The Match Out: Market down ahead of US rates decision, Aussie wages on the rise

It was a choppy session for the ASX, the market showing early signs of stabilisation to be down only marginally before weakness crept into US futures which dragged the local index lower by the close. The US Federal Open Markets Committee concludes its meeting on interest rates tonight, where it will raise rates, probably by 0.50% or potentially a more aggressive 0.75%. Recent leaks imply the latter, while there have been growing calls to bite the bullet and raise by 1%. A 0.5% hike would deliver a US benchmark interest rate of 1.25%-1.50%

- The ASX 200 finished down -85pts/ -1.27% at 6601 – 6600 is key support which is holding for now (just).

- The Communication sector was the best relative performer (-0.18%) while Staples (-0.64%) & Utilities (-0.74%) also outperformed the weakness – pretty much a carbon copy of yesterday.

- IT (-3.09%) and Real-Estate (-2.94%) were knocked again while Energy is now pulling back after a great run.

- The Fair Work Commission raised the minimum wage today, underpinning more concern around inflation and thus interest rates which explain the sector performances above.

- Australian 3-year bond yields are now at 3.69%, the 10 years pushed up through 4% to settle this afternoon at 4.20%!! Yields across the curve were up around 24bps.

- The RBA Governor Philip Lowe said in an ABC interview last night he expects inflation to peak at 7% in the December quarter – that’s higher and further out than originally thought, hence the move in bonds and yield-sensitive sectors today.

- Real Estate stocks have been belted, National Storage REIT (ASX: NSR) closed today at $2.09 down from $2.78, Abacus (ASX: ABP) $2.60 having been as high as $3.90, Centuria (ASX: CNI) $1.86 having been $3.60. These are big sell-offs in commercial real estate, those in the unlisted space will not be seeing this (yet) but it will happen in time on revaluations. If inflation is contained and rates fail to reach the markets hawkish expectations, this will be a sector to pile back into for yield-focused investors – but not yet.

- Chinese stocks are proving resilient trading to a new 3-month high – clearly some support coming from the coffers.

- The US is set to raise interest rates tonight, 0.50% is the consensus however they could easily do more given the hotter-than-expected inflation print last week.

- Bitcoin is still trading around US$21,000 – the news flow here continues to be poor.

- Iron Ore was around 2% lower today.

- Gold was up in Asia today, around US$1820 at our close.

- Asian stocks were mostly positive, Hong Kong was up +1.36%, China was up +1.30% while Japan fell -1.43%

- US Futures are all up, around +0.50%

ASX 200 chart

Wages

The Fair Work Commission moved to lift the minimum wage by 5.2% this morning, slightly above the expected 5.1% to increase a full-time employee by $40/week. Retailers, given their heavy award wage workforce, struggled in the lead-up to the announcement, but they outperformed for much of the session today with the “sell the rumour, buy the fact” analogy playing out. Perhaps a lift in wages will bolster consumer confidence and lead to a lift in demand. That trade softened into the close, though staples held up reasonably well in the end. Consumer stocks were caught up in the risk-off selling ahead of the FOMC decision due out early morning local time tomorrow. Interestingly, Woolworths (ASX: WOW) also announced it would freeze prices on a list of home brand everyday items until the end of the year due to rising inflation, to ease the cost of living pressures on their customers.

Woolworths (ASX: WOW)

Broker moves

- Lynas Rated New Buy at Barclay Pearce Capital; PT A$10.23

- Computershare Raised to Overweight at JPMorgan; PT A$26

- Capricorn Metals Rated New Neutral at Barrenjoey; PT A$4

- Clean Seas Seafood Rated New Buy at SpareBank; PT A$1.09

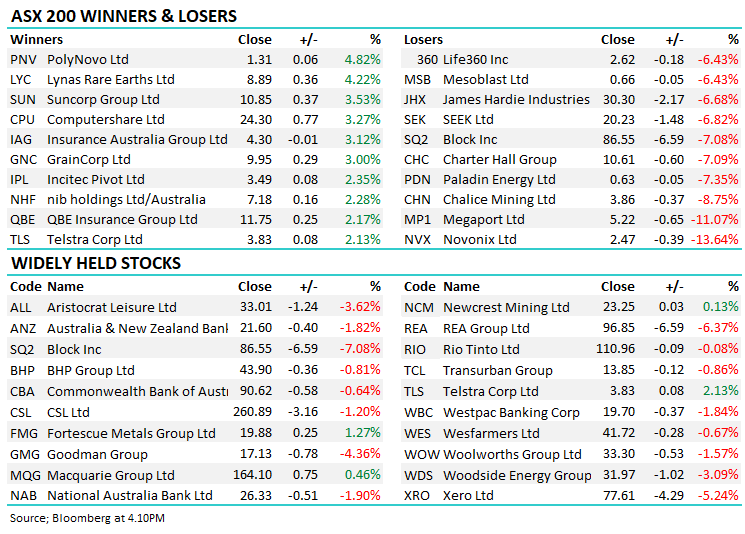

Major movers today

Have a great night,

The Market Matters team.

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

2 topics

3 stocks mentioned