The Match Out: Commodity markets weigh on ASX ahead of Thanksgiving

The daily Match Out for Thursday 23 November with James Gerrish of Market Matters.

Weakness across resources weighed on the ASX200 today, with Iron ore taking a breather from its recent rally and oil markets on the back foot as OPEC uncertainty weighs on Energy markets. Volume was light and is expected to remain so into the weekend given the US Thanksgiving Holiday takes place tonight. With little reason to make a conviction call today and a large portion of the index facing a commodity headwind, the index closed on session lows.

- The ASX 200 finished down -44pts/ -0.62% to 7029

- The Telcos Sector (+0.20%) was best on the ground, while Real Estate (+0.11%) was the only other sector in the black

- Materials (-1.44%) was the weakest area of the ASX, followed by Energy (-1.35%).

- AMP (ASX: AMP) +5.88%% finally putting to bed their disastrous buyer of last resort (BOLR) facility, settling with claimants for $100m. Despite being double what the company had provisioned for, the deal is a win for AMP, finally putting the issue to bed.

- Nick Scali (ASX: NCK) -6.71% MD Anthony Scali sold a good chunk of stock this morning, 4.6m shares worth just over $50 million. He remains the biggest shareholder with ~8% of shares on issue despite selling around 40% of his holding. The trade was done at $11/sh, which was a ~5% discount to yesterday’s close but NCK finished below that today.

- Origin (ASX: ORG) +1.07% has delayed the shareholder vote on Brookfield’s takeover that was due this afternoon. The suitor is pressing their case, even offering a few different paths - $9.43/sh in cash or scrip in the new entity, or splitting the energy markets business out. The vote is now scheduled for December 4, more uncertainty weighed on shares today.

- TPG Telecom (ASX: TPG) -0.21% increased their mobile coverage spectrum, adding 3.7 GHz spectrum to their 5G coverage for $128m

- Austal (ASX: ASB) +3.22% hit a 3-month high after it announced a deal with the Australian Government as a strategic partner in WA and picked up two new orders totalling $157 million of work.

- Iron Ore fell -1.6% in China, taking a breather after hitting long-term highs yesterday.

- Gold was up 0.25% today, $US1995/oz though most gold stocks struggled.

- Asian stocks were mixed with Japan’s Nikkei closed. Hang Seng was marginally higher but China is marginally lower.

- US Futures are flat at our close. The US market is closed tonight for the Thanksgiving holiday.

ASX 200 Index

Broker moves

- Netwealth Raised to Positive at Evans & Partners Pty Ltd

- Praemium Cut to Market-Weight at Wilsons; PT 40 Australian cents

- Pacific Smiles Cut to Underweight at Wilsons

- Gold Road Rated New Hold at Moelis & Company; PT A$1.90

- Red 5 Rated New Hold at Moelis & Company; PT 35 Australian cents

- Genesis Minerals Rated New Buy at Moelis & Company; PT A$2

- Silver Lake Rated New Buy at Moelis & Company; PT A$1.45

- Alkane Rated New Buy at Moelis & Company; PT A$1.05

- F&P Healthcare Rated New Underperform at Jefferies; PT NZ$19.50

- Anteris Technologies Ltd Rated New Buy at CLSA; PT A$28

- City Chic Raised to Speculative Buy at Evans & Partners Pty Ltd

- EVT Reinstated Accumulate at CLSA; PT A$12.65

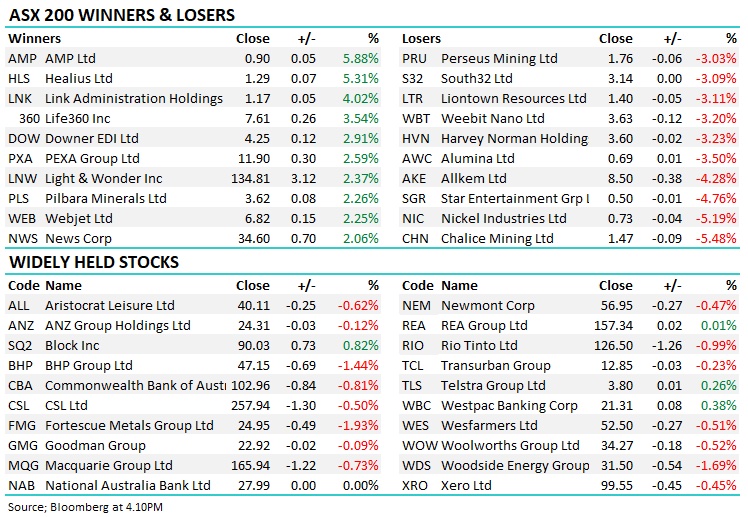

Major movers today

Enjoy the night,

The Market Matters team.

Never miss an update

Enjoy this wire? Hit the ‘like’ button to let us know.

Stay up to date with my current content by

following me below and you’ll be notified every time I post a wire

James is the Lead Portfolio Manager & primary author at Market Matters, a digital advice & investment platform with over 2500 members that offers real market intel & portfolios open for investment. He is also a Senior Portfolio Manager at Shaw and Partners heading up a team that manages direct domestic and international equity & fixed-income portfolios for wholesale investors.

........

Livewire gives readers access to information and educational content provided by financial services professionals and companies ("Livewire Contributors"). Livewire does not operate under an Australian financial services licence and relies on the exemption available under section 911A(2)(eb) of the Corporations Act 2001 (Cth) in respect of any advice given. Any advice on this site is general in nature and does not take into consideration your objectives, financial situation or needs. Before making a decision please consider these and any relevant Product Disclosure Statement. Livewire has commercial relationships with some Livewire Contributors.

2 topics

5 stocks mentioned

Comments

Comments

Sign In or Join Free to comment