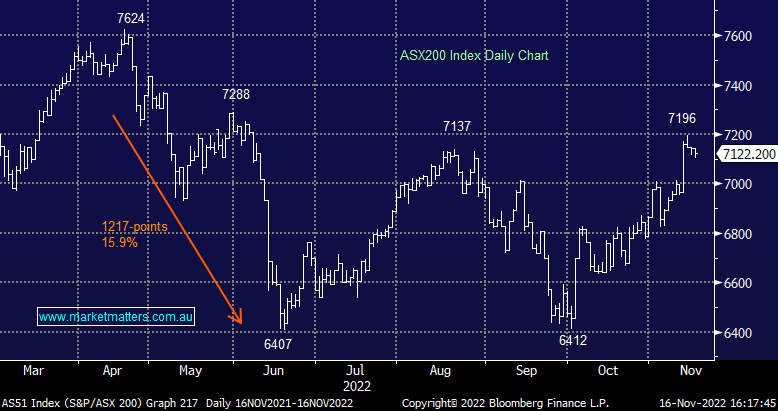

The Match Out: Market drifts, Oz Minerals (OZL) bid again, Aristocrat’s (ALL) guidance disappoints

Another day of consolidation for the ASX, a tight range as stock-specific news dominated, although, a lack of selling from a broader context following a solid ~12.5% rally from the lows on the ASX200 is the clear takeaway.

- The ASX 200 finished down -19pts/ -0.27% at 7122

- The Energy sector was best on ground (+1.18%) while Materials (+0.67%) & Property (+0.35%) were also strong.

- Utilities (-1.47%), Consumer Discretionary (-1.27%) & Financials (-1.02%) the weakest links.

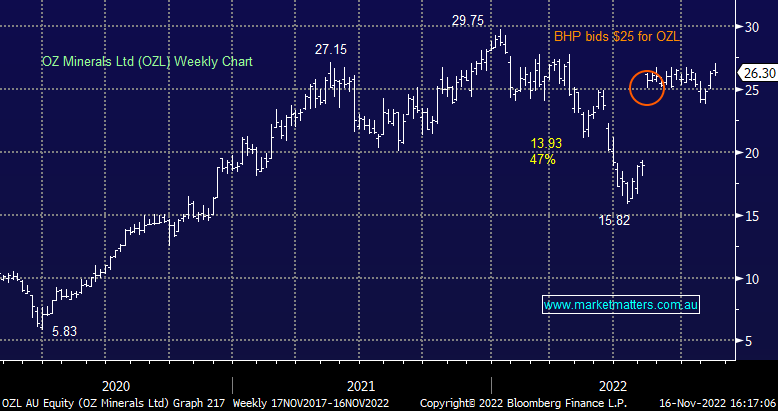

- Oz Minerals (ASX: OZL) in a trading halt pending a change of control transaction. Could be BHP coming back to the table or someone else.

- BHP Group (ASX: BHP) +1.16% was trading and edged higher – the OZL deal would represent less than 5% of BHP’s market cap so not deemed material.

- Sandfire (ASX: SFR) +6.7% was strong with the read-through from OZL being positive.

- Nufarm (ASX: NUF) +8.86% rallied on a good FY22 result plus guidance assumes growth in FY23 – which the market was not positioned for.

- Graincorp (ASX: GNC) -2% fell despite delivering a cracking FY22 result, the issue being that it will be difficult to repeat in FY23 given capacity constraints and current conditions.

- HUB 24 (ASX: HUB) -0.17% held their AGM but gave no new insights, just reiterated their strong story.

- Capitol Health (ASX: CAJ) -4.55% said they would now start closing unprofitable sites at their AGM today.

- Calix (ASX: CXL) -0.82% had a largely uneventful AGM having released a flurry of recent updates.

- Sezzle (ASX: SZL) +14.95% reported a lower net loss than expected, Zip Co (ASX: Z1P) +12.14% also rallied.

- Lithium shares recovered some of yesterday’s losses, IGO the best of them adding +3.97%.

- Coal prices jumped overnight, up 6% and that flowed through to coal stocks today, Whitehaven Coal (ASX: WHC) +5.83% & New Hope (ASX: NHC) +4.14%.

- Aristocrat Leisure (ALL) -5.02% fell on their more tepid growth outlook. Portfolio Manager James Gerrish discussed this morning on Ausbiz – Watch Here

- Commonwealth Bank (ASX: CBA) -1.78% only saw broker downgrades following yesterday’s quarterly.

- Iron Ore was ~2% higher in Asia today supporting Fortescue (ASX: FMG) +2.32% & RIO +1.55%

- Gold was up overnight to ~US$1780 before tracking down -US$7 in Asian trade today, settled $US1773 at our close.

- Asian stocks were mostly down, Hong Kong down -1.30%, Japan flat while China was off 0.5%.

- US Futures are largely flat.

ASX 200 Chart

Oz Minerals (ASX: OZL) $26.30

OZL (halted): was in a trading halt today pending the announcement of a change of control transaction - a takeover in other words. As we know, BHP bid $25 a share for the Copper miner and that price was rejected without giving BHP the chance to look under the hood. Two things could be happening here:

- BHP could have made a new bid which is clearly ‘Material’ for OZL (hence the trading halt), but not for BHP given it would represent less than 5% of their market cap, however, while the letter of the law says BHP don’t need to be halted, the profile of this deal in Australia is big and we would have thought BHP would stop trading while the news was being worked through.

