The Match Out: ASX up, but Magellan (MFG) tanks on weak FUM

What Mattered Today

Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify

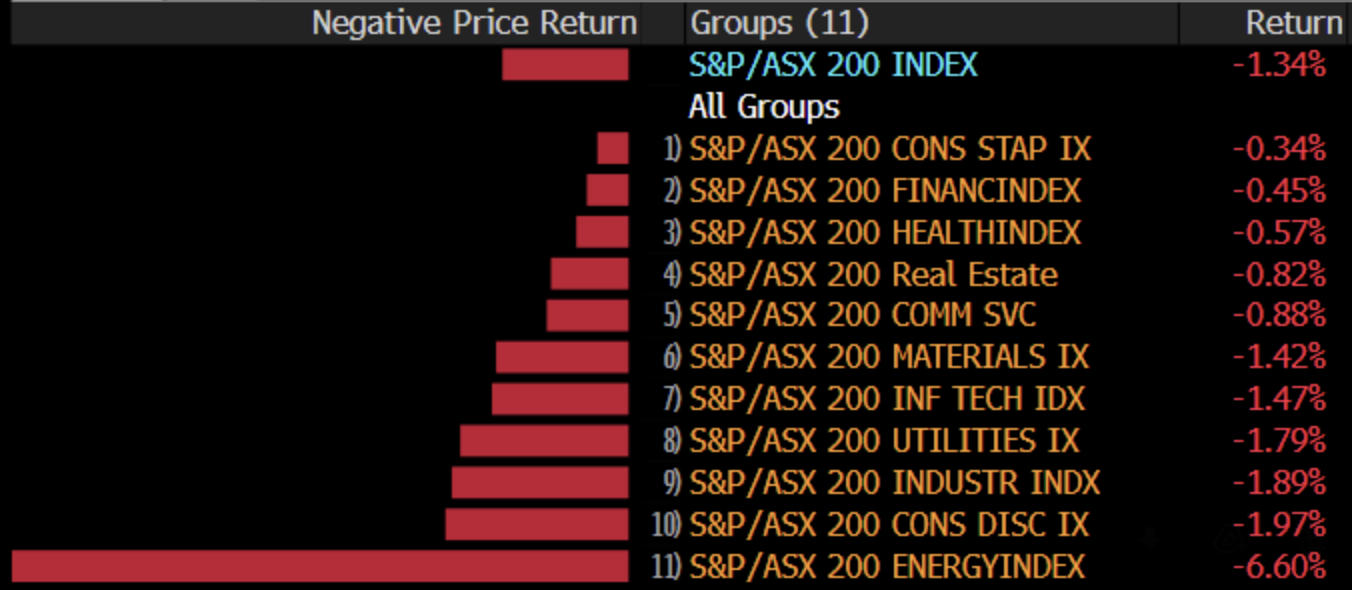

Local shares tracked higher into the weekend with the big end of town doing the heavy lifting. Banks were well supported, as were iron ore stocks as China’s Golden week wraps up and reports that the China Mineral Resources Group is getting on the front foot to secure supply for 2024. The Energy rout continued though with oil tumbling this week, a sharp ~8% decline put plenty of pressure on the sector, but it is good from an inflation perspective. Despite the recovery late this week, the ASX200 finished down -1.34%/ -94pts this week.

- The ASX 200 finished up +28pts/ +0.41% to 6954 with the large caps leading the way

- The Financial sector was best on ground (+1.21%) while Materials (+0.67%) and Staples (+0.16%) also did well.

- Energy (-0.76%), IT (-0.41%) and Property (-0.36%) the weakest links

- Of the 28pt gain by the market today, 27 points were covered between just 7 stocks -the Big 4 Banks and the Big 3 miners (BHP, RIO & FMG).

