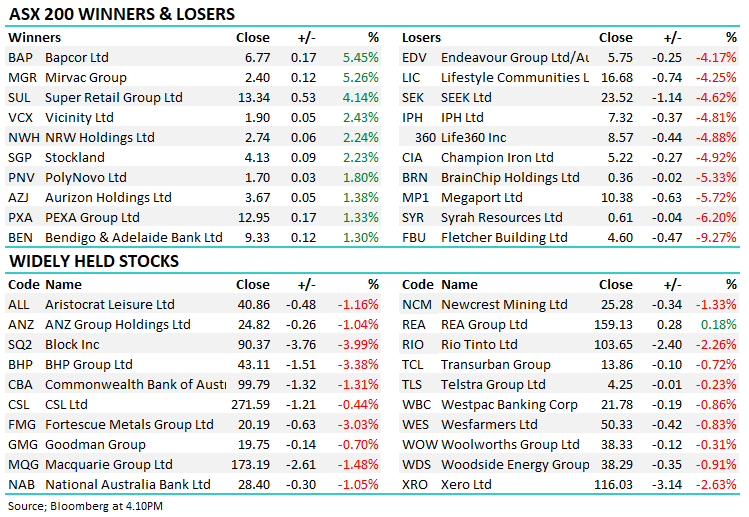

The Match Out: China jitters and US Retail sales sink ASX to 4-week low

Weakness across international equity markets bled into the ASX today with shares trading to a 4-week low. The US market struggled following better-than-expected retail sales prints leading to upwards pressure on rates. This compounded concerns around China’s property market and economic growth outlook which has weighed on equity markets across the region in recent weeks, yesterday’s rate cut from the PBOC only providing short-term relief. Reporting season is now well and truly in full swing, while CBA went ex-div today adding to the red on the index.

- The ASX 200 finished down -109pts/ -1.5% at 7195.

- All sectors finished lower, though Real Estate held up the best with -0.13% today – a mixed bag of reporting mostly supporting the sector.

- Tech -2.93%, Materials -2.63%, Financials -1.71% and Industrials -1.04% were the weakest links.

- Dexus (ASX: DXS) -3.12% Australia’s biggest office landlord lowered assets values which surprised no one. FY23 results were broadly in line but outlook commentary was a touch weak. More on that below.

- Mirvac (ASX: MGR) +5.26% a broadly inline result headlined by better-than-expected margins on residential. More bad news for office, though, as occupancy dropped to 95%.

- Vicinity (ASX: VCX) +2.43% a small beat on FY23 FFO at 14.3c vs 14.2c expected. They cut asset values by just -1.6% stating tenant health and occupancy remain healthy while guidance was a slight beat as well.

- Bapcor (ASX: BAP) +5.45% was in line, though it appeared the market wasn’t prepared for that + outlook was better than expected.

- Transurban (ASX: TCL) -0.72%slightly soft numbers for FY23 and guidance looks conservative as they promote a new CEO.

- Netwealth (ASX: NWL) -1.63% FY23 was a 1% miss to expectations but the market was left wanting more from their outlooks statements.

- Fletcher Building (ASX: FBU) -9.27% struggled despite an inline set of numbers though debt up and DPS miss was a major concern. Margins in their Australian division masked a softer underlying performance

- Endeavour Group (ASX: EDV) -4.17% a strong start to FY24 couldn’t save a weak FY23 result which missed by ~3% on profit, mostly on lower Hotel margins.

- Fineos (ASX: FCL) -15.69% raised $35m in a placement with another $5m planned through an SPP, though FY23 and FY24 commentary was soft. More on that below.

- Iron Ore was marginally higher in Asia today though the bulk miners still struggled.

- Gold was up slightly, yet still testing ~$US1,900/oz.

- Asian stocks were also broadly weaker – Nikkei, Hang Seng and HK China Index all around -1.5%.

- US Futures are all trading around flat at our close.

Reporting tomorrow: Super Retail Group (ASX: SUL), Centuria Office (ASX: COF) and NRW Holdings (ASX: NWH)

Download the Market Matters Reporting Calendar here

ASX 200 chart

.png)

Dexus (DXS) $7.76

DXS -3.12%: Shares fell today as they reported FY23 results, and offered guidance for the year ahead. The key to any result is around determining what is known information versus what is new information. For FY23, DXS booked Funds from Operations (FFO) of $738.5m ahead of consensus $728m & a dividend 51.6cps, inline with consensus expectations. FY24 guidance is for FFO to be broadly inline with FY23, which is slightly better than the current consensus (50.5cps) implies, while they have guided to a DPS of 48cps versus 50.5c consensus. Assets were revalued (lower) by ~6.9% which led to a net loss of $752.7m. Putting that number into perspective, it took 11.4% off the NTA, which declined to $10.88 per share, which as of today’s close, places the stock at a ~29% discount to NTA.

* Coming into this result we were well aware of likely asset revaluations lower, soft earnings and a tough outlook, our premise for owning DXS is that the discount to NTA is too great, for the quality of their underlying asset base, solid balance sheet (gearing 27.9% /84% hedged), while we can pick up a 6% (unfranked) yield while we wait for global office fundamentals to turn.

