The Match Out: Energy the star, IT struggled again, Qantas (QAN) goes pro-growth

This morning, the ASX opened better than the overnight market was implying before a sell-off in US Futures saw the index drop around 60pts between 11 am to midday before an RBA inspired recovery played out into the afternoon – a choppy session! Higher interest rates globally has been putting downward pressure on Tech stocks and that was the obvious theme again in Australia today – IT down approximately 3%, while Energy which was up about another 2.4%

- The ASX 200 fell -30pts /-0.41% to 7,248 today – the 'three steps forward, two back' sequence continues

- Energy and Utilities are up, IT and Telcos are down. But there was good buying across the market today from the lows – decent reversals in many stocks

- There is a growing belief that oil prices could continue to spike but more importantly, be very well supported in the medium term given not enough investment to replenish falling supplies. That is a theme I’ll cover in this weeks Live Webinar on Thursday - Register Here - Be quick the webinar is almost full.

- The RBA kept the interest rate unchanged as expected today with the 0.10% target for the cash rate and the three-year Australian government bond yield retained.

- They’ll also continue to purchase $4 billion worth of bonds each week until mid-February 2022. They say “This setback to the economic expansion in Australia is expected to be only temporary, as vaccination rates increase further and restrictions are eased, the economy is expected to bounce back.”

- They talked about the risks to housing, and it now seems likely that higher loan serviceability buffers are only a matter of time for Australian borrowers – i.e. making it tougher to get finance to buy into this hot housing market. We know prices follow supply in terms of both credit and stock (volumes of properties) and we’ll now likely see tighter credit and more stock coming on which should put a cap on prices.

- Importantly, the RBA reiterated that rates are likely to remain on hold until late 2024

- Redbubble (RBL) +7.19% had a good session after Morgan Stanley initiated coverage with an overweight and $6.50 price target (stock closed today at $4.47).

- Lithium stocks were interesting today – decent buying into early morning lows with the sector achieving our downside targets i.e. PLS, ORE & IGO look very good here for ~20% upside

- Qantas (QAN) -1.2% made a pro-growth move today which is a nice change – more on that below

- Energy stocks again the standout, Woodside (WPL) up ~4% the star, Santos (STO) & Oil Search (OSH) up ~2.4% - we continue to like the sector

- Gold stocks did pretty well today and the worm is gradually turning here, Gold in Asia flat down US$4 at US$1757

- China is closed for the start of this week – back Thursday, Hong Kong was marginally higher

- US Futures are trading largely flat

ASX 200 Daily Index Chart

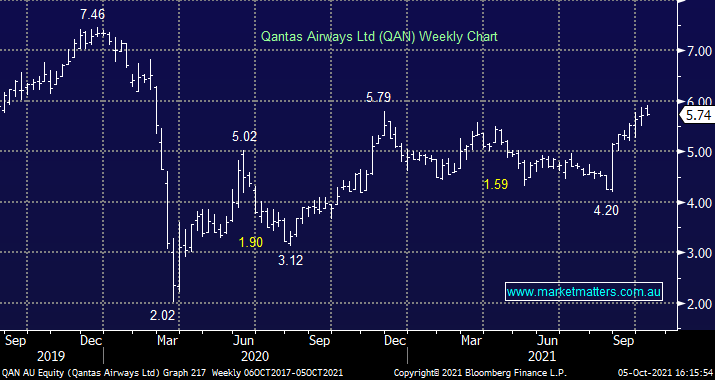

Qantas (QAN) $5.74

QAN -1.2%: Nice to be on a call today that was bullish / pro-growth from a travel stock - with Qantas outlining their intention to buy more than 100 new planes worth in excess of $9 billion as it pushes ahead with plans to start ultra-long flights non-stop between Sydney and New York plus London.

QAN will bring in the new aircraft by 2034 to renew its ageing domestic fleet of Boeing Co. 737-800s and smaller Boeing 717s with a decision due in December. However, we won’t have to wait that long to go to New York or London non-stop from Sydney. QAN says these services will start as soon as 2024 using the Airbus’s A350-1000 for the flights. I’m also hearing that leave for pilots is now getting harder to come by with demand ratcheting up into Christmas – a very good sign.

MM is long & bullish QAN

Broker moves

- Nick Scali Raised to Neutral at Jarden Securities; PT A$12.40

- Redbubble Rated New Overweight at Morgan Stanley; PT A$6.50

- Origin Energy Raised to Outperform at RBC; PT A$6

- Sonic Healthcare Raised to Outperform at CLSA

- Sonic Healthcare Raised to Buy at Jefferies; PT A$45.75

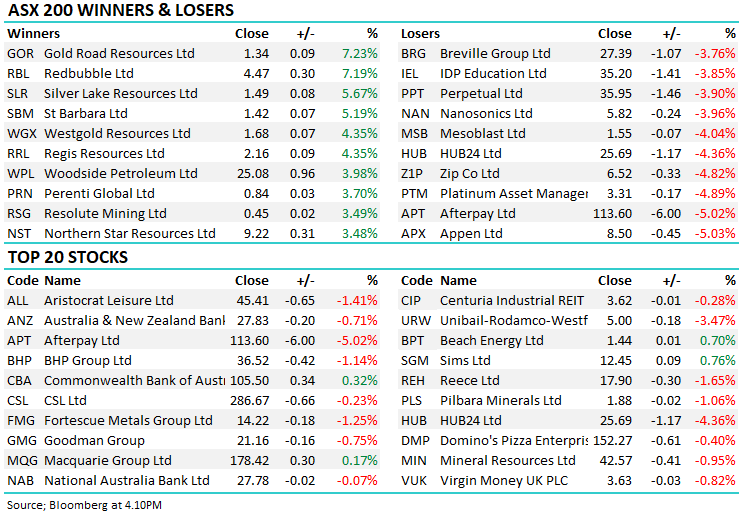

Major movers today

Commodities – where to from here?

Join me and analysts Peter O’Connor & Michael Clark from Shaw & Partners on Thursday 7 October at 11:30am for a discussion on iron ore, coal, nickel, uranium and everything commodities.

To register for this webinar, please click here.

1 stock mentioned