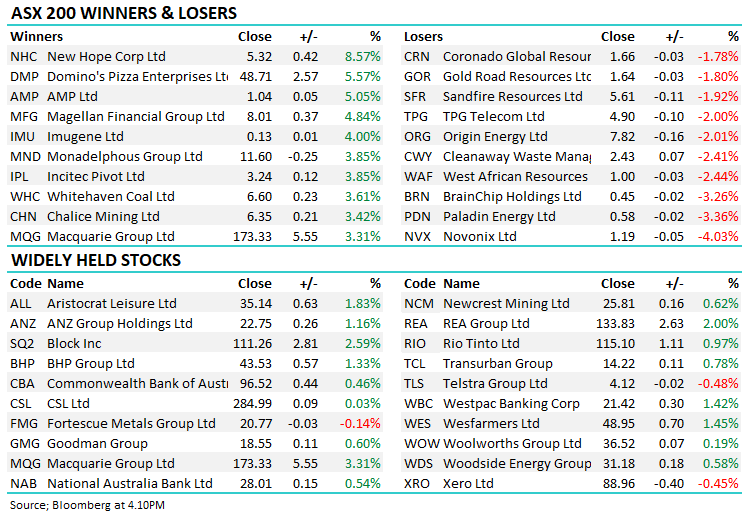

- The ASX 200 finished up +56pts/ +0.82% at 6955.

- The Consumer Discretionary sector was best on ground (+1.50%) while Financials (+1.18%) & Materials (+1.01%) were also strong.

- Utilities (-1.63%) and Communications (-0.06%) the weakest links.

- New Hope Corp (ASX: NHC) +8.57% rallied on a good set of 1H23 results, a big dividend + a special & resumption of buy-back.

- Dominos (ASX: DMP) +5.57% rallied hard on a Barrenjoey upgrade, they put the stock on a buy-equivalent and $59 price target, saying that the selling is overdone.

- Incitec Pivot (ASX: IPL) +3.85%, announced it had agreed to sell its Waggaman Ammonia plant in the US for $uS1.675b. The deal will be partly fulfilled by an ‘at cost’ supply agreement for around a quarter of the value of the sale which secures ammonia for Incitec’s Dyno Nobel explosives business. A smart deal providing Incitec with a more flexible balance sheet and offloading an asset the company has had issues with.

- Mincor (ASX: MCR) +42% rallied after Andrew Forrest’s Wyloo offered $1.40 for the stock, a 35% premium to last – more on this below.

- UBS refreshed their calls around Lithium, saying that while they expect supply to double by 2025, the downside has now been captured in stocks – they kept buy ratings on Allkem (ASX: AKE), Mineral Resources (ASX: MIN), IGO (ASX: IGO) & Liontown (ASX: LTR), with a neutral rating on Pilbara Minerals (ASX: PLS).

- ASX listed Hybrids have been in focus with margins on major bank notes increasing from ~2.2% up to ~3%, worth revisiting what we wrote this morning Here for those with an interest in Hybrids.

- The Market Matters Income Portfolio continues to hold Hybrid securities with a focus on well-capitalised, and safe institutions of ANZ, CBA, NAB & WBC. As we have written in the past, we don’t view the small yield uplifts in the likes of Challenger as adequate for the additional risk in those securities.

- The view the Market Matters Income Portfolio and see our Hybrid Investments, Click Here

- Gold edged higher in Asian trade up ~US$2, trading at $US1981 at our close.

- Asian stocks were higher, Hong Kong added +0.60%, Japan +0.60% while China was up +0.50%.

- US Futures are all marginally higher.

ASX200

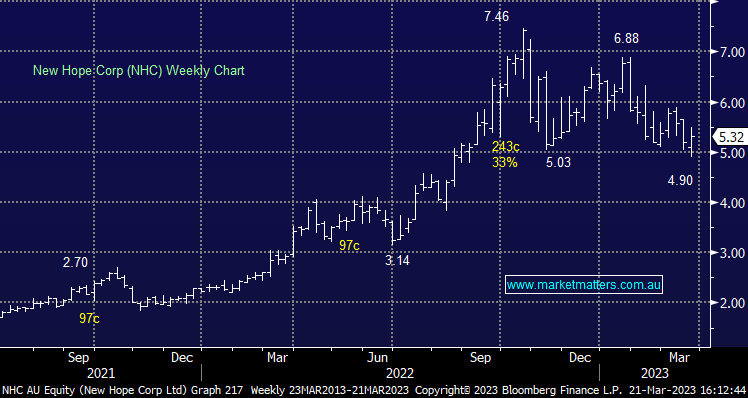

New Hope Corp (ASX: NHC) $5.32

NHC +8.57%: Rallied today after reporting 1H net profit of $668m vs. $330m this time last year while they announced an interim dividend of 30c fully franked plus a special dividend of 10c fully franked, putting it on a 7.5% yield for the half (15% annualised) plus franking. This equates to a ~10% grossed-up return for the half, which is the reason we hold a (4%) position in the Market Matters Income Portfolio. While the result was a record pretty much across the board, the commentary was more important with the company confirming its long-term strategy is to remain focused on coal, both through its existing thermal portfolio and in new opportunities in either metallurgical or thermal coal production. They said demand is continuing to outstrip supply, with future growth expected from South-East Asia. They restarted their $300m on market share buy-back and like all companies, said they think their shares are undervalued!

New Hope Corp

Mincor (ASX: MCR) $1.48

MCR +42.31%: the nickel company surged today after Andrew Forrest’s investment vehicle Wyloo lobbed a $1.40/sh on-market bid for the company. Wyloo already owns a 19.9% stake in the company which is ramping up production near Kambalda in WA along with a handful of other ore bodies in the area. Shares never traded at the bid, which was at a 35% premium to yesterday’s close with the market suspecting IGO, which owns 7% of Mincor, may put forward a competing offer. It’s not Wyloo’s first crack at a nickel play with the company picking up high-grade nickel play Noront which owns an asset in Canada.

Mincor

Broker Moves

- OFX Raised to Buy at Blue Ocean; PT A$2.30

- Ramsay Health Rated New Sector Perform at RBC; PT A$74

- Cleanaway Raised to Neutral at Credit Suisse; PT A$2.50

- Star Entertainment Raised to Outperform at Macquarie; PT A$1.65

- Healius Raised to Neutral at JPMorgan; PT A$2.72

- Healius Cut to Hold at Morgans Financial Limited; PT A$3.02

- Tabcorp Raised to Neutral at JPMorgan; PT A$1.05

- Healius Raised to Hold at Jefferies; PT A$2.60

Major Movers Today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

9 stocks mentioned