The Match Out: ASX up, Boral increases prices + grows volumes, Why Elders is getting cropped!

The ASX was higher today as company earnings took over the batten from central banks as the key driver of stocks, and overall, they were positive. The influential sectors of Financials + Materials led the line, a positive combination here rarely leads to a down day at the index level, while Energy stocks bounced back from recent weakness.

- The S&P/ASX 200 added 26 points / +0.35% to close at 7530.

- Financials (+0.90%), Materials (+0.76%) & Energy (0.23%) were up to varying degrees.

- Staples (-0.61%) and Healthcare (-0.61% the biggest drags while property (-0.44%) was also weak.

- Suncorp (ASX: SUN) +4.57% delivered a mixed result today & rallied, the banking division strong while they maintained group guidance.

- Boral (ASX: BLD) +12.78% showed that you can push through price increases and grow volumes, a good 1H23 update from them this morning.

- BWP Trust (ASX: BWP) –1.02% steady as always following results. It’s expensive but the consummate defensive property coy.

- Elders (ASX: ELD) -5.86% don’t know why their shares are getting so punished (half the problem right there!), the ASX queried them today - we give our take below.

- We think that ANZ will outperform CBA from here and have switched our holdings in the Growth Portfolio to reflect that view (still hold CBA in Income).

- Macquarie (ASX: MQG) +2.57% had a more realistic reaction to its strong quarterly yesterday, consensus was for earnings to be lower this year (v last), however, they are now guiding to marginally higher – cheeky buggers, they do this all the time!

- Centuria Capital (ASX: CNI) -3.23% fell again following yesterday’s results. We like this one, are long in 2 portfolios but can understand why it is falling. Tomorrow (day 3) is generally the time to step up for those interested.

- Newcrest (ASX: NCM) +2.61% rallied today, they are now heavily influenced by what NEM US shares do, which were up last night. Still, $25.58 undercooks the value of the stock and we doubt that Newmont will simply make one mediocre tilt & walk away.

- Iron Ore was down a touch in Asia, off -0.3%, Coal out of Newcastle was up 3.44%

- Gold edged higher, +US$4 to $US1877 at our close.

- Asian stocks were mixed, Hang Seng was up +0.23%, the Nikkei in Japan fell 0.14%, while China advanced -0.10%

- US Futures are basically flat

- Reporting tomorrow we have: AGL Energy (AGL) | Arena REIT (ARF) | Charter Hall Long WALE (CLW) | Megaport (MP1)

ASX 200 Chart

Elders (ELD) $8.83

ELD –5.86%: been a shocker of late with shares nearly halving in price at a time when agricultural businesses in Australia are meant to be killing it. In our opinion, we think it’s this disconnect between the market’s perception of their operational performance and what they’ve (now) been telling brokers in recent meetings (they have had a few this week). Market perception is that Ag is very strong, and ELD is leveraged to that strength, a view that was being pushed by their Chairman at the end of last year, however, they’re now suggesting some weak undercurrents are at play, with potential margin pressure in generic crop protection commodities which may impact near-term earnings & livestock prices off 10-15%. When the market is bullish and long a stock and there is a shift in tone from the company, selling can be quiet aggressive, which is what we’ve seen in recent sessions.

.png)

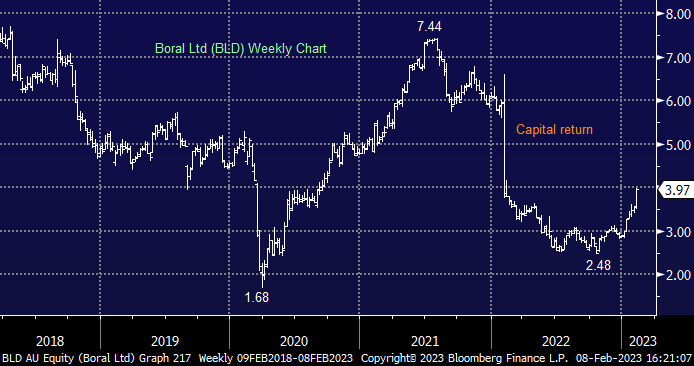

Boral (BLD) $3.97

BLD: +12.78%: A big beat from Boral today reporting 1H23 underlying net profit after tax (NPAT) of $57m, a big beat to the $37m consensus. It seems they had success pushing through higher prices while also growing volumes, a Kerry Stokes strategy that some in the market questioned given the prevailing economic backdrop - but he certainly knows what he’s doing! Volumes were up 4% with nearly all segments contributing while group revenue growth of 12% shows the success they had during the period. Margins were better (5.7% v 4.1% expected) and therefor profit was strong. They guided for flat HoH earnings (EBIT) which seems conservative. A great result and a solid read-through for others in the space.

.png)

Suncorp (SUN) $13.04

SUN +4.57%: Rallied today after posting a mixed 1H23 update. Cash NPAT was around 7% below consensus at the group level, however, General Insurance (GI) margin was solid and their soon-to-be-jettisoned banking division did particularly well, with Net Interest Margins (NIM) of 203bps, ahead of expectations. They reaffirmed key guidance measures and the momentum, particularly at the top line (gross written premiums of $4.9bn up 8%) is good.

.png)

Broker Moves

- Treasury Wine Cut to Accumulate at CLSA; PT A$16

- Beach Energy Cut to Accumulate at CLSA; PT A$1.81

- Centuria Capital Cut to Neutral at JPMorgan; PT A$2.10

- Transurban Cut to Underperform at Credit Suisse; PT A$12.30

- Region Group Cut to Underperform at Macquarie; PT A$2.52

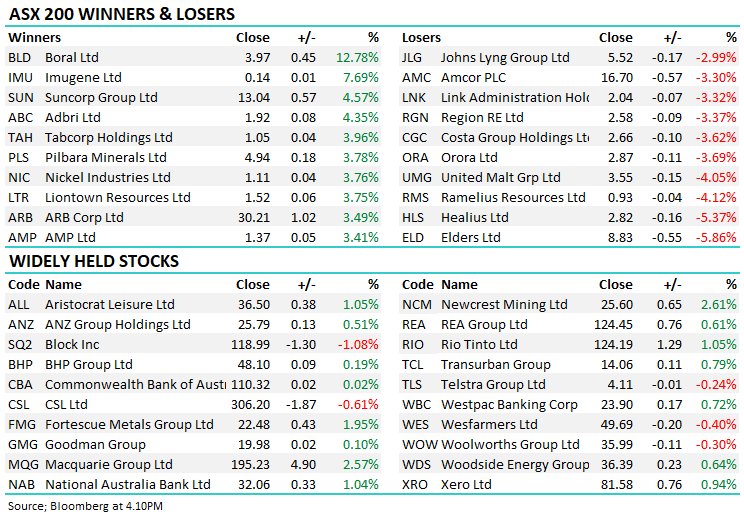

Major Movers Today

.png)

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

9 stocks mentioned