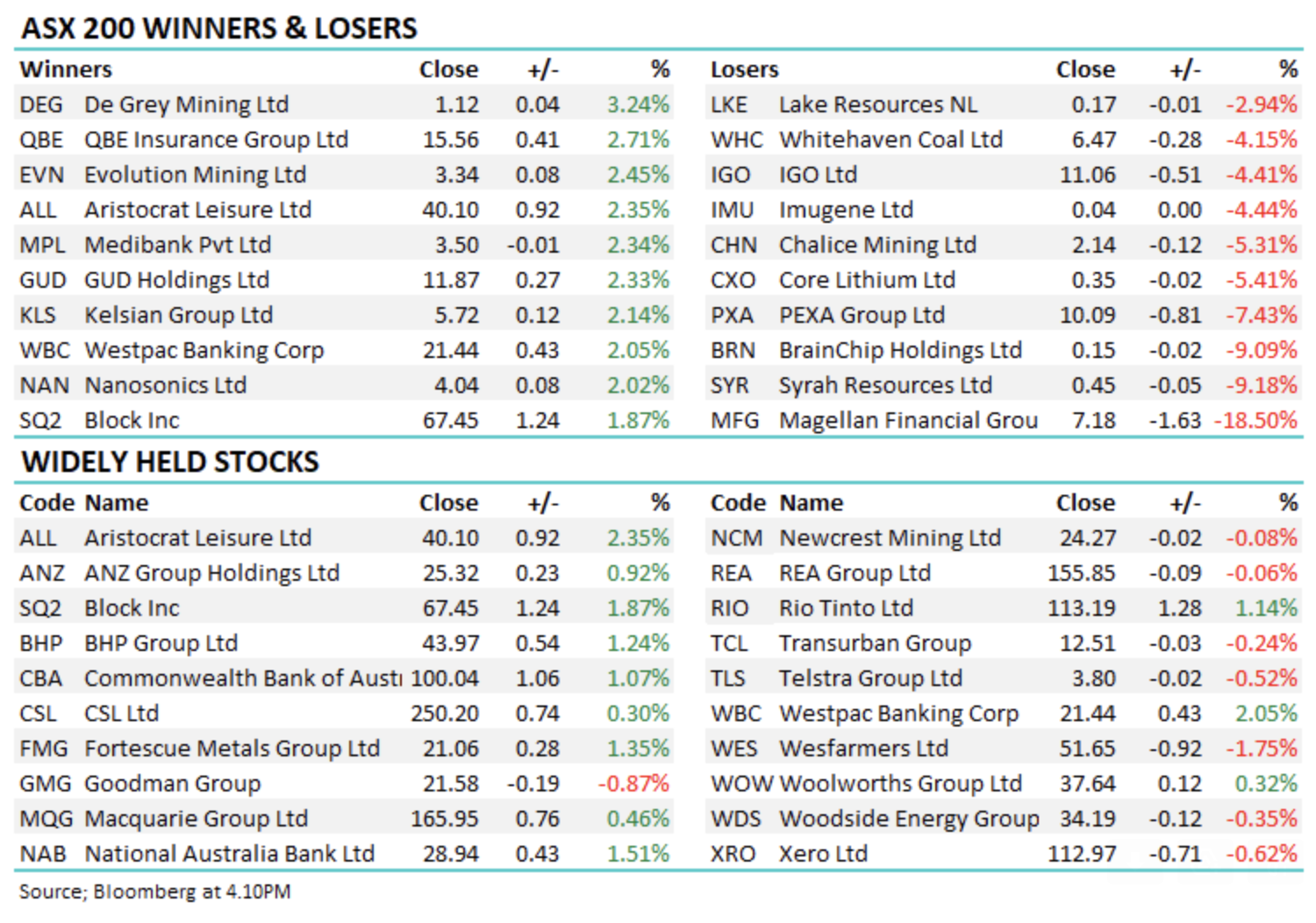

- UBS upgraded BHP, RIO & FMG from sell’s to neutral on revised long term commodity price assumptions.

- Their Iron Ore price forecasts went from $US65 to $US85, a 30% upgrade which you don’t see too often!

- Long term copper price assumptions moved up to US $4.00/lb from US$3.50/lb, driving an upgrade to Sandfire Resources (SFR) from hold to buy with $6.02 PT – we own SFR across two portfolios.

- They remain positive on Gold, and upgraded Evolution (ASX: EVN) to a buy from neutral, their revised target price of $3.70 is 13.5% above yesterdays close.

- Magellan (ASX: MFG) -18.5%, whacked today on big outflows in September which implies another loss of a mandate and weak performance across their global strategy – some observations on this below.

- GQG Partners (ASX: GQG) +3.03% rallied after reporting FUM of $US105.8bn, only a touch below the $US107.4bn it booked at end of August, implying positive net flows.

- Whitehaven Coal (ASX: WHC) -4.15% down again capping off a challenging week, weighed by softer coal prices.

- Gold was flat at $US1822.

- Asian stocks were higher, Hong Kong up 1.52% & Japan put on 0.1%, while China is back on Monday.

- US Futures are marginally lower.

- Non-Farm payrolls tonight, expecting +170k jobs to be added and the unemployment rate to dip to 3.7% (from 3.8%).

