The Match Out: Market falls as RBA lifts rates + says more to come, Macquarie (MQG) now expected to grow earnings, Transurban (TCL) CEO to step down

The market opened lower in line with overseas indices, however, buyers stepped up mid-morning and things turned positive, for a while at least. That was until Philip Lowe came to the parapet at 2.30pm and raised rates by 0.25%, taking the cash rate to 3.35% which was widely tipped, however, his rhetoric was a lot more hawkish than expected which sent bond yields higher, the AUD higher, and equities lower.

Markets @ Midday: Daily podcast covering the ASX, each trading day at lunchtime – Listen Here

- The ASX 200 finished down -35pts/ -0.46% at 7504

- The Energy sector was best on ground (+0.48%) while Utilities (+0.14%)was the only other sector in the green

- Real Estate (-1.59%), Healthcare (-1.41%), Consumer Discretionary (-1.27% and Consumer Staples (-1.17%) were the four sectors with a drop of more than 1% today.

- The RBA increased rates today by 25bps as expected today, taking the benchmark interest rate to 3.35%, however, the commentary was more hawkish than expected with more hikes to come (it seems).

- Bond yields went up as a consequence with Aussie 2 years +16bps to 3.23% while the 10 years added +14bpos to 3.61% - clearly the market was not positioned for Lowes rhetoric.

- The AUD advanced and is back trading US69.30c.

- Portfolio Manager James Gerrish providing his take on markets with Alan Kohler on Talking Finance – Listen Here

- Research Lead Shawn Hickman talking the Newcrest (NCM) takeover and how Market Matters intend to play it – Watch Here

- Macquarie (ASX: MQG) +0.72% said earnings for FY23 are tracking slightly ahead of FY22, which is a positive update. Consensus was sitting lower.

- Centuria Capital (ASX: CNI) -5.58% had some swings and roundabouts in their 1H23 result today, maintaining FY23 guidance but talking to higher funding costs.

- Transurban (ASX: TCL) -0.57% upgraded distribution guidance while announcing the departure of their long-standing CEO.

- Nuix (ASX: NXL) +43.65%, successfully defends legal proceedings brought by their former CEO.

- Iron Ore was ~1% lower in Asia today, Fortescue (ASX: FMG) +0.41% & RIO -0.90% a mixed bag.

- Coal prices rallied, the active futures contract +9% in Asia supporting Whitehaven (ASX: WHC) +1.89% and New Hope (ASX: NHC) +3.7%, although both were up a lot more early on.

- Gold was up overnight and continued to hedge higher in Asia, settling $US1873 at our close.

- Asian stocks were okay Hong Kong up +0.76%, Japan -0.11% while China was up +0.22%

- US Futures are all up, but only marginally.

ASX200 chart

Centuria Capital (ASX: CNI) $1.86

CNI -5.56% Out with 1H23 results this morning (3mins before mkt open which is ridiculous), and there were some swings and roundabouts in the numbers. Operating earnings per security (OEPS) of 7.4c and a 1H Dividend of 5.8c was inline with expectations while they maintained FY23 guidance for OEPS of 14.5c and distribution of 11.6c. Performance fees were a positive while total Assets Under Management (AUM) was strong, and ahead of our expectations. The main negative in the result was higher funding costs which came in at $15.6m for the half versus $8.4m in the 1H22 while asset values were down ~$100m, which seems very light on considering their total AUM – need to seek some clarification around this.

Centuria Capital

Macquarie Group (ASX: MQG) $190.33

MQG +0.72%: the investment bank announced a 3rd quarter update which has the company tracking ahead of expectations for the FYTD and highlights the diversification of income in the company. The markets facing business is trending above FY22 at this stage, carried by the commodity trading arm, while the annuity-style side of Macquarie is tracking below the same period, though cycling significant one-off profits seen last year. Banking and Financial Services is growing strongly, though offset in part by higher funding costs within the group. On the Asset Management side, base fees are in line but the group expects higher performance fees in FY23. Overall, this means Macquarie’s NPAT is slightly above last year for the first 9-months, with consensus currently expecting a slight decline for FY23. The Group also has more than $12b in excess capital available providing the ability for corporate activity for the rest of the year and into FY24.