.png)

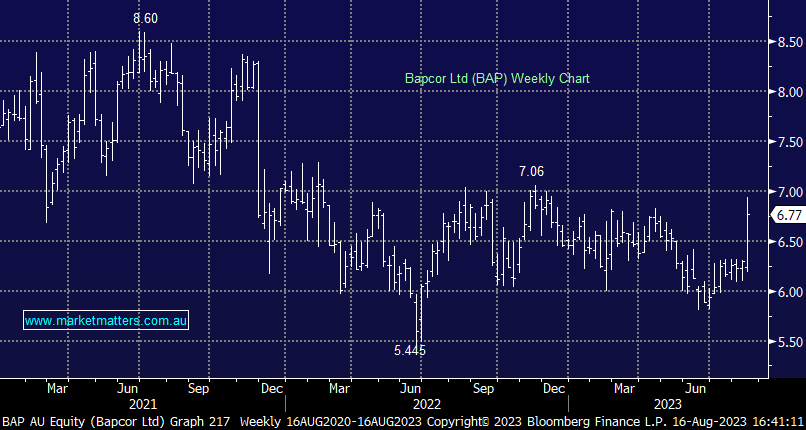

Bapcor (BAP) $6.77

BAP +5.45%: Shares rallied today after the automotive parts company put out FY23 results that were broadly in line with consensus. Revenue of $2b was as expected, Net Profit After Tax (NPAT) $125.3m vs $127.8m is ~2% short while the final dividend is slightly better at 11.5c vs 11c expected. The second half was highlighted by higher cash conversion rates as the company looked to reduce inventory levels. They have begun to implement the “Better than before” program which aims to improve operating efficiency across the group with the aim of “achieving at least a $100m” EBIT improvement by FY25 with early initiatives being passed through as expected, supporting an improvement in FY24. The stated aims look ahead of market expectations with consensus expecting a $65m increase in EBIT by FY25.

The outlook guidance was largely broad brush commentary, looking for Trade growth to return to more normalized longer-term levels, wholesale to improve on consolidation opportunities, and retail to continue to face headwinds while NZ is likely to see an improvement in FY24. The company noted cost headwinds remain, particularly on interest costs however the balance sheet is in good shape and the company is well placed to continue to grow. BAP is trading on a 12% discount to its historical average PE, a sign that investors were largely expecting a weaker set of numbers at today’s result.

* We expect the market to like the progress on their “Better Than Before” targets, on track to deliver at least $100m uplift in EBIT by FY25.

.png)

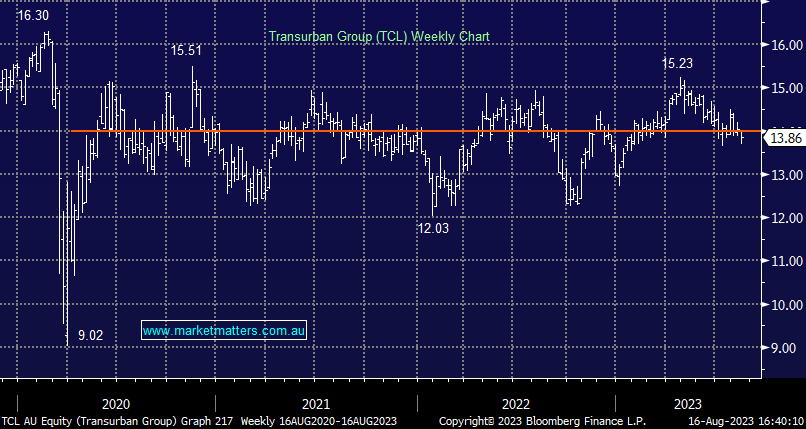

Transurban (TCL) $13.86

TCL -0.72%: The toll road operator reported FY23 results that were a touch light on. Proportional EBITDA of $2.448m was ~2% below consensus while the dividend of 58cps had already been announced. For FY24, they expect distributions of 62cps (v 62.5cps consensus), but they mentioned this was likely to include WestConnex cash previously held during construction (which is 3-4cps), which implies a softer underlying result, although worth bearing in mind, they like to upgrade distribution guidance through the year and this could give some ammunition to do that. While debt is high, it’s 96% hedged as you’d expect while inflation-linked tolls should also help with top-line growth. TCL also announced a new CEO, the impressive Michelle Jablko to take the reins from retiring CEO Scott Charlton.

.png)

Fineos (FCL) $2.15

FCL -15.69%: back online after raising $35m in new equity, the insurance software company struggle on its return to the boards. It is a frustrating raise from a few aspects, but mostly we think it was premature and very likely unnecessary. We recently bought FCL on the view that they were on track to be cashflow positive in the 2H of FY24 while we saw a pathway to that based on the cash burn rate and cash balance in 4Q23 while adding a key new contract to the books in June which supported that view. Despite that, the company went with a raise at $2.25/sh, an 11.8% discount to close on Monday. The raise also came with an update regarding FY23 and FY24 expectations with Revenue slightly below but EBITDA slightly ahead of expectations.

.png)

Broker Moves

- Computershare Falls Most Since May as CLSA Cuts to Accumulate

- REA Group Raised to Overweight at Morgan Stanley; PT A$200

- Treasury Wine Raised to Add at Morgans Financial Limited

- Sims Raised to Neutral at Macquarie; PT A$16.20

- Seek Cut to Neutral at JPMorgan; PT A$27

- Pro Medicus Raised to Hold at Morgans Financial Limited; PT A$66

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice-daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live

2 topics

12 stocks mentioned