- This brings up the prospect that another suitor has joined the fray, whether that’s Glencore or some other global player, it would certainly make things more interesting and create more tension in the price

Our well-regarded (Shaw) analyst on OZL Peter O’Connor wrote this recently…. To get to GAME point BHP may need to think closer to $40/share. Our recent missive, which joined the dots to peer RIO vs TRQ bid – highlighted that a $40/share valuation was not out of the question.

.png)

Aristocrat Leisure (ASX: ALL) $35.98

ALL -5.02%: Was weaker today following their FY22 results that were inline with expectations. Revenue of $5.57bn was +17% on FY21 and inline with consensus while underlying net profit was up 27% and also inline. The issue stemmed from the outlook with the company saying that they expect earnings to be higher in FY23 than FY22, although they failed to put a number on it (the market was positioned for +13%) while they went on to site some challenges in bookings from Pixel United compared to recent years. We’d expect some downgrades to flow ion the back of this.

.png)

Capitol Health (ASX: CAJ) 31.5c

CAJ -4.55%: the diagnostic imaging company hosted their AGM today with shares closing weaker on the session. They flagged a number of near-term efforts to drive further revenue growth including an additional 8 radiologists to be brought on by next quarter and adding a number of MRI machines to improve margins. YTD Revenue was down -1.8% though, as the company cycles strong growth last year but also closes down unprofitable sites potentially improving margins. Overall it looks like a solid update with CAJ cleaning up the business. The balance sheet remains in great shape adding that there is a potential for further M&A.

.png)

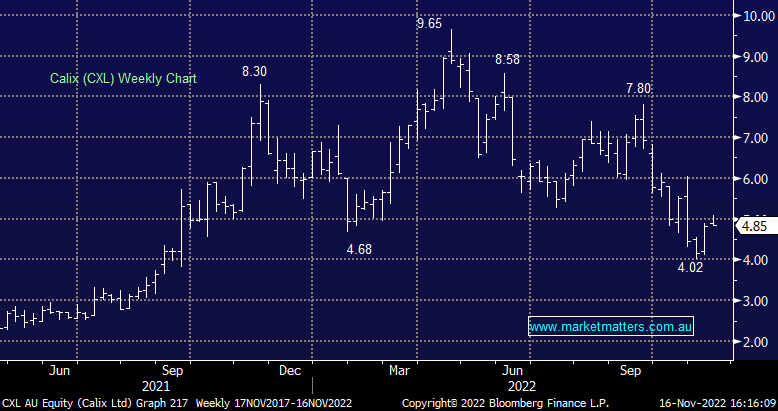

Calix (ASX: CXL) $4.85

CXL -0.82%: the green industrial solutions company hosted their AGM today with shares slightly lower on the day. There was little new news from the company today, more so highlighting progress in their technology across cement & lime, mineral processing, water purification and biotech applications. They recently completed a $60m raise, and upside the concurrent SPP from $20m to $21.6m, providing full allocations to all applications here. As a result, they are well-placed in terms of balance sheet strength and have more than 60 projects in the works. Selling after the raise & SPP was likely the reason shares were lower today, with this overhang expected to ease over the next week.

.png)

Broker Moves

- F&P Healthcare Rated New Overweight at Morgan Stanley

- Lifestyle Communities Cut to Hold at Canaccord; PT A$18.80

- CBA Cut to Negative at Evans & Partners Pty Ltd; PT A$84

- Incitec Cut to Neutral at Credit Suisse; PT A$3.92

- CBA Cut to Underweight at JPMorgan; PT A$96

- CBA Cut to Underperform at Credit Suisse; PT A$97.50

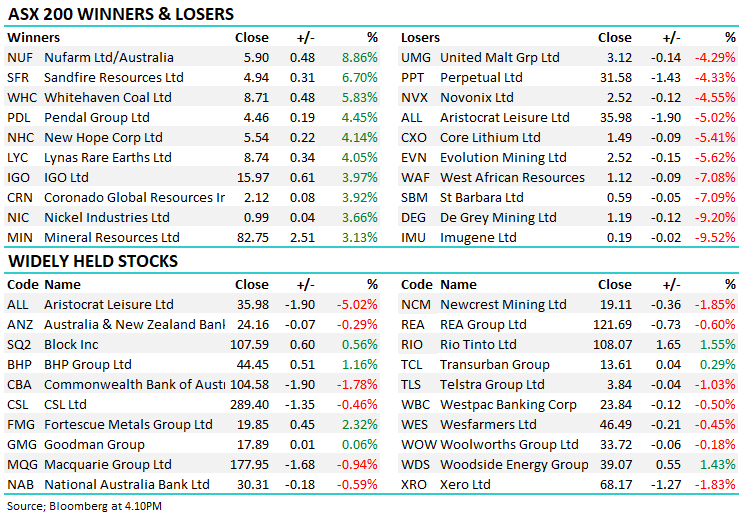

Major Movers Today

.png)

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

16 stocks mentioned