ASX 200 Index

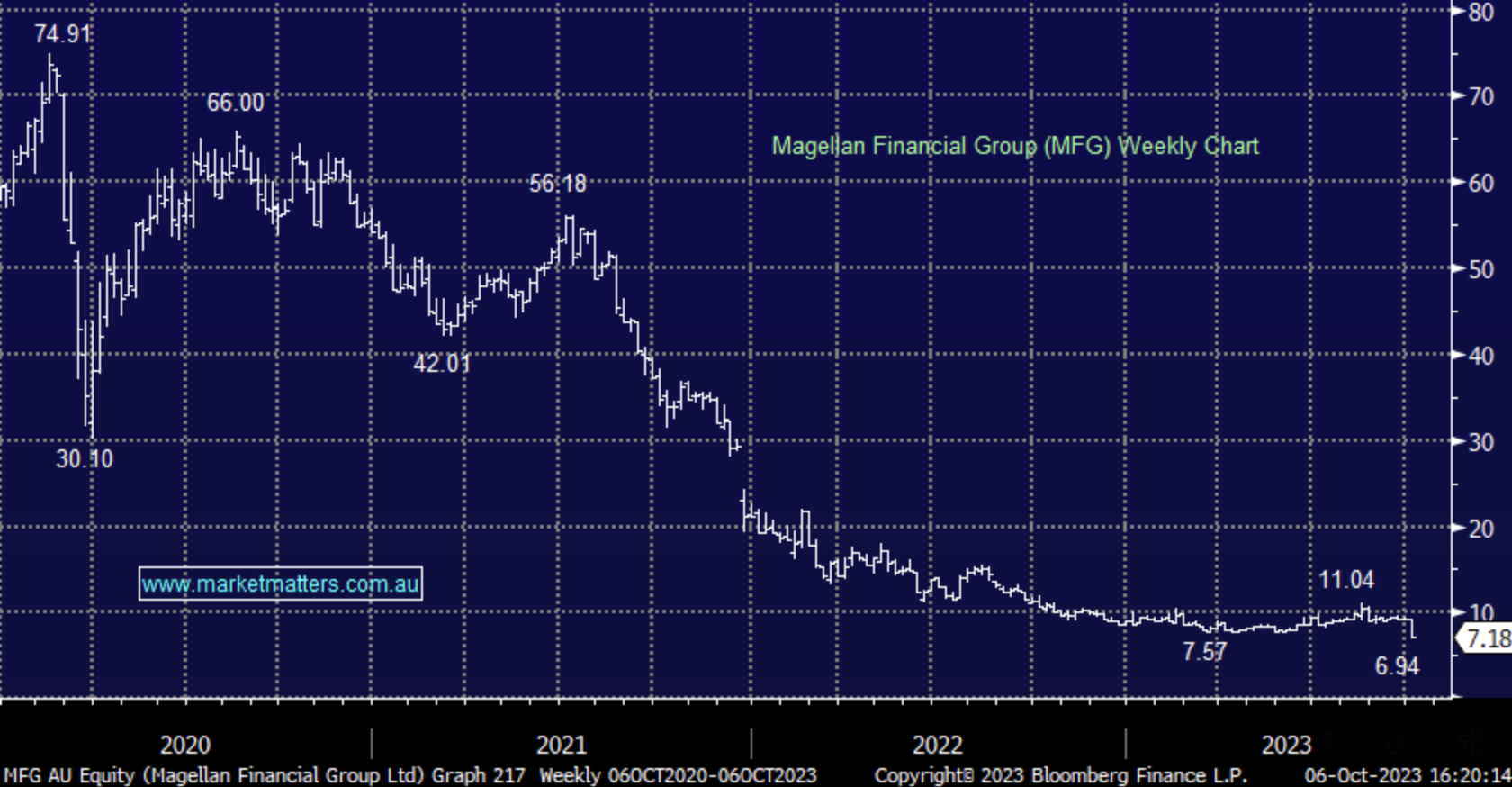

Magellan Financial Group (ASX: MFG) $7.18

MFG -18.5%: Endured a very tough session today following the resumption of big outflows exacerbated by weakness across financial markets in September. Total FUM dropped from $39bn to $35bn, over 10%, made up of $2bn in net outflows and $2bn due to market weakness. Unfortunately, details under the hood are light but we make the following assumptions/observations as owners of the stock:

- Our bullish thesis was predicated on improving performance stemming outflows, and in time leading to inflows - it looks wrong today.

- Principle investments account for around ~$5 worth of value, meaning the FUM business is priced very cheaply.