Macquarie Group

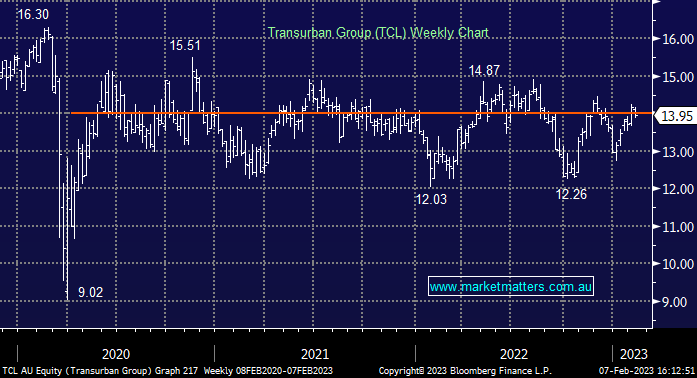

Transurban (ASX: TCL) $13.95

TCL -0.57%: A good 1H23 result this morning for the toll road operator, with EBITDA for the half of $1.24bn, above the $1.09bn expected while the distribution of 26.5c is a small beat (exp 26c). Funding costs were better than expected and Transurban has been proactive in hedging their interest rate risk with 94% of their debt book hedged for the short term. They also increased distribution guidance for the full year to 57c, up from prior guidance (and consensus) of 53c, amid record traffic across both the Sydney & Brisbane markets. Melbourne traffic remains below pre-COVID levels, however, the trend is improving with the December quarter traffic -6% vs -8% in the September Quarter. The resignation of Chief Executive Scott Charlton after 11 years behind the wheel was also taken as a negative by the market and was the main reason for pressure on shares today, alongside the RBA hike.

Transurban

Broker Moves

- Nick Scali (ASX: NCK) Cut to Neutral at Citi; PT A$11.05

- EQR AU (ASX: EQR) Rated New Speculative Buy at Morgans Financial Limited

- Nick Scali (ASX: NCK) Cut to Accumulate at CLSA; PT A$12

- ARB (ASX: ARB) Cut to Neutral at Macquarie; PT A$33

- Flight Centre (ASX: FLT) Raised to Outperform at Macquarie; PT A$20.75

- MLG OZ (ASX: MLG) Rated New Buy at Argonaut Securities

- oOh!media (ASX: OML) Cut to Hold at Jefferies; PT A$1.55

- Damstra Holdings (ASX: DTC) Cut to Underweight at Morgan Stanley

- 3P Learning (ASX: 3PL) Raised to Overweight at Morgan Stanley; PT A$1.60

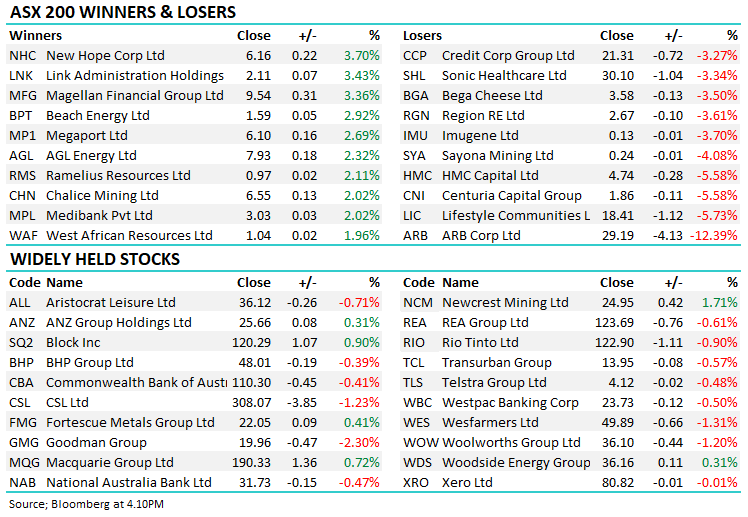

Major movers today

Have a great night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

16 stocks mentioned