The Match Out: Broad based selling knocks ASX off its perch

A sea of red today from Shanghai to Sydney with stocks pulling back from recent highs, the RBA’s dovish move yesterday a distant memory as local reporting stumbles into gear.

- The S&P/ASX 200 lost -96pts points / -1.29% to close at 7354

- IT (-0.45%), Healthcare (-0.57%) & Staples (-0.74%) were relative performers but all sectors finished lower.

- Utilities (-2.19%), Property (-1.95%) and Financials (-1.77%) the biggest drags.

- For what it’s worth, ratings agency Fitch downgraded the US credit rating to AA+ from AAA, reflecting expected fiscal deterioration over the next three years as well as a high and growing general government debt burden.

- Fitch have had the US on their top rating since 1994 so the move is a peculiar one. As Janet Yellen said this morning, it seems “arbitrary and based on outdated data”.

- Travel agency Helloworld (ASX: HLO) + 1.34% upgraded its FY23 earnings guidance for the 3rd time, saying underlying EBITDA would be between $42-45m. The market was already expecting $41m so not a big change (but positive none-the-less).

- AGL Energy (ASX: AGL) -4.8% hit today on a broker downgrade from Macquarie (to Neutral $11.43 PT)– we covered the stock this morning in a timely note – click here

- BWP Trust (ASX: BWP) -3.27% fell despite a broadly inline result – some value starting to emerge here after years of being too expensive.

- Calix (ASX: CXL) +2.66% signed off alongside Pilbara (ASX: PLS) +0.41% to move forward with their Lithium Spodumene processing demonstration plant. The project is aiming to reduce carbon emissions in the process by more than 80% and is just one of ~70 project Calix is currently working on. We own CXL, but it’s been weak of late.

- PSC Insurance (ASX: PSI) +2.08% after saying it now expects to deliver $111m in earnings in FY23.

- The Aussie Dollar was whacked 0.7% to 65.69c, it’s lowest level since February.

- Iron Ore was lower in Asia dragging down Fortescue (ASX: FMG) -1.96%.

- Gold was soft overnight before adding +$US5 in Asia to be $US1950 at our close

- Asian stocks were weak, Hang Seng off -2.03%, the Nikkei in Japan fell -2.36%, while China lost -0.65%

- US Futures are down, S&P -0.5% while Nasdaq Futures are off -0.76%.

- Reporting Tomorrow: Nothing of note while Block (ASX: SQ2) & Resmed (ASX: RMD) are out Friday

- Download the Market Matters Reporting Calendar Here

ASX200 chart

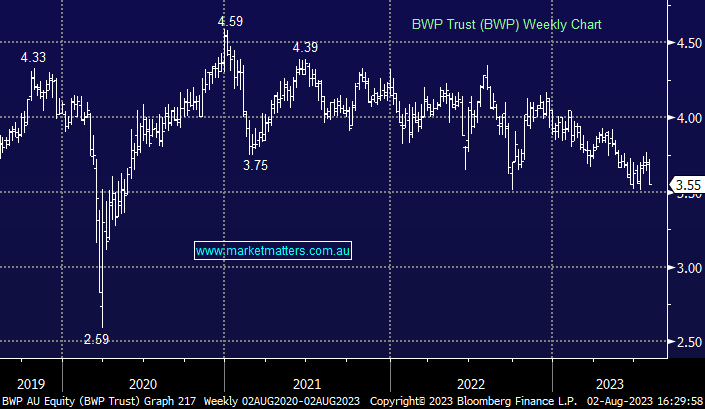

BWP Trust (ASX: BWP) $3.55

BWP -3.27%: The Bunnings landlord (85% of book leased to Wesfarmers) edged lower today in a soft market despite reporting FY23 results that were inline with expectations. Revenue of $158m v $157.7m expected with earnings per share (EPS) 17.68c v 17.9c consensus. The FY dividend of 18.29 as per programmed while they saw some slight revaluations lower of their portfolio, with reported NTA at $3.75. Nothing too much to turn the dial for BWP, although shares now trading ~20c below NTA which is a rare occurrence relative to a historical premium. Weakness across the broader property sector didn’t help shares.

BWP Trust (ASX: BWP)

Broker Moves

- AGL Energy Declines After Macquarie Downgrades to Neutral

- Pro Medicus Raised to Overweight at Wilsons; PT A$76.04

- EVT Cut to Neutral at Citi; PT A$13.30

- Sonic Healthcare Cut to Reduce at CLSA; PT A$36.40

- Netwealth Cut to Underweight at Jarden Securities; PT A$14.10

- Deterra Cut to Reduce at CLSA; PT A$4.90

- MoneyMe Raised to Speculative Buy at Morgans Financial Limited

- NTU AU Reinstated Speculative Buy at Argonaut Securities

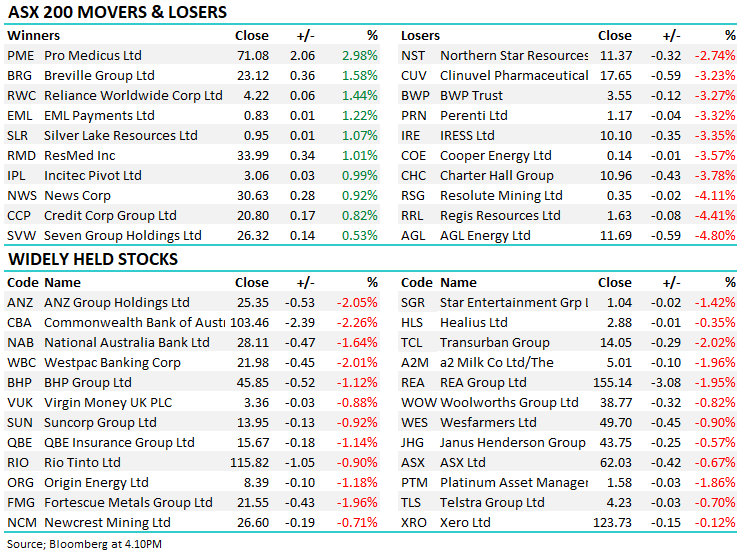

Major Movers Today

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

9 stocks mentioned