- Stemming outflows, however, was critical, and they’ve clearly lost another institutional mandate in September.

- Performance remains key, -$2bn of market-related declines implies clear underperformance in their global strategy wherever we draw the line.

- Performance impacts flows + it impacts performance fees. Without stating the obvious, it’s the lifeblood of an active manager.

- MFG had turned the performance corner at their last update, today's number suggests otherwise.

The points above imply the thesis is broken on MFG, and that might be so, the shares are screaming that we’re wrong, however, a ~$300m reduction in market cap does seem excessive. We will again reconsider our holding over the coming days.

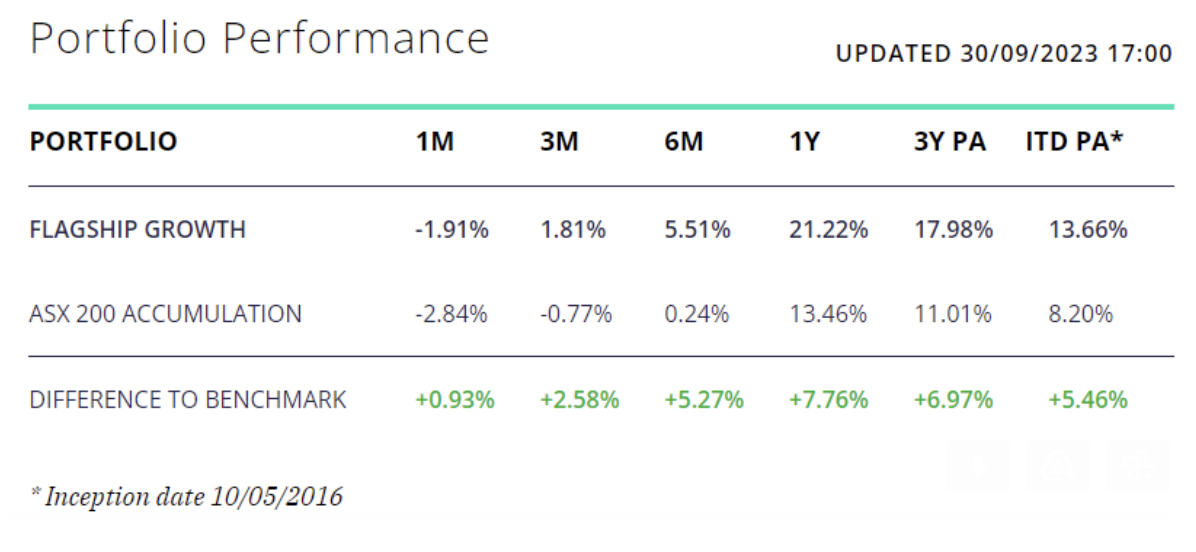

September Performance – Market Matters Published Portfolios

The performance for the Market Matters published (website) portfolios for September are as follows:

- Flagship Growth Portfolio: -1.91% vs benchmark of -2.84% and is +21.22% over 1 year (vs benchmark of 13.46%)

- Active Income Portfolio: +0.32% vs benchmark of +0.65% and is +14.96% over 1 year (vs Benchmark of +7.51%)

- Emerging Companies Portfolio: +1.42% vs benchmark of -4.04% and is +8.42% over 1 year (vs benchmark of +6.85%)

- International Equities Portfolio: -1.62% vs benchmark of -3.98% and is +18.35% over 1 year (vs benchmark of 21.49%)

Performance updates and monthly reports for Market Matters Invest will be out early next week, and are broadly aligned with the numbers quoted above.

Flagship Growth Portfolio Performance

Sectors This Week – Source Bloomberg

Stocks This Week – Source Bloomberg

Broker Moves

- St Barbara Raised to Hold at Ord Minnett; PT 20 Australian cents

- Evolution Raised to Buy at UBS; PT A$3.70

- Sandfire Raised to Buy at UBS; PT A$7.50

- Deterra Raised to Neutral at UBS; PT A$4.80

- Fortescue Raised to Neutral at UBS; PT A$20.30

- Rio Tinto Raised to Neutral at UBS; PT A$115

- BHP Raised to Neutral at UBS; PT A$43

- Carnarvon Energy Ltd Cut to Underperform at Macquarie

- Adbri Cut to Sell at Goldman; PT A$1.85

- Webjet Raised to Outperform at RBC; PT A$8

- National Storage Rated New Buy at Citi; PT A$2.60

Major Movers Today

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

4 stocks mentioned