The Match Out: Pain in the commodities sends the index to 11-month lows, South32 (S32) off to a slow start

Further pain was felt across the ASX today as the risk-off trade continued in the face of rising geopolitical tensions. Commodity markets took a hit, flowing through to local Materials and Energy stocks with the weakness today sending the index to an 11-month low. The recent underperformers from a sector perspective were the relative outperformers today, healthcare and Staples bucking the trend to close higher.

- The ASX 200 finished down -56pts/ -0.82% to 6844

- Healthcare (+1.53%) was best on ground today, joined in the black by Staples (+0.73%) and Utilities (+0.06%).

- Energy (-3.00%) and Materials (-2.34%) were hit hard today causing the bulk of the weakness seen on the index. Three other sectors (Telcos, Industrials and Financials) were more than -0.5% worse off.

- South32 (ASX: S32) -2.97% production report was a touch soft, though the company maintained FY guidance. More below

- Helloworld Travel (ASX: HLO) -6.35% posted a strong 1Q but it wasn’t enough for the lofty expectations built in. TTV was up 120%, EBITDA tripled to $16.8m vs 1Q23 and the margin of 31.3% was up from 24% in FY23. The company maintained guidance, however, the travel sector will need to stay resilient from here to hit those numbers.

- Centuria Office REIT (ASX: COF) +3.57% provided a strong trading update with 96.7% of floor space leased, recent transactions in line with book values and reaffirming Funds From Operations (FFO) and Distribution guidance for the year.

- Centuria Industrial REIT (ASX: CIP) -0.34% a very similar update to its Centuria sister fund above, occupancy at 98.6% and improving leasing spreads were the highlight in today’s quarterly. CIP also reaffirmed FFO and distribution guidance.

- Viva Energy (ASX: VEA) -2.85% quarterly was mixed, the focus was on falling refining margins which were hit by oil prices moving sharply higher through the first quarter.

- Treasury Wines (ASX: TWE) +1.36% ticked higher on further movement on Chinese wine tariffs. The company expects a review and potential removal of the tariffs to take 5 months.

- Syrah (ASX: SYR) +41.51% rallied to 3-month highs following news of China’s plans to curb graphite exports. A ~10% short position here, funds are finding it hard to cover the position.

- Iron Ore struggled in Asia, off more than 3%

- Gold was marginally lower during our time zone at $US1,974 producing a mixed result gold equities.

- Hong Kong was closed but the Nikkei (-0.51%) and China (-0.8%) struggled as well.

- US Futures are up by around +0.25%

ASX 200 chart - intraday

.png)

ASX 200 chart - daily

.png)

South32 (ASX: S32) $3.27

S32 -2.97%: the diversified mining company was out with 1Q production numbers which were soft, though well flagged and the company maintained FY23 production guidance. Manganese, Alumina and Aluminium production was up QoQ, though only by 4% at best. Silver and copper production fell in the single digits while Nickel and Zinc (-19% each) and Met Coal (-31%) were off by more significant amounts. The quarter was impacted by industrial action and mine works which also increased capex in the period, and net debt jumped $US299m as a result, a little more than what the market would have hoped. Shares struggled today though mostly on the back of broader weakness in the sector.

- MM would be interested in S32 from lower levels, however, we prefer BHP & WHC here for similar exposure

Broker moves

- Liontown Resources Raised to Outperform at Macquarie; PT A$2.70

- Westpac Raised to Neutral at Evans & Partners Pty Ltd; PT A$20

- Cleanaway Raised to Positive at Evans & Partners Pty Ltd

- Liontown Resources Cut to Underweight at JPMorgan; PT A$1.30

- Liontown Resources Cut to Underweight at Barrenjoey; PT A$1.60

- Bluescope Raised to Overweight at JPMorgan; PT A$22

- Nick Scali Raised to Buy at CLSA; PT A$13.50

- Reckon Raised to Equal-Weight at Morgan Stanley

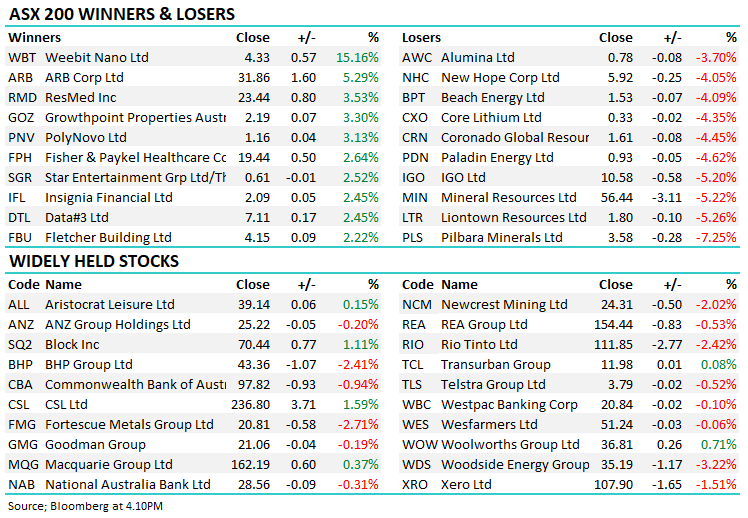

Major movers today

.png)

Enjoy the night

The Market Matters Team

Make informed investment decisions

At Market Matters, we write a straight-talking, concise, twice daily note about our experiences, the stocks we like, the stocks we don’t, the themes that you should be across and the risks as we see them. Click here for your free trial.

The Match Out will be available each day after the market close. Follow my profile to be notified when the latest report is live.

1 topic

7 stocks mentioned